Port access drives Melbourne logistics

Contact

Port access drives Melbourne logistics

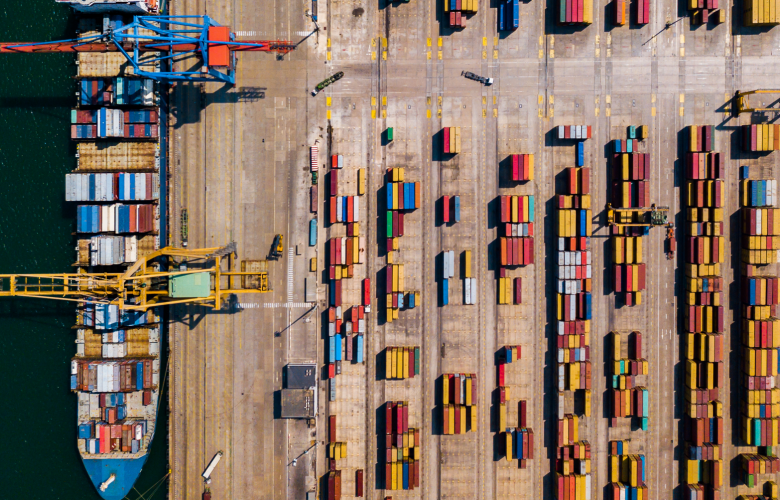

The Victoria Department of Transport recently released The Container Logistics Chain Study 2020, concentrating on the Port of Melbourne. The study reported a 95% increase in import container volumes since the previous report in 2009.

The Victoria Department of Transport recently released The Container Logistics Chain Study 2020, concentrating on the Port of Melbourne. The study reported a 95% increase in import container volumes since the previous report in 2009. A key part of the report identified the top five suburban destinations for import containers through the Port of Melbourne. These containers accounted for 43.5% of all TEUs, imported through the port and remained in the metropolitan area in 2020. Of these, four suburbs – Derrimut, Truganina, Brooklyn and Altona – are located within Melbourne’s West precinct, and one – Dandenong South – is in the South East. More importantly, all these five suburbs have robust connectivity to the Port of Melbourne via the Westgate Freeway and Princes Highway in the West and the Monash Freeway in the South East.

Using this study, we can better understand the nature of the relationship between Melbourne’s import patterns and the distribution of industrial occupiers across the city. According to JLL research, four out of the five top import destination suburbs were also the top five for gross take-up (≥5,000 sqm) from 1Q15 to 3Q21. These top import destinations accounted for 45% of the Melbourne market in this period. The only suburb not included was Brooklyn, reflective of its tightly held nature and predominantly older-style stock base.

Interestingly, take-up in these suburbs was also over-weighted towards the transport, postal and warehousing sector, accounting for 44% of the total take-up, compared to the rest of the Melbourne market (27%). Of particular importance in these suburbs were the sub-sectors of services like road transport, postal & courier and warehouse & storage, which accounted for over 80% of the sector’s total take-up during the same period. With occupier activity so heavily weighted to tenant industries involved in the movement of goods, the accessibility to major ports is a driving force between the level of occupier activity in select suburbs around the city.

Evidently, importing goods is key for the Melbourne industrial property market, illustrating the need for increased and sustained investments into the city’s port system. The transport, postal and warehousing sector has seen take-up levels increase by 79% since 2009, an average annual increase of 12%. Over the same period, it has accounted for 36% of total take-up across the Melbourne industrial market.

The increasing relevance of this sector will be governed by access to the population, as tenants compete on location to reduce stem time. As supply chain efficiency becomes increasingly important for these groups, access to the port is weighed against access to the population. Hence, investment in rail infrastructure may allow for geographically wider distribution networks.

By Xavier Wilson a Logistics & Industrial Research Analyst in JLL’s research team in Sydney, Australia.