Industrial & Logistics market hits new record 1.1 million Sqm in Q1 JLL

Contact

Industrial & Logistics market hits new record 1.1 million Sqm in Q1 JLL

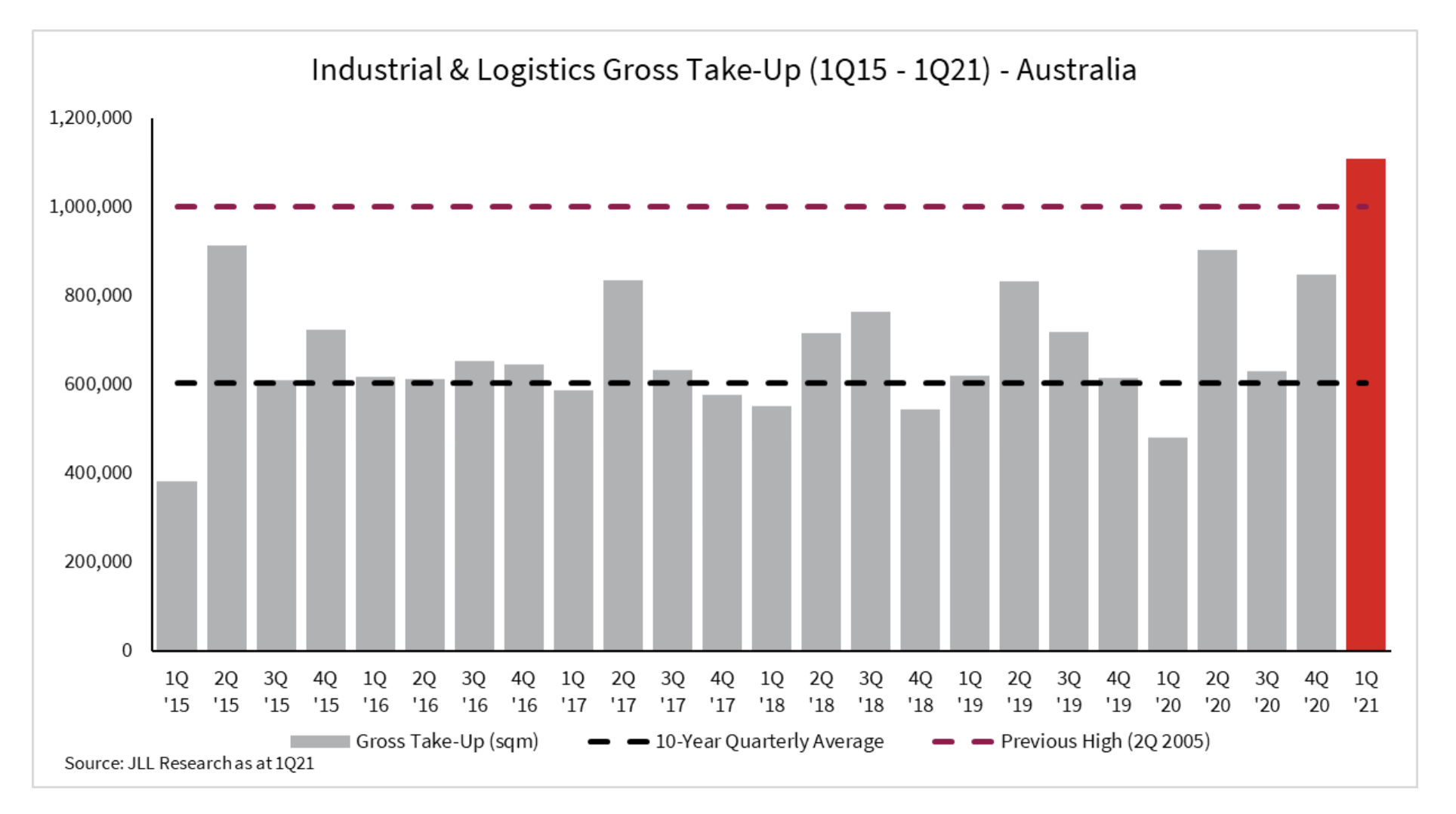

JLL Research figures show The Australian industrial & logistics occupier market exceeds 1.1 million Sqm breaking single-quarter demand record from 1997 figures, after reaching a new annual benchmark in 2020

JLL Research figures show The Australian industrial & logistics occupier market exceeds 1.1 million Sqm breaking single-quarter demand record from 1997 figures, after reaching a new annual benchmark in 2020

The Australian Industrial & Logistics market has continued its strong run from last year into the start of 2021, with occupier demand reaching a new record high in the first quarter of the year.

JLL Research figures show gross take-up of industrial space (a measure of demand) exceeded 1.1 million sqm for the first time since the data was first tracked nationally in 1997.

Activity was concentrated along the markets on the Eastern Seaboard, which accounted for 88% of gross take-up of space in Q1. However, all five tracked industrial markets in Australia outperformed totals recorded in Q1 of 2020.

JLL’s Senior Director, Research, Annabel McFarlane said, “The activity recorded in the first quarter of the year comes off the back of a record-breaking result in 2020, which saw national gross take-up levels reach a new annual benchmark of 2.86 million sqm over the course of the year.

“Face and effective rents are increasing across many markets. Strong annual net face rental growth was recorded for Sydney’s North at 4.4%, Sydney’s Outer Central West at 3.5% and Melbourne South East at 2.7%. The ongoing wave of occupier expansion across the country is placing pressure on asset availability, exacerbated by declining levels of speculative stock completions in the early stages of the year.

“Most developers adopted a ‘wait-and-see’ approach to speculative development during 2020 and, given the relatively short build-time for warehouses, this has now flowed through in the form of declining completions of new stock. In fact, Q1 2021 was the first time since JLL started tracking the market that zero available space in new stock has been delivered in Australia, as the little speculatively developed stock has been absorbed quickly prior to completion. This has proved to be a winning decision for those developers that could push aside pandemic uncertainty,” said Ms McFarlane.

The Melbourne industrial & logistics market has recorded the strongest levels of activity of any city in Australia, recording 546,940 sqm of gross take-up during the quarter – equivalent to 49% of the national total. Leasing and pre-commitment activity in the Melbourne market was primarily attributed to the expansion of retailers and associated transport companies.

JLL Head of Industrial - Victoria, Matt Ellis said, “Since Melbourne has re-opened over the last six months, we have seen occupiers increasingly confident in making real estate decisions to strategically position themselves for their future needs. This has pushed occupier enquiry to new heights since the end of last year, with end-users across the retail, logistics and manufacturing spaces competing for limited available space.”

The Sydney industrial & logistics market also recorded elevated levels of demand in 1Q 2021, as gross take-up totaled 313,110 sqm – 55% higher than the 10-year quarterly average. Activity was primarily concentrated in the Outer West precincts in Sydney, which accounted for 97% of gross take-up during the quarter, reflective of the relatively larger and newer assets that are available in that segment of the market.

JLL Head of Industrial – New South Wales, Peter Blade said, “We have seen substantial growth from the retail trade sector in the Western Sydney market over the last 12 months, as many major retailers have sought to expand their industrial footprint in response to structural changes in consumer behavior. This is also feeding through to third-party logistics providers, who have rapidly expanded since the beginning of last year as their customer bases have grown exponentially.”

Occupier activity in the Brisbane industrial & logistics market was relatively consistent with long-term averages, however with gross take-up historically weighted to later in the year, the quarterly total of 118,000 sqm is 18% higher than the average for the first quarter over the previous decade. Tenants in the Wholesale Trade (41%) and Retail Trade (20%) industry sectors accounted for the highest proportion of demand during the quarter, with most major deals occurring in the Southern precinct (75%).

JLL Head of Industrial – Queensland, Shaun Canniffe said, “A number of tenants showed some hesitation to expand in the Brisbane market throughout 2020, and it appears that this trend has now reversed in the early stages of 2021 and tenant enquiry has accelerated to higher than pre-COVID levels. There remains some pent up demand in the Retail and Wholesale Trade sectors, as a result of dramatic changes in the relationship between consumers and retailers that have occurred as a result of the pandemic, and we expect to see this filter through to strong demand metrics throughout the rest of the year.”