Industrial & logistics becomes Australia’s largest commercial property sector at $300 billion - CBRE

Contact

Industrial & logistics becomes Australia’s largest commercial property sector at $300 billion - CBRE

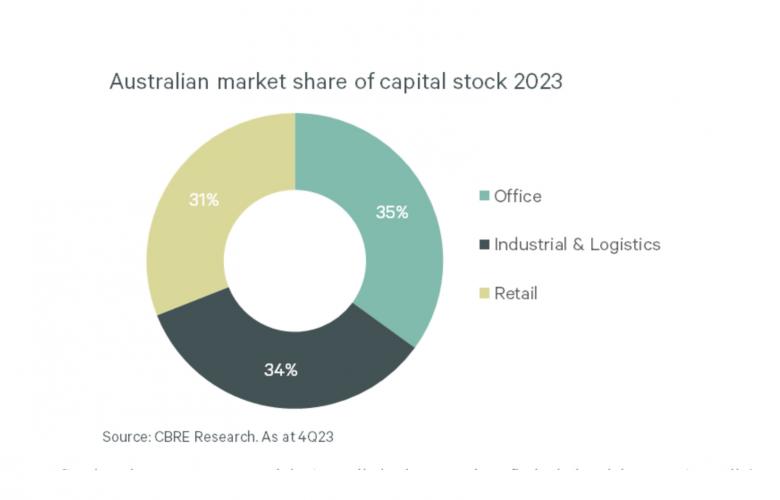

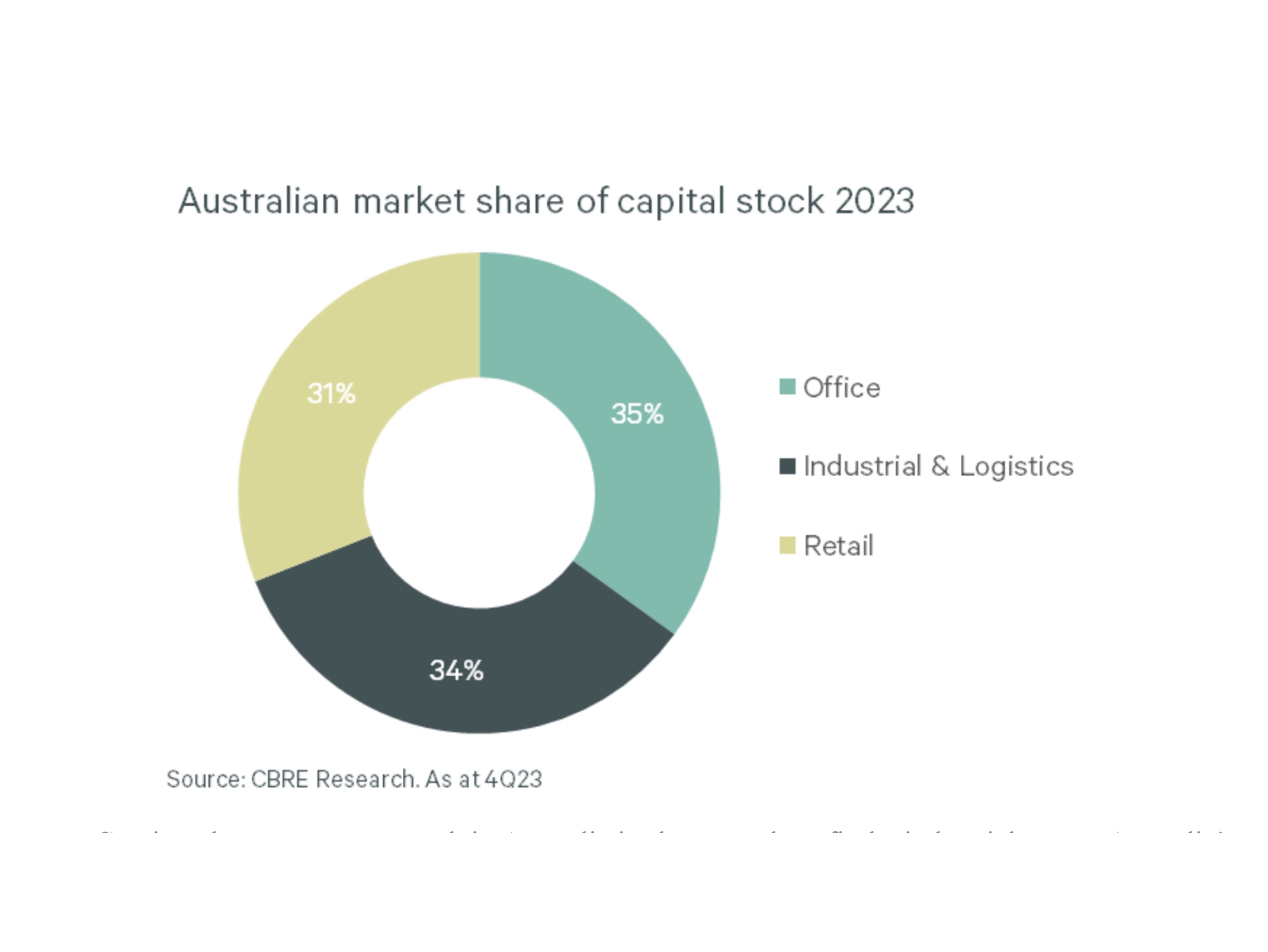

Australia’s industrial & logistics investment universe has reached close to $300 billion to be on par with the office sector for the first-time following record rental growth nationwide said, CBRE’s Australian Head of Industrial & Logistics Research Sass Jalili.

Australia’s industrial & logistics investment universe has reached close to $300 billion to be on par with the office sector for the first-time following record rental growth nationwide.

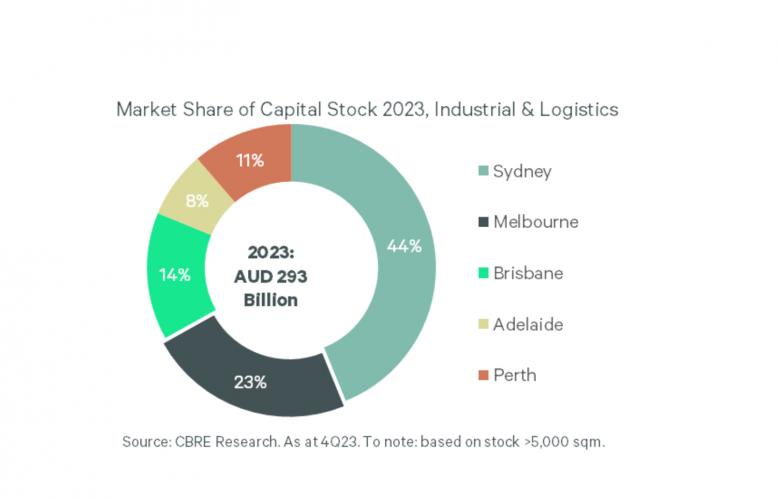

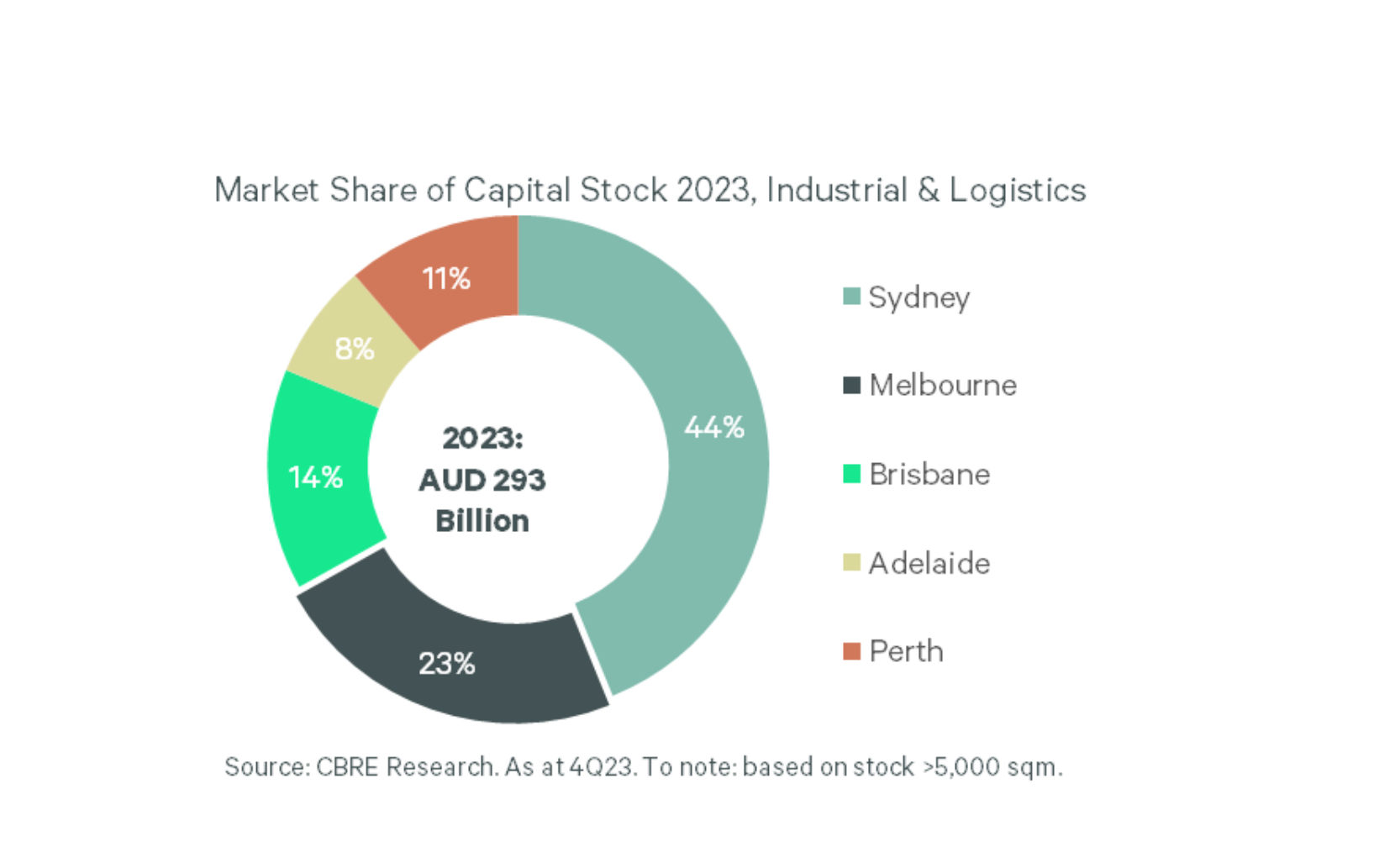

CBRE Research has broken down the market share of capital stock by city, with Sydney leading at 44%.

CBRE’s Australian Head of Industrial & Logistics Research Sass Jalili said, “We forecast Australia’s industrial & logistics investable universe will reach AUD 410 billion in the next decade and expect the asset class to remain the dominant commercial sector over the next few years.”

“Despite industrial & logistics yields expanding by an average of 122 bps across the country over the past 12 months, rents grew by 18% y-o-y. Three million sqm of new floorspace was also added to the market over this time.”

While CBRE Research is forecasting a slowing of this rental growth trajectory, rents will keep rising given that vacancy rates are expected to remain below 4% in 2024.

“Occupiers will have more choice this year as more space is anticipated to come to the market. Despite this, the 2024 supply pipeline is already 50% pre-committed and therefore vacancies won’t reach the equilibrium rate of 4% in the next 12 months. We forecast rental growth for the year ahead will be in high single digits, particularly for markets where vacancy rates currently remain below 1%,” Ms Jalili added.

Chris O’Brien, CBRE Capital Markets Executive Director, Industrial & Logistics, said, “We have identified around $20 billion of capital that is currently seeking to be deployed into industrial & logistics assets, which is expected to lead to more strategic partnerships as capital seeks alternative paths into the Australian market.”

This aligns with CBRE’s latest APAC Investor Intentions Survey, which found that Australia is the second most preferred market for cross-border investment, with the industrial & logistics sector continuing to be the preferred property asset class for core investors.

Continued e-commerce growth in Australia is also set to benefit the industrial sector. Australia’s online share of retail sales reached 13 per cent in 2023 to be four years ahead of the pre-pandemic trend rate and is expected to reach 15% by late 2026.

E-commerce has accounted for an average of 25% of Australia’s industrial & logistics occupier demand across the Eastern Seaboard over the past three years.

Related Reading:

JLL Podcast: How warehouses took on sustainable, employee-centric design | The Industrialist

New industrial development to be driven by demand for efficiency - Knight Frank | The Industrialist

Industrial & logistics driving real estate investment across Asia Pacific - Colliers