Industrial & Logistics assets top buyer wish lists, with ESG another key focus area says CBRE

Contact

Industrial & Logistics assets top buyer wish lists, with ESG another key focus area says CBRE

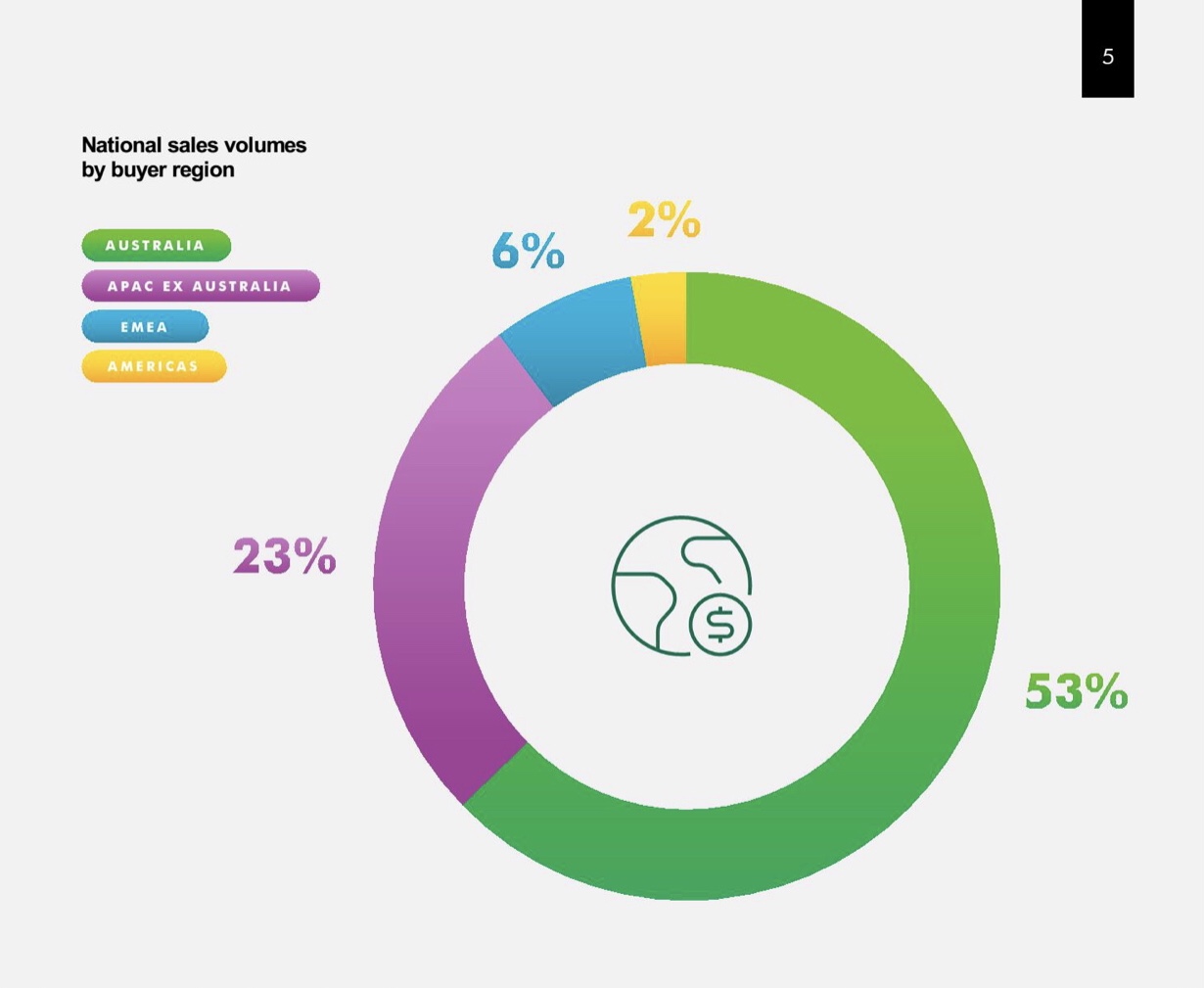

Australia’s major commercial property investors are moving back into buying mode after a subdued 2020, with a heightened focus on Industrial & Logistics assets and Environmental, Social and Governance (ESG) considerations.

Australia’s major commercial property investors are moving back into buying mode after a subdued 2020, with a heightened focus on Industrial & Logistics assets and Environmental, Social and Governance (ESG) considerations.

A new CBRE Investor Intentions survey highlights that 69% of Australian respondents expect to be more acquisitive in 2021 relative to last year, with Industrial & Logistics assets at the top of their buy list.

However, the rub will be stock availability, with only 47% of Australian respondents indicating a willingness to sell more commercial assets.

However, the rub will be stock availability, with only 47% of Australian respondents indicating a willingness to sell more commercial assets.

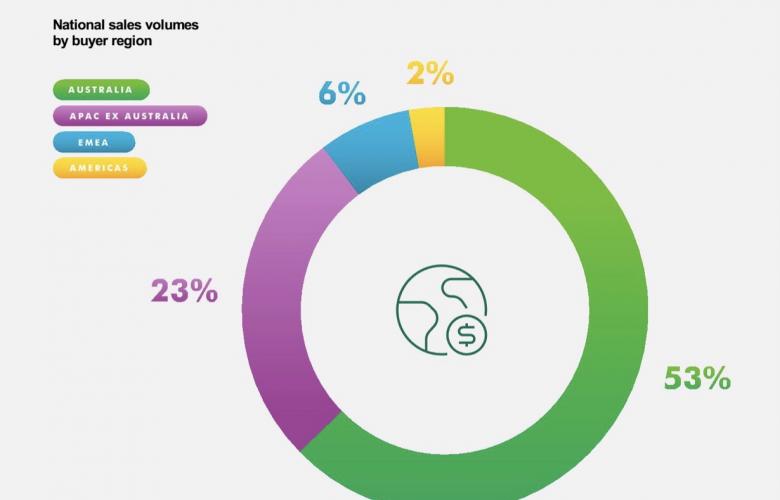

CBRE’s Pacific Head of Capital Markets, Mark Coster noted; “Uncertainty and border closures had a significant impact on Australia’s capital markets sector last year, with commercial sale volumes falling by 40% to the lowest level since 2012. However, there is a light at the end of the tunnel, with investors indicating a willingness to get back into the game and be more acquisitive in 2021.”

The Investor Intentions findings are highlighted in CBRE’s newly issued Australia Capital Markets – Market Outlook report, which highlights that the Industrial & Logistics sector is expected to be a key beneficiary of a bounce-back in investor demand.

Australian investors have also put a much firmer line in the sand when it comes to building ESG considerations into their acquisition strategies.

“Our Investor Intentions survey confirms what buyers were telling us last year – namely that ESG is playing a much stronger role in the analysis investors are undertaking when assessing the risks and growth opportunities for funds, portfolio and individual assets,” Mr Coster said.

Some of the key take-outs include:

- 69% of Australian respondents expect to be more acquisitive in 2021 relative to last year

- The rub will be stock availability, with only 47% of Australian respondents indicating a willingness to sell more commercial assets.

- Australian investors have also put a much firmer line in the sand when it comes to building ESG considerations into their acquisition strategies, with 78% of Australian investors indicating that they had adopted ESG considerations into their buying criteria, relative to just 54% of respondents in the previous year. Australia appears to be one of the leaders in the region when it comes to ESG, with only 48% of Asia Pacific investors revealing that they had adopted ESG criteria.

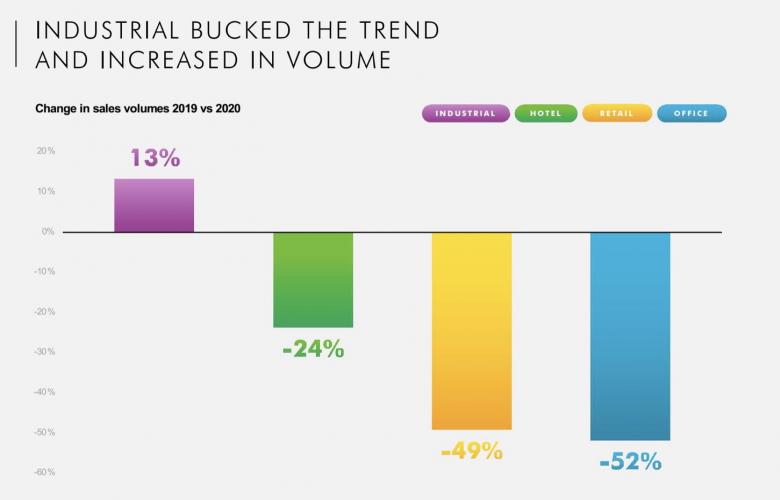

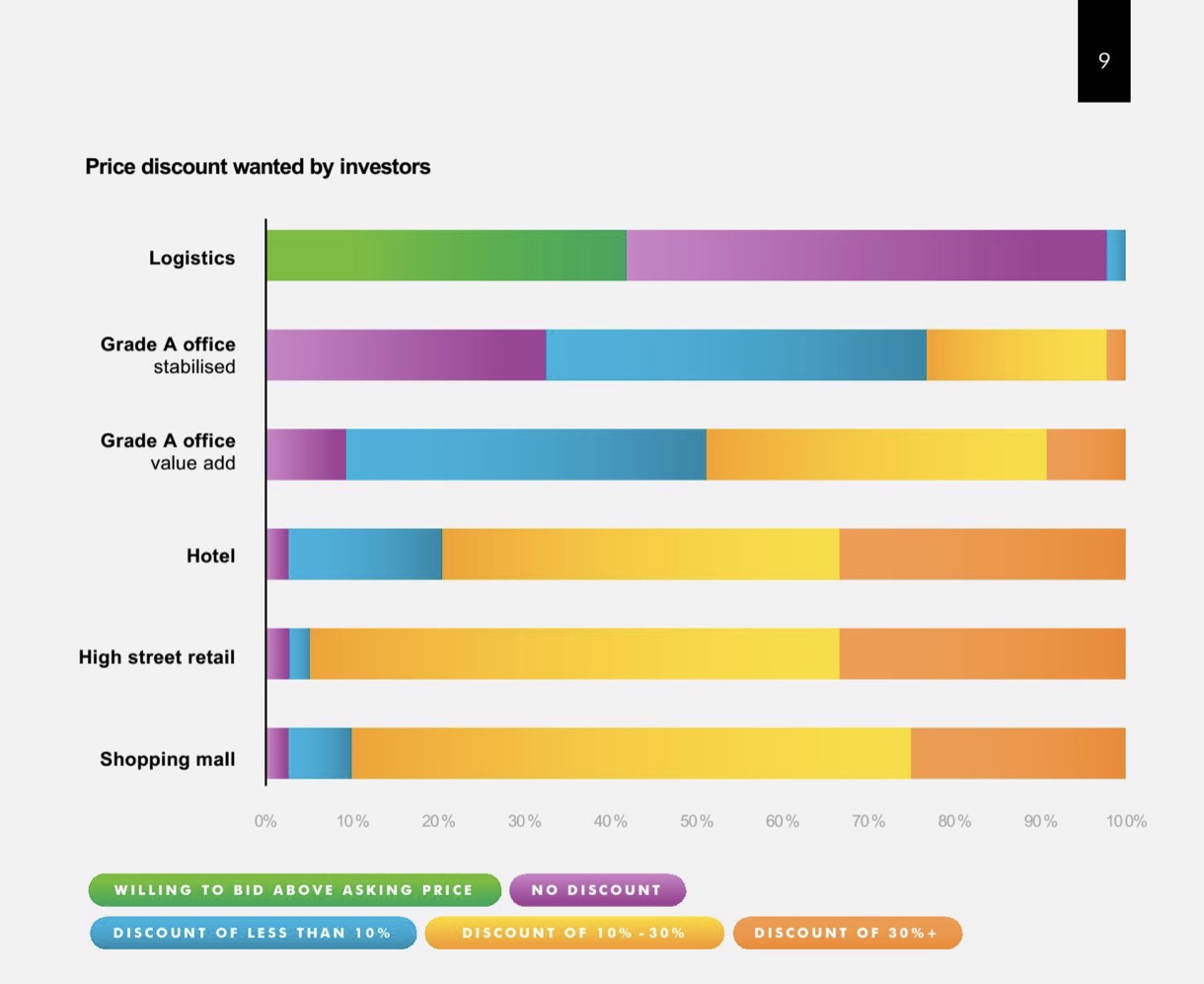

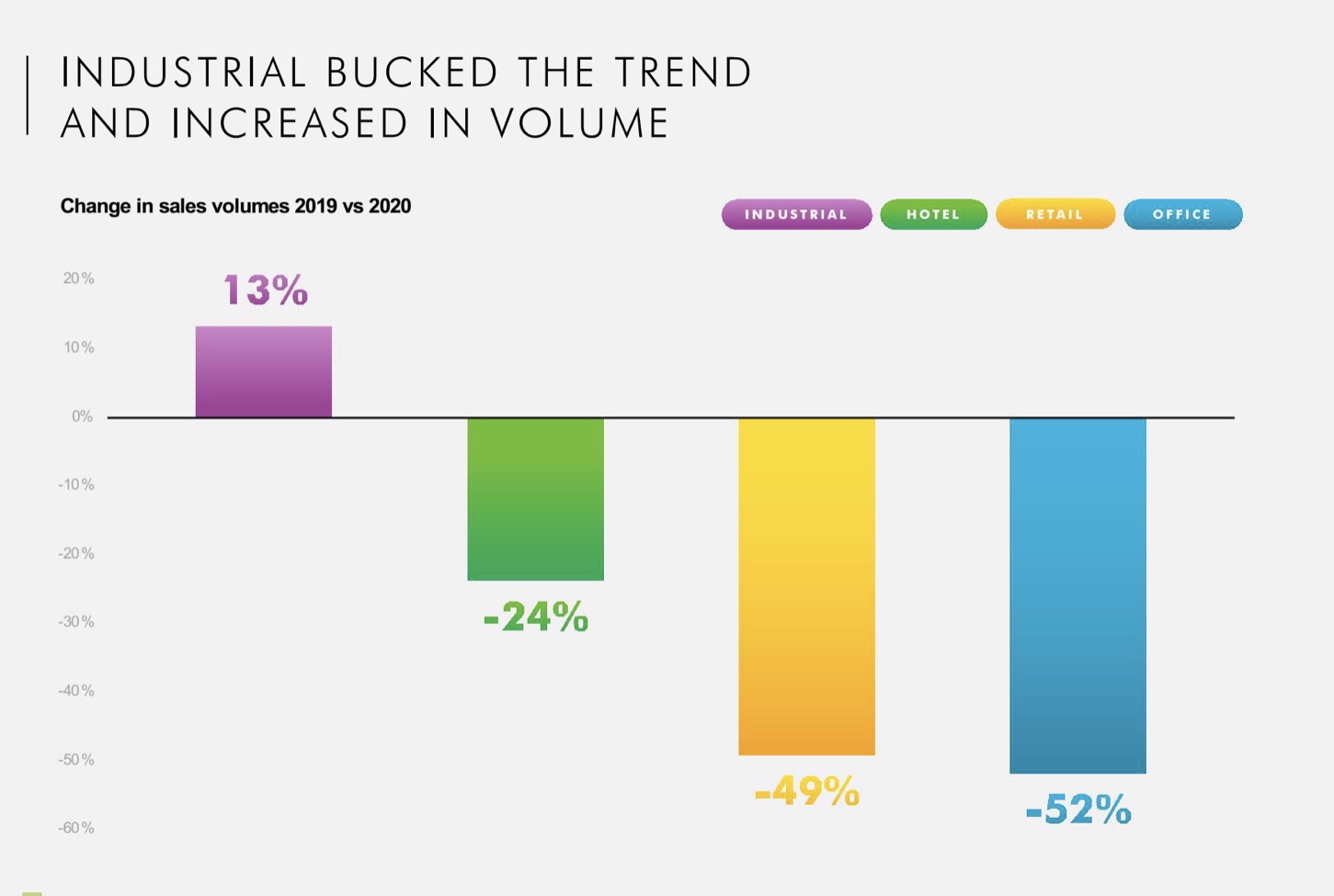

- I&L was the only sector to record an increase in sales volumes in Australia in 2020 (+13%) and survey respondents also put I&L assets at the top of their buying wish list for 2021 and indicated that they were willing to put their money where their mouth is – with 41% indicating that they were willing to pay above the bid price for logistics assets.

- Capital values for all the major commercial property asset classes will bottom out in 2021 before showing moderate increases.

“In our latest survey, 78% of Australian investors indicated that they had adopted ESG considerations into their buying criteria, relative to just 54% of respondents in the previous year. Australia appears to be one of the leaders in the region when it comes to ESG, with only 48% of the Asia Pacific investors revealing that they had adopted ESG criteria.”

“In our latest survey, 78% of Australian investors indicated that they had adopted ESG considerations into their buying criteria, relative to just 54% of respondents in the previous year. Australia appears to be one of the leaders in the region when it comes to ESG, with only 48% of the Asia Pacific investors revealing that they had adopted ESG criteria.”

Another trend has been the heightened investor focus on Industrial & Logistics (I&L) assets – both last year and moving into 2021.

In 2020, I&L was the only sector to record an increase in sales volumes in Australia (+13%), as activity dipped across the office, retail and hotel asset classes.

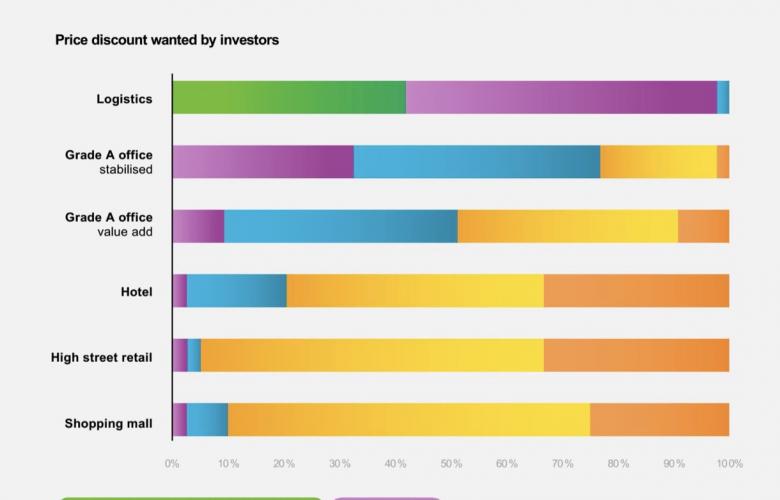

Survey respondents also put I&L assets at the top of their buying wish list for 2021 and indicated that they were willing to put their money where their mouth is – with 41% indicating that they were willing to pay above the bid price for logistics assets.

CBRE Capital Markets Executive Director, Industrial & Logistics, Chris O’Brien noted, “The increase in sales volume activity will continue throughout 2021 with a record year expected for Industrial & Logistics. The momentum gathered in 2020 through into Q1 of this year will result in continued yield compression and an overall increase in capital value rates.”

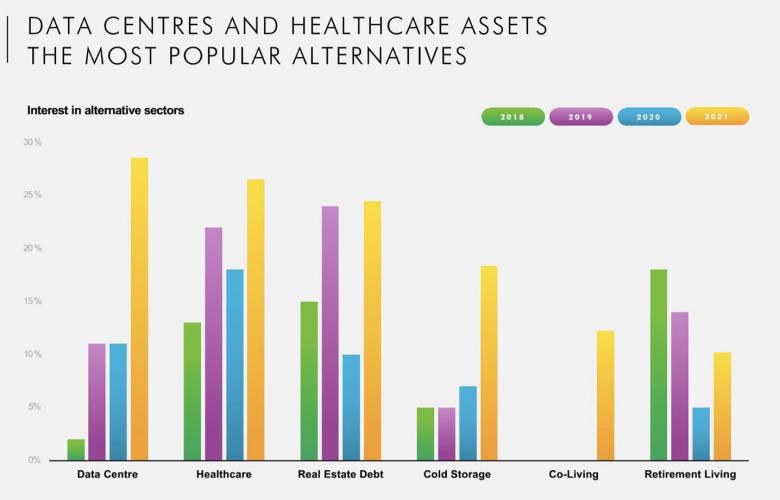

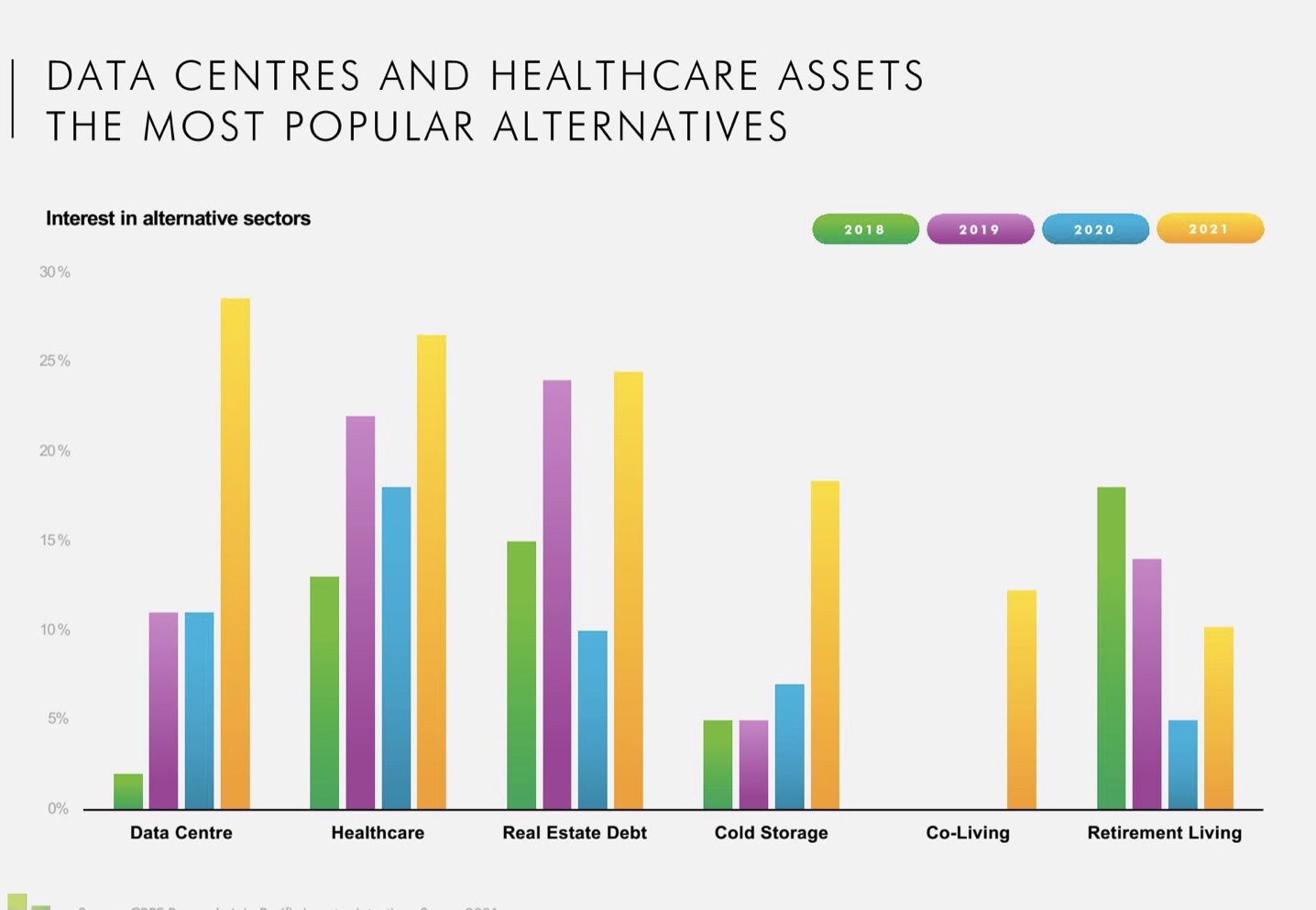

Alternative assets classes are also on the buy list – primarily data centre and health care assets – with 29% of respondents indicating an interest in data centre investment.

CBRE’s Market Outlook report also forecasts that capital values for all the major commercial property asset classes will bottom out in 2021 before showing moderate increases.

To request a copy of the CBRE Market Outlook 2021 please email either Mark Coster, Tom Broderick or Chris O'Brien of CBRE via the contact forms below.