Investors have long viewed Brisbane as part of a greater Eastern Seaboard institutional-grade industrial market - JLL

Contact

Investors have long viewed Brisbane as part of a greater Eastern Seaboard institutional-grade industrial market - JLL

National industrial occupiers are increasingly looking to Brisbane as stock tightens and rents soar elsewhere, says Shaun Canniffe, JLL’s Head of Industrial & Logistics – QLD.

National industrial occupiers are increasingly looking to Brisbane as stock tightens and rents soar elsewhere.

Commercial factors driving the trend include cost and vacancy pressures in southern states and particularly Sydney.

Rents:

Brisbane has experienced very strong industrial rental growth, with prime net rents growing by 15% on average across different Brisbane market precincts over the year to 1Q22.

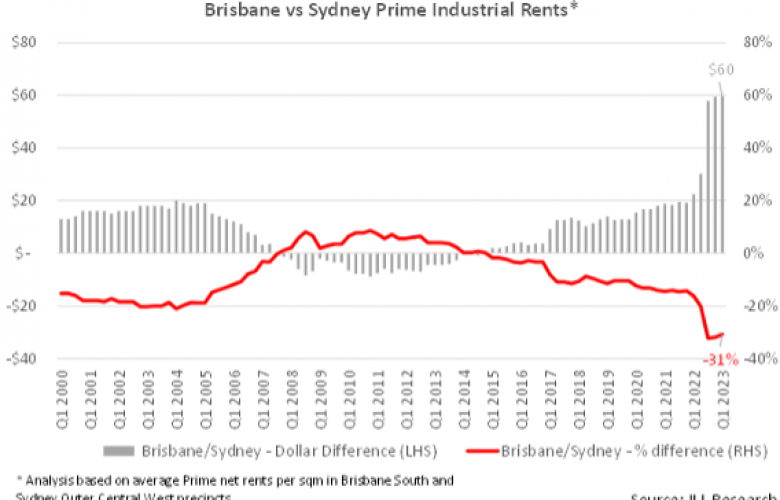

Queensland still lags the southern states, particularly Sydney rent prices, JLL research shows. The difference is increasing, with the gap between Brisbane and Sydney rents going from 16% in 1Q 2022 (and about 14% over 2020 and 2021) to 31% in 1Q 2023.

Shaun Canniffe, JLL’s Head of Industrial & Logistics – QLD said: “The result is that despite strong recent growth in Brisbane rents, the gap between Brisbane and Sydney rents has significantly widened. Our analysis of Brisbane’s South verse Sydney’s Outer Central West suggests the differential has gone from 16% in early 2022 to 31% in 1Q23 meaning Brisbane is becoming increasingly more and more affordable relative to alternative markets.

“This price differential combined with the lack of available stock in the Sydney market has certainly caused many national occupiers to take a closer look at shifting more operations towards Brisbane.

“This interesting trend is being proved up through JLL data, with our analysis showing that around 90% of the major occupier moves we’ve tracked over the past year have been from national tenants, and even more interestingly, almost 50% of these groups are new entrants for the Brisbane market.

“We have transacted over 85,000sqm in 7 separate deals so far this year, all of which are national occupiers choosing Queensland as their growth market, with 3 of these groups being new entrants into the Brisbane market.

“The increasing popularity of Brisbane with national and multinational companies has long been a trend on the capital market side and investors have long viewed Brisbane as part of a greater Eastern Seaboard institutional-grade industrial market,” said Mr Canniffe.

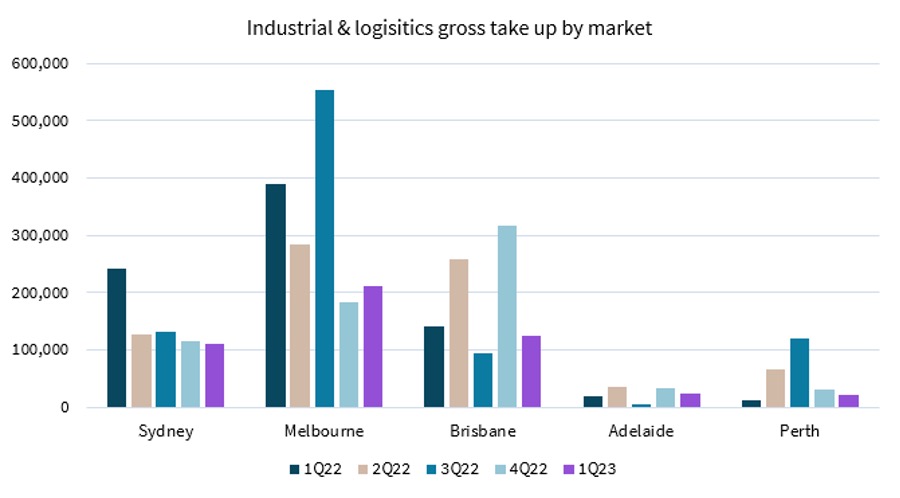

JLL’s data shows that gross take-up of industrial space by major occupiers in Sydney and Melbourne has slowed significantly in recent quarters due to the lack of options and Brisbane (777,248 sqm) actually recorded more take-up over the year to 1Q23 than Sydney (553,050 sqm) which is a highly unusual result. Melbourne recorded 1.18 million sqm of gross take-up, but it too has slowed in recent quarters.