“Industrial Property Revolution” set to continue off the back of an unprecedented 2021

Contact

“Industrial Property Revolution” set to continue off the back of an unprecedented 2021

The industrial & logistics sector was the strongest performer in 2021 across all commercial asset classes in WA, with transaction volumes hitting a record high. According to JLL, the WA market shows no signs of slowing down, with the industrial brokerage giant setting their sights on an even more active 2022.

The industrial & logistics sector was the strongest performer in 2021 across all commercial asset classes in WA, with transaction volumes hitting a record high. According to JLL, the WA market shows no signs of slowing down, with the industrial brokerage giant setting their sights on an even more active 2022.

With WA’s strong economic momentum expected to build in the medium term, Ronak Bhimjiani, Director, Research - WA expects that buoyant conditions within the resources sector will continue to lead the remarkable economic growth story, ultimately driving further demand for industrial and logistics space.

“The WA economy recorded its strongest growth in eight years during 2020-21, with economic growth up 4.3%, the strongest of any state for the second year running. Inevitably, growth has been bolstered by ongoing resurgence in the resources sector – a sector which makes up 47% of overall Gross State Product (GSP).”

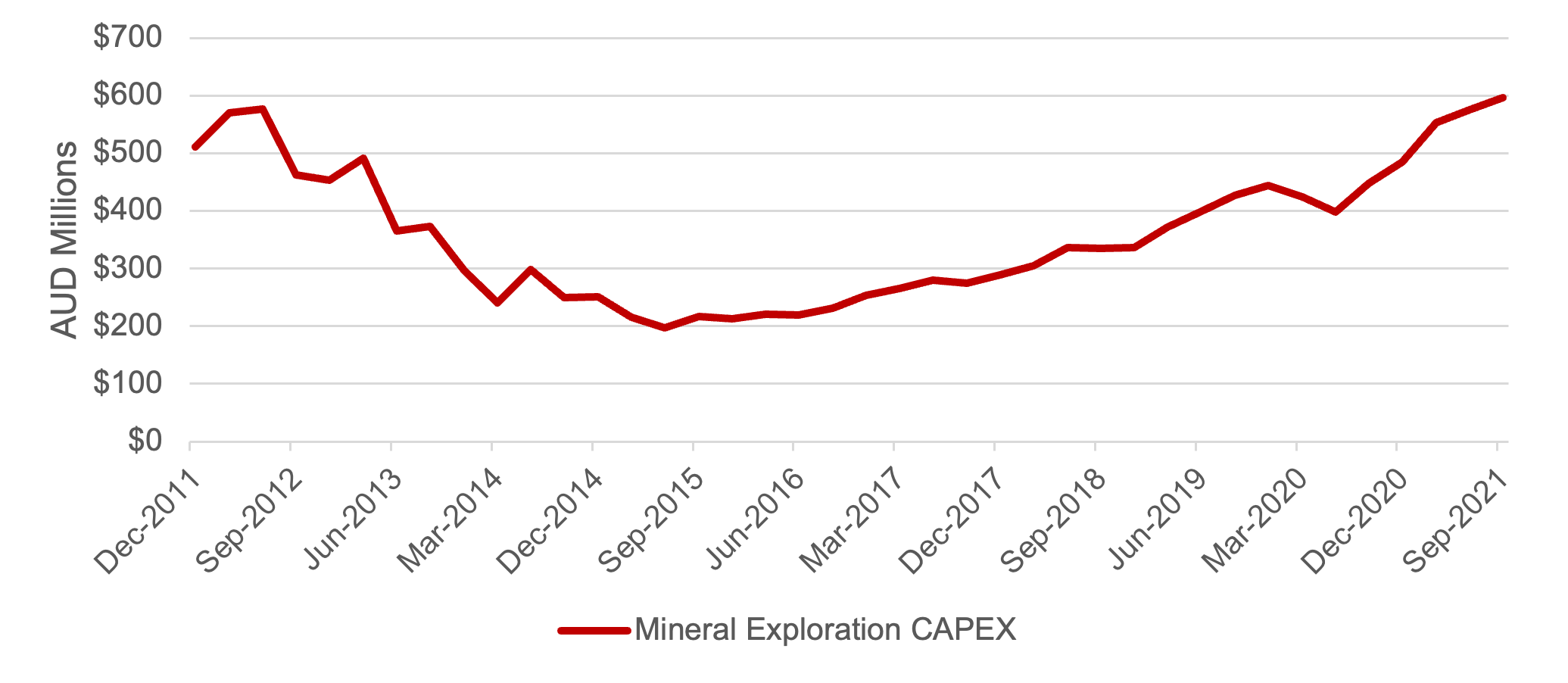

“Looking ahead, companies within the resources sector are investing heavily into exploration activities to cope with unprecedented global demand for WA commodities. This is evident in the latest exploration data which shows that exploration capital expenditure recently returned to 2012 levels – a time when WA’s economy grew by 8.3%, the state’s population grew by 3.1% and Perth industrial & logistics gross take-up totalled 297,000 sqm – close to 2021 levels”.

“The 2021 gross take-up figure of 301,000 sqm eclipsed the 2012 reading despite WA’s current population rising by only 0.7%, due to forced border closures. If we account for the fact that population growth will once again lift in 2022, the upside potential for industrial & logistics demand increases significantly” said Mr. Bhimjiani.

Private Companies Exploration Expenditure – WA only

Source: JLL Research, ABS

Nick Goodridge, Head of JLL’s Logistics and Industrial - WA expects that the continued occupier demand and record take-up will be a key contributor to the ongoing performance of the sector, but will also present challenges, with scarcity of land supply and rising construction costs are already impacting feasibilities and development modelling.

“Surging occupier demand on the ground saw a record quarter of take-up across the Perth market 4Q21 with some 80,000 sqm of gross take-up recorded, an amount almost double the 2 year quarterly average,” said Mr. Goodridge.

“As vacancy rates decline, and development volumes and future supply remain pre-lease driven, stock availability will be problematic at a brokerage level locally. Surging demand on the ground in what is a relatively small market is already starting to feed through to face and effective rental growth, to the tune of 10% in Perth’s east over the past 12 months”, said Mr. Goodridge.

Whilst the e-commerce and associated logistics demand juggernaut continues to roll on, it’s the diversification of the sectors taking up industrial space in the WA market that underpins the demand for industrial and logistics space.

“Ecommerce and related logistics were certainly the dominant driving force behind unprecedented demand for industrial & logistics space, with the sector representing 46% of annual gross take-up. However, the balance of take-up was more evenly spread between the manufacturing, wholesale trade, construction, and professional services sectors,” said Mr Goodridge.

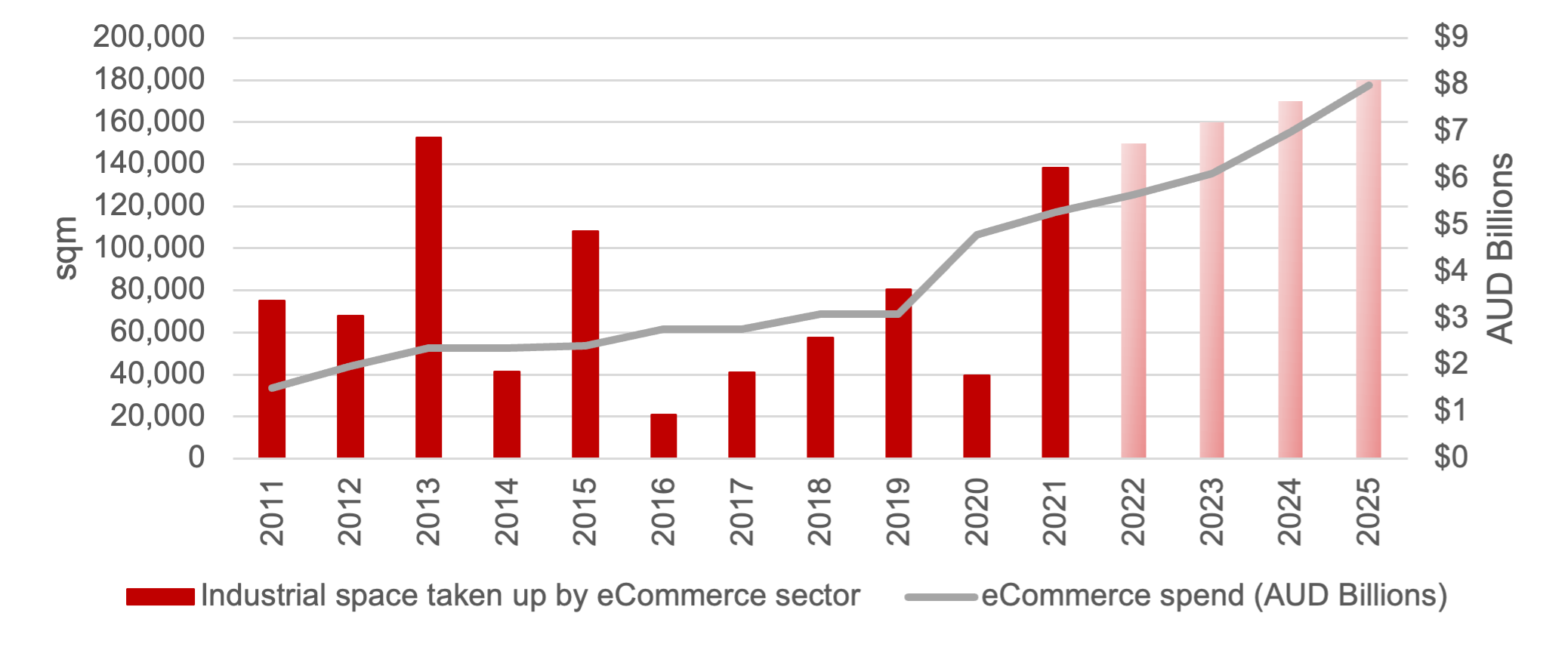

Looking forward, JLL anticipates that the eCommerce penetration will continue to grow, leading to even higher levels of demand for Perth industrial & logistics space.

According to JLL, the current eCommerce penetration rate of 14.4% is set to expand further, to 20.0% by 2025, which alone is expected to result in an additional 640,000 sqm of industrial & logistics space between 2022 and 2025. If we account for other sectors currently contributing towards demand, that figure could reach upwards of 1,000,000 sqm of industrial and logistics floor space demand.

Perth eCommerce industrial take-up versus eCommerce spend

Source: JLL Research, NAB, Macquarie Research

“When we pair the live data and our forecasts, it comes as no surprise that there is upward pressure on land values across the board. The Perth market has traditionally had a finite supply of core land holdings, with this trend always being a safety net for developers and investors, particularly around tenant retention strategies,” said Mr Goodridge.

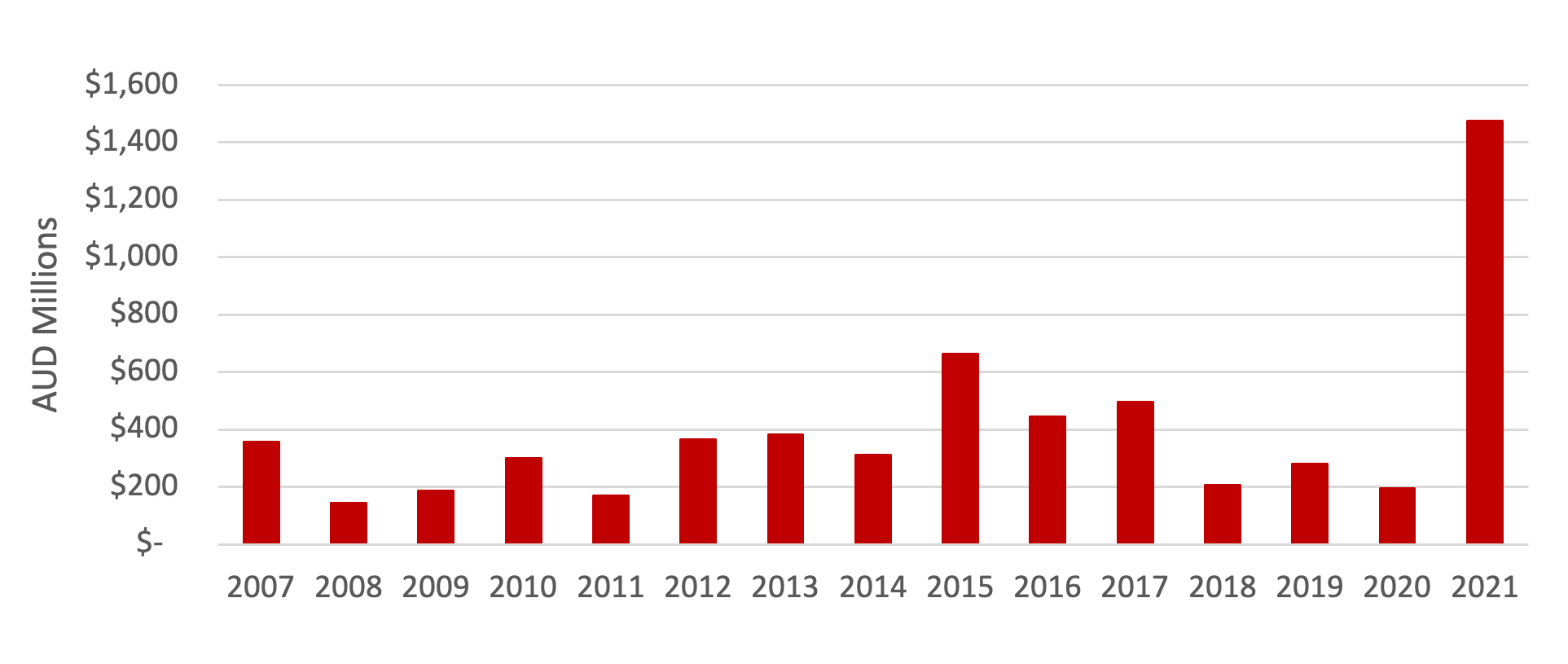

The unprecedented volume of investment into WA’s industrial capital markets sector over the past 12 months saw AUD 1.5 billion placed across 23 transactions. Traditionally a market dominated by private ownership, the weighted arrival of institutional capital has according to JLL, structurally changed the face of the market.

Perth Industrial Transaction Volumes

Source: JLL Research

“We don’t expect the appetite for WA assets to subside in the medium term, as capital allocations to industrial and logistics sector continue to grow amongst institutional buyers. WA landlords will be clear beneficiary of the limited opportunities on the eastern seaboard,” said Mr Goodridge.

JLL has identified AUD 53 billion worth of local and global capital seeking logistics investments within Australia, and while the scale of the investor pool for industrial & logistics assets has expanded, there has still not been sufficient acquisition opportunities to meet the volume of demand for these assets, which has, in turn, placed significant pressure on pricing for both prime and secondary assets.

JLL’s sale of the Perfect Pair Portfolio in South Guildford last year re-rated the market from a core capital perspective, achieving a record yield in WA of 4.25%, with multiple bidders aggressively participating in the on-market campaign.

“Core capital mandates have traditionally dominated the buyer landscape in WA, however the depth across buyer pools has increased, with core plus, value-add and last mile infill logistics strategies being targeted across Perth’s industrial markets”, said Mr Goodridge.

“This means that owners of WA industrial property now a have genuine liquidity advantage over previous years, as various buckets of capital target a wider range of industrial assets,” said Mr. Goodridge.