Australian commercial sales volumes bounce back slightly in Q3, but remain subdued - JLL

Contact

Australian commercial sales volumes bounce back slightly in Q3, but remain subdued - JLL

Continued pricing discovery contributed to subdued sales volumes, with domestic investors driving activity and offshore interest building.

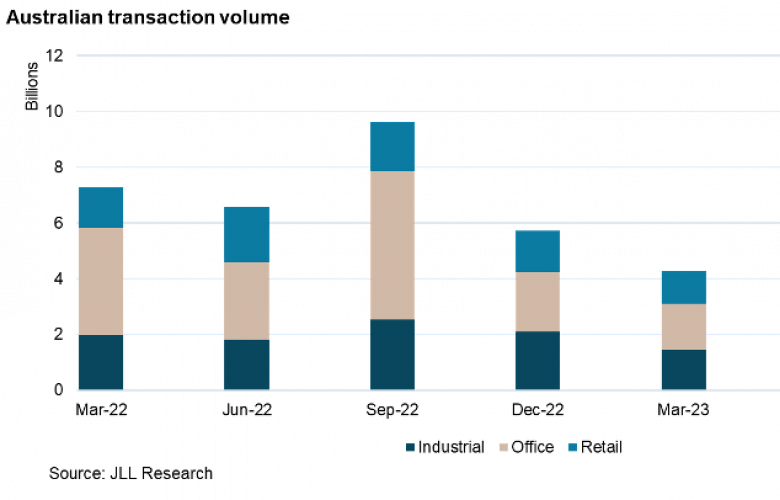

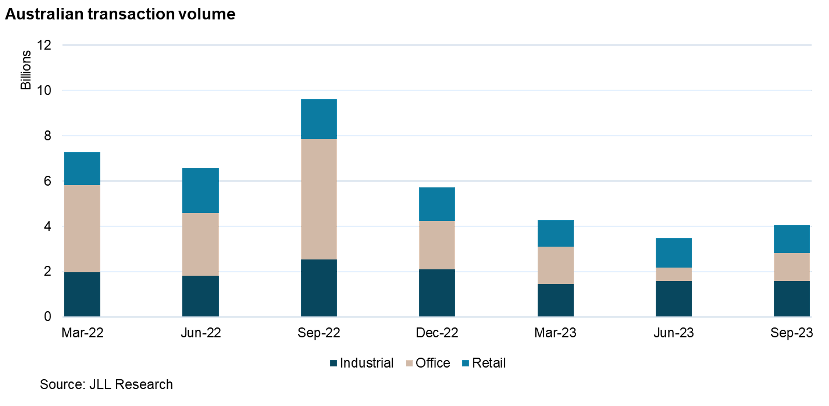

JLL’s preliminary Australian commercial property volumes for Q3 2023 saw total sales across the office, logistics & industrial and retail sectors fall 58% to $4.0 billion compared to $9.6 billion in Q3 2022.

Across the three key sectors, comparing Q3 2023 with Q3 2022, there was a 77% fall in office volumes to $1.2 billion, a 38% drop in logistics & industrial volumes to $1.6 billion and a 29% drop in retail volumes to $1.2 billion.

Year-on-year transaction volumes in the first nine months of 2023, as at Q3, totalled $11.8 billion compared to $29.2 billion for the full calendar year of 2022.

JLL’s preliminary figures for all transactions across the commercial property market (office, retail and logistics & industrial) show volumes for Q3 2023 have slightly increased.

Significantly, Q3 2023 Office volumes were up 106% from Q2 2023, rising from $594 million in the June quarter to $1.2 billion in the September quarter with a significant volume of deals expected to close in Q4.

The most significant sales for Q3 across all sectors was the divestment of a 50% interest in 20 prime industrial assets to UniSuper for $560 million, Midland Gate Shopping Centre (WA) for $465 million, 7 Spencer Street (Vic) for $313 million, 44 Market Street (NSW) for $393.1 million, 1 Margaret Street (NSW) for $296 million and 189 Kent Street (NSW) for $200 million.

JLL’s Head of Capital Markets – Australasia, Luke Billiau said that a large composition of activity capital across sectors is originating from offshore, with Hong Kong-based PAG acquiring both 44 Market Street and Midland Gate, demonstrating that large-scale offshore investment was starting to return to Australia.

“The top three foreign buyer groups most active in Australia across all sectors in the first nine months of 2023 have been from Hong Kong ($664.3 million), USA ($434.4 million) and Singapore ($343.5 million).

“Our preliminary sales figures don’t capture the significant foreign investment into the Alternatives space in Australia, with the pending sale of the Student One portfolio to Blackstone in Q3 for $500+ million.

“There has also been new capital raising involving offshore institutions including the recent $500 million raised for Centuria’s industrial fund and $1.3 billion raised for the HomeCo Healthcare and Life Science fund that will also drive future sales,” Mr Billiau said.

In the first nine months of 2023, offshore groups accounted for around 19.0% of total investment volumes across all sectors (office, retail and logistics & industrial). This is down from 25.5% in the same period last year.

Relatively Asia Pacific is positioned well to attract global capital with Australia’s appeal underpinned by a growing population, increased infrastructure investment and economic resilience.

Mr Billiau said, “The fall in transactions since the beginning of 2023 is indicative of the pricing discovery in the market as a result of rapidly changing funding costs and a low-leverage environment relative to other global markets that prolongs this period.”

“We have observed quarterly fluctuations in national sales volumes during 2023 from $4.3 billion in Q1, $3.5 in Q2 and bouncing back to $4.0 in Q3.

“The outlook for Q4 is a robust transaction environment that should see momentum build into 2024, as local and offshore investors re-enter the markets,” Mr Billiau said.

JLL’s Head of Capital Markets Research, Andrew Quillfeldt said a range of factors will begin to drive investment activity in 2024.

“While the institutional real estate market in Australia is well capitalized relative to other countries, we’re still expecting some capital recycling for sector re-allocation purposes to drive asset sales. Industrial and build-to-rent are becoming even higher conviction strategies for many groups. Furthermore, some funds are likely to be looking to divest assets to fund development and to de-lever to maintain conservative gearing,” Mr Quillfeldt said.