Australia’s Industrial & Logistics vacancy rate hits 1.3% - the lowest rate in modern history says CBRE research report

Contact

Australia’s Industrial & Logistics vacancy rate hits 1.3% - the lowest rate in modern history says CBRE research report

CBRE Head of Industrial & Logistics Research Sass J-Baleh said, “Demand for industrial and logistics space continues on its upward trajectory, with the national vacancy rate sitting at a historic low,” CBRE’s Industrial & Logistics Vacancy Report for the second half of 2021*

The total industrial & logistics vacancy rate across Australia’s five major cities has dropped to an historic low of 1.3% as national net absorption surpasses 2 million sqm, new CBRE research shows.

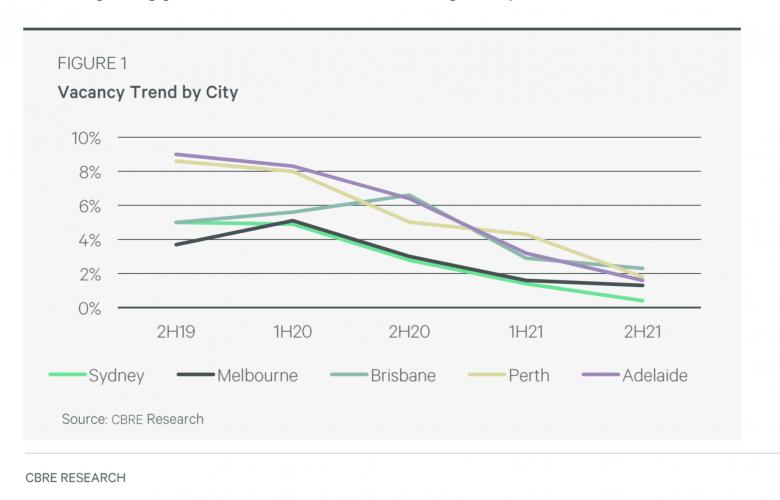

Since the second half of 2019 (pre-pandemic) the national vacancy rate has been trending down, from 6.3% in the second half of 2019 to a record low 1.3% as at second half of 2021*, demonstrating strong occupier growth and activity within the sector.

Through the six-month period across 1H2021 and 2H2021*, the national net absorption of 4,000 sqm-plus industrial assets, was up 30% to 2.38 million sqm when compared to the first half of the year.

Sydney was the exception with the market experiencing a decline in net absorption due to lack of stock availability.

CBRE’s Head of Industrial & Logistics Research Sass J-Baleh said, “Demand for industrial and logistics space continues on its upward trajectory, with the national vacancy rate sitting at a historic low, underpinned by stable, long-term factors, which is driving significant rental value uplifts across Australia.

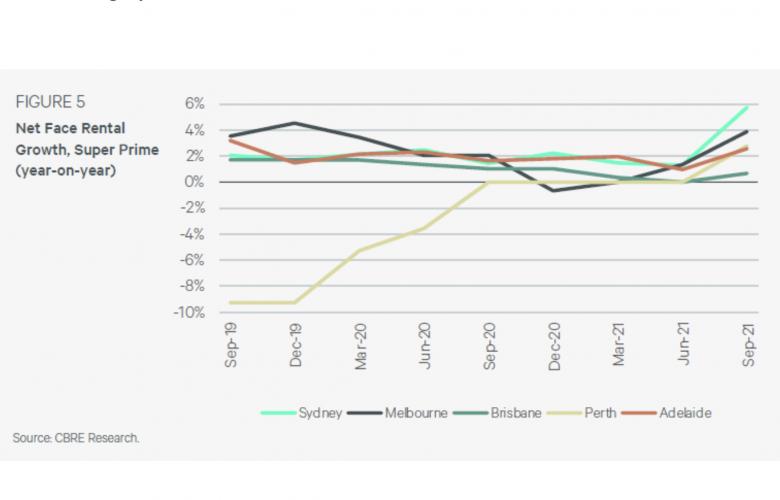

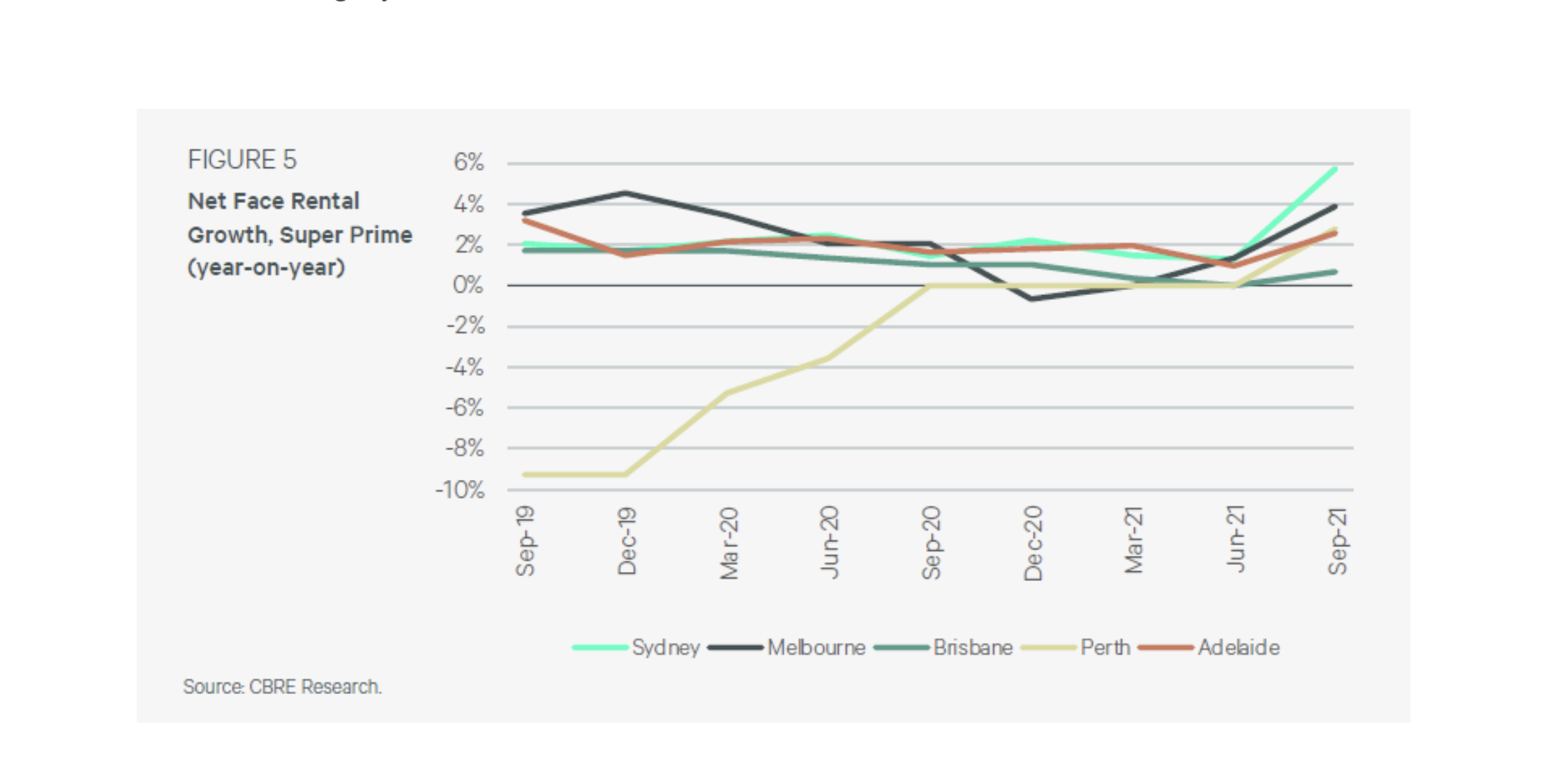

“The Sydney and Melbourne markets are leading the country with respect to occupier activity and have recorded y-o-y rental growth of 6% and 4%, respectively, for super prime grade assets.”

“The significant growth comes as Australia’s e-commerce penetration rate hits a record 14%. Interestingly, the US market experienced strong rental growth for industrial and logistics assets when their e-commerce penetration rate reached 14%, and this is now what is being observed in the Australian market.”

CBRE’s Industrial & Logistics Vacancy Report for the second half of 2021* highlights that 90% of national occupier movements are due to tenant expansion and new space requirements, rather than purely for relocation purposes.

Occupier activity in Melbourne remains the strongest in the country, representing 50% of national total gross take-up over the past 12 months. Even though new supply in 2021 is just over double the long-term average (at 481,600sqm), net absorption of space has been positive and has totaled 860,000sqm for 2H21* alone. As a result, vacancy across most Melbourne precincts has fallen.

Sydney's strong occupier demand, coupled with a limited supply of new developments has led to a significant rental value uplift of 5.7% over the past 12 months, and a lowering of incentive levels (which now average 13%).

While below 2019 levels, Brisbane's tenant demand over the past 12-months remains robust with around 560,000sqm of positive net absorption recorded, with demand being driven primarily by wholesale/retail trade occupiers, transport operators and manufacturing services.

Sydney has the lowest vacancy rate in the country, falling by a full percentage point to 0.4%, with net absorption over 2H21* remaining strong at around 548,000 sqm, while Perth recorded the largest decline in vacancy rates (-2.5%) to 1.8%, hovering just above the national average.

The vacancy rates in Sydney, Brisbane and Perth are 0.4%, 2.30% and 1.80% respectively, with Adelaide's also dropping to just below 2.0% - almost half of what was reported in 2H21*.

CITY — H2 2020 VACACNY — H2 2021 VACANCY — NET ABSORPTION

Sydney — 1.40% — 0.4% — 548,000sqm

Melbourne — 1.55% — 1.30% — 860,000sqm

Brisbane — 2.90% — 2.30% — 560,000sqm

Perth — 4.30% — 1.80% — 400,000sqm

Adelaide — 3.20% — 1.64% — 200,000sqm

Cameron Grier, Regional Director Industrial & Logistics Advisory and Transactions Services said, “With vacancy tightening so swiftly this year, we have seen many occupiers fighting it out to secure the last remaining warehouses to secure their supply chains.

“This competition has resulted in strong net effective rental growth for owners in the most tightly held submarkets, with many recent deals being negotiated with no incentives, whereas 12 months ago incentives in the same building would have been 15-20%.

“With occupiers looking to grow their omni-channel offering, we have also seen a surge in enquiry outside the major markets. With retailers wanting to have both a geographic presence and the ability to control their own warehouses, vacancy fell in Queensland, South Australia and dramatically in Western Australia during 2H21*.

“The supply/demand equation is setting 2022 up as a great year for rental growth for landlords that own assets in these tightly held markets.

“E-commerce continues to be transformational across all Australian markets,” Ms J-Baleh added.

“While warehousing continues to have the biggest up-take of space, the retail sector has climbed to be the third highest industry sector driving demand for industrial space in Australia.”

CITY OVERVIEWS

Sydney

Vacancy: 0.4%

Net Absorption: 548,000sqm

Michael O’Neill, Managing Director, Western Sydney, Advisory & Transaction Services – Industrial & Logistics

“The NSW leasing market has continued to tighten with sustained e-commerce demand, as well retailers and 3PL’s needing to accommodate buffer stock due to supply chain constraints.

“Supply has been unable to keep pace with demand given a lack of speculative stock which was also delayed due to the most recent COVID lockdown. Insufficient speculative stock and an increasing rate of renewal has seen vacancy rates fall and will continue to decrease into 1H22. Some developers are also expecting further upward pressure on rents given the increasing costs of construction due to an insufficient supply of building materials.

“Occupiers are committing to speculative stock sooner, and over 100ha of pre-lease stock in Kemps Creek region has now been committed to. Land rates have also strengthened in all markets by as much as 5%-6% within 6 months in some markets, primarily due to underlying leasing demand.

“Benchmark rates are being achieved in all precincts, and several recent transactions are likely to facilitate new multi-level sites in South Sydney, the Central West, and South West precincts.”

Melbourne

Vacancy: 1.3%

Net Absorption: 860,000sqm

James Jorgensen, State Director, Victoria, Advisory & Transaction Services – Industrial & Logistics

“Vacancy rates continued to fall, which resulted in some effective rental growth across all precincts, however most pronounced in the South East.

“There is a significant amount of speculative development supply due to be delivered across Victoria from 2H22, however occupier requirements continue to surge meaning we expect this speculative supply to be absorbed without impacting market rates.

“A trend in the market that continues is the appetite of institutional investors who are now buying speculative developments, off the plan, via fund through structures with vacant possession.”

Brisbane

Vacancy: 2.3%

Net Absorption: 560,000sqm

Peter Turnbull, State Director, Queensland, Advisory & Transactions Services – Industrial & Logistics

“Leasing has been strong with take up of speculative developments continuing, seeing circa 326,000sqm of take-up in 2021 YTD across the industrial leasing market.

“Highlights would include Dexus at its Freeman Central estate, Capitaland at its Green Road, Crestmead development and GPT at Wembley Business Park estate. All these developments were leased close to practical completion.”

Perth

Vacancy: 1.80%

Net Absorption: 400,000sqm

Jarrad Grierson, State Director, Western Australia, Advisory & Transactions Services – Industrial & Logistics

“Continued tenant demand has seen the Perth vacancy rate drop to a historical low of 1.8%, resulting in an increase in rental rates for super prime and prime assets. Tenants are being driven by continued confidence and activity in the state’s resource and mining sector, as well as demand from e-commerce tenants. Current pre-lease metrics are placing upward pressure on both pre-lease and existing market rents, with incentives continuing to tighten.”

Adelaide

Vacancy: 1.64%

Net Absorption: 200,000sqm

Jordan Kies, State Director, South Australia, Advisory & Transactions Services – Industrial & Logistics

“The South Australian Industrial & Logistics market continues to push ahead with elevated demand from tenants, occupiers, developers, and investors. The SA statistics continue to show a decreasing vacancy rate and we therefore expect to see more speculative build activity throughout 2022, capitalising on the elevated levels of demand.

“During 2021 we have seen the smaller infill unit developments come out of the ground and on the back of their successes, as well as the low vacancy, we are now expecting to see larger format warehouse developments come to fruition during 2022 and beyond.

*2H21 includes data up to and including December 1

To request a copy of CBRE’s Industrial & Logistics Vacancy Report for the second half of 2021 please contact CBRE Head of Industrial & Logistics Research Sass J-Baleh via the below contact form.