The range of warehouse sizing is increasing in both Melbourne and Sydney markets says JLL

Contact

The range of warehouse sizing is increasing in both Melbourne and Sydney markets says JLL

JLL’s Head of Industrial and Logistics Valuations, Peter Fay talks with The INDUSTRIALIST. “Inventory management is considered a contributor to demand in Sydney and Melbourne, as logistics occupiers look to hold more stock to address supply chain risks.”

With the growth of e-commerce requiring more space for distribution centres and warehousing, inventory management has the potential to drive the expansion of asset sizing.

A noticeable trend has followed in the form of demand for increased asset sizing. The three-year average size of assets leased has increased by 29% in Sydney in 2020-2021, compared to the 2011-2013 average, according to JLL’s latest blog on ‘How big can Australia’s Logistics assets go?’.

The ‘big box’ warehouse is defined as warehouses between 50,000- 100,000 sqm. Facilities of this scale primarily serve as major distribution centres for 3PL’s or retailers, generally serving as centralised hubs for holding stock before it gets sent out to bricks and mortar stores or directly to customers.

Australia’s logistics and industrial sector set a new leasing record in the June quarter this year. Industrial and Logistics asset demand continues to grow in the Sydney and Melbourne markets, accounting for 73% of gross take up since the beginning of the year.

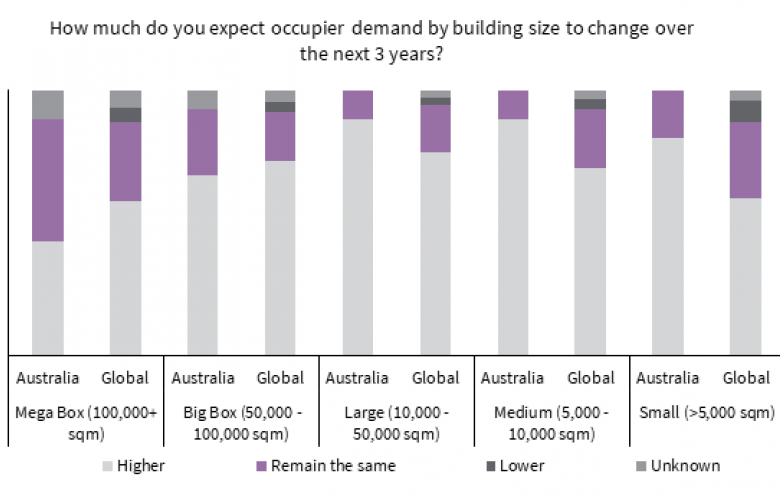

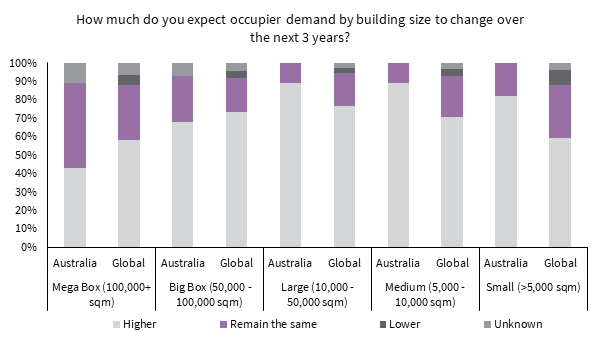

JLL’s Global Logistics Survey (April 2021) questioned the expected demand growth across building size. 19 percent of respondents globally expect a 20 percent plus increase in take up of mega boxes (100,000+ sqm) over the next three years. The demand for mega boxes is expected to be less in Australia, however, for the APAC region, respondents predict the most in-demand asset size to be the 5,000 to 10,000 sqm range. Closely followed by the 10,000 to 50,000 sqm range. Globally and in Asia Pacific, growth in e-commerce and last mile logistics are by far projected as the most important drivers of future occupier demand for new construction.

JLL’s Head of Industrial and Logistics Valuations, Peter Fay said, “In the 1990’s the supermarket chains were the only occupiers for warehouses in excess of 30,000 sqm, with demand shallow behind them. Advancing to the present day, compound population growth has fuelled consumption, importation has replaced local manufacturing, and a global pandemic has accelerated consumer behaviour to e-commerce, resulting in major occupiers existing accommodation not meeting demand.”

“Consequently, 40,000 sqm to 60,000 sqm requirements are now market norm for major occupiers with the supermarket chains and food and beverage manufacturers now adopting sophisticated high automation operating models, mirroring best practices from around the globe.”

“Inventory management is considered a contributor to demand in Sydney and Melbourne, as logistics occupiers look to hold more stock to address supply chain risks. With the growth of e-commerce requiring more space for distribution centres and warehousing, inventory management has the potential to drive the expansion of asset sizing,” Mr Fay said.

The increasing popularity and depth of demand for assets of this scale is emblematic of a number of emerging themes in the industrial occupier market.

“Major players are keen to include automation in their supply chain processes, however the technology infrastructure required to do this is normally too expensive to do across a number of smaller locations. Therefore, some occupiers are choosing to locate themselves in one large facility in which they invest in the best technology to see those efficiency benefits,” Mr Fay said.

With more sales occurring online and therefore accelerating e-commerce adoption, there is benefit in holding most of the stock in warehouses that can easily be dispatched to either stores or customers, so more warehousing space is needed.

Another emerging theme that is increasing popularity for these assets is that more groups are providing end-to-end supply chain solutions to their customers, allowing them to hold inventory across a network of warehouses occupied by the 3PLs. This has become a self-perpetuating cycle, with more retailers signing up to these services meaning 3PLs can expand their coverage, which draws in more retailers to sign up.