Perth rental growth slows in Q2 but annual growth remains strong - Knight Frank

Contact

Perth rental growth slows in Q2 but annual growth remains strong - Knight Frank

The Quarterly pace of rental growth moderated in Perth’s industrial market over the second quarter of the year, but annual growth remains high with limited vacancy, according to the latest research from Knight Frank.

The Quarterly pace of rental growth moderated in Perth’s industrial market over the second quarter of the year, but annual growth remains high with limited vacancy, according to the latest research from Knight Frank.

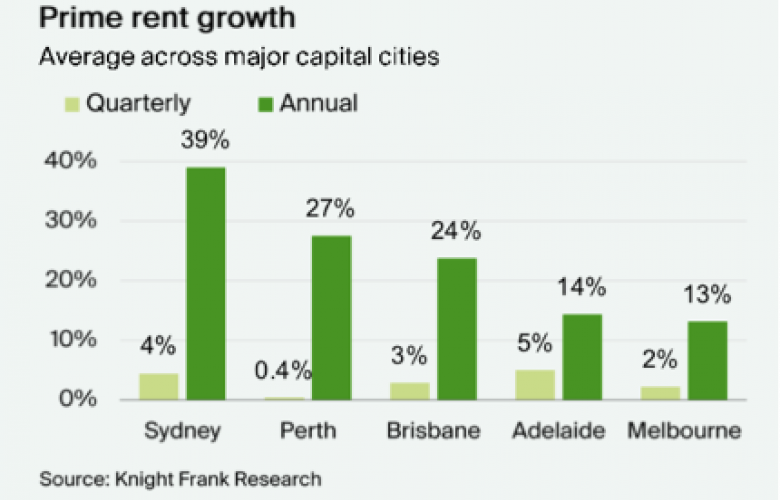

Knight Frank’s Australian Industrial Review Q2 2023 found Perth rents rose by just 0.4 per cent over Q2, in line with slowing growth in all major capital cities except Adelaide, however the annual increase remained high at 27 per cent, second only to Sydney at 39 per cent.

Secondary industrial rents in Perth’s industrial market rose by 32 per cent over the year to the end of June.

Knight Frank Associate Director Research & Consulting Dr Theo Connell-Variy said vacancy in Perth’s industrial market remained low with the majority of larger movements happening only as tenants moved into newer, pre-committed space.

“This meant limited vacant space dropped on the market, contributing to the broadly quiet quarter,” he said.

“Continuing the trend from Q1, rents have risen slightly with demand focused on specific locations.

“Prime rents across both manufacturing and warehousing remained stable in Q2, with only a modest increase in Outer South manufacturing, at 3.8 per cent.

“The rental growth was similar for secondary markets with Outer South the only market to record rental growth this quarter.

“Demand for both prime and secondary properties continues in the face of a chronic shortage of quality stock.

“The subsequent lack of lease transactions has made it difficult to identify where the ceiling for prime rental rates currently sits.”

The Knight Frank research found there had been growth in land values over Q2, albeit at a slower pace than 2022, while annual growth figures were broadly positive but had fallen from their 2021/22 highs.

The research found Outer South larger lots have shown strength in the most recent quarter, lifting $10 per square metre in Q2 and driving annual growth to 17.2 per cent.

In the North, where submarkets were generally quiet, Wangara, Gnangara and Landsdale lifted the broader regional averages; for small the lots the price improved $25 per square metre while larger lots increased $10 per square metre.

Knight Frank Head of Industrial Logistics WA Geoff Thomson said in established precincts of Perth such as the North and East, a lack of land on market has meant little evidence of growth.

“Meanwhile development in the south and the resurgence in interest more broadly in areas adjacent to the Westport development in Kwinana has driven a sustained uptick for both small and larger lots,” he said.

“We expect the South to show continued strength as developments reach completion and stock is added to the region.

“With economic headwinds and increased construction costs, land purchases have been subdued over the quarter with larger institutional investors perceived to be waiting for the new financial year before committing to development sites.

“Owner occupiers have dominated the purchaser group for existing assets with specific, targeted acquisitions.

“Resource companies remain a major player in the market, buoyed by strong sector performance and underpinned by foreign demand.”

The Knight Frank research found yields in Perth’s industrial market had shifted out with the more challenging financial environment.

The average prime yields, in part by virtue of limited transactions, softened by 12.5 basis points to average 6.47 per cent. By precinct, the Inner and Outer South yields remained stable at 6.25 per cent and 7.1 per cent respectively.

Secondary yields softened by six basis points to measure 7.1 per cent. Inner South secondary yields moved out marginally to reach seven per cent, while Outer South yield stock also went out 12 basis points to reach 7.5 per cent.