The only way is up: global CBRE analysis highlights further room for growth in Australian industrial rents

Contact

The only way is up: global CBRE analysis highlights further room for growth in Australian industrial rents

Super prime industrial & logistics rents across Australia are set to keep climbing based on a new global analysis from CBRE.

Super prime industrial & logistics rents across Australia are set to keep climbing based on a new global analysis from CBRE.

While net rents have already risen nationally by circa 27% year-on-year (on a supply-weighted average basis), occupiers should brace for further increases, particularly in markets such as Sydney and Perth, which have the country’s lowest vacancy rates at 0.3% and 0.4% respectively.”

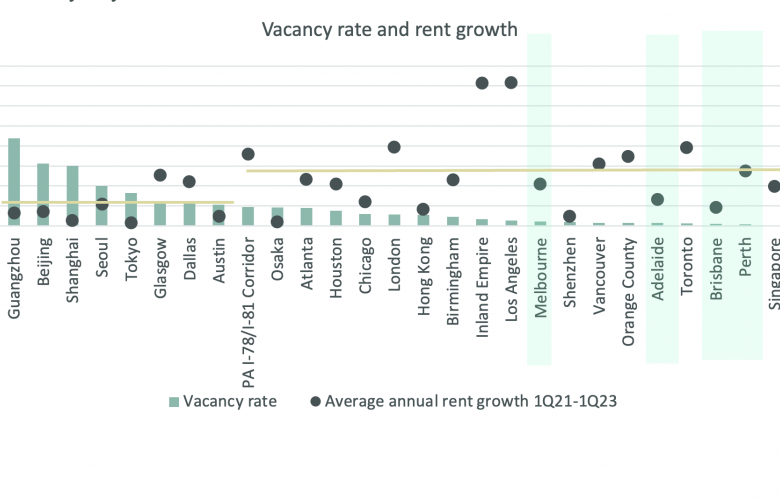

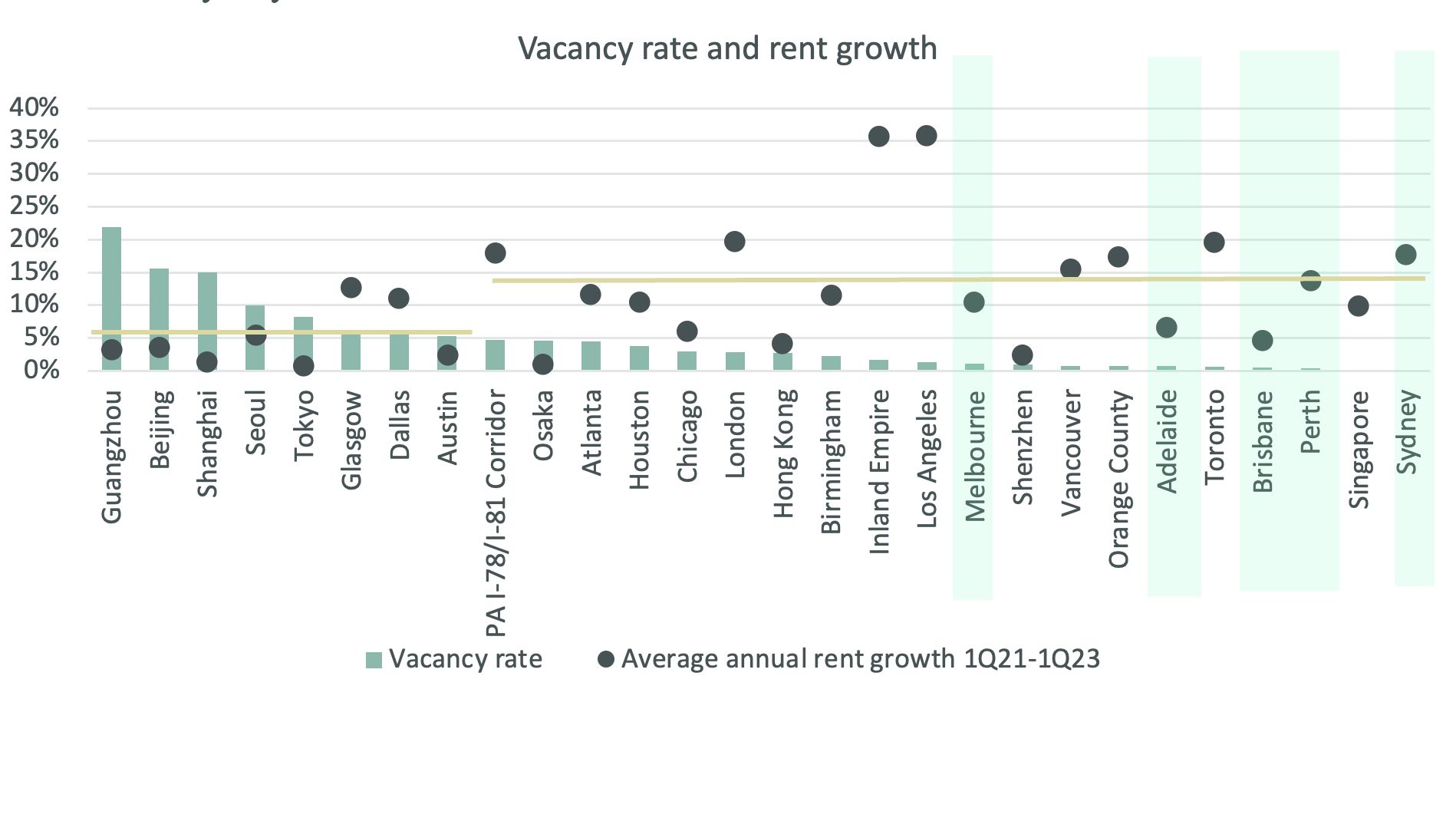

CBRE’s Australian Head of Industrial & Logistics Research Sass J-Baleh said a global deep-dive had highlighted a direct correlation between tighter vacancy rates and significant rental increases.

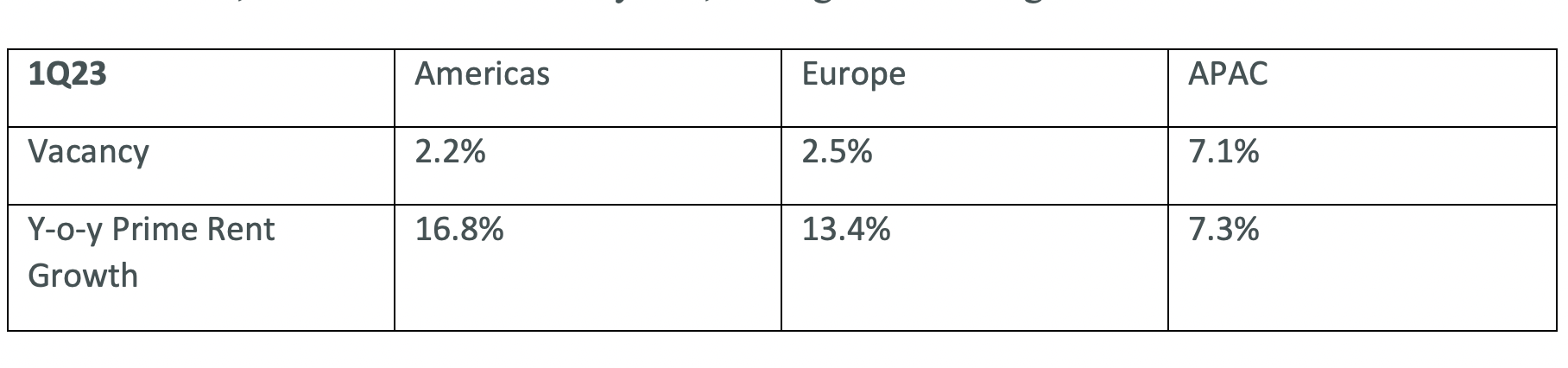

“Double-digit rental growth, averaging 14.2% year-on-year, has been recorded globally for cities with a sub 4% vacancy rate,” Ms J-Baleh said.

“In contrast, rental growth has been less than half this - averaging 6.5% - for cities with vacancy rates higher than 4%. This is one reason why we expect to see further rent growth in Australia, particularly for cities such as Sydney and Melbourne.”

Ms J-Baleh believes Melbourne – the Australian city with the lowest super prime rents – will be another interesting city to watch this year.

“Rents have already increased 23% y-o-y and we’re forecasting an additional 13% growth over the next 12 months, given Melbourne’s affordability relative to other capital cities, the fact that the city is home to Australia’s largest container port, and the city’s population growth, which has been the strongest in the country.”

Looking at regional comparisons, Ms J-Baleh said the average vacancy rate across Asia Pacific was 7%, with Australia’s vacancy rate being 0.6% - the lowest in the APAC region and globally. The Americas vacancy rate currently averages at 2.2%, with Europe sitting at 2.5%.

Noted J-Baleh, “The lower the vacancy rate, the higher the rent growth.”

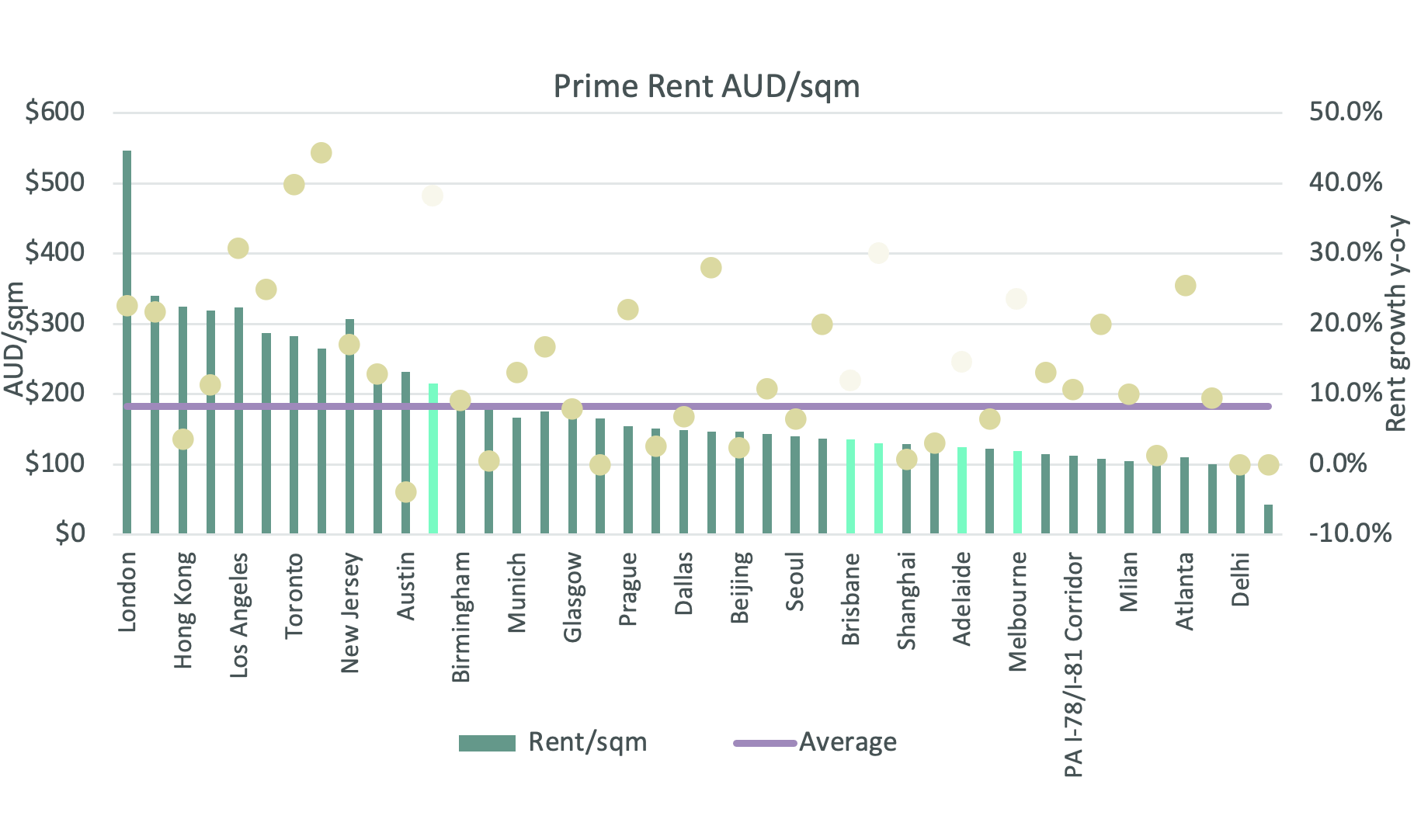

CBRE’s analysis also factors in rental costs for major global cities, converted to AUD and ordered from most to least expensive. It shows that Sydney, the most expensive market in Australia, is not among the top 10 most expensive cities to operate in from an I&L perspective.

“Arguably, there is further scope for Sydney rents to rise. While occupiers are less willing to pay higher rents, there is simply no vacancy in the market,” Ms J-Baleh said.