Perth prime industrial rents rise by 41% in 2022 - the fastest rate of growth nationally - Knight Frank

Contact

Perth prime industrial rents rise by 41% in 2022 - the fastest rate of growth nationally - Knight Frank

Perth experienced the fastest pace of industrial rental growth nationally over 2022, according to the latest research from Knight Frank, commented by Knight Frank Director and Head of Industrial Investments WA Tom Iredell and Knight Frank Head of Industrial Logistics WA Geoff Thomson.

Perth experienced the fastest pace of industrial rental growth nationally over 2022, according to the latest research from Knight Frank.

Knight Frank’s Australian Industrial Review – Q4 found Perth prime rents were up by 41 per cent over 2022 and seven per cent over Q4 2022 as the market responded to strong tenant demand and rising construction costs.

This rate of growth put Perth considerably ahead of the next best performing industrial market nationally, Sydney, which saw annual growth of 29 per cent, followed by Melbourne (19 per cent), Brisbane (16 per cent) and Adelaide (12 per cent).

Prime net face rents in Perth are now $133/sq m, higher than Melbourne at $126/sq m. In Sydney prime net face rents are $210 per square metre, followed by Brisbane at $137/sq m.

Knight Frank Head of Industrial Logistics WA Geoff Thomson said occupier demand in Perth remained strong but with supply shortfalls, there had been significant rental growth.

“We saw sustained strong demand in the fourth quarter of last year and into this year, with supply well below 100,000 square metres.

“Strong demand continues to come from the mining industry, manufacturing and the e-commerce sector, all of which are underpinning strong rental growth.

“We’re currently experiencing a resources boom with a number of new mining projects, and this sector is performing extremely well which is having a ripple effect onto businesses and creating huge demand for workshop space in particular.

“There are also a number of sizeable infrastructure upgrades in the Perth metropolitan region, which is also leading to demand for industrial space.

“Existing tenants are requiring additional space and new market entrants have new requirements, which is increasing competition for scarce stock and has continued to push rents to new highs.”

Knight Frank’s industrial report found there had been strong rental growth particularly in Perth’s North and East, where rents increased by 12.7 per cent and 7.4 per cent respectively. The South precinct was still performing strongly with increases of 3.8 per cent and 4.3 per cent respectively.

“The container terminal to be developed in Kwinana suggests the South precinct will see further rental growth in the near term, with supply continuing to tighten,” said Mr Thomson.

Land is at a premium

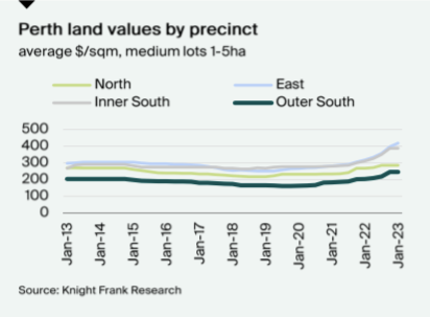

The Knight Frank Australian Industrial Review – Q4 found there had been land value growth for medium-sized lots of 19.8 per cent over 2022.

The South (both inner and outer) remains the highlight, with medium-lot land values up by 25 per cent.

Knight Frank Director and Head of Industrial Investments WA Tom Iredell said rents had seen huge growth due to tenant demand and with land scarce, land values are now holding after significant increases.

He said building costs looked to be trending down, which would make industrial developments more feasible.

“Land supply is generally tight across Perth’s industrial areas but has tightened most notably in the South precinct, with developers refocusing and increasingly looking for value in areas that have traditionally been seen as secondary.

“Any available stock particularly in the most sought after areas of Kewdale/Welshpool, Canning Vale/Jandakot and Kenwick are quickly snapped up.

“Developers are now looking at secondary markets to accommodate occupier demand.”

The Knight Frank report found that rental growth in the leasing market had largely offset the impact of rising rates and higher funding costs on asset values around Australia.

In Perth, yields for industrial property had softened slightly, according to the report, and while there had been limited activity over Q4 last year, high quality space in preferred locations was still sought after.

“Investors still see a unique value proposition in Perth, with yield expectations still above eastern seaboard capitals, and we believe this will continue in the short term,” said Mr Iredell.