Future trends: Industrial demand normalizing but set to strengthen in 2024 -JLL

Contact

Future trends: Industrial demand normalizing but set to strengthen in 2024 -JLL

The outlook for 2024 is positive, with an anticipated increase in activity in several major markets due to pent-up demand from occupiers who put new deals on hold over the last year - JLL Global Real Estate Perspective.

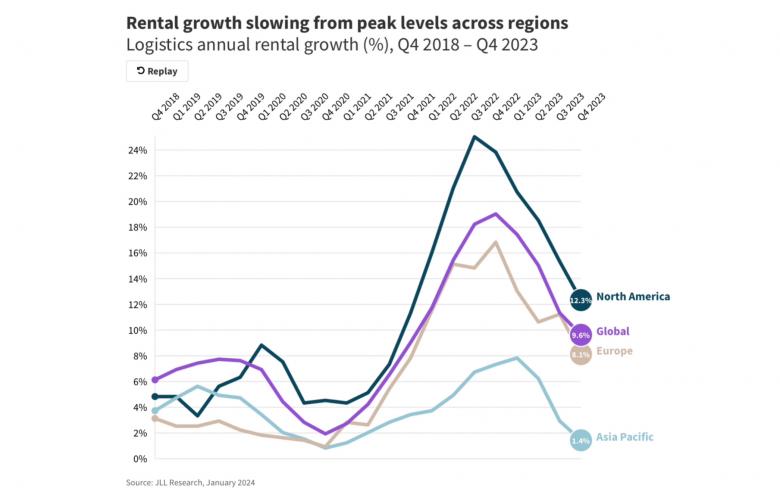

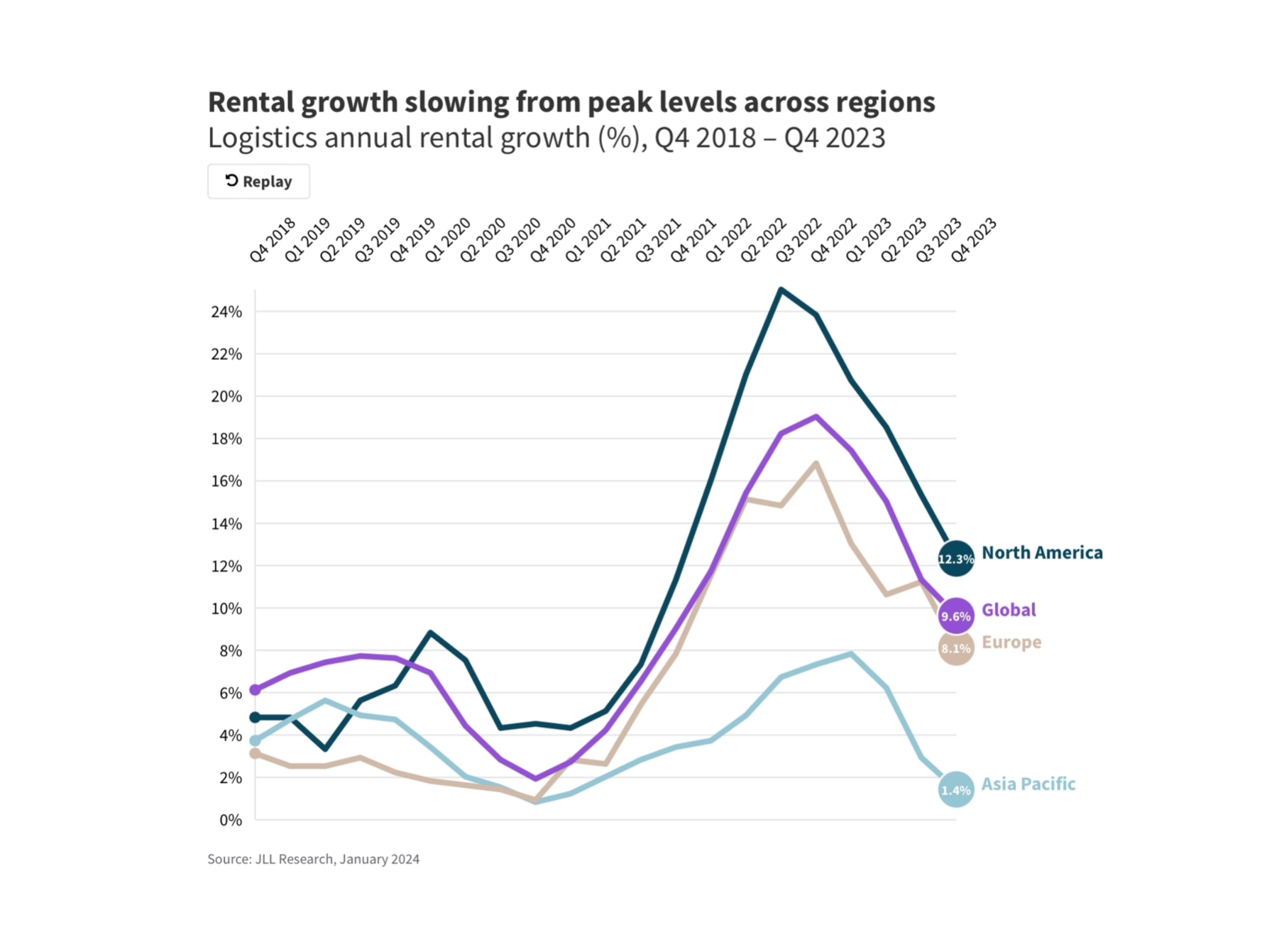

Global industrial and logistics markets faced obstacles throughout 2023 including elevated interest rates, inflationary pressures and heightened occupier uncertainty. Decision-making timelines remain extended as occupiers maintain a cautious approach, which has helped to push activity in the U.S. and Europe back to pre-pandemic levels. However, there were positive signals during Q4 as leasing volumes in the U.S. rose by 17% over the quarter following six consecutive quarters of declines, while net absorption in Asia Pacific set a new annual record. Rental growth stayed positive but continued to moderate across regions during Q4.

ESG initiatives and energy efficiency will be increasingly crucial in all aspects of industrial activity worldwide and are contributing to the manufacturing, energy and utilities sectors emerging as key sources of leasing and development demand. Available supply that is ESG compliant and future-proofed with reliable, renewable energy is limited in logistics markets globally and this will contribute to an ongoing need for new development and redevelopment.

Image: Rental growth slowing from peak levels across regions Logistics annual rental growth (%), Q4 2018 – Q4 2023.

Future trends: Industrial demand normalizing but set to strengthen in 2024 -

Outlook for 2024: The outlook for 2024 is positive, with an anticipated increase in activity in several major markets due to pent-up demand from occupiers who put new deals on hold over the last year. Leasing activity in the U.S. is expected to rebound modestly, while the regionalization of industrial users, as companies diversify supply chains and locate closer to end-users, is also set to boost demand in Mexico and Canada. Industrial fundamentals are forecast to remain broadly steady in Europe, while net absorption will stabilize at elevated levels in Asia Pacific. The ongoing trend of nearshoring operations and the need to replace aging industrial buildings with more efficient spaces will also drive renewed momentum in construction starts as the current pipeline reduces.

Long-term: With the global shift towards renewable energy and reduced reliance on fossil fuels, the manufacturing sector will experience continued significant growth. Lower-emission products such as electric vehicles (EVs) will be a major contributor, with EV sales reaching a record high in 2023 and projected growth of 10% per year through 2028. This will also contribute to increasing demand for EV batteries and their recycling. Regulatory bodies and customers are pushing for sustainable and transparent supply chains, with the drive for cost reduction in electricity expenses playing a complementary role, leading to transformations in pricing, procurement and overall operations. The rapid evolution and adoption of AI technology and advances in automation will enable greater resiliency not only in supply chains but across industrial production and distribution.