Empty industrial properties yield depreciation deductions - BMT

Contact

Empty industrial properties yield depreciation deductions - BMT

BMT Tax Depreciation delves into industrial estates and highlights hidden deductions.

Industrial estates are often strong investments due to their versatility and spaciousness, making them ideal for accommodating diverse industries and businesses. Not only are industrial properties lucrative investments, but they also generate significant depreciation deductions. According to BMT Tax Depreciation, even seemingly ‘empty’ properties hold valuable deductions.

In this article, BMT Tax Depreciation delves into industrial estates and highlights hidden deductions.

What is an industrial estate?

An industrial estate is an area of land developed as a site for factories and other industrial businesses. Industrial estates house a diverse array of establishments, including manufacturing facilities, warehousing and distribution centres, research and development spaces, as well as technology and IT companies. In recent years, we have also witnessed the emergence of gyms within these industrial precincts. This blend of industries creates a dynamic and vibrant environment, making industrial estates an attractive hub for various businesses and activities.

Industrial vacancy rates

The Australian Financial Review revealed that according to the Australian Industrial Review Q1 2023, Sydney is currently experiencing the tightest market conditions in the eastern region, with a mere 43,759 square meters of available space, indicating a significant 51 per cent reduction. In comparison, Melbourne offers 174,330 square meters of available space, while Brisbane has 226,592 square meters. The impact of the pandemic is evident as pre-COVID vacancy rates, which hovered around 5 per cent, have now plunged to an astonishingly low 0.8 per cent, marking one of the lowest vacancy rates ever recorded globally.

high demand in industrial property translates to a encouraging scenario for property investors, as it suggests the likelihood of heightened rental income and capital appreciation prospects.

Depreciation in industrial estates

There are two components of depreciation, capital works (Division 43) deductions and plant and equipment (Division 40) depreciation. Capital works deductions are claimable on the building’s structure and permanent assets such as car parks, ducting for air conditioning and flooring. Plant and equipment depreciation is claimable on the easily removable or mechanical assets such as smoke alarms, shelving, manufacturing equipment and light fixtures.

The depreciation eligibility of a property depends on its ownership structure. If the property is owner-occupied, the owner is entitled to claim all available depreciation deductions. However, if the property is leased, depreciation deductions are available to both parties but are claimed differently, reflecting their respective ownership arrangements.

Depreciation deductions in an empty industrial property

Commercial property owners often wonder about the available depreciation within industrial spaces. They will often say ‘I don’t occupy the property or own the equipment inside, so there isn’t depreciation to claim.’ While it’s true that fit-outs generate significant deductions in commercial properties, it’s also important to recognise that even an ‘empty’ property holds depreciable assets.

Apart from easily noticeable assets, other assets that are permanently attached to the building might not be as obvious. Examples include electrical wiring, plumbing, air conditioning systems, and other hidden components essential to a property’s functionality.

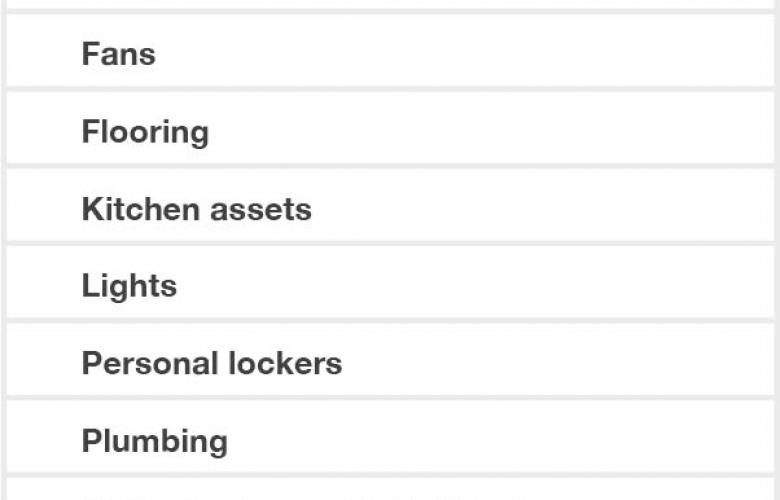

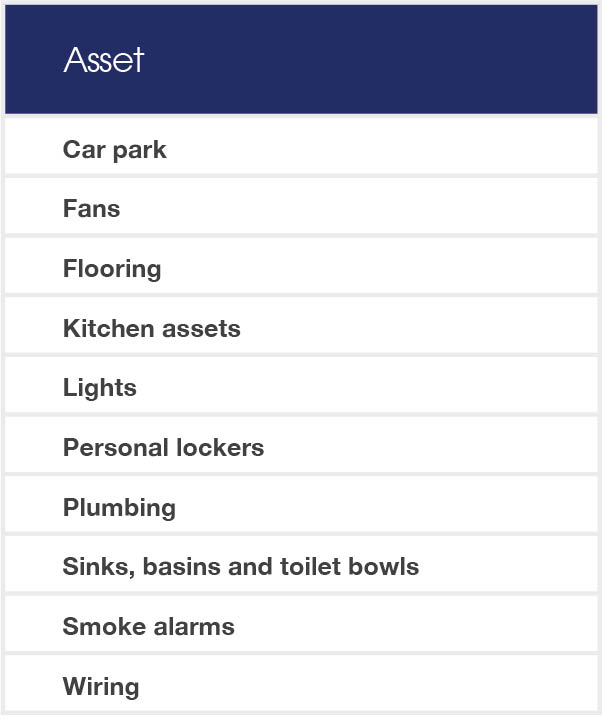

Table 1 lists some inconspicuous assets within an industrial property.

Table 1: Depreciable assets within an industrial property

As shown in Table 1, an 'empty' industrial property contains numerous depreciable assets. This isn’t a comprehensive list, there are many more claimable assets in most scenarios. To ensure all assets are identified, its essential commercial investors engage a quantity surveyor.

A specialised quantity surveyor, such as BMT Tax Depreciation, will have the expertise to accurately calculate construction costs and ensure compliance with Australian Taxation Office guidelines while identifying every possible depreciable asset.

To learn more about the deductions within an industrial property, get in touch with BMT on 1300 728 726 or Request a Quote.

The information in this article is general in nature and shouldn’t be taken as a quote or a guaranteed outcome.

Related Reading: