Buyers to battle for rare Qantas portfolio for sale by Colliers

Contact

Buyers to battle for rare Qantas portfolio for sale by Colliers

Qantas has appointed Colliers’ Michael Crombie, Trent Gallagher, Gavin Bishop and Sean Thomson to offer the Qantas Investment & Land Portfolio for freehold sale or 99-year lease either individually or in-one-line via an International Expressions of Interest campaign.

Investors and developers are set to compete strongly for a once-in-a-lifetime opportunity to acquire a rare, scaleable Sydney industrial and commercial portfolio being offered to the market by Qantas. Qantas has appointed Colliers’ Michael Crombie, Trent Gallagher, Gavin Bishop and Sean Thomson to offer the Qantas Investment & Land Portfolio for freehold sale or 99-year lease either individually or in-one-line via an International Expressions of Interest campaign.

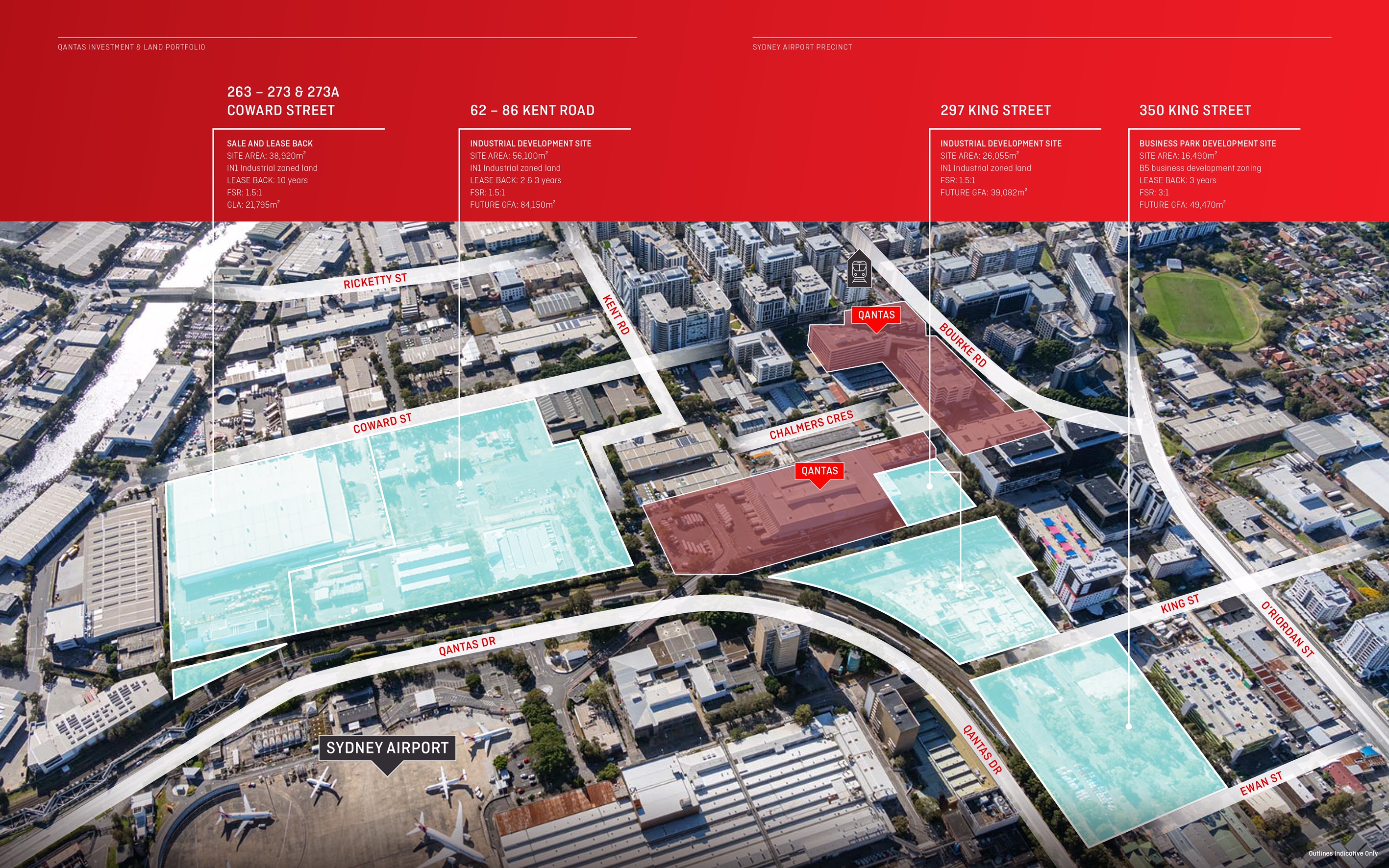

The properties are situated at 263 – 273 and 273A Coward Street, Mascot; 62 – 86 Kent Road, Mascot; 297 King Street, Mascot; and 350 King Street, Mascot. They offer a combined building area of 32,684sqm and a total site area of 137,565sqm, with development potential for more than 230,000sqm of gross floor area.

The Qantas Investment & Land Portfolio offers:

• A long-term sale and lease back of Qantas’ 21,795sqm state-of-the-art distribution centre, positioned on a large 38,920sqm prime industrial land holding, providing a secure income profile for an initial 10-year term with further 2 x 5-year options;

• Multiple allotments of IN1 Industrial land totalling 82,155sqm, structured on three-year lease back and with vacant possession, ideally positioned for the development of multi-level warehousing;

• A substantial B5 Business zoned lot of 16,490sqm, benefiting from multiple development opportunities and a 3:1 FSR, available for immediate development;

• Significant potential value-add through planning uplift allowing for greater density on the various land parcels;

• Initial net passing lease back rental of $10,529,950 per annum, benefitting from a fixed income profile;

• Long term WALE of ten years on the distribution centre and up to three years on some of the other industrial land.

Colliers’ Head of Strategic Advisory, Neil Murray; Managing Director of Valuation & Advisory Services, Dwight Hillier; and Senior Analyst Rebecca Ngan, have been working with Qantas for more than a year to review the company’s owned and leased portfolio.

Mr Crombie said the portfolio represented a once-in-a-lifetime opportunity underpinned by superior scale and supported by Australia’s most recognisable brand.

“This is a truly unique chance to acquire a scalable, 100% Sydney-centric portfolio with significant future upside, located within Australia’s most tightly held industrial and commercial market,” Mr Crombie said.

“Located within the heart of Mascot, immediately adjacent to the Sydney Kingsford Smith Airport Precinct, the development sites totalling 98,645sqm offer an unprecedented opportunity to develop (*STCA) a super core, multi-level industrial and logistics estate and institutional grade mixed use development of commanding scale, and become one of the largest industrial landlords within the South Sydney market.

“Prime grade institutional investment and development opportunities of this nature are very rarely offered to the market and are highly sought after. This portfolio is particularly rare as it is located in the highly sought-after key transport corridor of South Sydney and adjacent to Sydney Airport Precinct, with an end value, once fully developed, estimated at around $2 billion.”

There is also income security underpinned by various leasebacks to ASX-listed Qantas Airways Limited.

To request a copy of the Information Memorandum please contact one of the marketing agents via the contact details below.