How can industrial tenants take more control of outgoings? - JLL

Contact

How can industrial tenants take more control of outgoings? - JLL

According to Murray Pettinger, Director, Logistics & Industrial JLL, careful negotiations are giving tenants better control of their future amid rising costs.

Industrial and logistics occupiers are taking the hit financially on multiple fronts. Not only are they experiencing up to 100% rent rises, but the increasing cost of outgoings, especially in Sydney, is also affecting their gross occupancy costs.

Outgoings include statutory costs such as land tax and rates, as well as the costs of operating a property or estate.

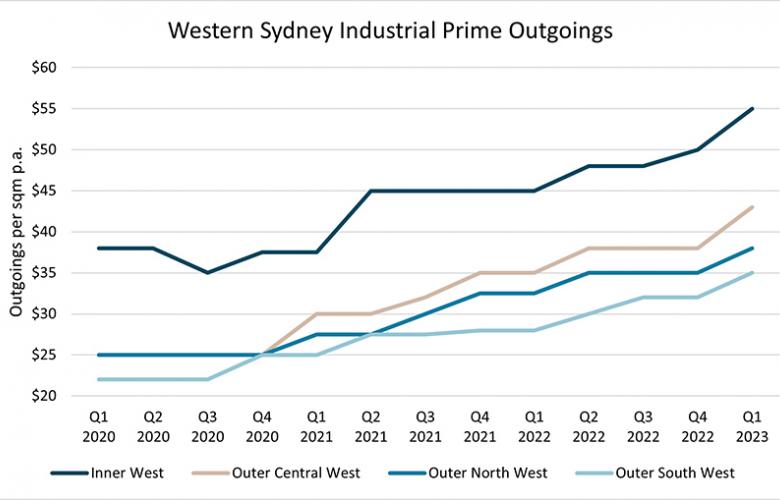

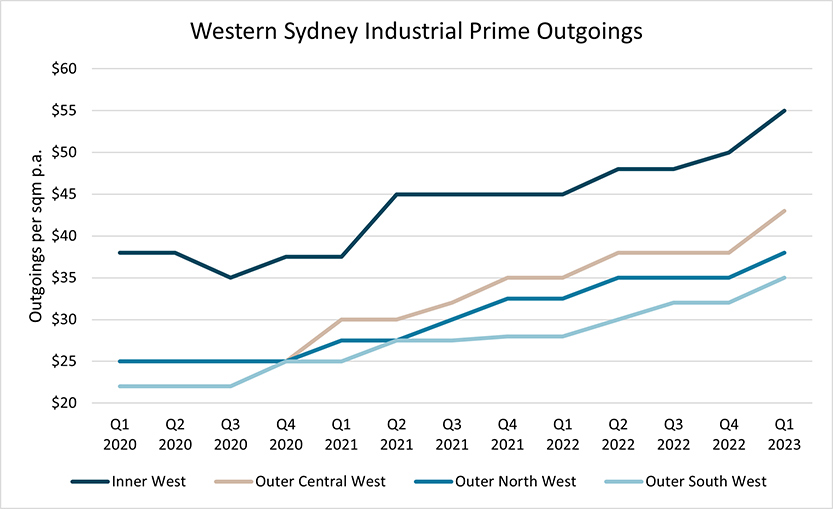

JLL has observed upwards of 30% growth in Sydney’s major industrial hubs, with expectations of further growth in the months to come. For tenants this means more challenges amidst the financial uncertainty in the current economy.

“After a pause on land value assessments during the COVID-19 pandemic, the valuer general is now playing catch up,” says Murray Pettinger, industrial leasing broker, JLL. “Outgoings are now forming a larger proportion of occupiers’ costs than ever before.”

Source: JLL research

What does this mean for occupiers?

The impost of major cost increases is a challenge for any business. In Sydney, the added burden of increased outgoings means that occupiers are even considering alternative locations to find cost savings.

For tenants entering new leases, the structure and wording of outgoings clauses in 'heads of agreement’ contracts and leases must be carefully negotiated. Limitations on aspects of the outgoings clauses will give tenants better control of their destinies. Many of the statutory costs may be fixed, but the nature of operating costs and how they are charged or increased is an important element of an occupier’s negotiating position.