Reaping the rewards of logistics and industrial rental reversion - JLL

Contact

Reaping the rewards of logistics and industrial rental reversion - JLL

Accelerating rents in many logistics and industrial (L&I) properties will provide a buffer for returns in 2023, says Peter Guevarra a Director in JLL’s Asia Pacific Research team, based in Singapore.

Accelerating rents in many logistics and industrial (L&I) properties will provide a buffer for returns in 2023. And while peak rental growth is now in the 2022 rear-view mirror, the forward-looking view is for rents to trend up, albeit at a slower pace.

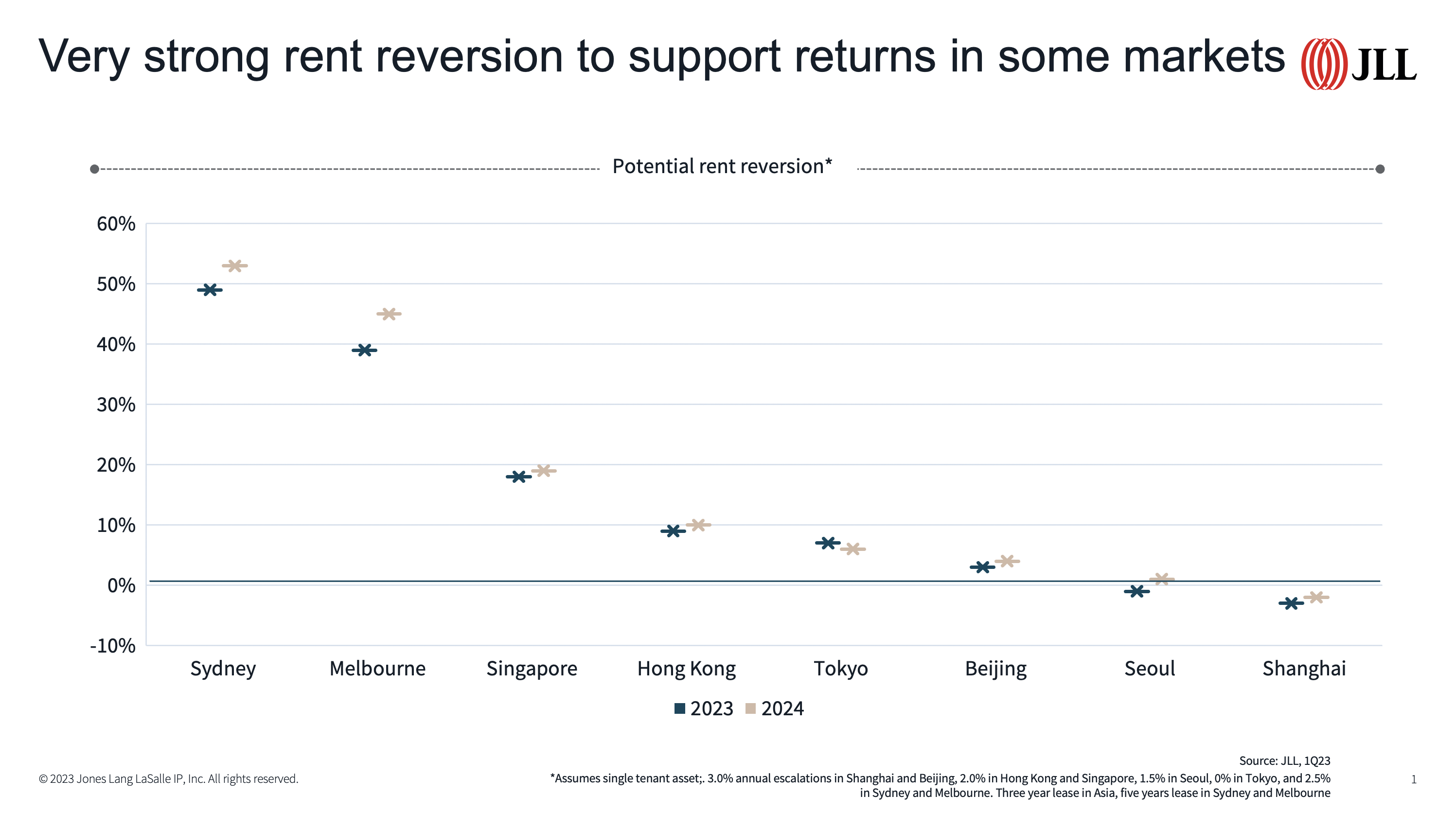

An important outcome of surging rents is positive rent reversion. Assets leased 3-5 years ago at average market rents will now be significantly under-rented today across many markets. This potentially means immense rental upside for portfolios or assets with upcoming rental expiries in 2023 and 2024.

The chart below shows the potential rent reversion (i.e. the change in rent between an expiring lease and the rent in a newly signed lease) in some of the major markets in Asia Pacific For this analysis, we assumed a single-tenant asset covered by a standard market lease. While individual assets will show different results, there is a strong positive rent reversion story at a market level. Sydney and Melbourne are the clear outperformers. An asset in Sydney’s Outer Central West leased five years ago and with expiry in 2023/2024 could command rent that is 50% higher. Similarly, assets in Melbourne’s West precinct could fetch more than 40% upon expiry this year or next year.

Also compelling is the rent reversion across Asia’s more mature markets. Singapore, Hong Kong and Tokyo could record rental uplift of between 7 and 18% this year. Beijing and Seoul also show positive rent reversion, but at a more modest pace.

Rents will be an important component for investors looking to shield returns from the assault of rising interest rates. Yields in markets such as Australia, New Zealand and South Korea have decompressed by more than 50 basis points in 2022. And with more decompression expected, this will further erode portfolio returns for many investors in 2023. Investors with existing L&I portfolios positioned to take advantage of rent reversion in 2023/2024 are well-placed to navigate the current environment. And for those without current exposure but looking to capitalise on the rent reversion upside, being selective and patient for the right opportunity will be key.

Our recent Investor Sentiment Barometer suggests slower transactional activity and lower competition for assets this year. If investors can find comfort in targeting the right assets, they may be able to protect returns across their L&I portfolio. This will be especially important in an environment that is without the safety of a rising tide.