Brisbane industrial supply hits 12-year high in 2020 says Knight Frank

Contact

Brisbane industrial supply hits 12-year high in 2020 says Knight Frank

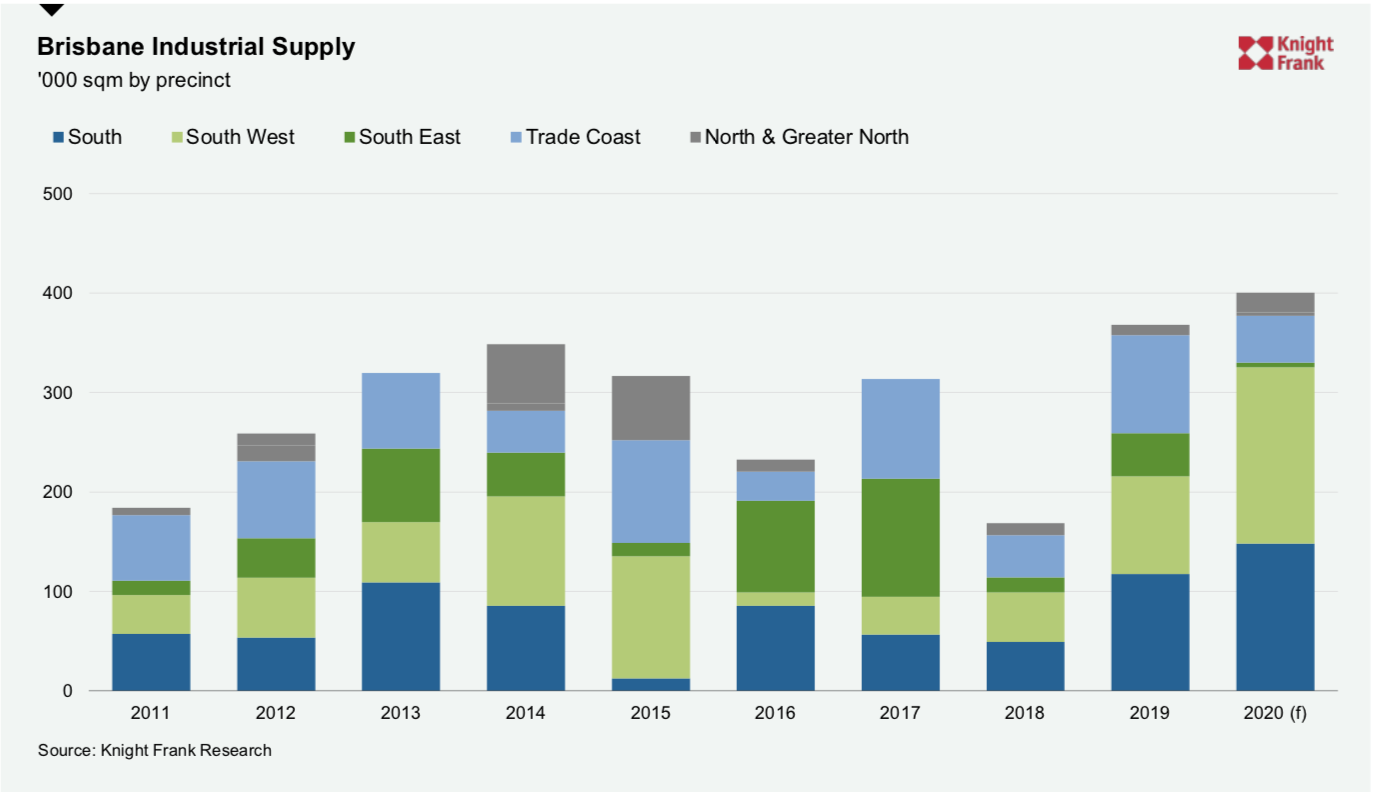

Tenant demand for new space will see construction of industrial facilities in Brisbane hit 12-year highs in 2020, according to the latest research from Knight Frank.

Tenant demand for new space will see construction of industrial facilities in Brisbane hit 12-year highs in 2020, according to the latest research from Knight Frank.

The Knight Frank Brisbane Industrial Market Report – October 2020 found more than 400,000sq m of industrial space will be delivered to the market this calendar year.

Knight Frank Partner and Joint Head of Industrial Queensland Chris Wright said the supply delivery was in direct response to the tenant preference for new space in Brisbane’s industrial market.

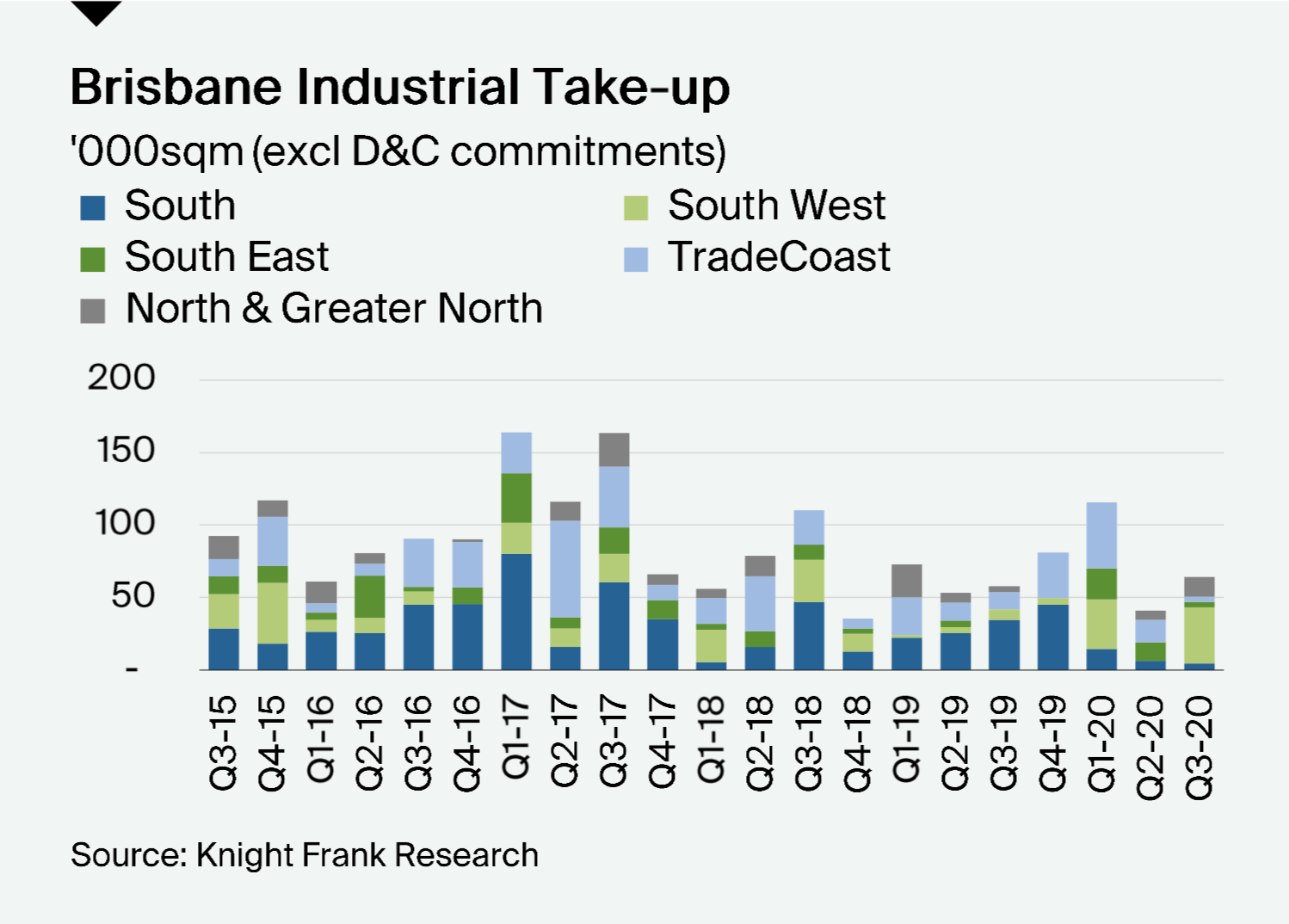

After a strong first quarter of 2020, building on momentum from 2019, second and third quarter activity had been impacted by a lack of confidence due to the pandemic and deferred decisions, he said.

“The demand we are seeing for industrial space remains focused on logistics and 3PL users, with these accounting for more than one-third of take up this year.

“The need to upgrade to better facilities is coming predominantly from these users, as they desire a faster and direct B2C delivery as online retailing accelerates.

“Of the leases that had been signed to date this year, 42 percent have been for new space.

“Newly constructed speculative stock and first generation backfill space will continue to be highly regarded by tenants, creating increasing obsolescence issues for older facilities.”

According to the Knight Frank report construction starts slowed over the course of this year, with a conservative mindset adopted as the pandemic took hold, but at least two projects will begin work in October.

It found the majority of supply in Brisbane’s industrial market was being added in the South West (44%) and South (37%) precincts with available land institutional ownership facilitating development.

The key major institutional developers of Charter Hall, Dexus, Fife, Stockland, Frasers, Goodman, GPT and Logos have 315,000sq m in industrial space either delivered in 2020 or currently under construction.

Knight Frank Partner Research and Consulting Queensland and report author Jennelle Wilson said lower levels of leasing activity had led to the lowest take up in Brisbane’s industrial market in five years in the second quarter of this year.

“Take up increased slightly during the third quarter, largely due to two 12,000sq m commitments in the South West, with other regions quiet,” she said.

“Demand from logistics and 3PL users accounts for 34 per cent of take up this calendar year, with manufacturing just behind at 32 per cent of activity as local production increases.

“Vacancy increased by 3.4% in the third quarter, after a 30 per cent jump in the second quarter to be 596,173 square metres.

“Of the available space added in the past six months 30 per cent comes from speculative development in the South and South West, while 26 per cent is backfill space from tenants relocating to purpose- built facilities and 14 per cent is attributable to downsizing activity.

“While prime face rents have been stable year-on-year at $113 per square metre net, prime incentives have increased by 420 basis points to 15.7 per cent to encourage tenants to act.”

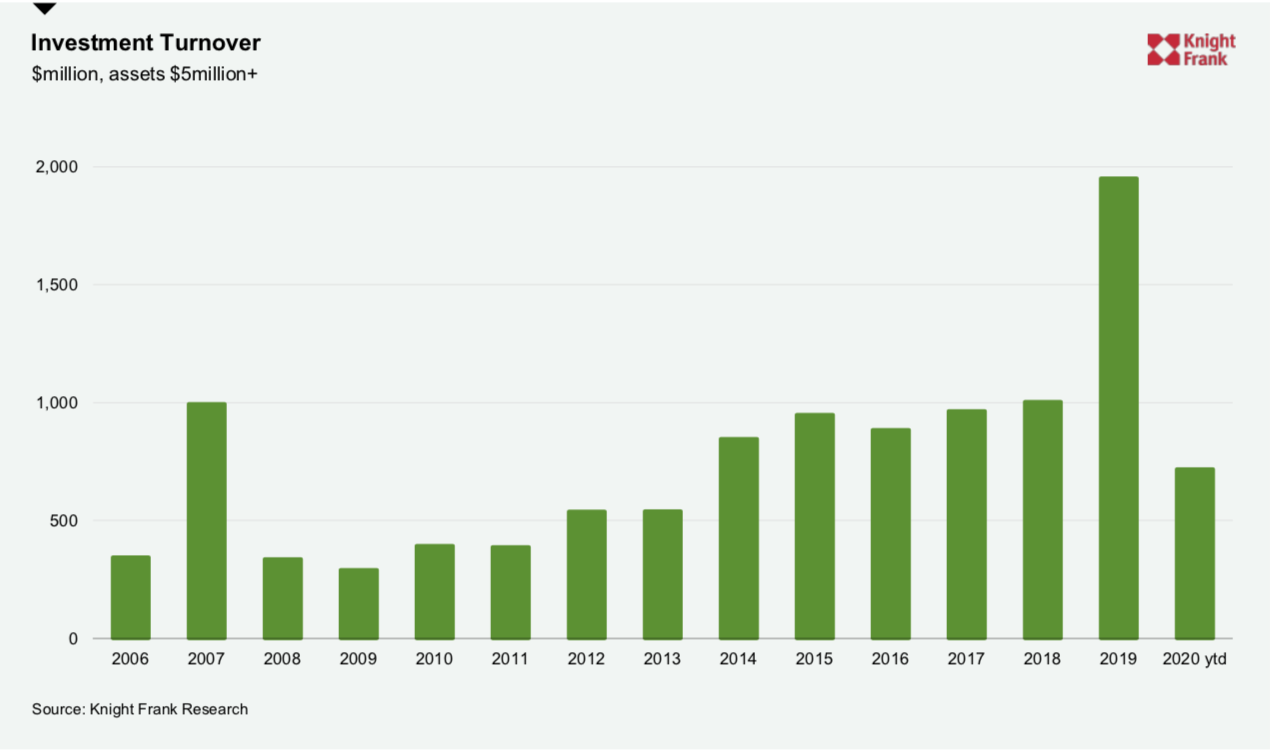

Mr Wright said just like the leasing market, the Brisbane industrial investment market had also had a quieter year, with turnover lower in 2020 as the middle-tier market activity had been low.

“Institutional demand for industrial investments has remained strong throughout the COVID-19 period with the relative resilience of industrial tenants, particularly those in the retail supply chain, maintaining appetite for the sector,” he said.

“Nevertheless, the level of transactions during 2020 is expected to be lower than that seen in 2019, which at $1.95 billion was a standout year for the Brisbane industrial market.”

The Knight Frank research found that in the year to October 2020 there has been $717 million in turnover which is roughly in line with the level seen in 2014 to 2018.

“With the four largest deals accounting for more than half the turnover, 2020 has seen relatively thin trade in the $5 million to $25 million price bracket, where private and smaller syndicators have been impacted by confidence and travel restrictions,” said Mr Wright.

“As asset allocations turn away from retail, and to an extent office, the large players will increase industrial market penetration.

“Prime yields have remained firm with tightening for true core assets, and land values will stabilise in the short term while the market reassesses.”

View the full Knight Frank Brisbane Industrial Market Report for October 2020 here.

Similar to this:

ESR Australia Development Partnership acquires strategic Acacia Ridge Infill Redevelopment Site

Gold Coast warehouse sold to Centuria Industrial REIT for $43 million - Colliers & JLL

Knight Frank appoints new National Head of Industrial Logistics with French connection