Tenant demand in Brisbane remains high with limited vacancy, but record supply is expected to come online this year

Contact

Tenant demand in Brisbane remains high with limited vacancy, but record supply is expected to come online this year

Tenant demand for industrial property in Brisbane remained elevated over 2022 while limited vacancy and a supply pipeline constrained by slower completions and higher delivery costs fuelled rental growth, according to Knight Frank’s latest research.

Tenant demand for industrial property in Brisbane remained elevated over 2022 while limited vacancy and a supply pipeline constrained by slower completions and higher delivery costs fuelled rental growth, according to Knight Frank’s latest research.

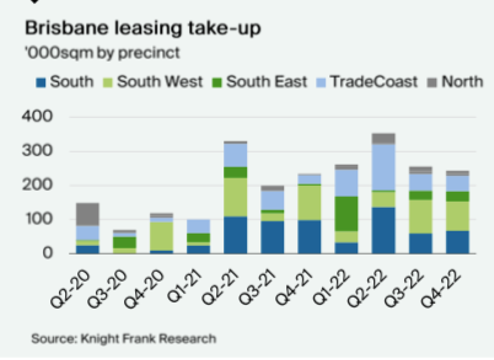

The Australian Industrial Review – Q4 2022 found there was 1.1 million square metres in industrial space taken up in Brisbane over 2022, which was a record level and the highest across the East Coast markets for the year.

Vacant space fell a further 14% in Q4 to be 38% lower than a year ago and 65% (408,000sq m) below the recent peak in early 2021. It is now sitting at 10-year lows.

The fall in Brisbane’s vacancy rate over 2022 was second only to Melbourne (71%), while Sydney fell by 31 per cent.

Sydney remains the tightest market with 89,1292sq m of available stock, followed by Brisbane (226,916sq m) and Melbourne (231,640sq m).

The research found Perth prime rents rose the fastest over 2022, up by 41% year-on-year, followed by Sydney (29%), Melbourne (19%) and Brisbane (15.5%).

Prime net face rents in Sydney are now $210 per square metre, followed by Brisbane ($137/sq m), Perth ($133/sq m) and Melbourne ($126/sq m).

Knight Frank Head of Industrial Logistics Queensland Mark Clifford said leasing activity in Brisbane’s industrial market fell slightly in the fourth quarter of last year, but remained at the elevated levels seen in the market since 2021.

“During the fourth quarter the strongest take up was for pre-committed space, totalling over 94,000 square metres, followed by existing space with 92,600 square metres and speculative developments at 46,000 square metres.

“Take up was highest in the South West with 35 per cent of the quarterly activity.

“Transport, postal and warehouse users were the most active tenant type with 32 per cent of take up during 2022, ahead of manufacturers at 21 per cent and 16 per cent for retailers.

“Absorption of vacant space was lower over Q4 as opportunities continued to contact, with more than half of vacancy absorbed in speculative space, all of which was still under construction with no completed speculative space available across the Brisbane market.

“The demand to occupy immediately or within three months remains high with more deals than ever occurring before the sitting tenant has vacated and the asset becoming formally vacant.”

Knight Frank Partner, Research and Consulting, Queensland and report author Jennelle Wilson said the delivery of new supply in Brisbane accelerated during 2022, despite some projects being delayed into 2023 by weather and materials and labour shortages.

“This year supply may top one million square metres, the highest in Australia and more than triple the historical average, underpinned by pre-leases of more than 500,000 square metres,” she said.

“However as construction delivery timeframes continue to blow out to 10-plus months, completions for 2023 may moderate and be pushed into 2024 if projects do not commence in the short term.

“As more supply comes online we expect rental growth will moderate likely to between five to 10 per cent over 2023, but nevertheless we will continue to see growth in rents this year as demand continues to be strong.”

Ms Wilson said land values in Brisbane’s industrial market remained historically high but feasibility deterioration, driven by higher yields and construction costs, had seen prices begin to moderate by an estimated $10 to $20 per square metre.

“Investment sales remained slow in Q4 with the gap in pricing expectation between vendor and purchaser still a hurdle to greater investment turnover,” she said.

“Yields appear to have softened by 15 to 30 basis points in Q4 and a total of 55 to 60 basis points from early 2022 but a further lift in sales volume is required to determine the stabilised yield levels.”

Mr Mark Clifford said Knight Frank’s industrial team currently had more than $100 million in off-market transactions in progress.

“Investor transaction volumes are expected to return after a slow finish to the calendar year in 2022,” he said.

“Owner occupiers are active, with the motivation to secure long-term premises front of mind for many users.”