Industrial market to flourish on back of record-breaking 2021 - Colliers

Contact

Industrial market to flourish on back of record-breaking 2021 - Colliers

With around $50 billion worth of capital still seeking industrial opportunities, the outlook for 2022 remains very strong.

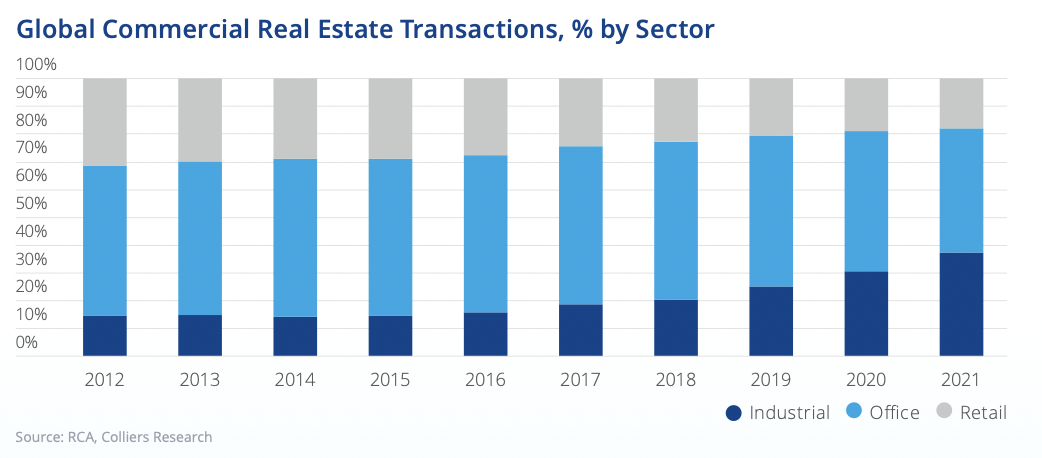

The Australian industrial and logistics sector is set to continue to benefit from the momentum of an unprecedented 2021, that saw favourable structural tailwinds coincide with a re-weighting of capital towards the industry allowing almost every record to be broken.

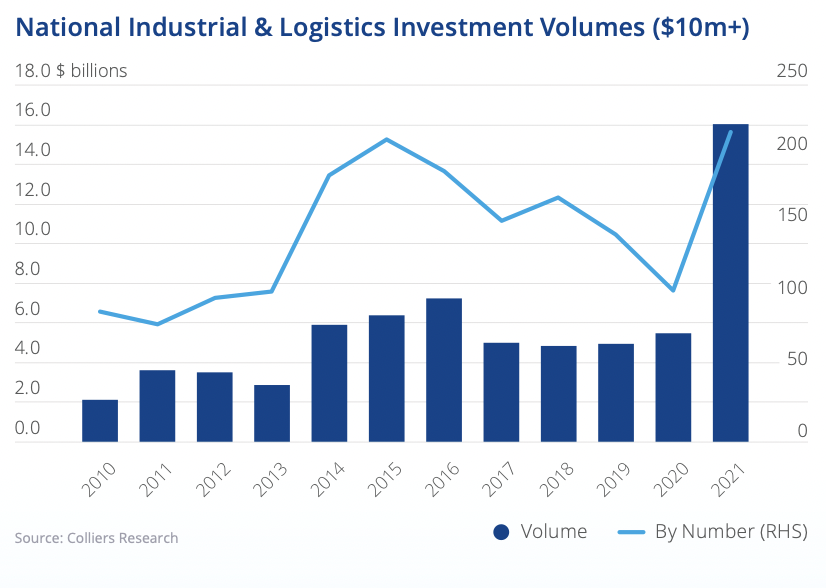

The Colliers 2022 Industrial Investment Review shows that investment volumes reached $16 billion in 2021, up 191 per cent from 2020 where volumes totalled $5.5 billion. This eclipses the previous record of $7 billion achieved in 2016 and was a common theme across the world, with investment volumes in the sector (globally) up 39 per cent in 2021 compared to 2020.

Market conditions for the year ahead are expected to remain buoyant as existing fundamentals such as e-commerce, infrastructure investment, and automation remain strong. At the same time, population growth is forecast to pick-up following the relaxation of international border rules.

While it was a record year on the investment front, the weight of capital seeking opportunities, which is estimated to be $50 billion, far outweighs the availability of assets for sale, Colliers Managing Director for Industrial Gavin Bishop said.

“Private investors, corporates and selected institutions looking to recycle capital are expected to take advantage of this factor in 2022, and large portfolios will continue to be brought to the market,” he said. “It is likely that new pricing benchmarks will be set in 2022, and we expect yields have a little further to run despite the 110 basis points of compression recorded in 2021. By mid-2022, average yields in Sydney and Melbourne are forecast to be under 3.50 per cent for prime core assets.”

While yield compression has driven asset performance over the past two years, it is likely to be supported going forward by an acceleration of rents in selected markets, particularly in the infill markets across the country.

“Rental growth really started to kick in during the second half of 2021 with prime rents increasing by almost 10 per cent, which is the largest level of annual growth since our series began in early 2000,” Luke Crawford, Colliers Director of Industrial Research said. “With macro drivers for tenancy demand expected to remain strong in 2022 and coupled with tight vacancy rates across most markets, rents are expected to remain robust”.

The report highlighted that a growing number of institutional groups have adopted an infill acquisition strategy to best capture the forecast uplift in rents. Occupiers are actively seeking warehouse space in these locations to fulfill their last-mile logistics functions, and investors are looking to take advantage of this via value-add opportunities, accentuated by the lack of future supply, which will drive land prices higher.

“We started to see a shift to infill markets in 2021 as groups looked to capitalise on land constrained markets in close proximity to densely populated areas where occupiers are actively seeking space to improve supply chain efficiencies,” Mr Crawford said. “In 2021, almost $5.5 billion was sold within infill markets across the country, representing 34 per cent of assets by volume to trade and compares to 14 per cent of total investment volumes in 2020”.

The Colliers report noted that there are potential headwinds that could emerge in 2022 and impact sentiment within the sector. This included a further rise in inflation which could trigger interest rate rises sooner than previously thought, and there could be flow-on impacts to pricing given increased funding costs.

Despite this, Mr Bishop believes it is likely that any movement in interest rates would be gradual, as real interest rates (adjusted for inflation) have continued to fall and are currently below zero.

“This environment will remain supportive of further yield compression within the sector and has further increased the appeal of well leased and located industrial and logistics assets, which provide fixed rental reviews,” he said.

Register here to view and download the Report.