Industrial remains the leading performing commercial asset class says Ray White

Contact

Industrial remains the leading performing commercial asset class says Ray White

Industrial and its limited supply, keeping vacancies low across the country, has performed ahead of other major asset classes this year. Capital returns remain in positive territory while income returns have been consistently positive, providing an attractive hedge to inflation and increased financing costs, says Vanessa Rader Ray White Commercial Head of research.

The commercial property market has taken a hit in 2023 after a difficult late-2022 period. Growing interest rates and uncertainty surrounding their movement, together with high inflation causing investors to be more considered in their property decision making, while some buyers have completely retreated from the marketplace.

There is no doubt that sales volumes have reduced and are expected to remain subdued for the remainder of the year with price corrections starting to be realised, albeit some asset classes performing better than others. Industrial and its limited supply, keeping vacancies low across the country, has performed ahead of other major asset classes this year. Capital returns remain in positive territory while income returns have been consistently positive, providing an attractive hedge to inflation and increased financing costs.

Coming off the highs of 2021/22, capital returns have fallen away inline with interest rates’ upward momentum across each state. NSW has been the most resilient region for industrial given its heavily constrained land supply and low vacancy Total returns have been recorded at 12.7 per cent in March 2023 according to the latest PCA/MSCI All Property Digest, of which capital returns sit at 8.6 per cent after peaking at 24.7 per cent in December 2021. Encouragingly capital returns sit close to the 10 year average of 9.1 per cent, in contrast to Victoria and Queensland whose current results of 3.7 per cent and 3.0 per cent, and are well below the longer term averages of 6.9 per cent and 5.4 per cent respectively.

For Western Australia, despite the falls in returns, this state has shown greater stability compared to other regions. The strength of the local economy and underlying industrial demand kept total returns at 14.6 per cent in March 2023, well ahead of historical averages. The strong income returns for WA are highlighting these strong fundamentals, with stock shortages recording 5.9 per cent in March 2023, the highest rate of all states, propping up these total returns.

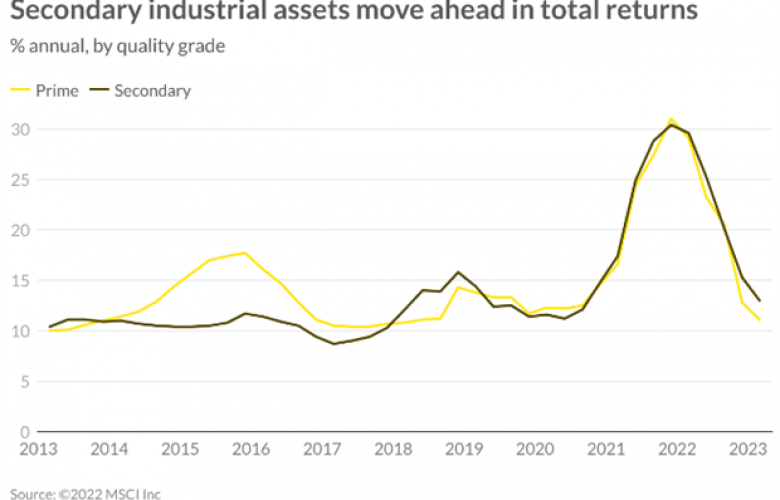

More recently there has been some divide between primary and secondary assets which have been tracking closely since the onset of COVID-19. The high demand for investment and occupancy of industrial assets resulted in total returns being closely aligned regardless of asset quality. The quest to purchase is seeing some investors move up the risk curve in regard to quality and affordability, seeing tenants considering secondary assets.

As we move into 2023, some break in their consistency has emerged. Prime assets, which typically outperform secondary, have seen superior capital returns while income returns remain stable across both quality types. The affordability associated with secondary assets is more attractive to tenants and investors, including owner occupiers, resulting in total returns up for secondary assets to 13 per cent, just behind the long-term 10-year average of 13.8 per cent, while prime asset returns of 11.1 per cent sit considerably below the 10 year average of 14.6 per cent. .

Capitalisation rates for industrial continues to maintain a low rate, albeit starting to creep upwards. Prime industrial currently sits at 4.2 per cent while secondary has grown to 5.0 per cent after bottoming out at 4.4 per cent mid last year. Sydney is still dictating the lowest rate of 4.1 per cent, followed by Melbourne at 4.3 per cent, with distribution assets remaining tight at 4.1 per cent and warehouses moving up to 4.5 per cent in March 2023.

The outlook ahead may see further compression in capital returns, while high inflationary pressures may see income returns remain stable, this will see capitalisation rates move upward accordingly.

By Vanessa Rader Ray White Commercial Head of research.

Related Reading:

Moorabbin warehouse sold for $4.16M at auction - Ray White

Second strongest yearly result of gross take up of logistics and industrial space in 2022 - JLL

Bullish conditions put the squeeze on Gold Coast industrial land shortage, says Colliers

Stock shortage fuels strong rental increases in Adelaide industrial market - CBRE