350,000sqm plus of multi-storey warehouse space expected in Sydney over next five years says CBRE

Contact

350,000sqm plus of multi-storey warehouse space expected in Sydney over next five years says CBRE

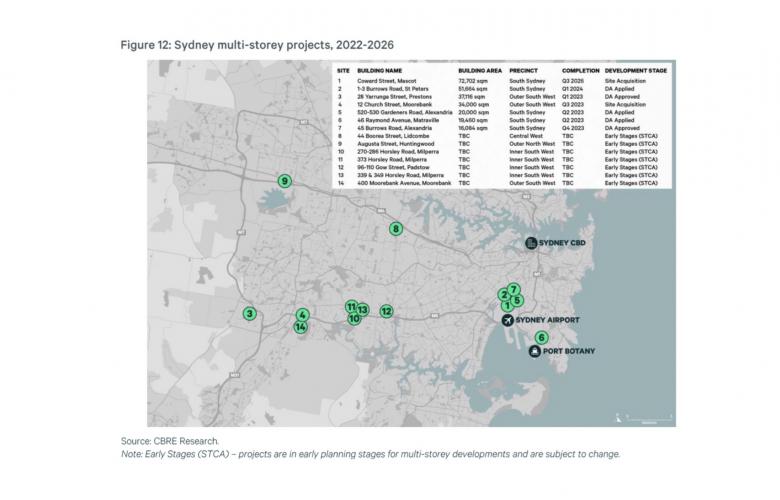

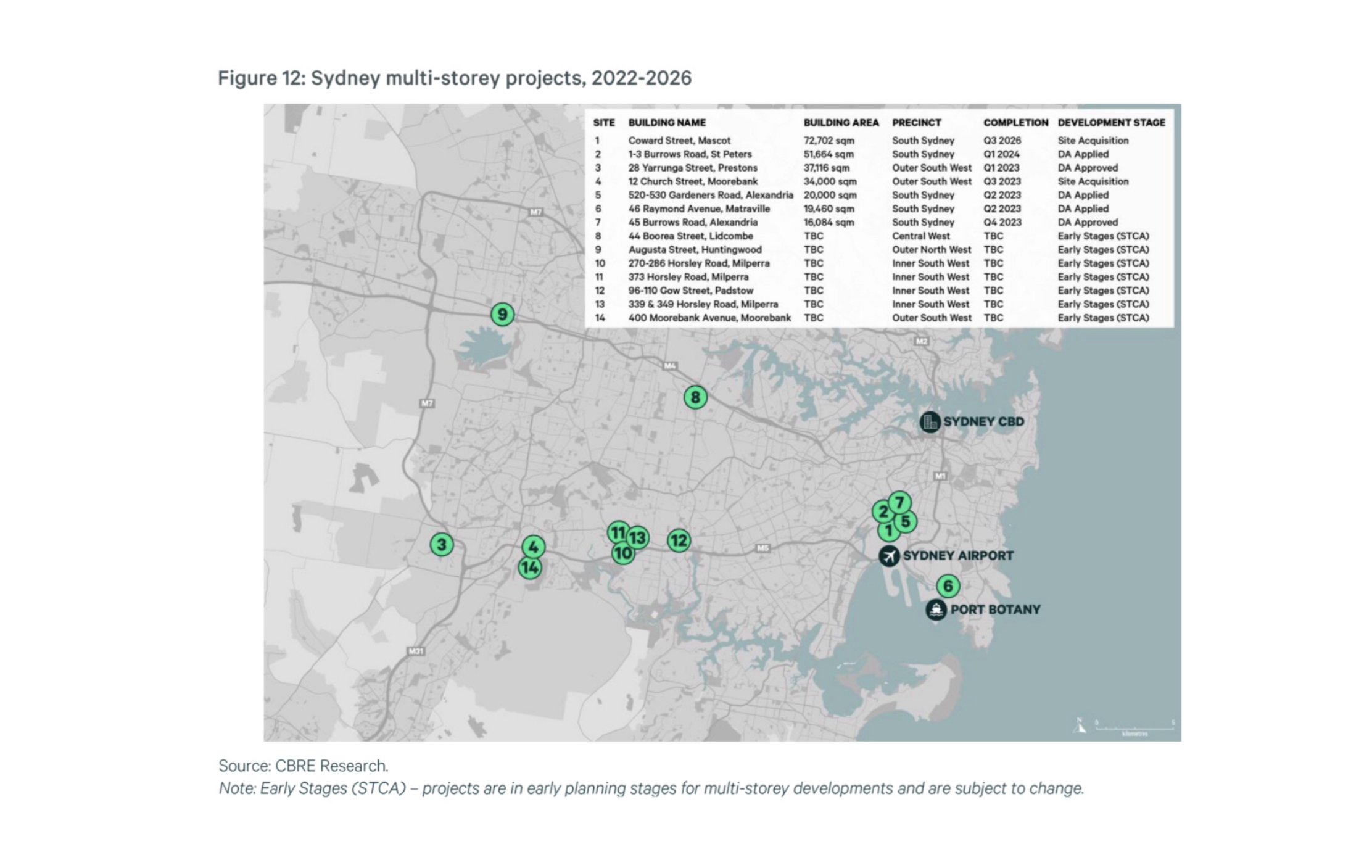

A new CBRE report highlight 14 notable multi-storey projects in the Sydney pipeline. CBRE Regional Director, Industrial & Logistics, Cameron Grier noted, “With vacancy close to 0%, rents skyrocketing northwards, and land prices doing the same, multi-storey has never made more sense in Sydney than it does right now.

More than 350,000sqm of multi-storey warehouse space is expected to be delivered in Sydney over the next five years, as the availability of zoned land propels developers to reach skyward.

A new CBRE report highlight 14 notable multi-storey projects in the Sydney pipeline – including a mammoth 172,702sqm LOGOS development at Mascot, scheduled for completion in late 2026.

Other significant projects include a 51,664sqm, three-level Goodman warehouse in St Peters due to be delivered in Q1, 2024.

CBRE Regional Director, Industrial & Logistics, Cameron Grier noted, “With vacancy close to 0%, rents skyrocketing northwards, and land prices doing the same, multi-storey has never made more sense in Sydney than it does right now. That said, developers still need to ensure design functionality to ensure these developments are fit for purpose for the Australian market.”

CBRE’s “The Rise of Multi-Storey Warehousing” report, highlights the significant influence that high land values, low vacancy rates and minimal new land supply is having on the Sydney industrial & logistics market, where vacancy has hit at an all-time low of 0.4% - the tightest in the country.

CBRE’s “The Rise of Multi-Storey Warehousing” report, highlights the significant influence that high land values, low vacancy rates and minimal new land supply is having on the Sydney industrial & logistics market, where vacancy has hit at an all-time low of 0.4% - the tightest in the country.

In tandem, the average super prime net face rent is expected to maintain double digit annual growth between 2022 and 2026, with the greatest movement in rents of above 12% per annum expected to occur in South Sydney – a market which accounts for 80% of the city’s current multi-storey development pipeline.

“Cities such as Hong Kong, Shanghai and Tokyo have built vertical warehouses in order to keep up with occupier demand for precincts with extremely limited space available,” noted CBRE’s Head of Industrial & Logistics Research Sass J-Baleh.

“Sydney is following that trend, with dwindling industrial land supply in precincts that are becoming more sought after as ‘last mile’ distribution hubs due to recent and forecast growth in e-commerce. This is particularly the case in South Sydney, which has strong access to the Port of Botany, airport, and the CBD but accounts for only 2.5% of Sydney’s total supply of undeveloped, zoned land.”

The CBRE report notes that South Sydney has the highest land values in the country, averaging $2,850/ sqm for 1.6 ha lots, which is justifying multi-storey construction costs. South Sydney also has the highest rents in the country, averaging $225/sqm for super prime grade assets.

“As the Sydney market continues to experience unprecedented levels of growth, we expect multi-storey facilities will become an intrinsic part of Sydney’s industrial landscape,” Ms J-Baleh said.

“The significant increase in construction costs associated with multi-storey warehouses are offset in precincts such as South Sydney, given land availability and the desire to be located close to the consumer to minimise supply chain costs as e-commerce accelerates. As land values appreciate across the city, we also expect to see an increase in multi-storey warehousing in outer precincts such as the Outer North West and the Outer South West in the medium to long term.”

For more information or to request a copy of the report please contact CBRE via the below contact details.