Adelaide records the highest quarterly industrial prime rental growth over Q2 2023 - Knight Frank

Contact

Adelaide records the highest quarterly industrial prime rental growth over Q2 2023 - Knight Frank

The quarterly pace of industrial rent growth slowed in all markets around Australia over Q2 2023 except Adelaide, with demand continuing to outweigh supply, according to the latest research from Knight Frank.

The quarterly pace of industrial rent growth slowed in all markets around Australia over Q2 2023 except Adelaide, with demand continuing to outweigh supply, according to the latest research from Knight Frank.

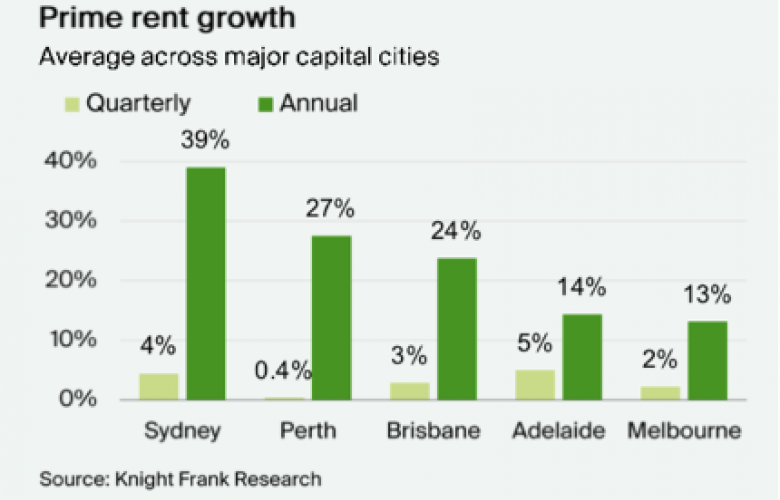

Knight Frank’s Australian Industrial Review Q2 2023 found Adelaide recorded the strongest prime rental growth over the quarter of five per cent.

It was followed by Sydney at 4.4 per cent, Brisbane (three per cent), Melbourne (two per cent) and Perth (0.4 per cent).

Secondary net face rents in Adelaide also saw a rise of 5.12 per cent over the quarter period.

Knight Frank Partner, Research & Consulting Dr Tony McGough said Adelaide was playing catch up after having one of the lowest rates of growth over the past year of 14 per cent, compared to Sydney, which had the highest growth of 39 per cent.

“The combination of limited industrial stock in Adelaide and high levels of demand has seen the rental market continue to grow through 2023,” he said.

“In 2023 development forecasts have shown relative stability but total projected supply has faced hindrances due to construction costs soaring over 25 per cent over the past five years.”

“Consequently a supply-demand gap has emerged, resulting in increased rental rates for existing properties,” Dr McGough confirmed.

Knight Frank Head of Industrial Logistics in SA David Ludlow said there was still caution around cost control, but overall rents had risen as tenants were willing to pay more to secure a quality premises and avoid missing out.

“As rents continue to rise amidst a tight market, affordability for tenants will likely emerge as a focal talking point in the coming months, which could lead to a slight cooling of the market,” he said.

Mr Ludlow said with a significant portion of market participants adopting a ‘wait and see’ approach in the current economic climate, there would be opportunities for active purchasers to secure quality assets with attractive returns, while rents are still high and vacancy remains low.

“However, those conditions will not remain for an extended period of time, as forecasts show the rate of growth in the market slowing into 2024,” he said.

The Knight Frank research found that in addition to rental growth, industrial land values were also rising in Adelaide, with all precincts experiencing growth over Q2 2023.

Values of small allotments (2000sq m to 5,000sq m) grew by 5.6 per cent in the quarter, while medium (1-5 hectare) sized allotments rose by 4.81 per cent on average.

The Inner North (+7 per cent) and Inner South (+6.52 per cent) experienced the largest quarterly rise for small allotments, with the Outer South (+8.33 per cent) and Inner South (+6.25 per cent) precincts leading growth for medium-sized allotments.

Mr Ludlow said despite the macroeconomic challenges the industry has faced in 2023, namely rising costs of debt and construction, Adelaide’s industrial assets have continued to draw high demand, especially in the northern precincts.

“These areas are emerging as market heavyweights, particularly the Outer North,” he said.

“Eighty per cent of expected developments slated for completion by 2025 are concentrated in the Inner or Outer North precincts, in stark contrast to only 9.9 per cent in the Inner and Outer South precincts.

“The Outer North’s allure for development is primarily driven by its accessibility and cost effectiveness of land, bolstered by the north/south connector.

“As a result the precinct is expected to see a surge in investment and development activity in the coming years.”

The Knight Frank research found sales volumes for industrial assets above $5 million grew by nearly 27 per cent to $168.67 million in Q2 2023, which highlighted the continued popularity of the Adelaide industrial market to investors, said Mr Ludlow.

The Outer North dominated sales with $120.60 million, followed by the Inner West ($34.7m) and Inner North ($13.38m). The South precincts had no sales registered over the quarter.