JLL APPD Market Report - Melbourne

Contact

Jul 25, 2023

JLL APPD Market Report - Melbourne

According to, Annabel McFarlane, Senior Director - Research, Australia, limited available stock and strong occupier demand resulted in significant rental growth in 1Q23.

JLL have released their APPD market report. Annabel McFarlane, Senior Director - Research, Australia, said limited available stock and strong occupier demand resulted in significant rental growth in 1Q23.

Take-up levels rebound over the quarter

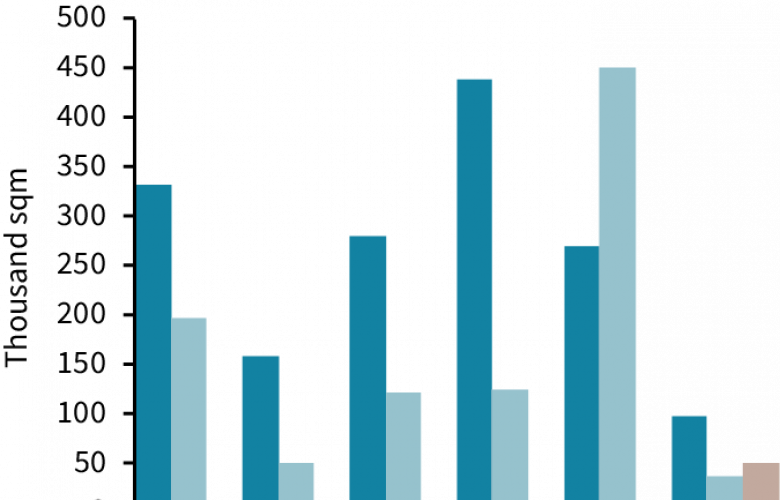

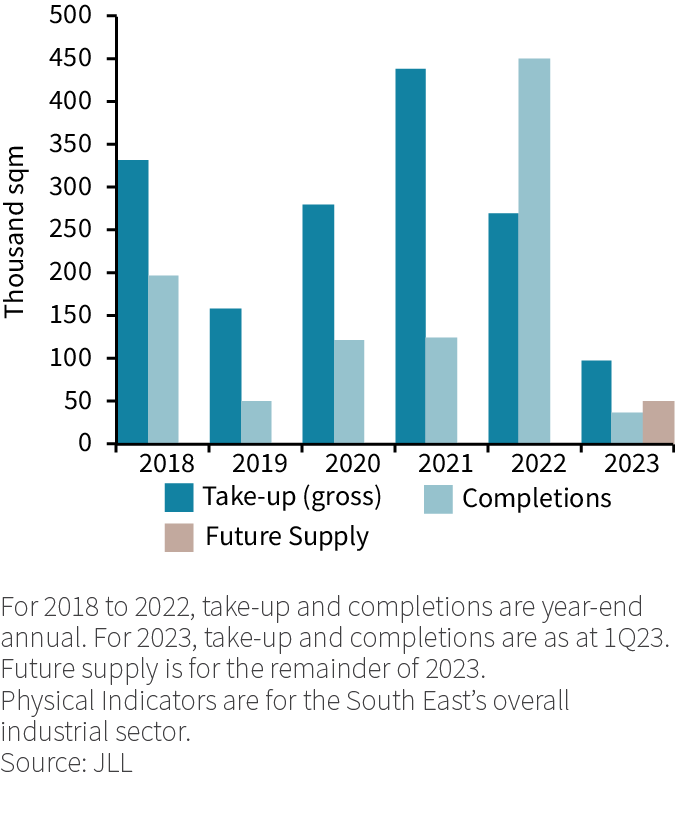

- Gross take-up rebounded in 1Q23, increasing 16% q-o-q to about 211,300 sqm, although quarterly gross take-up is 15% below the 10-year quarterly average of 248,400 sqm. Despite high levels of enquiry from occupiers, availabilities remaining at a record low coupled with limited speculative stock delivery further restricted take-up totals.

- Take-up was weighted heavily towards the Transport, Postal and Warehousing sector, which accounted for 33% of take-up in 1Q23 (68,800 sqm). This was followed by the Construction sector which accounted for 20% of total take-up (42,700 sqm).

Completion levels significantly decreased

- New stock delivery decreased significantly by 82% q-o-q to about 56,000 sqm, a level less than half the 10-year quarterly average of 149,100 sqm. This is a result of the labour shortages, high construction costs and supply chain disruptions that were experienced over 2022 affecting the quarter’s completion level.

- Only four projects reached practical completion in 1Q23, 48% of which was pre-committed to. All completions of the quarter were in Melbourne’s industrial West precinct. An elevated wave of supply delivery is expected next quarter, followed by completion levels below historical averages over the back half of 2023.

Accelerated rental growth was recorded

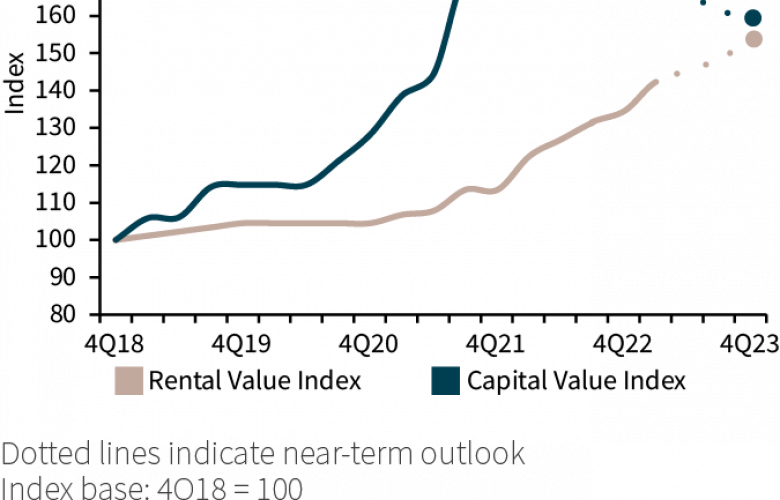

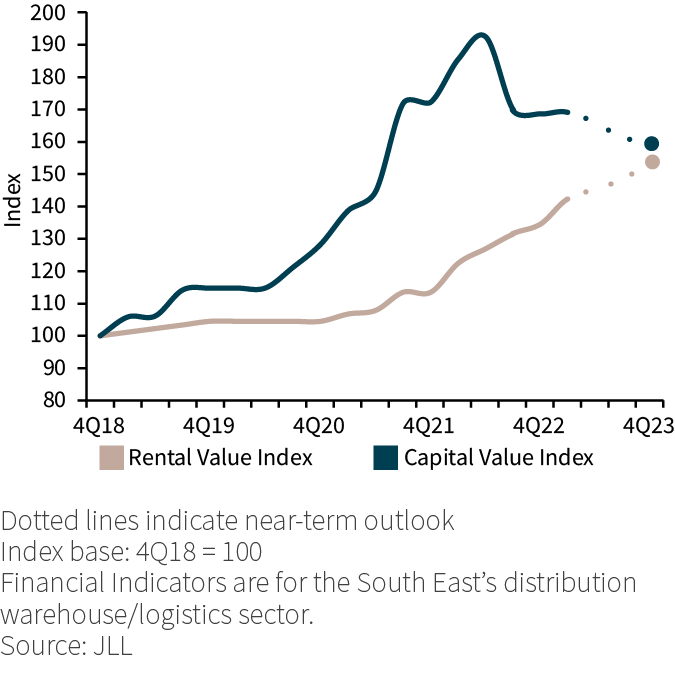

- There was significant rental growth recorded in the Melbourne industrial market in 1Q23. Prime asset quarterly rental growth ranged from 0% to 9.7%. Secondary rents grew between 0% and 12.2% q-o-q, continuing to outpace prime rental growth due to a lack of availability. The highest quarterly growth in both the prime and secondary market was recorded in the North precinct.

- Transaction volumes over the quarter totalled AUD 350 million, a 28% decrease from 4Q22. However, 1Q23 transaction volumes remained well above the 10-year quarterly average of AUD 240.4 million. Transactions for investment purposes accounted for 57% of transaction volumes, while development projects comprised 43%.

Outlook: Rental growth to stabilise amid further yield softening

- Strong rental growth is expected to persist in the medium term, however at a decelerated rate from the growth recorded in recent quarters. Increasingly low availability continues to drive rental growth in the Melbourne industrial market. Reversions in land values are expected to continue in the short term, following substantial growth.

- Further yield softening over the balance of 2023 is expected as a result of elevated interest rates, high bond rates and an uncertain economic environment. Accelerated rental growth has resulted in a positive quarter of capital value growth, however we expect negative growth over the remainder of 2023.

Important Information:

Contact details:

Contact details:

Annabel McFarlane

JLL Head of Strategic Research – Australia.

+61403052672

Email

11515

9471

Annabel McFarlane