The only way is up for Brisbane industrial rents and land values says CBRE

Contact

The only way is up for Brisbane industrial rents and land values says CBRE

Shrinking land availability and rising e-commerce demand are set to drive significant growth in Brisbane’s industrial rents and land values according to new CBRE forecasts.

Shrinking land availability and rising e-commerce demand are set to drive significant growth in Brisbane’s industrial rents and land values according to new CBRE forecasts.

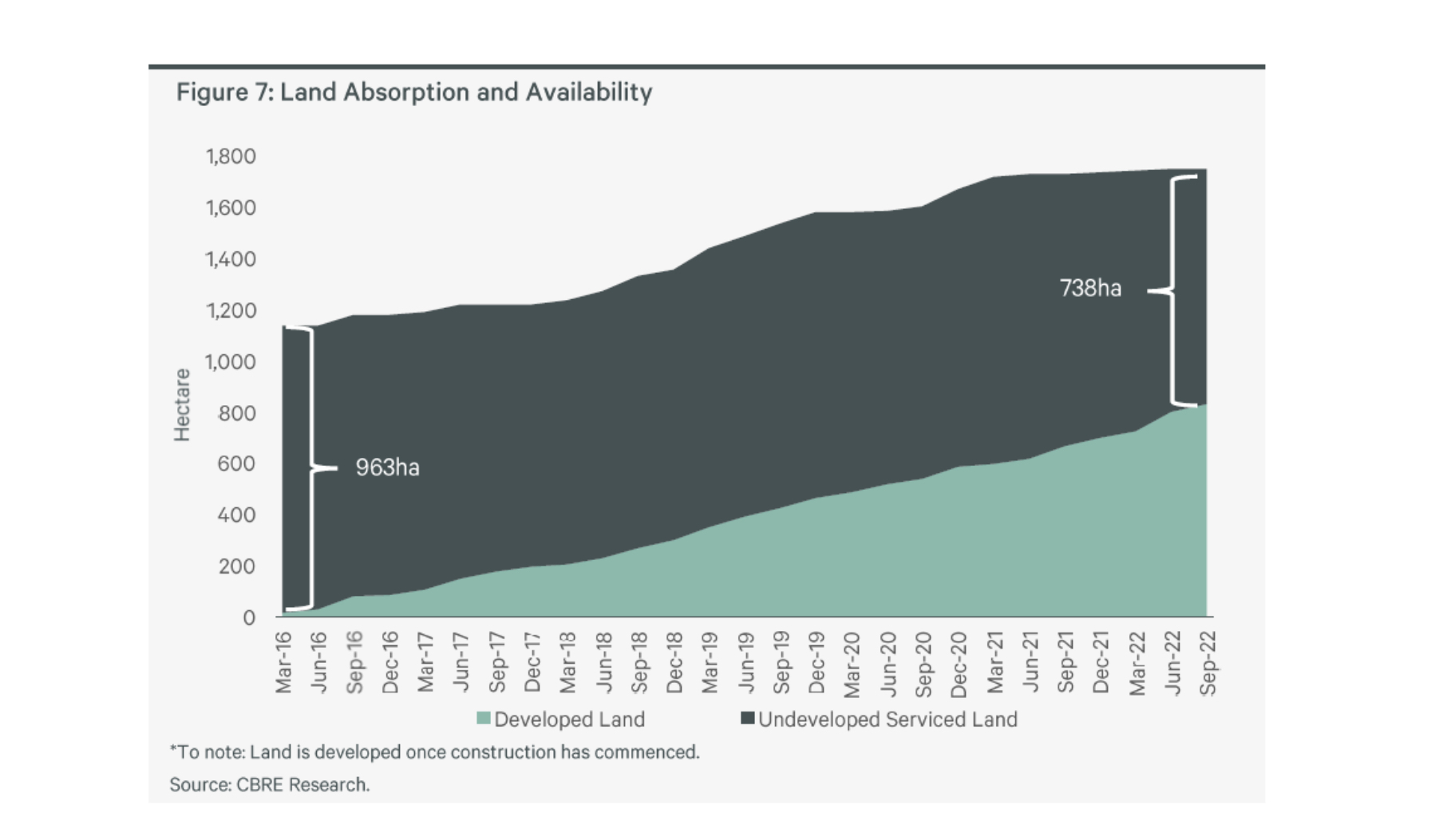

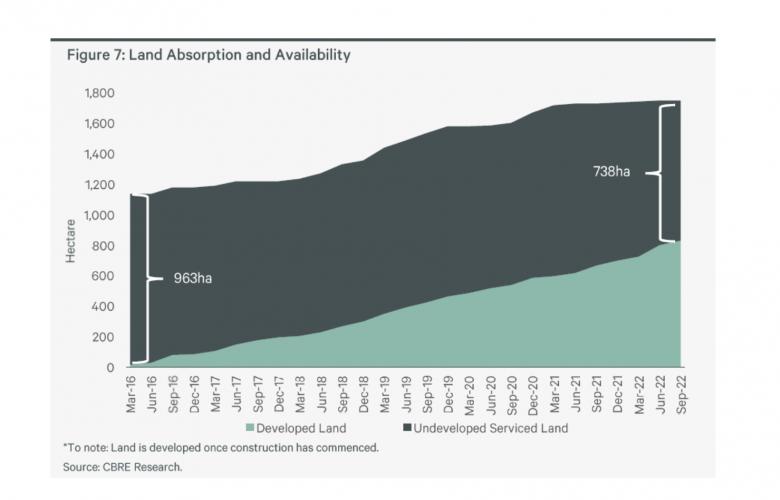

Brisbane’s stock of vacant serviced industrial and availability has dropped from 985ha to 733ha since 2016, led by Brisbane’s North, Outer South and Trade Coast precincts.

This has already driven strong rental growth, with further upward pressure anticipated as demand for Last Mile Logistic locations continues to rise.

CBRE Research Analyst, Sophie Plumridge noted, "Land absorption has accelerated over the past two years with an average absorption of 135ha per annum over 2021 – 2022, while leasing activity reached a record high of over 790,000sqm in 2021. Rising e-commerce sales will continue to fuel demand as Brisbane snares a higher share of national occupier requirements.”

The report shows the share of floorspace take-up from retail trade occupiers in Brisbane represents a quarter of the national total but forecasts that as more space is demanded from e-commerce growth, occupier requirements will skew further toward Brisbane.

“The Queensland e-commerce penetration rate currently stands at circa 12% and is expected to reach 16% by 2026, meaning around 83,000 sqm of space per annum will be required. Historically an average of 300,000sqm of space has been delivered to the Brisbane market each year since 2011. Therefore, to cater for this growth, new supply will need to elevate by approximately 30%,” Ms Plumridge said.

CBRE’s Queensland Director of Industrial & Logistics Peter Turnbull added, “Strong occupier activity in Brisbane has been mainly due to population growth, port activity, labour productivity improvements, significant investment in the road infrastructure network, as well as the rent cost differential compared to the Sydney market. With the Brisbane industrial vacancy rate at an all-time low of 1.4%, new supply additions are being absorbed quickly, with 63% of 2022 supply additions already taken up and a pre-commitment rate of 36% for 2023 stock.”

Related Reading:

Industrial land sale sets new Sunshine Coast record - CBRE | The Industrialist

Goodyear to lease Frasers Property Industrial’s Vantage Yatala estate Queensland | The Industrialist