Industrial incentives down, rents up as lack of availability bites for tenants says JLL research

Contact

Industrial incentives down, rents up as lack of availability bites for tenants says JLL research

Industrial real estate landlords are benefitting from elevated levels of tenant competition, shows new JLL 4Q research from Annabel McFarlane JLL Senior Director of Logistics & Industrial Research - Australia and Peter Blade JLL’s Head of Industrial & Logistics Agency - Australia.

A perfect storm of constrained asset availability and near-record levels of occupier activity has continued to benefit industrial property landlords at the end of 2021, according to the latest research figures from JLL, with little relief expected for tenants in the first half of 2022.

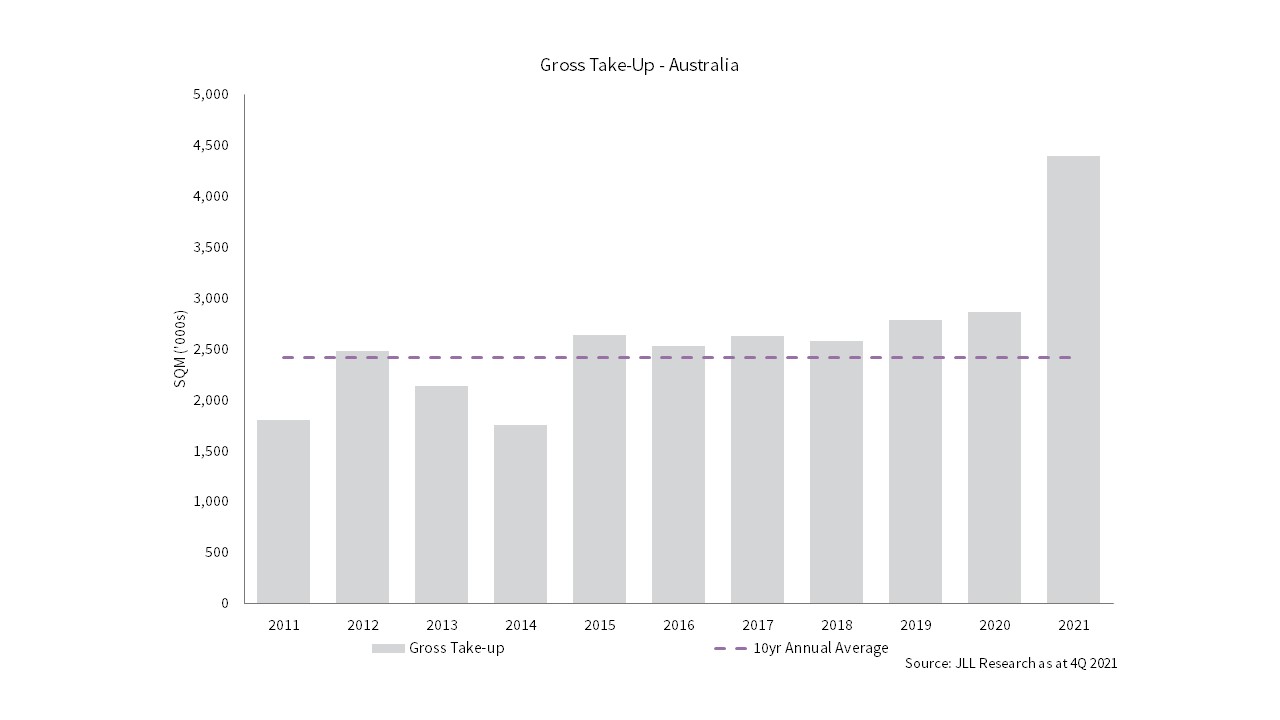

Gross take-up, a measure of occupier demand, was significantly above the long-term average nationally for the fifth consecutive quarter, with 877,200 sqm of space leased over the last three months of 2021. Activity continues to be concentrated in the two largest population bases, with Melbourne (39%) and Sydney (33%) accounting for almost ¾ of the national total.

Whilst 4Q21 marked the only quarter in 2021 in which the quarterly gross take-up total was below 1 million sqm, JLL’s Head of Industrial & Logistics Agency - Australia, Peter Blade believes that the decline was reflective of the severe lack of available leasing opportunities in the market at present. Mr Blade said “We have continued to see consistent levels of occupier inquiry across all of our national markets in the second half of 2021, but there is a real shortage of scalable and immediately available industrial space which has really constrained the flow of deals.”

The main contributing factor to the decline in available space in Australia’s industrial market has been a lower-than-expected volume of new development completions. As per JLL Research’s most recent data, a total of 1.47 million sqm of new space was developed nationally in 2021, which is in line with the 10-year annual average despite the full-year gross take-up total (4.4 million sqm) was 82% higher than the long-term annual average.

This issue has been further exacerbated by the relatively minimal volume of the 2021 development pipeline that was completed speculatively.

This issue has been further exacerbated by the relatively minimal volume of the 2021 development pipeline that was completed speculatively.

JLL Senior Director of Logistics & Industrial Research - Australia, Annabel McFarlane said “Over the course of 2021, the immediacy of most occupiers’ requirements has forced most tenants to primarily focus on existing assets in their search for space. However, in instances where this isn’t feasible there has also been opportunities sought in soon-to-complete developments, which has minimized the amount of speculative space delivered to the market year.

“If you look at the ratio of speculatively delivered space to total gross take up over the 10 years prior to 2021, the average has been approximately 10%. However, in 2021 this reached a record low of 6.5% - demonstrating the relative lack of available space delivered in comparison to the volume of occupier demand. For comparison, during the last economic shock in 2007 and 2008 this number jumped to 39.7% and 58.3%, respectively.”

Whilst 2021 take up has been above the 10-year average in all five markets, supply of new speculatively built stock has been well down in Sydney, Melbourne and Perth.

New supply completions (256,000 sqm) in Sydney industrial markets were 50% less than the 10-year annual average. Just 61,340 sqm of speculatively built stock was delivered to the market in 2021.

In Melbourne, supply completions (>5,000sqm) in 2021 exceeded 800,000 sqm for the first time in a calendar year since JLL started tracking the market. However, incredibly strong occupier precommitment and leasing activity through the year has absorbed 91% of the stock indicating the ongoing challenge for occupiers in the market. In Perth supply volumes 20,300 sqm were 17% of 10-year average volumes for the market.

The current disconnect between occupier demand and available supply has fed through to rental negotiations, particularly in the back half of the year. A new data series from JLL Research, which shows net effective industrial rents going back over 20 years in some markets, demonstrates the combined impact of growing face rents and declining incentives is having on the real cost of occupying warehouse space in Australia.

Ms McFarlane said “As landlords have seen increasing levels of competition between tenants on available space, we have seen significant prime net face rental growth for prime and secondary existing assets across all of our tracked markets. This has particularly started to accelerate on an effective basis over the year, when incentives begun to trend down, led by prime effective rental growth in the Perth (+14.6% y-y) and Melbourne (+14.0% y-y), Adelaide(+13.0%) and secondary effective rental growth in Brisbane (16.3% y-y), Melbourne (16.2% y-y) and Sydney (9.6% y-y). As such, all markets are well above their pre-COVID peaks.”

Mr Blade said “Most occupiers that are looking for new space are looking to expand to service new or existing contracts, particularly across the 3rd party logistics (3PL) and eCommerce sectors. The cost of occupying real estate is generally the fourth or fifth highest cost base and is much lower than transport and labour costs. As such, most groups are comfortable paying a premium for good quality space in a good location, even as those prime rates have increased by $10-12 per sqm on an effective basis in the back half of 2021.”

The development market response has been emphatic with close to 1.3 million sqm under construction with delivery expected in the first six months of 2022. Occupiers are committed to over 940,000 sqm. However, with precommitment levels already high (71%), conditions are likely to remain in favour of landlords in coming months.