Industrial capital forecast to grow with $30 billion 'ready to be deployed'

Contact

Industrial capital forecast to grow with $30 billion 'ready to be deployed'

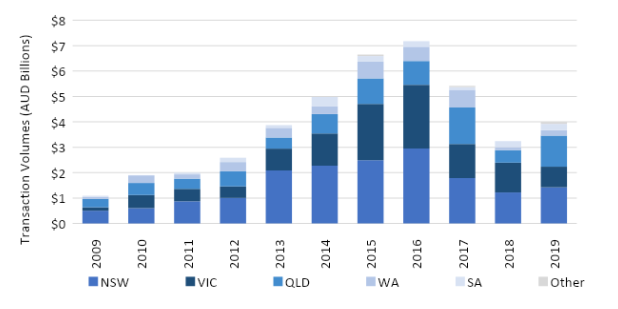

Australia's industrial and logistics market could be set to reach new heights after JLL identified $30 billion in investment capital for assets within the sector as part of its Australian Industrial Investment Review & Outlook 2020.

Australia's prime industrial assets will again be in hot demand throughout 2020 with $30 billion of capital ready to be injected into the market, JLL says.

The company's Australian Industrial Investment Review & Outlook 2020 found that the Asia Pacific (APAC) region is attracting more capital in a global context, driven by GDP and population growth.

According to the report, Australia represented 11 per cent of the cross-border transactions in the APAC region in 2019, ranking fourth behind China, Japan, and South Korea.

Australian Industrial Investment Review & Outlook 2020 - At a glance:

- Australia is in a prime position to take advantage of changing demographics within the world’s emerging markets

- A depreciating Australian dollar is attracting investment sale activity as well as trade activity

- Australia’s industrial investable universe is growing

JLL’s Head of Capital Markets, Industrial and Logistics Tony Iuliano said the key for 2020 would be how investors unlock prime industrial assets in the midst of demand outweighing supply and availability.

“The $30 billion of capital we have identified has been derived by many different mandates, including development, speculative construction, and investing with managers who have the skillset and expertise to continually add value coupled with capabilities in growing the platform year on year," he said.

JLL’s Head of Capital Markets, Industrial and Logistics Tony Iuliano. Source: JLL

“We are seeing a significant amount of capital playing in the development space to increase their exposure and footprint as stabilised product remains difficult to obtain.

"Furthermore, we expect corporate sale and leaseback to be a significant driver in 2020 which will help corporates reinvest their capital back into their operating streams.

“Investors and developers will be forced to be creative to help unlock opportunities."

JLL estimates the value of the capital to increase from its current estimated value of $88.2 billion, or 55.2 million sqm of gross lettable area (GLA), to $114 billion by 2024.

Mr Iuliano said Sydney was expected to remain the largest market by capital value of stock and physical stock by GLA, despite Melbourne’s share of physical stock being only just behind the city in 2019 at 28 per cent, in comparison with Sydney's 29 per cent.

The attractiveness of Australia

With industrial vacancy across the Eastern seaboard sitting at 3.8 per cent, there continues to be strong demand for Australian assets.

JLL’s Director of Industrial Research Sass J-Baleh said stable long-term factors had contributed to trend.

“The Asia Pacific market is growing and, in turn, attracting capital to the region with Australia being a beneficiary," she said.

"The Australian market offers a liquid, stable and strong return performance trend, low interest rates, a weakening dollar, and robust growth mainly supported by infrastructure expenditure and population growth.

“Domestic population growth as well as global demand influences - particularly within the Asia-Pacific region – will further drive the sector in the short, medium and long term.

“Industrial property has emerged as a mature, institutional-grade investment sector, and plays a vital role in a diversified investment portfolio."

Click here to download the full report.

Similar to this: