Acceleration in data centre investment with significant pipelines underway says Colliers

Contact

Acceleration in data centre investment with significant pipelines underway says Colliers

According to IBM, a whopping 90% of the world’s data has been created over the last two years. Australian operators have responded to demand with a large pipeline of future capacity on the way, which has the potential to more than double existing supply. As outlined in Colliers’ Data Centre Insight report, According to David Hall, Colliers’ National Director Industrial.

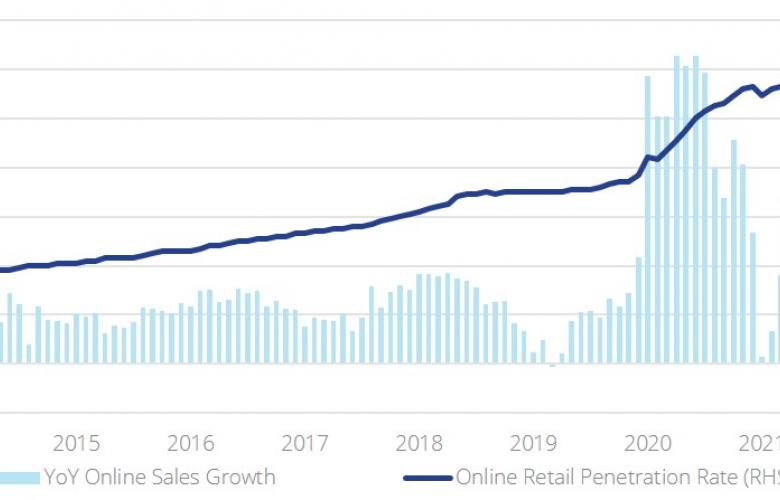

Data centres have gained significant interest from real estate investors over the past 10 years but this has accelerated over the past two years. According to IBM, a whopping 90% of the world’s data has been created over the last two years, and we are now doubling the rate data is produced every two years. Be it the growth in e-commerce, the introduction of new technologies like 5G or the overarching impact of Covid-19 on our lives like remote working, the demand for cloud-based systems and data centre services is only going to escalate.

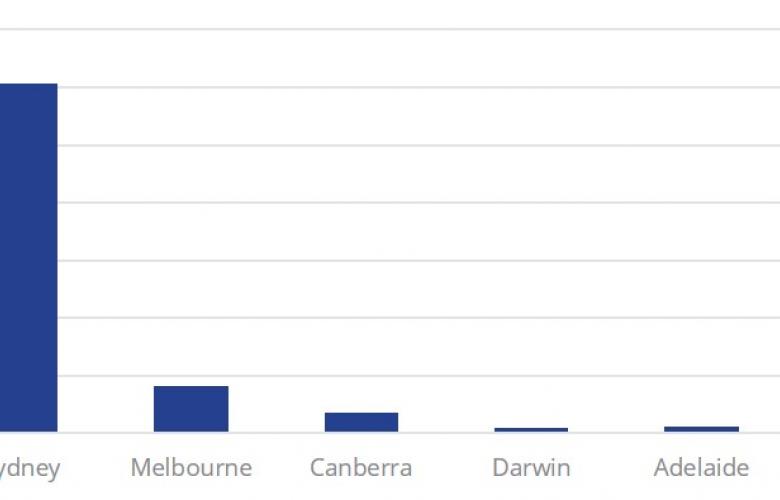

Australian operators have responded to demand with a large pipeline of future capacity on the way, which has the potential to more than double existing supply. As outlined in Colliers’ Data Centre Insight report, the bulk of Australia’s data centre activity is based in Sydney. According to David Hall, Colliers’ National Director Industrial, Sydney provides an estimated 430 megawatts (MW) of third-party data centre capacity with a further ~1,200 MW in the pipeline.

"The pipeline is underpinned by Airtrunk’s planned SYD3 facility at Blacktown (320 MW at full capacity) and Next DC announcing plans to build a 300 MW facility at Horsley Park, named S4,” Mr Hall says. “There are a number of reasons Sydney remains the focal point for data centres, it is home to Australia’s key financial and economic hub and is the major landing port for submarine communication cables that connect directly to Asia and the United States.”

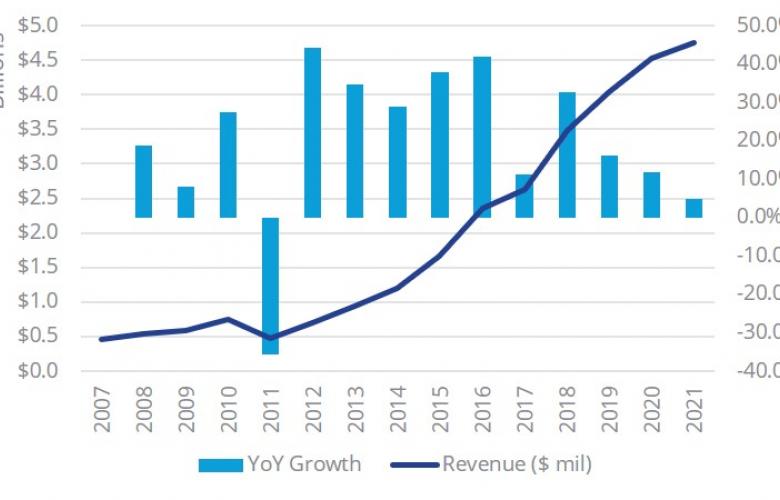

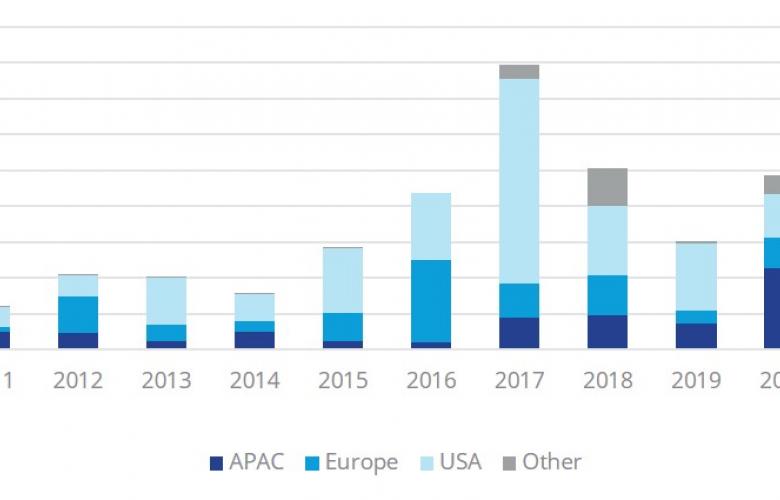

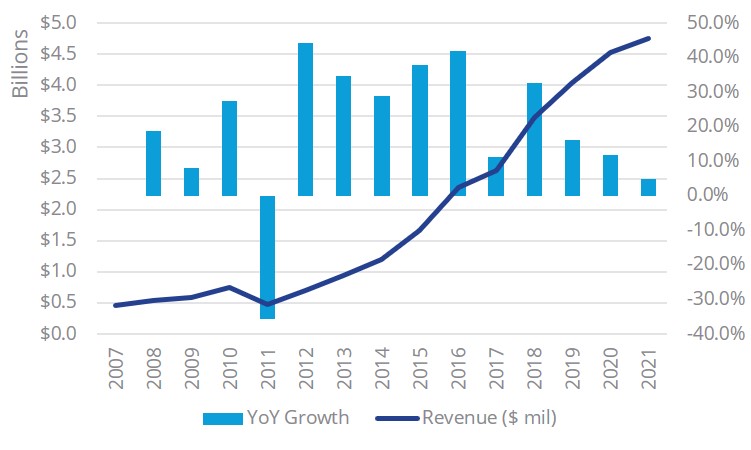

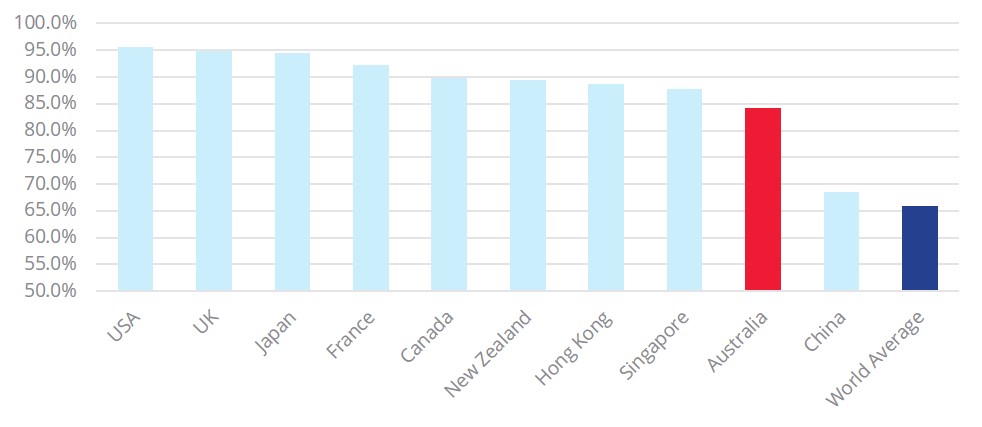

Currently the United States is the largest data centre market in the world, with capacity estimated to be almost 5,500 MW. This represents almost half of the world's data centre market, with capacity growing by approximately 10.0% per annum over the past five years. Global investment volumes for data centres have averaged $9.4 billion per annum between 2015 and 2020, over half of which occurred within the United States. Investment volumes jumped again in 2021 with over $12.8 billion transacting this year to date, again dominated by the United States. And while the United States market is considered the most transparent and liquid given its maturity, this is expected to change over the coming decade as institutional groups actively pursue investment opportunities in other key data centre markets.

“Across the APAC region, investment volumes have increased exponentially over the past two years, with $4.5 billion recorded in 2020 and $3.8 billion already in the first nine months of 2021, including Q3,” Tanya Parker, Colliers’ National Director Valuation and Advisory Services, says. “By comparison, annual investment volumes averaged $1.2 billion between 2015 and 2019.”

Historically, many data centres were owned within infrastructure funds; however, they are now primarily held in property funds, highlighting the acceptance of this asset class from traditional commercial real estate owners. Like the broader industrial and logistics market, long WALE data centre assets have been actively chased by institutional groups and are essentially being purchased for the cashflow in much the same way as a Government Bond. From a cap rate perspective, as data centres are generally backed by a strong covenant and long lease, cap rates for data centres tend to be on par with little to no discount being paid when compared to traditional industrial and logistics assets.

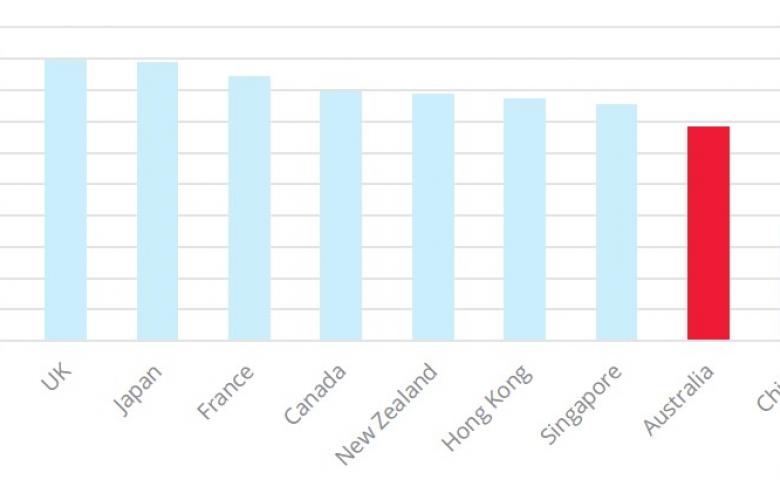

"More broadly, data centre yields in Australia range from 4.00% to 6.00% and depend on the asset’s location, covenant and age of the facility. For selected assets with a long WALE, if they were brought to market today, they would be expected to trade closer to 3.50%. Pricing at this level is broadly in line with other global markets, albeit Hong Kong (3.50 to 4.50%) and Tokyo (4.00% to 5.00%) being at the lower end of the range,” Luke Crawford, Colliers’ Director of Research, explains.

"More broadly, data centre yields in Australia range from 4.00% to 6.00% and depend on the asset’s location, covenant and age of the facility. For selected assets with a long WALE, if they were brought to market today, they would be expected to trade closer to 3.50%. Pricing at this level is broadly in line with other global markets, albeit Hong Kong (3.50 to 4.50%) and Tokyo (4.00% to 5.00%) being at the lower end of the range,” Luke Crawford, Colliers’ Director of Research, explains.

The key attributes that dictate the appropriateness of a site for a data centre include large-scale industrial zoned land, close power supply infrastructure, the ability to install the required air-conditioning systems and an average external cooler temperature for passive cooling where possible.

“The major design consideration for a data centre is the supply of significant and reliable power to run the servers and security of the building and, more importantly, the air conditioning systems to keep the servers in a cool and controlled environment. This is the significant difference when compared to most warehouses that are used for storage and logistics, they don't require significant power unless they are a specialised facility such as cold storage,” Brad Bennett, Colliers’ National Director Project Leaders, says.

In the early days of the industry, data centres were built within high-rise zones closer to city CBDs as clients wanted to access these facilities to ensure the security of their data and to be able to deal with issues quickly and efficiently. But over time confidence has grown, and users have become more comfortable that operators can ensure security and access further away from the CBD. Today, city outskirts have become the target for data centre operators where land is more affordable, and in the future, Mr Bennett predicts the growth of regional-based data centres?

“For temperature reasons, some regional locations are now being considered for data centres, and lower land costs are also attractive. The main barrier is that of reliable and significant power supply. Remote sites are often well away from town centres that may not have the infrastructure,” Mr Bennett says. “If this can be solved by renewable energy supplies like wind or solar, passive climate cooling in cooler climates would significantly open up cheaper land opportunities.”

Colliers predicts other capital cities will see additional facilities brought online over the next five years, with Melbourne and Canberra being the next dominant locations. As Hugh Gilbert, National Director Industrial, explains, Melbourne offers a prime opportunity for data centre development.

“As you can appreciate, it is much hotter per year in Brisbane's outskirts for example, than in the outskirts of Melbourne. Winter on the outskirts of Melbourne, with good design solutions, you can use the cooler outside ambient temperatures as a benefit to cool the internals of the building and therefore use less power in the cooler winter months. These factors are critical in assessing the feasibility of any development.”

To request a copy of Colliers’ Data Centre Insight report 2021 please contact one of the Colliers contacts below.