Knight Frank’s Australian industrial market update - Strong demand and low vacancy trigger unprecedented rental growth across Australia

Contact

Knight Frank’s Australian industrial market update - Strong demand and low vacancy trigger unprecedented rental growth across Australia

According to James Templeton, Knight Frank National Head of Industrial Logistics, Australia’s industrial leasing market continues to be very strong, with ongoing high demand from industrial occupiers amidst a lack of supply driving widespread rental growth.

Australia’s industrial leasing market continues to be very strong, with ongoing high demand from industrial occupiers amidst a lack of supply driving widespread rental growth.

Knight Frank’s Australian Industrial Review – Q4 2022 found vacancy rates were still at record low levels, with 547,748sq m available across the Eastern Seaboard capital cities, following a 56 per cent drop in availability over the 2022 calendar year and an eight per cent fall over Q4 2022.

Sydney remains the tightest market with 89,1292sq m of available stock, followed by Brisbane (226,916sq m) and Melbourne (231,640sq m).

Vacancy in Melbourne fell by 70 per cent in 2022, while Sydney fell by 31 per cent in 2022 and Brisbane vacancy fell by 38 per cent.

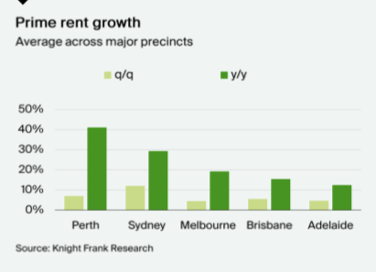

As a result of record low vacancy levels and sustained occupier demand, significant rental growth continues to be recorded across all capital cities.

Knight Frank’s research found Perth was experiencing the fastest pace of rental growth nationally, with prime rents up by 41 per cent year-on-year and seven per cent over Q4 2022 as the market responds to strong tenant demand and rising construction costs.

Sydney followed suit with 12 per cent growth over the quarter and 29 per cent growth over the year, with the South West precinct seeing the strongest growth of the submarkets at 37 per cent year-on-year.

Meanwhile, Melbourne prime rents rose by 19 per cent over 2022, while Brisbane saw a 16 per cent rise and Adelaide saw a 12 per cent rise.

Prime net face rents in Sydney are now $210 per square metre, followed by Brisbane ($137/sq m), Perth ($133/sq m) and Melbourne ($126/sq m).

Rent have escalated nationally

Limited availability and pent-up demand had triggered unprecedented rental escalation nationally.

There is ongoing intense competition for available industrial space, especially new stock, which has led to surging double-digit rental growth.

Alongside face rental growth incentives have also fallen slightly, which has seen stronger growth in effective rents, particularly in precincts where rents have historically been lower, such as Sydney’s Outer West and South West and Melbourne’s West.

In Sydney the South Sydney market is the tightest, with no vacancy recorded since Q3 2021, while the Inner West and Outer West experienced significant vacancy decline in 2022. The limited vacancy has left tenants with no choice but to negotiate or renew leases for space three to 12 months in advance.

In Melbourne availability of good space is becoming more of an issue, with only secondary stock immediately available in the over 5,000 square metre range.

Across the three major cities of Sydney, Melbourne and Brisbane the most active sector over 2022 was transport, postal and warehousing, with logistics and retail trade operators continuing to drive tenant demand.

We expect further rental growth in the industrial market over 2023, but it is likely to be at a slower pace closer to 10 per cent on average, particularly as more supply is delivered and vacancy likely ticks up from its extremely low current levels towards the end of the year.

2023 set to be a record year for new developments

This year is forecast to be a record year for new developments across the East Coast with 2.5 million square metres expected to be delivered.

Brisbane is leading this with over one million square metres to be delivered, which is more than triple the historical average.

Sydney is expected to add 855,000 square metres and Melbourne 670,000 square metres, after this city led completions in 2022, with more than 1.3 million square metres in new supply.

Given the construction delays in 2022, multiple projects were pushed in 2023 and thus it is forecast for a record year of new developments which will provide some relief to the undersupplied markets.

The strength in the leasing market and widespread rental growth has offset the impact of rising rates and higher funding costs on asset values, and is expected to continue doing so despite yields rising by around 75 basis points in most markets since April last year.

Supply will continue to be tight over the mid-term, so the demand-supply imbalance will see rents continue to rise.

The demand-supply imbalance will remain particularly acute in Sydney this year, where an equilibrium is unlikely to be restored until a larger quantum of developable land comes online in 2024-25.

Ultimately structural undersupply in industrial markets will not be resolved until significantly more developable land comes online.

By James Templeton, Knight Frank National Head of Industrial Logistics