Self storage interest soars - RWC

Contact

Self storage interest soars - RWC

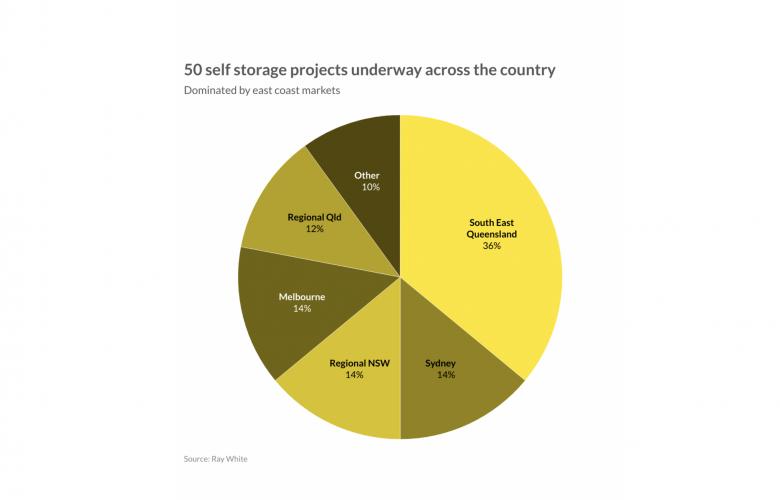

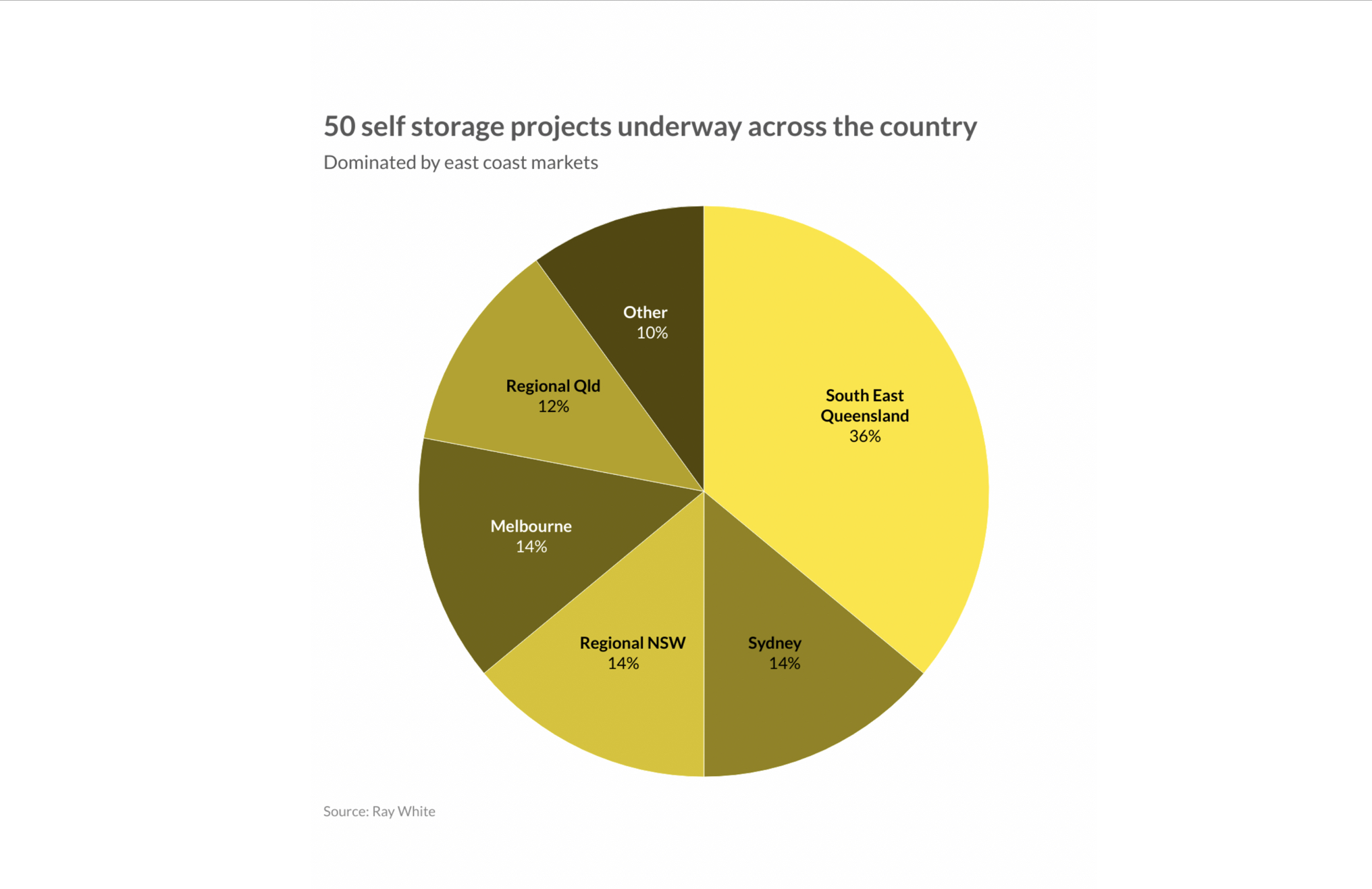

Currently 50 self storage developments in the construction phase across the country contributing more than 300,000sqm. SEQ is expected to enjoy the greatest new project completions, mostly across metropolitan Brisbane and Gold Coast currently hampered by the housing shortage, keeping residential vacancies low which historically has a strong correlation with the occupancy of self storage says Vanessa Rader, Head of research RWC.

Activity in the self storage market has always tracked well. Historically, larger offshore funds have purchased large portfolios of assets across the country, however, in more recent years the private sector has increased its appetite for these assets. Industrial assets have been the most desired commercial investment class since the start of the pandemic and these assets were not forgotten, selling at yields in the sub 5 per cent range.

Over the last 12 months, there has been $132 million in sales recorded achieving mixed results. Quality assets have maintained low yields, however, assets have recorded capitalisation rates as high as 8 per cent in some regional markets. Enquiry levels have been elevated across the country from the private sector including syndicates and high net worth individuals looking for the security of these assets and their stable income streams. There has been an increase in buyers venturing interstate to secure these assets with high population growth zones across the country the key focus for these buyers.

Like other industrial assets, rents have increased considerably and the end consumer has been hit hard by these increases thanks to higher insurances, increased land costs and taxes, and the overall high demand keeping vacancies low. The major users of self storage facilities are individuals who need to store their personal belongings rather than business use, and with the current housing shortage felt across the country, difficulty in securing a rental property has added to the need to store goods for a prolonged period, keeping occupancy high. This is most apparent in highly populated areas or those which have seen strong migration growth such as south east Queensland, Perth, and western Sydney, while there has been some move away from regional markets as post COVID-19 some population flows have come back to major cities.

There are currently 50 self storage developments in the construction phase across the country contributing more than 300,000sqm of industrial storage space to the marketplace. Development is heavily dominated by east coast markets, with south east Queensland expected to enjoy the greatest new project completions, mostly across metropolitan Brisbane and Gold Coast. These high population areas are currently hampered by the housing shortage, keeping residential vacancies low which historically has a strong correlation with the occupancy of self storage, which is currently high. New developments in self storage have grown in sophistication with technology around security increasing as demand increases with greater multi-storey facilities with flexible spaces for growing accommodation needs of their end users.

As end user activity remains high, demand to purchase self storage facilities is expected to grow. The stable income stream is a drawcard for buyers, together with the continued appetite for industrial assets in the current environment.

By Vanessa Rader, Head of research RWC