Why semi-automated warehouses are getting cheaper

Contact

Why semi-automated warehouses are getting cheaper

Occupiers are increasingly adopting semi-automation as technology costs fall says Tom Woolhouse, Head of Logistics and Industrial for Asia Pacific at JLL.

Warehouses have been moving toward greater levels of automation, but the cost of fully automating industrial properties has caused sticker shock for many owners.

“A fully automated warehouse can take up to 10 years to pay back. You have to be certain that you’re investing in the latest equipment that is most suitable for your business function,” says Tom Woolhouse, Head of Logistics and Industrial for Asia Pacific at JLL. “If you get that wrong, it’s significant.”

Enter the Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs), two of the most widely used semi-automation technologies that are fast gaining traction in the sector, in part due to falling costs.

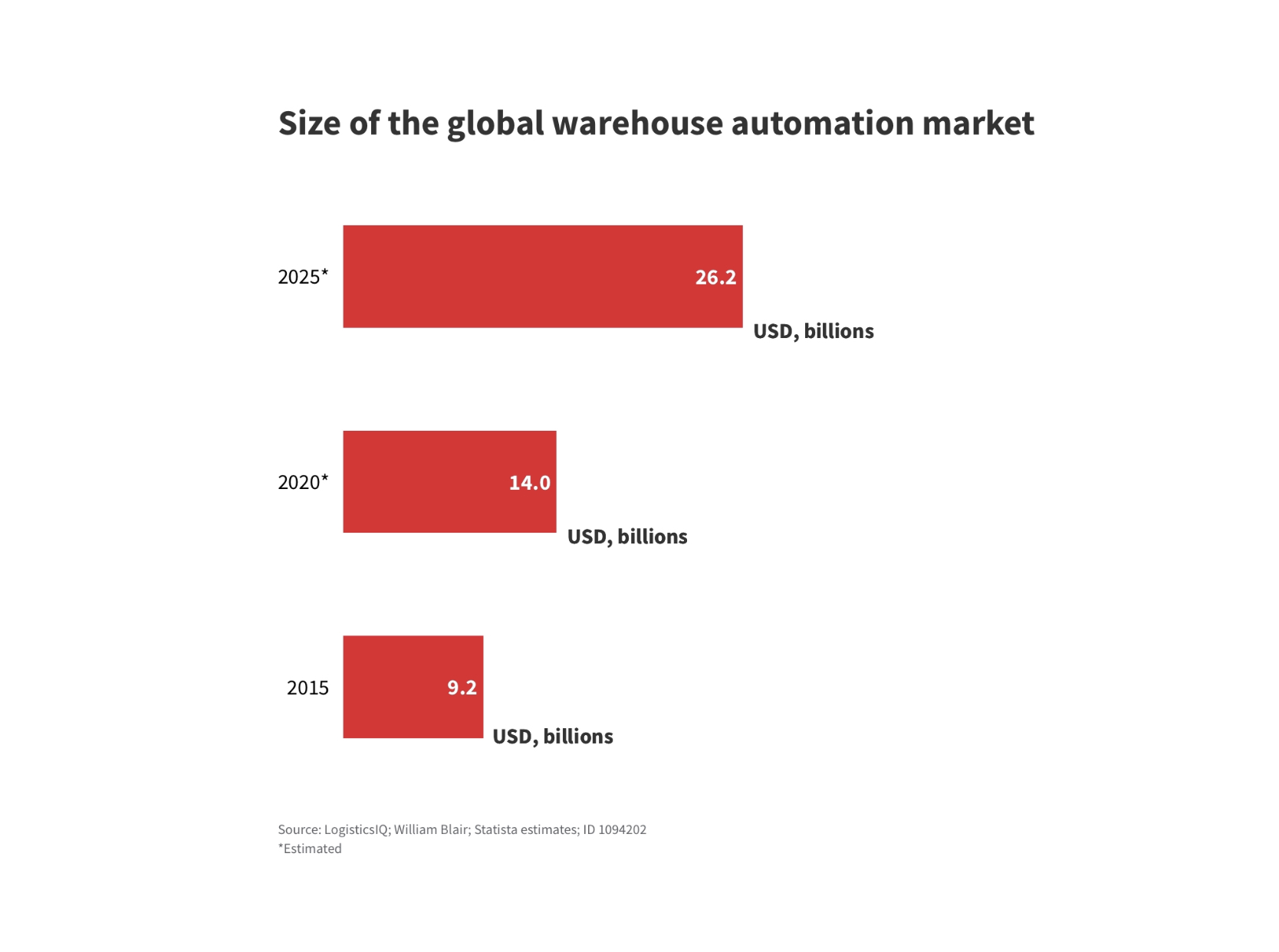

The average price of an industrial robot has fallen from about US$46,000 in 2010 to US$27,000 in 2017 and is forecast to dip further to under US$10,900 by 2025 due to lower technology costs, according to data portal Statista.

“This is becoming a much more viable option for occupiers who need a higher level of automation for their business,” says Woolhouse.

For instance, logistics giant DHL deploys assisted picking robots, which can increase the number of items picked per hour by up to 180%, in its facilities to reduce manual, repetitive tasks for employees who focus on value-adding work.

Other than falling costs, the ability to scale up or down and the ease of integrating such solutions into existing systems are also accelerating the pace of adoption, according to JLL’s Mechanization and Automation report.

“We expect existing users to deepen their use of mechanization and automation technologies, while occupiers who haven’t historically implemented such technologies will gradually adopt these solutions,” says Peter Guevarra, Director, Regional Research, Asia Pacific, JLL.

No one size fits all

No one size fits all

The ideal type of automation technology to deploy, however, varies depending on the occupier.

Occupiers have different requirements, impacting facility design, footprint, scale, and the overall integration of mechanization and automation technologies within the facility.

The balance between the initial upfront capital expenditure costs and the return on investment also differs between different occupiers — hence the need for flexibility.

“If flexibility and suitability are not factored in the initial design and implementation stage, the second round of investment may be equally as large,” says Guevarra.

To lower the risks for occupiers, some investors and developers are providing Robots as a Service (RaaS) for occupiers to leases robots — typically AGVs and AMRs — rather than purchase them.

“This reduces the initial upfront costs while providing flexibility,” says Guevarra. “RaaS helps bridge the mechanization and automation gap for many small to mid-size enterprises, as well as 3PL providers who need more flexible semi-automation solutions.”

To access the Mechanisation and Automation: Powering smarter, faster logistics research report visit here.