Strong underlying fundamentals continue to cement the tailwinds for growth, says Savills

Contact

Strong underlying fundamentals continue to cement the tailwinds for growth, says Savills

Historically low levels of available space continue to support strong rental growth rates, highlighting investor focus on structural tailwinds to drive future returns, according to leading agency Savills Australia’s latest Shed Briefing report.

Historically low levels of available space continue to support strong rental growth rates, highlighting investor focus on structural tailwinds to drive future returns, according to leading agency Savills Australia’s latest Shed Briefing report.

According to Savills Australia’s research, investor appetite, particularly new capital, is persistent, driven by the income-upside and strong underlying demand fundamentals, which are getting an extra boost from recovering supply-chains and the faster than expected rise in Australia’s population growth rates.

“The strength of the occupational market is steadfast, with a historically low vacancy rate nation-wide and a rebound in some macro drivers,” said Katy Dean, Head of Research at Savills Australia.

Savills Research found that take-up of existing space in Q2 was 60% more than its three-year quarterly average.

“The increase in take-up volumes suggests that economic headwinds are being partially offset by an even sharper focus on securing supply chains and building in efficiencies to cope with rising costs, including increased labour and transport costs, as well as higher rental rates,” said Dean.

The record low vacancy rate, which averages below 1.0% in some areas limited the churn of existing space in Q1 and total leasing take-up volumes dipped to c.700,000sqm on the east coast.

However, in Q2, c.1.03 million sqm was leased on the east coast, making it the busiest quarter since Q3-2022,” Dean said.

According to Savills Shed Briefing, 30% of the deals reported in Q2 were for speculative or pre-committed space, indicating that some companies are focused on improving operational efficiencies and supply-chains, while for others, the outlook for persistent low vacancy is helping to cement future plans on their floor space requirements.

Michael Wall, National Head of Industrial & Logistics at Savills Australia said more than a third of the pipeline due to come online this year is already committed, with the lack of new product to lease and recovery in the supply-chains combining to push up rents.

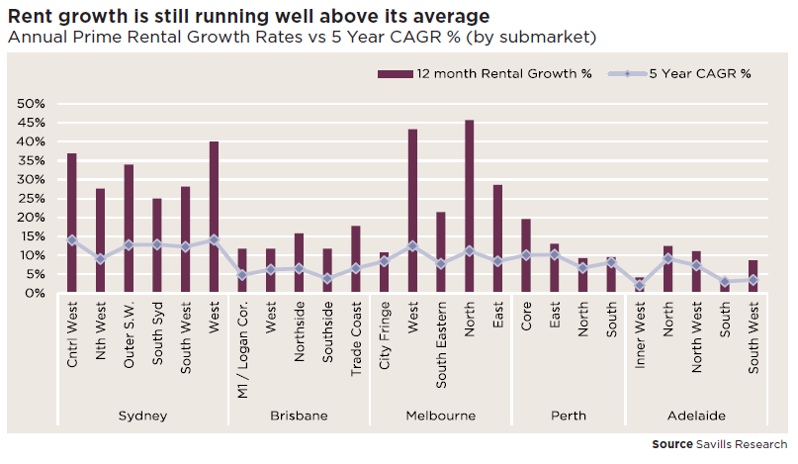

According to Savills’ Shed Briefing report, Sydney prime net face rents grew 31.5% over the past year, with a 5.9% push in Q2. Melbourne has been similarly strong, with rents growing on average 27.2% year-on-year, after a 6.3% rise in Q2. Brisbane grew 14% year-on-year and 3.7% in Q2, while Adelaide saw 8% average rise year-on-year and just 2.7% in Q1. Perth rents rose 13% year-on-year but have held in Q2 after averaging 5.3% growth in Q1.

“Compared to three years ago, prime rents have grown by 42% and secondary, nearly 50%, increasing the potential for rent reversion to market in most markets,” said Dean.

This supports the outlook for income growth for investors and mitigates a large proportion of the yield expansion that has occurred.”

Wall said “The structural tailwinds for industrial and logistics are very healthy, and this continues to be supported by the investment appetite to deploy capital through this cycle, but there is some caution in the broader economy, with the early emergence of sublease space on the market.

“On the back of this, developers are likely to take a more cautious approach on future development levels and rental growth assumptions, despite recent record growth.”

Savills has tracked approximately 2 million square metres in new industrial developments on the east coast, all of which are earmarked for completion in 2023, with around 770,000 square metres of this stock already delivered.

Investors remain bullish on the long term outlook as capital diverges.

The report found that estimates for Q2 indicate c$2.4 billion has transacted (+$5m), which is about 52% more than what transacted in Q1-23.

“There is resilience in the level of liquidity for industrial and investors are still bullish on its outlook,” said Dean.

“New capital sources are emerging, with overseas pension funds, the US and Japan contributing to the return of some of the larger scale deals seen during Q2, while privates and owner occupiers are largely dominating the smaller scale acquisitions,” said Wall.

Savills found that there has been a marked increase in owner-occupier and private investor activity, with these buyers accounting for 50% of investment transaction volume in Q2 – up from its long-run average of 30%. The trend suggests that private capital and lower-leveraged buyers are acting opportunistically.

“Privates are typically proving to be more nimble when it comes to snapping up industrial assets – they also don’t face the same issues as institutional capital, benefiting from reduced competition, and ability to be more flexible as less constrained by debt costs when deploying capital,” Dean noted.

SAVILLS SHED BRIEFING: STATE-BY-STATE OVERVIEW

Sydney: Prime net face rents are up 5.9% quarter-on-quarter, or 31.5% year-on-year. Strong growth continues in the secondary market, which faces similarly low vacancies, but its pace is slowing. Secondary face rents have increased 3.4% quarter-on-quarter and are up 32% on average over the year.

Melbourne: Prime net face rents are up 6.3% quarter-on-quarter, or 27% year-on-year. There continues to be strong growth across secondary rents, particularly in the West and Northern precincts due to low vacancy. Secondary face rents have increased 8.5% quarter-on-quarter and are up 26% on average over the year.

Brisbane: Prime net face rents are up 3.7% quarter-on-quarter, with secondary rents unchanged. However, secondary rents have increased 14.4% year-on-year, which is slightly more than prime - demonstrating the low vacancy profile of the market despite a lifting development pipeline. Land remains scarce in the Trade Coast, contributing to strong take-up rates in other precincts.

Adelaide: Prime net face rents are up 2.7% quarter-on-quarter, or 8.0% year-on-year. Secondary rents have grown to 7.2% quarter-on-quarter, with lower vacancy starting to limit the churn of stock, particularly in the Inner West and South West. Secondary rents are up 12% on average over the year, suggesting that demand is still outpacing supply.

Perth: Average prime net face rents are now holding stable following a 13% rise over the last 12 months and nearly 40% growth over the last three years. Prime net face rents average $125 per square metre per annum, up from an average of $113 per square metre a year ago.