Western Sydney land market experiencing unprecedented levels of demand - Colliers

Contact

Western Sydney land market experiencing unprecedented levels of demand - Colliers

Colliers latest Industrial Development Update has found that demand for industrial land in Western Sydney continues unabated as institutional groups adopt a build-to-core strategy.

The Sydney industrial and logistics market is experiencing unprecedented levels of tenant demand for new space as transport and retail occupiers look to strengthen their supply chains; placing considerable pressure on Western Sydney’s industrial land stocks.

Colliers latest Industrial Development Update has found that demand for industrial land in Western Sydney continues unabated as institutional groups adopt a build-to-core strategy.

Recent yield compression and limited buying opportunities has resulted in it becoming more difficult to acquire stabilised assets and as a result, several groups are seeking scale via development.

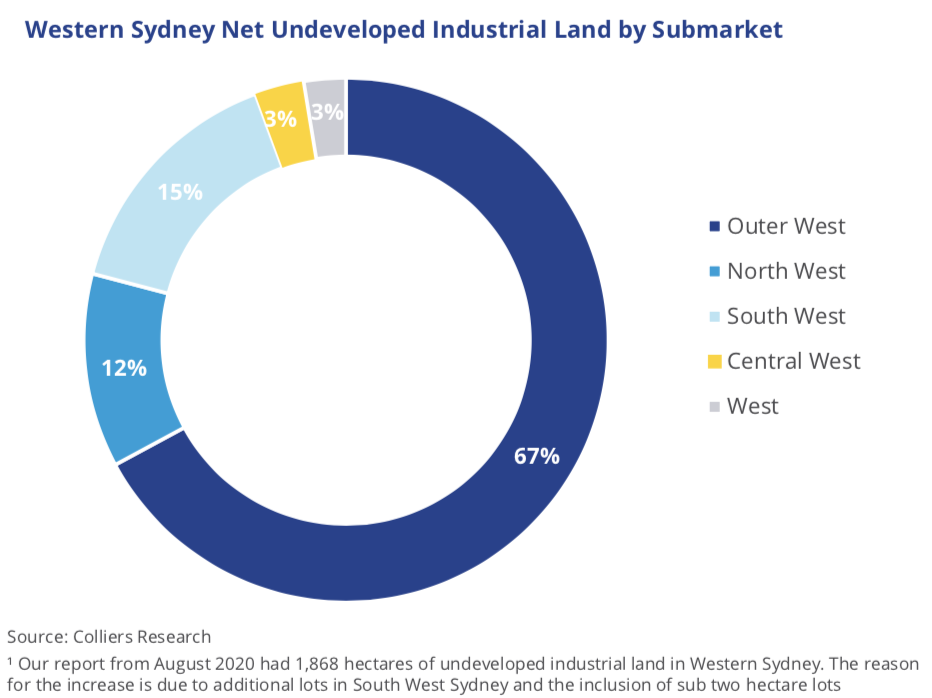

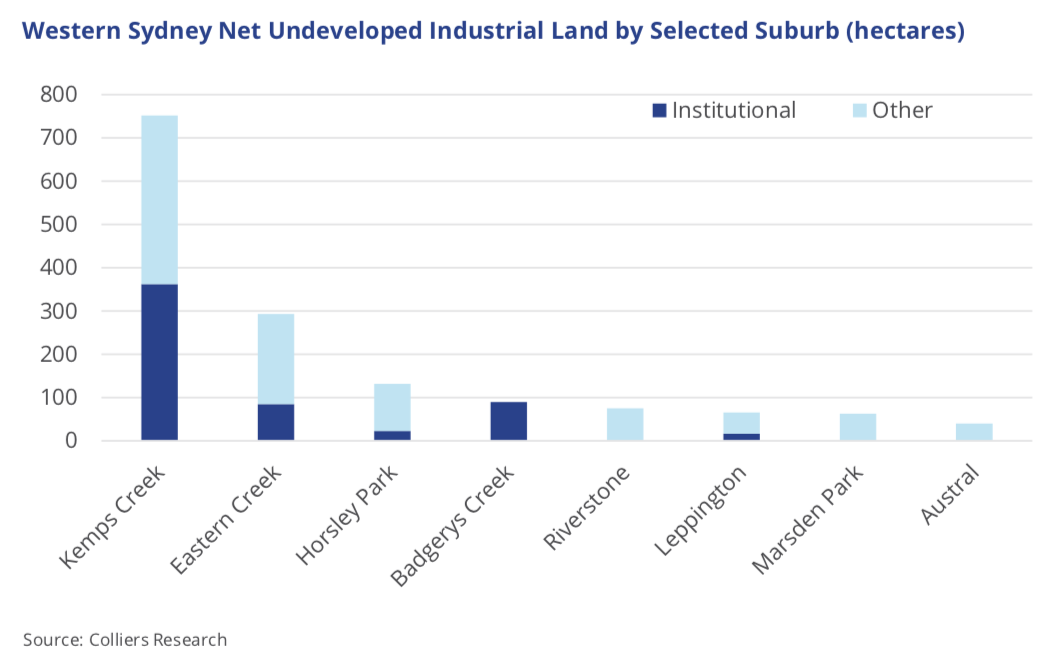

David Hall, National Director, Industrial at Colliers said, “In Western Sydney, there is 1,997 hectares of net developable industrial land which can be delivered within the next five years, with 64% of this land owned by privates or Government Departments which will limit take-up.”

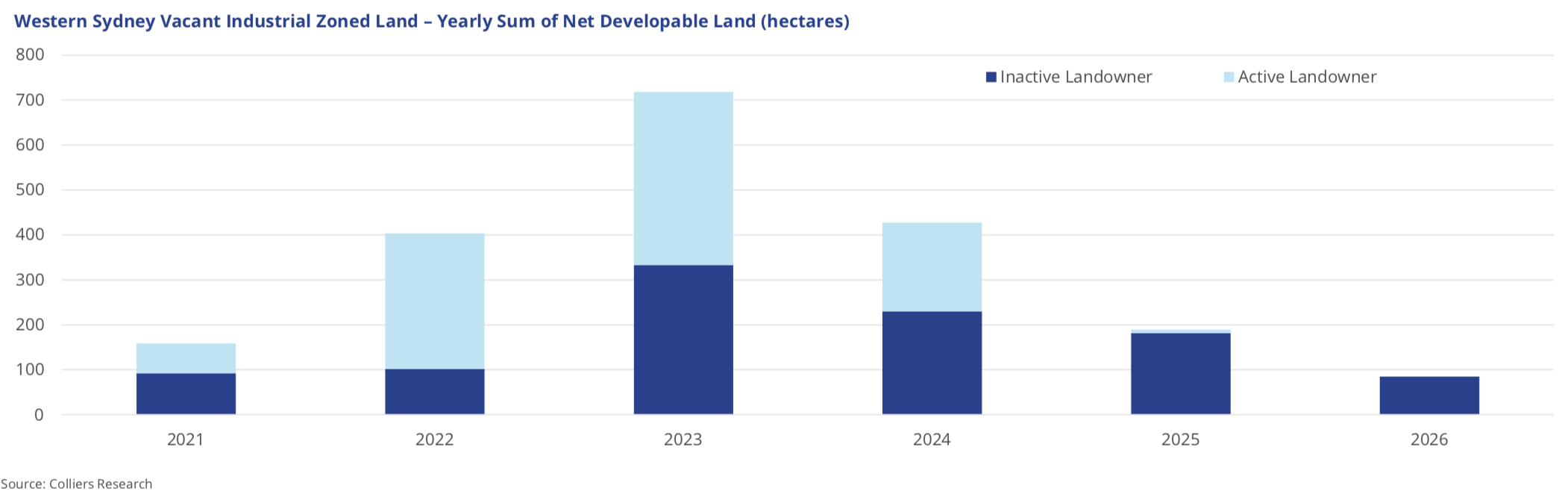

“Land take-up has averaged 135 hectares each year, however, take-up has been restricted by a lack of available serviced lots in key locations.”

“Looking ahead, we expect take-up levels to well exceed historical levels given the increased availability of land as a result of development within the Mamre Road Precinct. As a result, this means there is just under five years of industrial land supply based on land owned by active owners.”

“Notwithstanding this, the longer-term pipeline will be boosted by land within the Enterprise zoning as part of the Western Sydney Aerotropolis.”

“We estimate the Aerotropolis will provide 2,000-2,500 hectares of land for industrial use, the bulk of which will be delivered over the next 10-20 years and will be structured around the overall growth of the Western Sydney Airport and the delivery of critical infrastructure such as roads and services”.

Colliers’ report states that the availability of land within the Mamre Road Precinct will result in hyperscale sheds becoming more prevalent within Western Sydney.

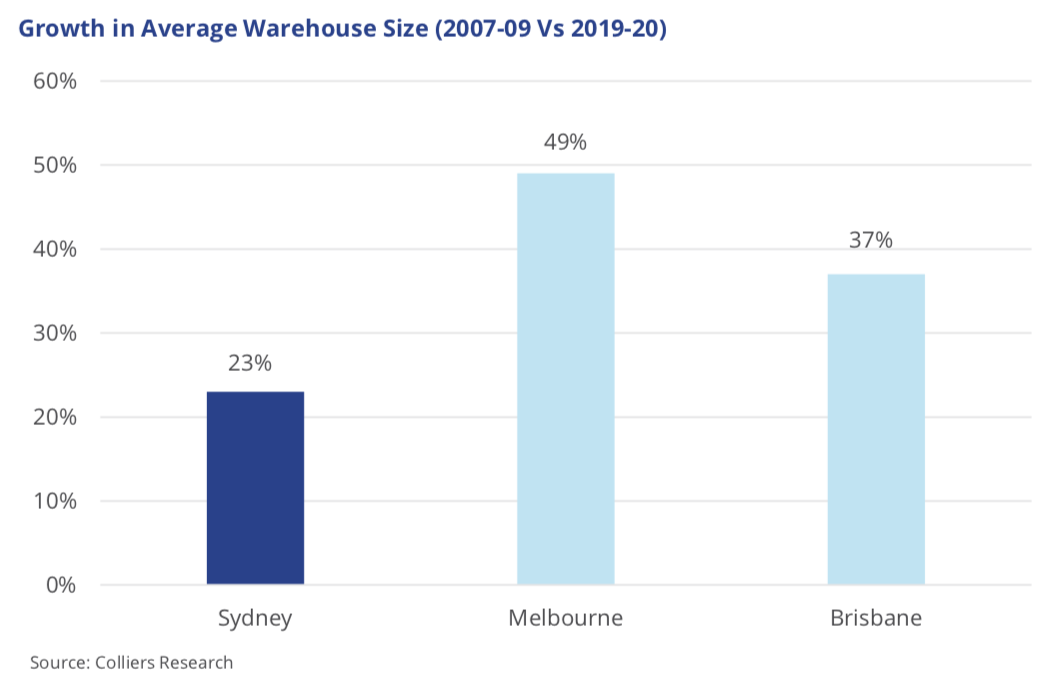

Luke Crawford, Director, Research at Colliers said, “Sydney for a long time has been unable to accommodate hyperscale requirements in scale and as a result, the growth in the average warehouse size over the past decade as lagged that of Melbourne and Brisbane.”

“The delivery of larger facilities (net lettable area of more than 40,000 sqm) has been a growing trend in Melbourne in recent years and we expect these types of developments to become more widespread in Sydney. TTI’s recent pre-commitment of 73,920 sqm within the Mamre Road Precinct highlights this.”

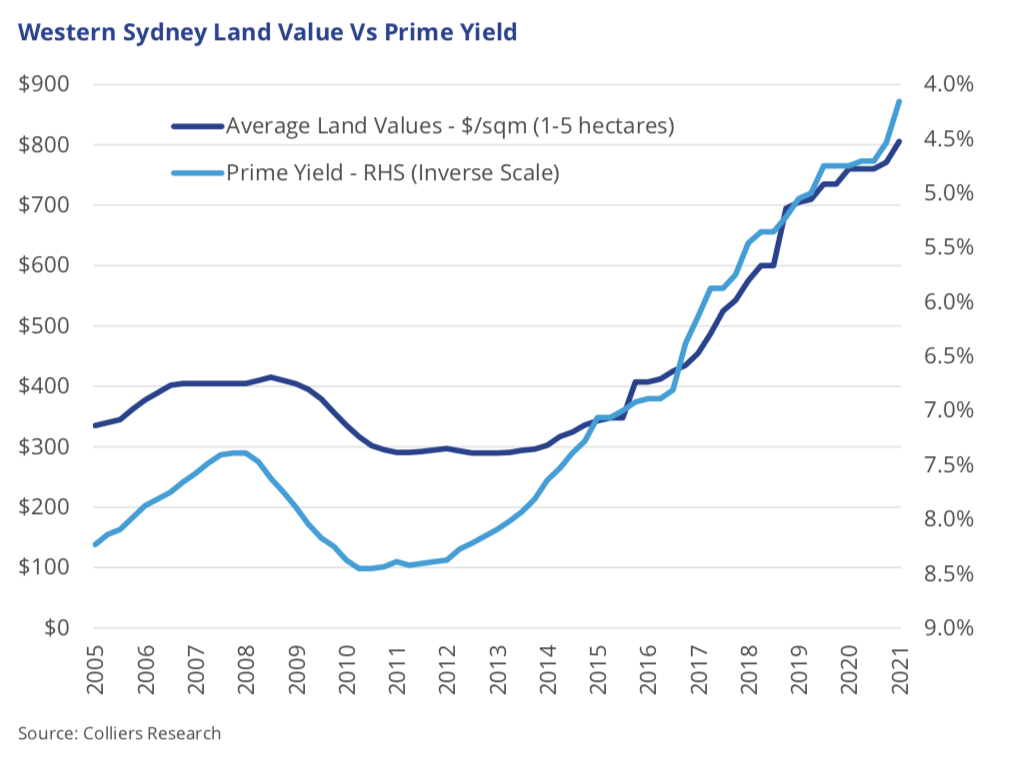

“From a land value perspective, yield compression has driven growth as it has enabled institutions and developers to pay a premium for land as the value on completion is now significantly higher.”

“The outlook for further yield compression is favourable, underpinned by the significant weight of capital chasing assets in the market and positive structural tailwinds driving demand levels. With this in mind, we are forecasting land value growth of 8.0%-10.0% in Western Sydney in 2021.”

To view and download the report click here.

For more information contact the agents via the contact details below.

Similar to this:

South Sydney Industrial asset sold $16 m plus by Colliers and LJH

Colliers exclusively appointed to sell high quality multi-tenanted industrial investment Brisbane

Colliers & JLL appointed to sell four brand-new state of the art logistics facilities c $200m