JLL Report assesses the impact of sustainability commitments in New Zealand’s Industrial sector

Contact

JLL Report assesses the impact of sustainability commitments in New Zealand’s Industrial sector

New research from JLL senior analyst Sam Butler examines major structural changes and the opportunities they present to industrial property investors in New Zealand.

New research from JLL senior analyst Sam Butler looks at the opportunities for industrial property investors presented by major structural changes in the industry in New Zealand.

New Zealand has moved beyond the carbon neutral ambitions of most countries with legislation passed in 2019 that commits to making the country carbon neutral by 2050.

This is going to have a material impact on future development of industrial assets across the country, with several major structural changes being accelerated because of the pandemic.

These changes include a growth in eCommerce, increasing the reliance of retailers on industrial warehousing and logistics providers to reach their customers.

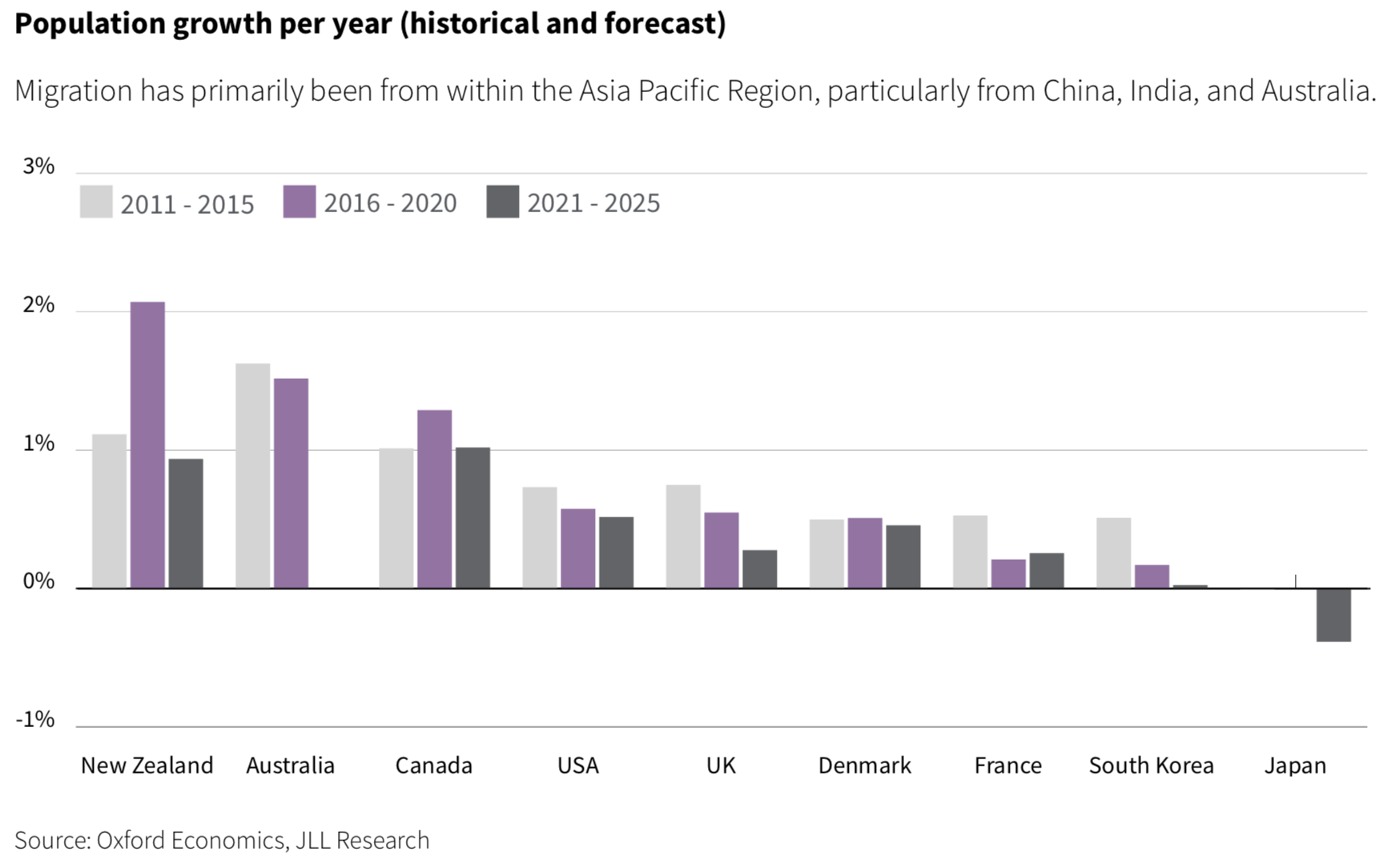

Population is also a key multiplier for industrial development and New Zealand’s population growth has outperformed most other developed nations over the last decade, having grown at the second fastest rate of any country in the OECD since 2011.

The next generation of Industrial assets will need to evolve

From an occupier perspective, a focus on improving the sustainability of their premises is important to not only their marketability and brand, but also to their capacity to build a financially sustainable business.

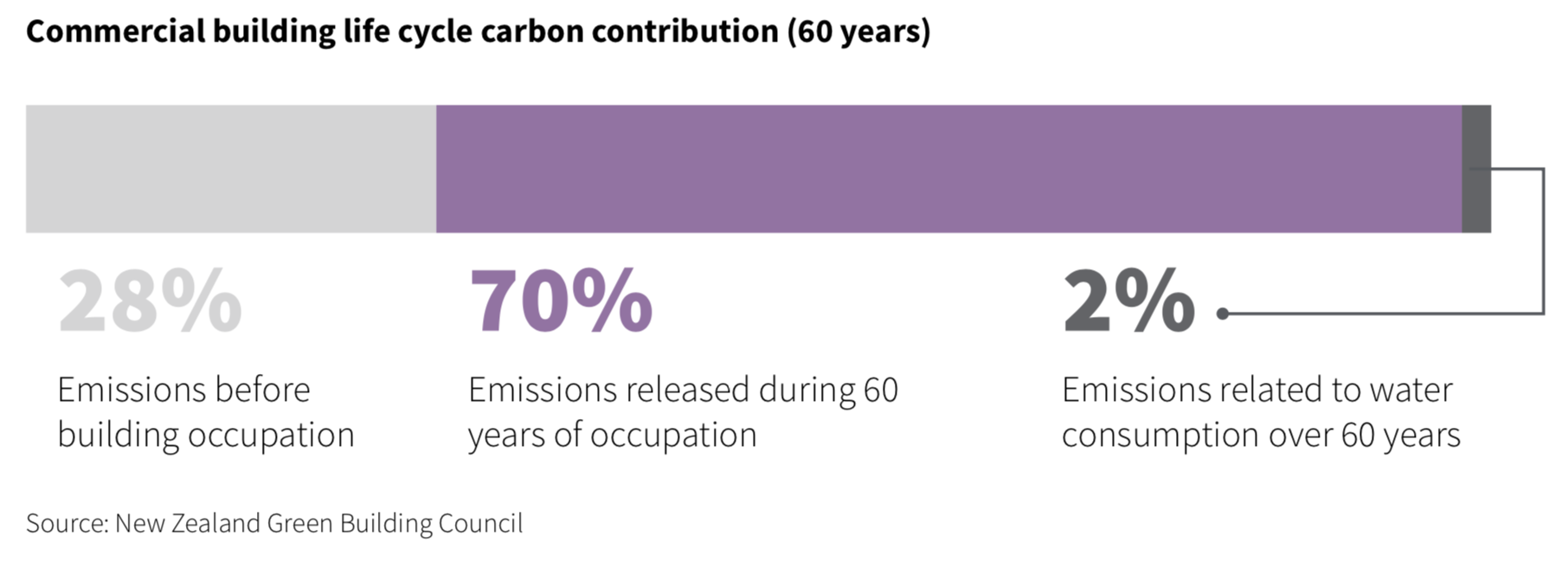

As per a recent report by the New Zealand Green Building Council, savings on operating costs over a 5-year period can be as high as 15% in industrial buildings which are Green Star rated.

The World Building Council showed that a 2% upfront cost to support sustainable design principles can result in an average saving of 20% of total construction cost over the lifetime of an asset.

Assets which fail to adapt will be left behind

Over the long run, assets which fail to keep up with the evolving ESG requirements of industrial occupiers will likely risk extended let up times, shorter lease terms and declining asset values.

To hedge against this, investors and owners of stabilized assets will need to become increasingly selective in their capital allocation.

Read the report here: A sustainable future – Industrial in New Zealand

Related reading: