Cadence Property Group Announce New Leadership Structure Following Growth

Contact

Cadence Property Group Announce New Leadership Structure Following Growth

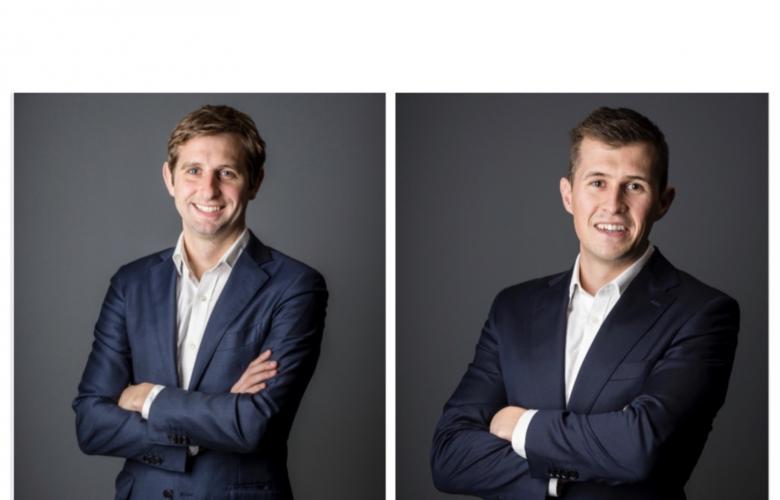

Charlie Buxton is now Chief Executive Officer of the business and Mitchell Kent, the first hire Cadence made, is now Chief Operating Officer. This announcement comes off the back of recent growth in the business including their first successful capital raise of $55 million and also comes ahead of their 10-year anniversary.

On the precipice of reaching a decade in business, Cadence Property Group (Cadence) has announced a new leadership structure following significant growth within the organization and in turn, the expansion of their internal capabilities.

Founded in 2014 by Charlie Buxton, Cadence has restructured their management with the appointment of an executive leadership team to further sharpen their operational efficiency and to establish a robust foundation for the comprehensive growth journey they plan to embark on over the next few years.

After holding the role of Managing Director since the inception of the business, Buxton is now making the move to Chief Executive Officer, with a view to focus on further growth for Cadence in the areas of transactions and capital raising.

Along with the newly appointed Head of Capital Transactions, Marco Cunningham, the pair have ambitions to continue to bolster their pipeline of projects and investment assets.

Mitchell Kent has stepped into the role of Chief Operating Officer and will now take on the oversight of day- to-day operations across the business while improving operational efficiency to handle their growth aspirations.

“Mitchell was our first ever employee at Cadence and as such, our longest standing staff member. He has contributed significantly to the growth the business has achieved to date,” Buxton said of the newly appointed COO.

“Mitchell is a well-respected and highly regarded leader in our business, and we know that he will thrive in his new role.”

Jack Mullen and Tony Mount have maintained their roles of Chief Financial Officer and Head of Investment Management, respectively.

Cadence’s new-look leadership team has been structured following the recent accomplishments within the business, highlighted by the successful capital raise for its first multi asset value-add fund, the Cadence Australian Real Estate Partnership I (CAREP I), reaching $55 million; $5 million above the initial target.

CAREP was established to focus on value-add real estate opportunities and continue to follow a strategy that Cadence has successfully executed since it made its first value-add investment in 2015.

“The success we’ve had in raising capital beyond our target is a significant milestone for the business,” said Mount.

“Re-structuring our leadership team ensures we’re resourced appropriately to not only achieve outperformance for the investors of CAREP I and our existing funds, but also build our capacity to increase the portfolio when strong investment opportunities are identified.”

As it approaches 10 years in operation, Cadence has transacted over $1.54b in property and has land holdings with the potential to develop approximately $2b of end product.

Related Reading

Charlie Buxton is now Chief Executive Officer of the business and Mitchell Kent, the first hire Cadence made, is now Chief Operating Officer.