National industrial rent growth led by Sydney, with Melbourne offering strong rental upside - CBRE

Contact

National industrial rent growth led by Sydney, with Melbourne offering strong rental upside - CBRE

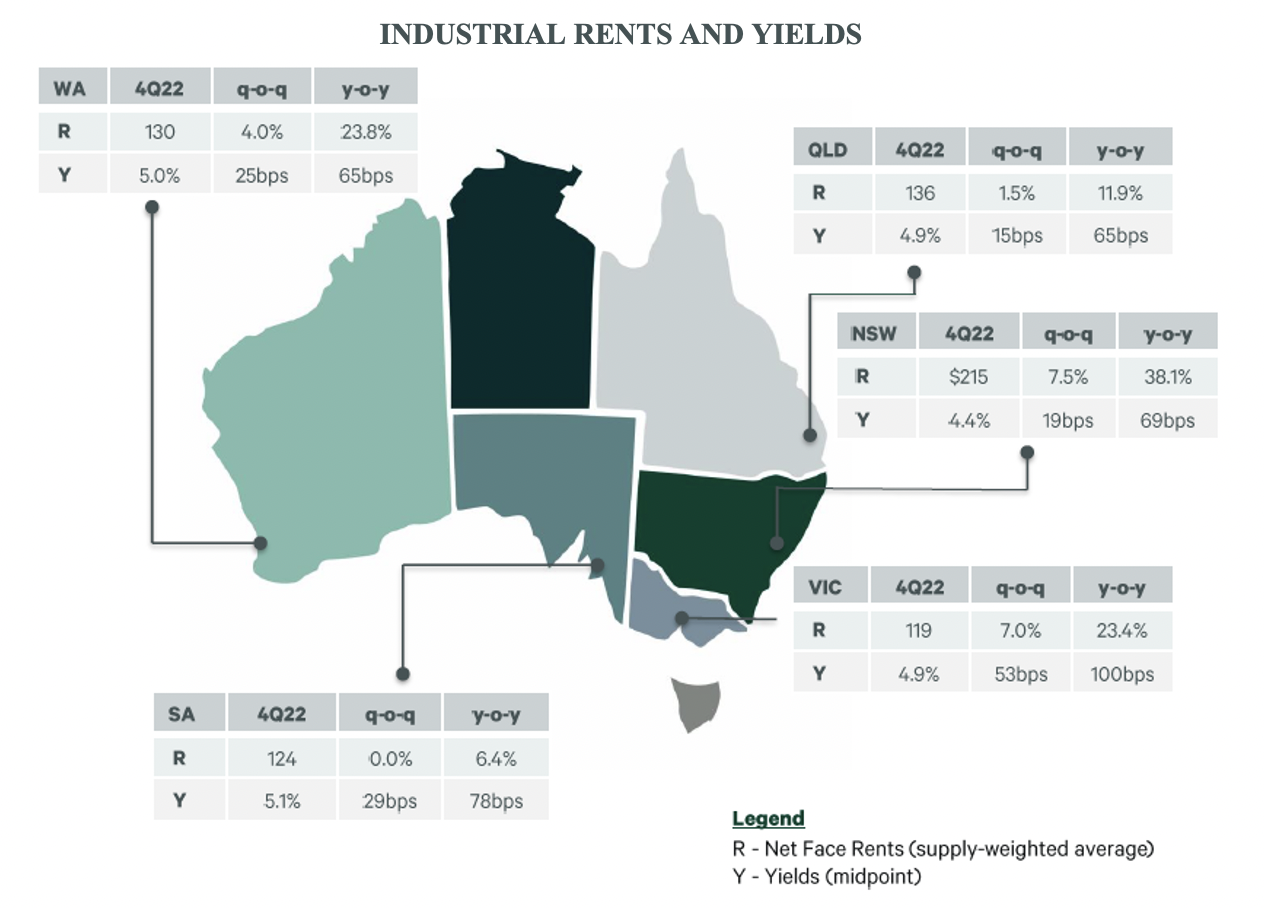

New CBRE data shows that average net face rents for super prime assets in Sydney jumped by another 7.5% in Q1, bringing the y-o-y growth rate to 38.1% - the strongest in the country.

Industrial & Logistic (I&L) rents are continuing to accelerate across Australia underpinned by extremely low vacancy.

New CBRE data shows that average net face rents for super prime assets in Sydney jumped by another 7.5% in Q1, bringing the y-o-y growth rate to 38.1% - the strongest in the country.

Perth is in second position with 30% y-o-y growth, following a 4.0% rental hike in Q1.

Rents have also accelerated in Melbourne, following a similar trajectory to that observed in the Sydney market during 2022. CBRE’s data highlights 5.2% average rental growth in Q1, taking the y-o-y growth figure to 23.4%. Effective rental growth in Melbourne was even higher at 8.3%, as incentives have fallen taking the y-o-y growth figure to 38.3%.

Sass J-Baleh, CBRE’s Australian Head of Industrial & Logistics Research, noted, “For the first time average I&L rents in Sydney have surpassed $200/sqm for super prime grade assets, reaching $215/sqm. Strong rental growth has also been observed in Melbourne, however this is off a low base and the city’s average super prime rent remains quite attractive for occupiers at $119/sqm – the lowest in the country.”

CBRE I&L Regional Director Cameron Grier said delays caused by planning issues had exacerbated the rental situation in Sydney, with the I&L vacancy rate having shrunk to sub half a percent, the lowest levels globally.

“The severe undersupply of Sydney stock is due to high take-up in 2021/2022 and supply issues caused by inclement weather and planning approvals, which has super charged rents. For every building available there are three to five users fighting for it and the person who signs first wins. The only thing that will solve this is more supply and that won’t happen until planning authorities can turn around approvals in a speedier way,” Mr Grier said

Based on the current Sydney pipeline, CBRE is forecasting that rents could rise by a further 10% by year’s end.

There is also scope for strong growth in Melbourne rentals over the next 12 months, with CBRE forecasting an additional 13% increase in super prime rents by the end of 2023.

“The Melbourne market has an extremely low vacancy rate of circa 1% and a high pre-commitment rate for new developments coming online over 2023-2026. Of the circa 1.7 million square metres of confirmed stock in the pipeline for this period, 72% has already been pre-committed,” Ms J-Baleh said, noting that the strong outlook for Melbourne was also underpinned by its Australia-leading population growth forecast and access to the country’s largest port.