Industrial property is the top targeted sector for private capital in 2023, according to Knight Frank’s The Wealth Report 2023

Contact

Industrial property is the top targeted sector for private capital in 2023, according to Knight Frank’s The Wealth Report 2023

Knight Frank’s recently-released The Wealth Report 2023 found the top targeted sector in commercial property in Australia for ultra-high-net-worth individuals (UHNWI) this year is logistics and industrial.

Industrial property is a sought-after asset class by all types of buyers, including private buyers.

Knight Frank’s recently-released The Wealth Report 2023 found the top targeted sector in commercial property in Australia for ultra-high-net-worth individuals (UHNWI) this year is logistics and industrial.

UHNWIs are those with a net worth of US30 million or more, including the primary residence.

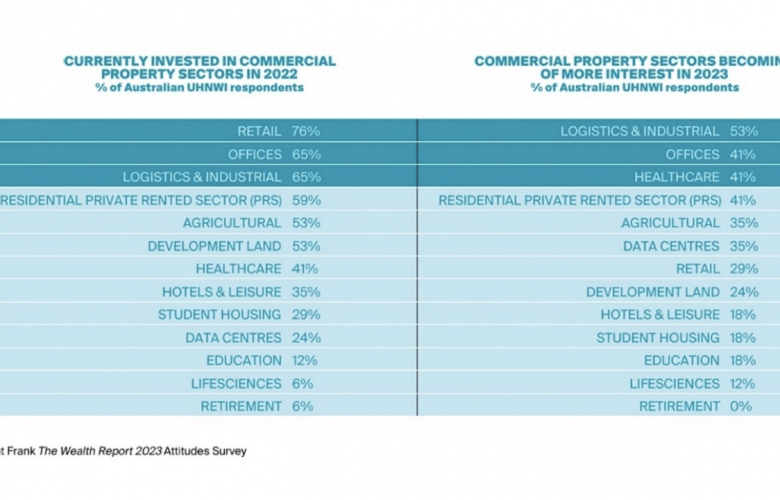

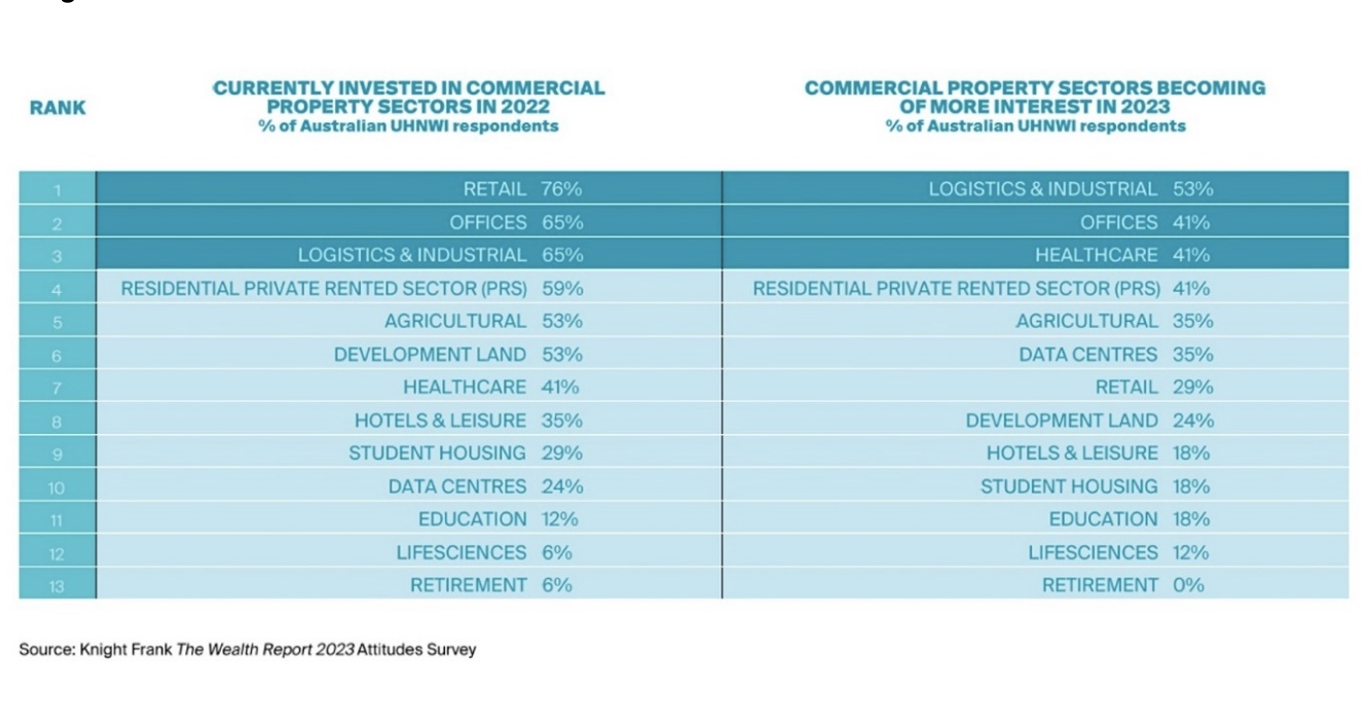

Fifty three per cent of respondents to The Wealth Report 2023 Attitudes Survey indicated logistics and industrial was the top sector of interest for 2023, followed by offices and healthcare (41 per cent).

The results indicate there is actually a growing interest in the sector, with the survey finding that Logistics and Industrial was third on a list of sectors that private capital was invested in during 2022, coming in behind retail and offices.

The consistency of the industrial sector being rated highly for private capital is demonstrative of its investment fundamentals.

Demand is still outweighing supply for industrial property, and with vacancy rates still at record lows rental growth is expected to continue to underpin asset values.

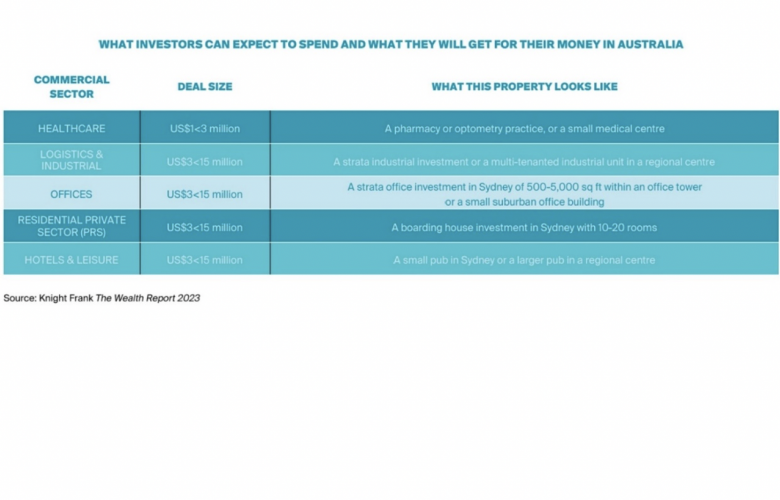

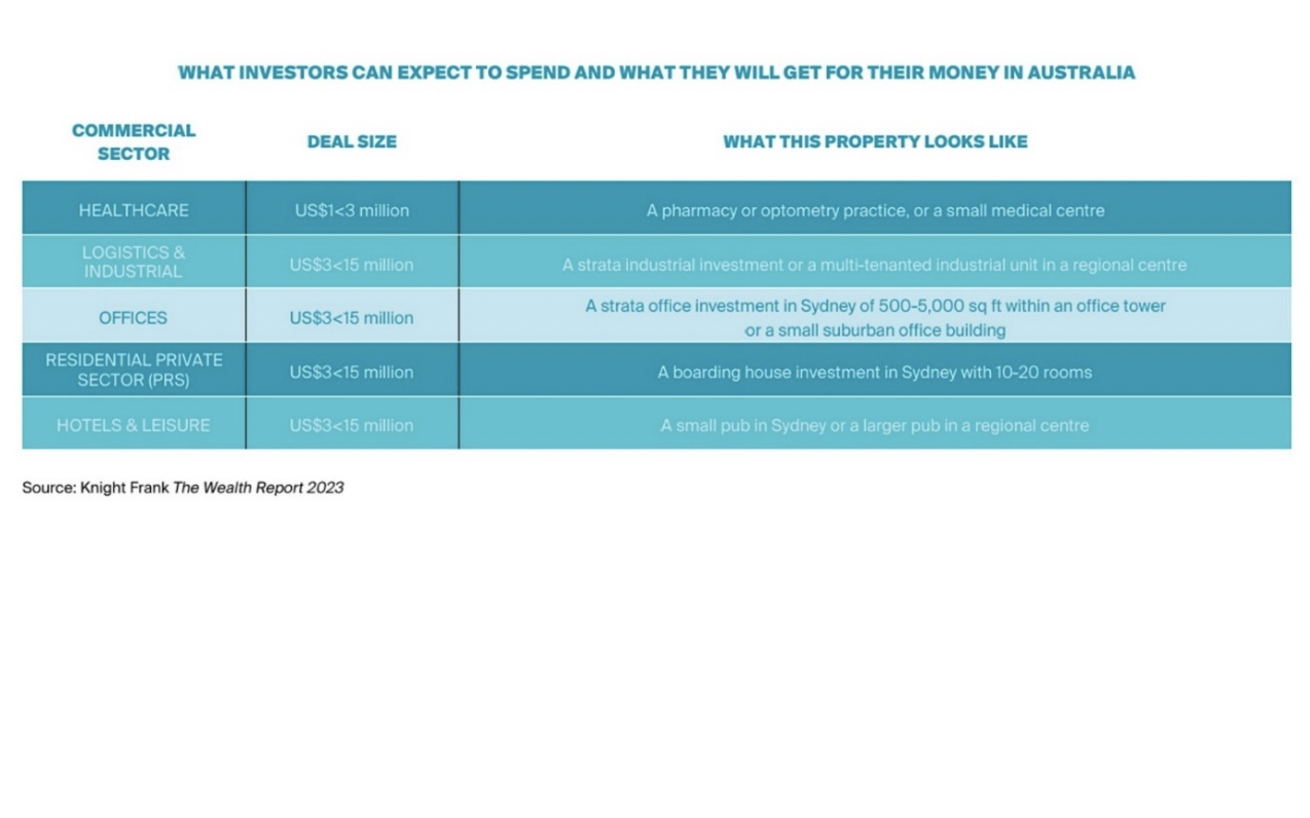

Knight Frank’s The Wealth Report 2023 found that In the logistics and industrial sector, an investment of $5 to $20 million could buy a private investor a strata industrial investment or a multi-tenanted industrial unit in a regional centre.

According to the report, private capital accounted for a growing share of commercial acquisitions in Australia and globally over 2022.

In Australia private capital rose to a new high at 26 per cent of total commercial property investment volumes, up from 25 per cent the year prior, while institutional dipped from 19 per cent in 2021 to 16 per cent and listed capital fell from 17 per cent to 14 per cent.

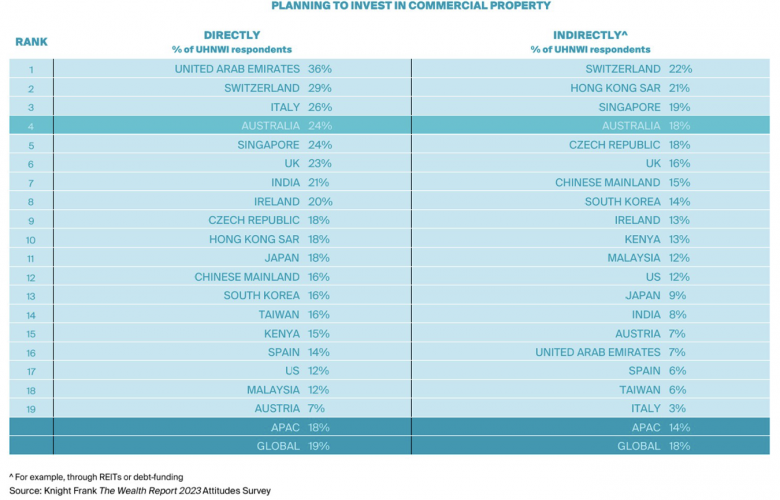

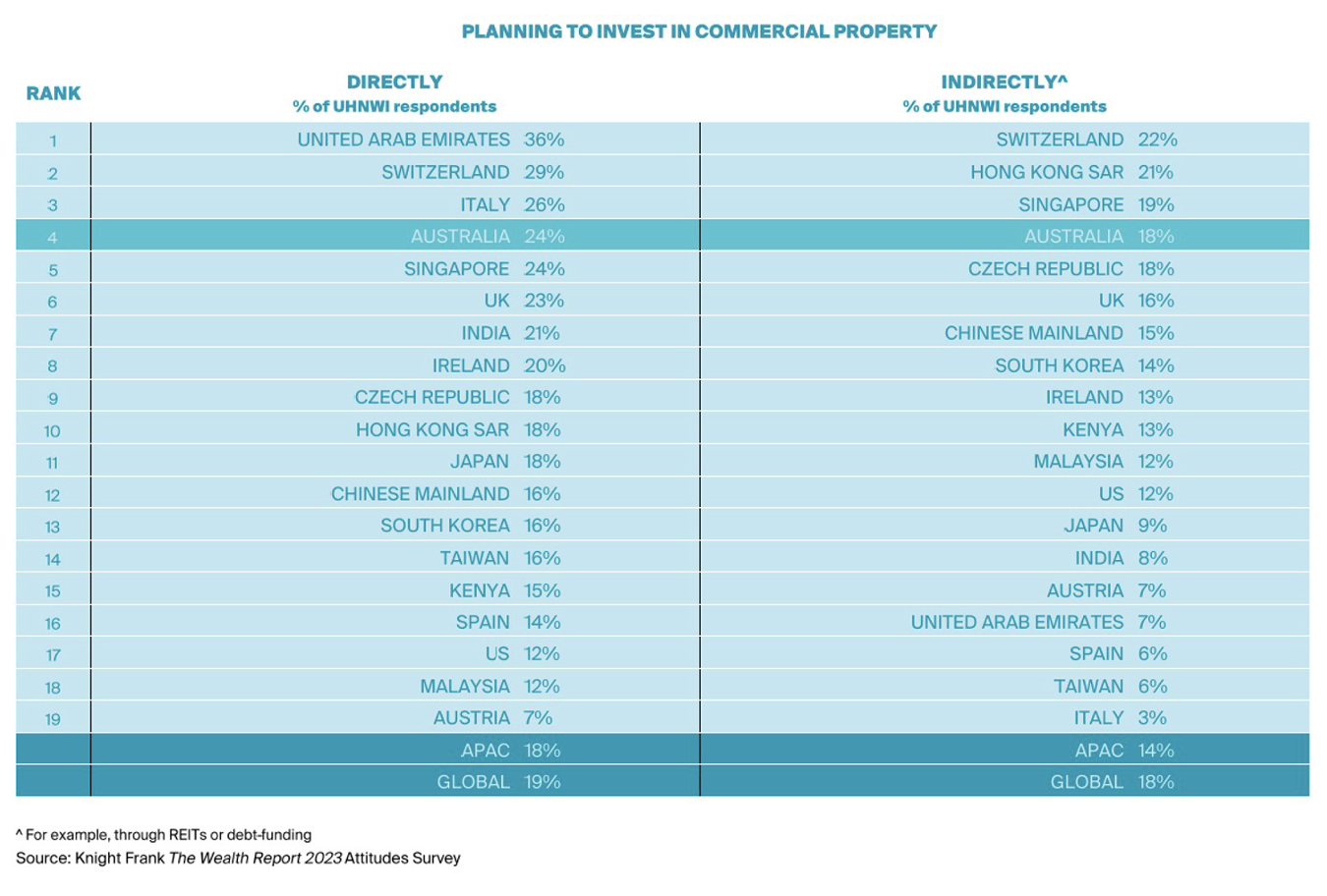

The report found Australia is ranked fourth globally for UHNWI plans to invest directly into commercial property, with 24 per cent indicating these intentions, sitting well above the global average of 19 per cent. For plans to invest in commercial property indirectly, Australia is also ranked fourth, but on par with the global average.

Private investors were also the most active buyers in global commercial real estate investment in 2022, recording their strongest year in history in terms of their share of spend and surpassing institutional investment for the first time, according to Knight Frank’s The Wealth Report 2023.

A significant US$455 billion was invested by private investors, accounting for 41 per cent of the total $1.12 trillion, according to the Knight Frank’s capital flows tracker.

While overall private capital investment was down eight per cent from its all-time high of US$493 billion in 2021, the investment in 2022 represented the highest share of the total spend on global commercial real estate for private investors on record, sitting 62 per cent above the 10-year average of US$243.2 billion.

Institutions invested a total of US$440 billion in 2022 globally, 28 per cent below 2021 volumes, but two per cent above the 10-year average.