Industrial unit activity decreases as mum and dad investors exit the market - Ray White

Contact

Industrial unit activity decreases as mum and dad investors exit the market - Ray White

The industrial asset class has been the stand out performer in the commercial market over the last few years. Increases in demand during the COVID-19 lockdown period aided in reducing vacancy in an already tight market, with a growth in logistic, distribution and storage requirements. Insights by Vanessa Rader, Head of research, Ray White Commercial.

The industrial asset class has been the stand out performer in the commercial market over the last few years. Increases in demand during the COVID-19 lockdown period aided in reducing vacancy in an already tight market, with a growth in logistic, distribution and storage requirements. Also borne out of the pandemic was the increase in small businesses which overtime outgrew homes and garages into small, local industrial unit facilities.

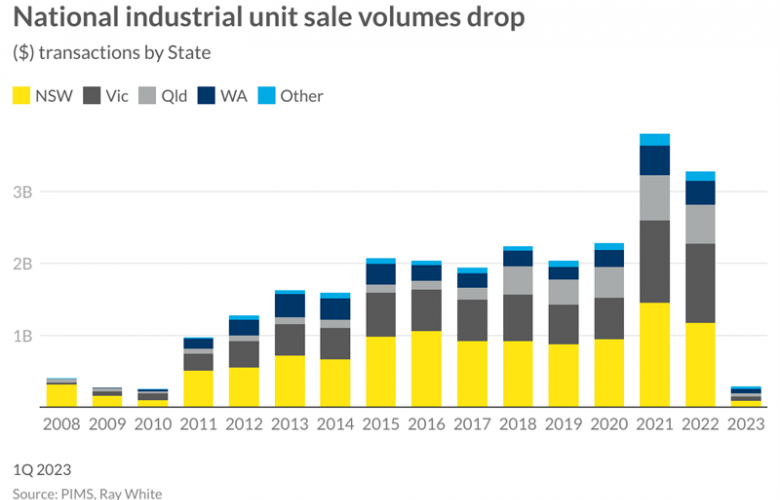

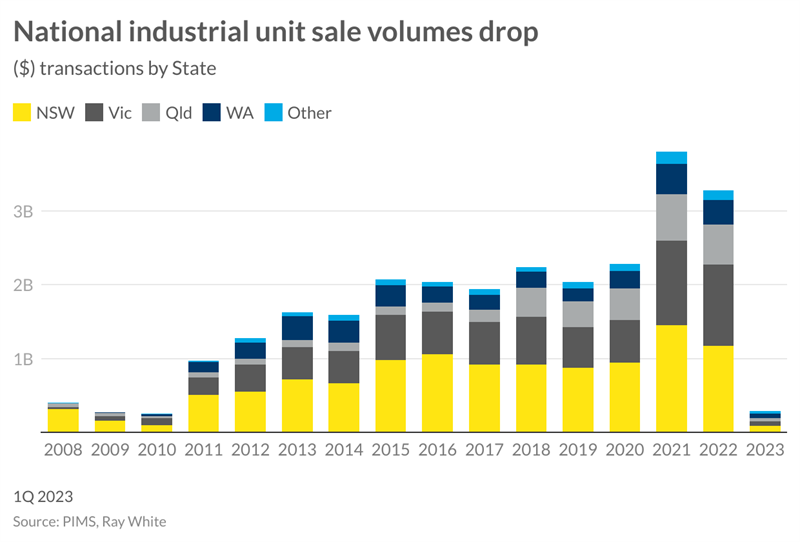

The strong tenant demand was instrumental in driving up rents in this vacancy environment across the country, while record low interest rates and the high finance availability saw investment yields plummet. With industrial yields being the lowest ever on record and rents surging, we saw an increase in first time investors such as mum and dad buyers looking to diversify their investment portfolio and jump into the market. Similarly, owner occupiers were also quick to join the investment bandwagon to shelter from the rapidly rising rents, with SMSFs an attractive vehicle to purchase. While the broader industrial market experienced high volumes, the smaller industrial unit market and its affordable price point was instrumental in growing investment by these various smaller investors to close to $4 billion in 2021 nationally.

NSW has been the recipient of the greatest volume of industrial unit sales followed closely by Victoria, a strong result given the various lockdowns across these states. During this period we witnessed significant increases in sales transactions across both Queensland and WA, markets which benefited from improved local demand, interstate migration and economic performance. Affordability also came into play during this time as values rapidly escalated, with many private buyers looking to these markets as more affordable options to make their first foray into commercial property investment and, as a result, volumes in SA and Tasmania also recorded some uptick.

As interest rates started to make their move upward in 2022, many first time buyers exited the market. However, the continued strong increases in rents resulted in many savvy buyers continuing to pursue these assets despite the rising finance costs, keeping total volumes upwards of $3 billion. The reduction in residential values late in 2022 was a blow for many mum and dad investors, creating some uncertainty across all property markets. Owner occupiers, however, remained committed to the asset class despite rental growth slowing, albeit overall vacancy remaining relatively tight.

As we moved into 2023, hampered by continued interest rate rises, the demand for these small investments halted, recording less than $300 million in Q1. Surprisingly, investment across the country seems evenly distributed, something unseen ever before. With rental growth now stabilised for this asset class, the high cost of finance and difficulty in obtaining funds has seen mum and dads, owner occupiers, and the many private investors retreat until more certainty surrounding interest rates emerges. While tenant demand has slowed across the industrial sector, there continues to be limited new stock being added to the market. Limited vacant, developable land; high land prices, and construction costs are all barriers to continued supply, which is expected to keep vacancy limited and upward pressure on rents as new assets set rental benchmarks.

Looking ahead, the recent pause in interest rate movements has restored some confidence. However, many buyers will be watching these results over the coming months before making property decisions. While volumes have started the year slow, activity is expected to rebound before the end of the year with transactional activity eclipsing the poor results achieved post GFC for this segment. It is likely that sales across Sydney, Melbourne and south east Queensland will move first as investors return to these more prime locations ahead of smaller markets.

By Vanessa Rader, Head of research, Ray White Commercial

Industrial unit activity decreases as mum and dad investors exit the market - Ray White