Will the industrial development pipeline be put on pause? - Knight Frank

Contact

Will the industrial development pipeline be put on pause? - Knight Frank

Over the past few years we saw a boom in the industrial property market due to the huge growth in online retailing during COVID by James Templeton Knight Frank Partner, Managing Director, Victoria & National Head of Industrial Logistics.

Over the past few years we saw a boom in the industrial property market due to the huge growth in online retailing during COVID.

There was a chronic lack of supply to cater for the surging occupier demand at this time, and developers responded with a rapid rise in the development pipeline.

However, with the market now having stabilised, with vacant space ticking up since the start of the year, we may now see the development cycle pause for breath nationally until demand catches up again.

Let’s look back to where we were, compared to where we are now.

Demand surged during the pandemic leading to low supply, and extreme rises in rents and land values

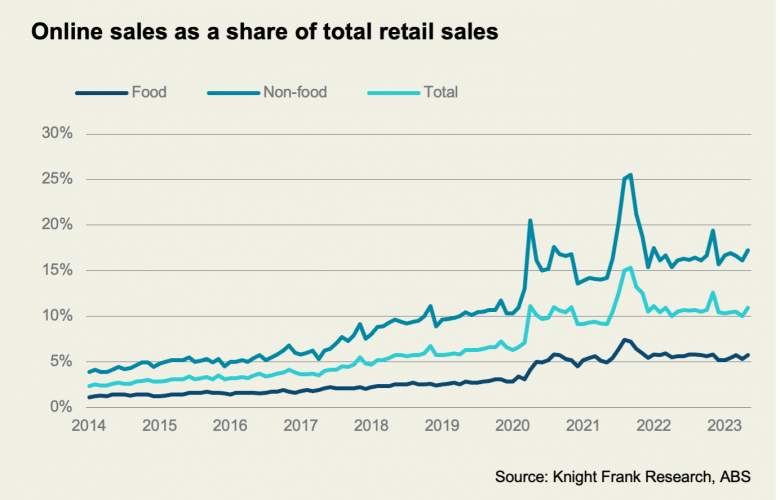

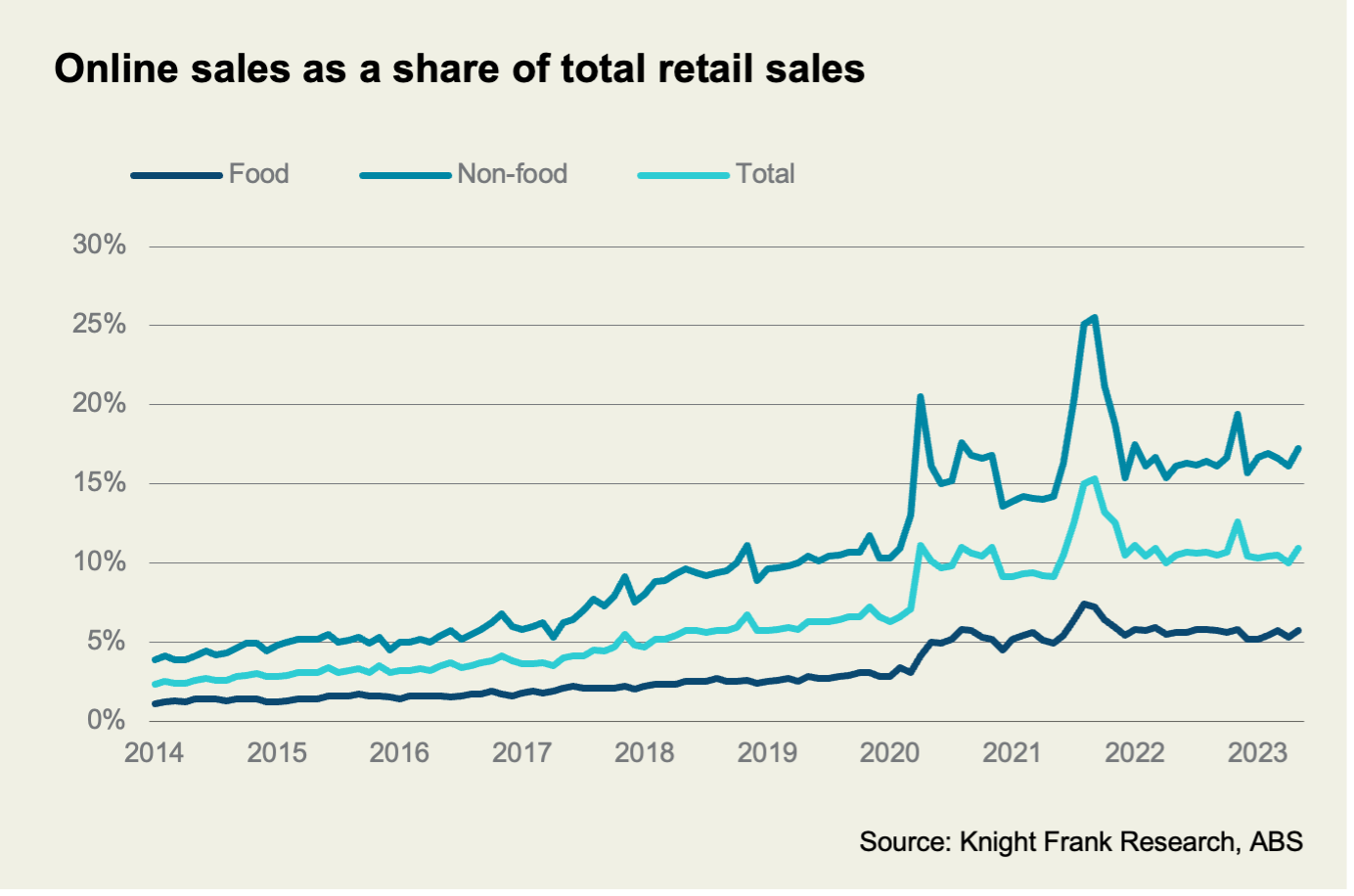

We all know of the step change that occurred in requirements for industrial space as a result of the pandemic. The initial turbocharging of the consumer move to e-tailing saw its share of the market rise from below 10% to briefly 15% of all retail sales, and 25% of non-food sales. This caused a massive increase in warehousing and general logistics requirements. Following on from this the issue of supply chain problems saw a trend of reshoring, which only continued to increase demand for industrial space.

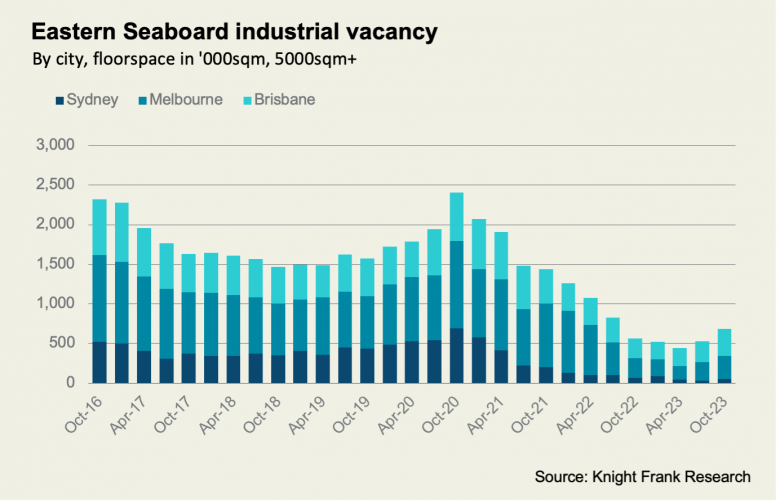

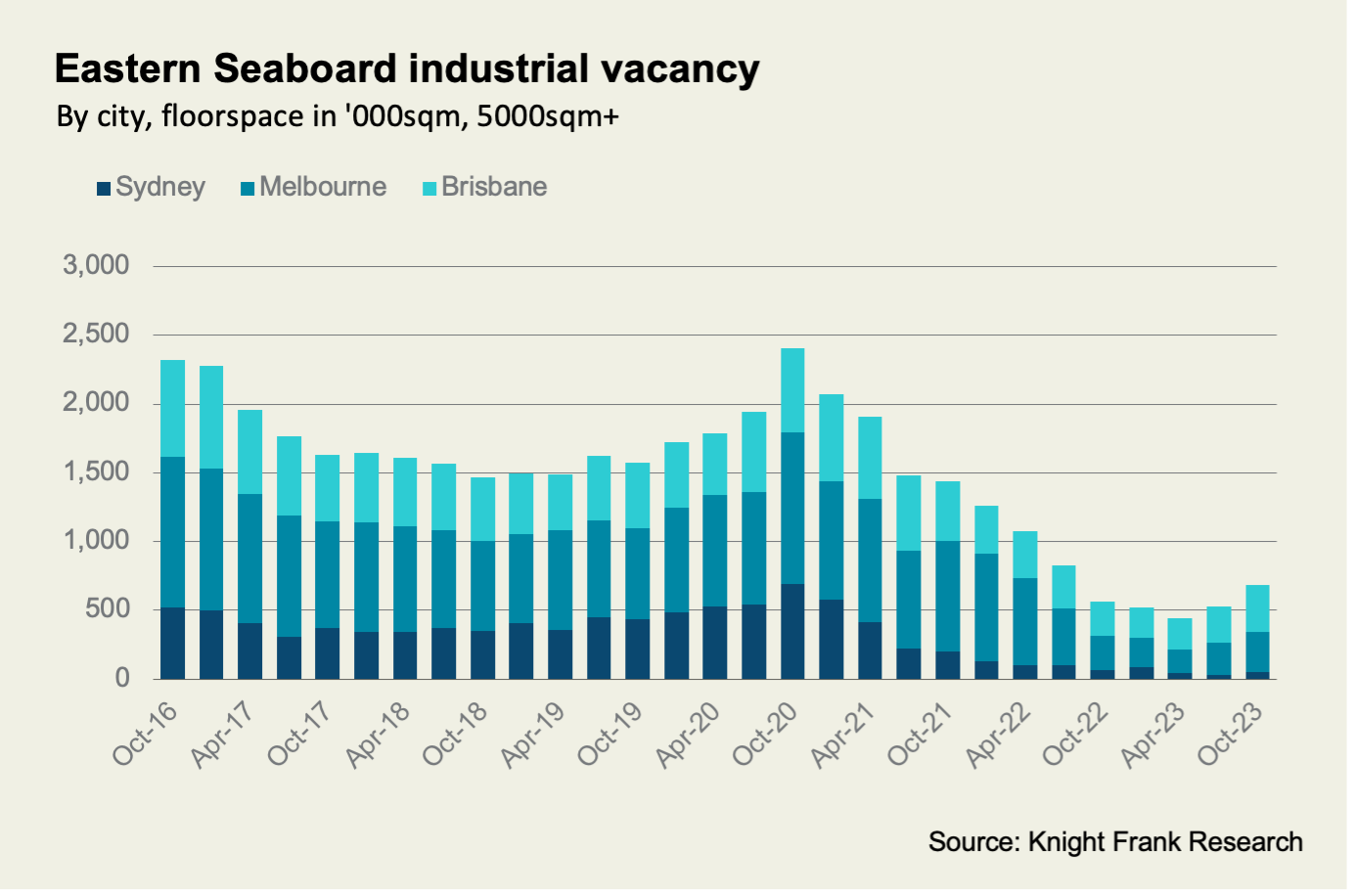

The unprecedented and continued increase in demand for industrial space in Australia saw availability dwindle. By Q1 2023, vacant space across the Eastern Seaboard had fallen by 75% compared to Q1 2020 as the pandemic started, with total available space of 441,000sq m across the three main cities of Sydney, Melbourne and Brisbane, down from 2,406,000sq m. Vacancy rates fell from their usual 6-8% range to sub 1% in areas, with less than 40,000 sqm available in Sydney at one point. The large increase in demand incorporated all quality of space as a rush for accommodation took place, resulting in both prime and secondary space being in very short supply.

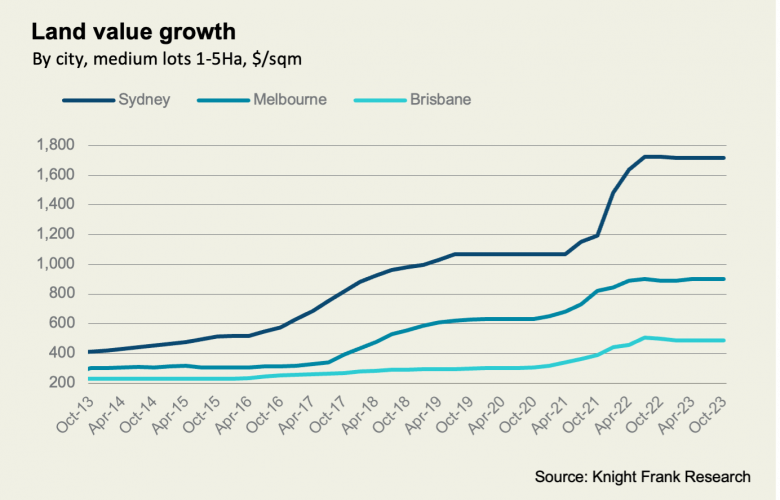

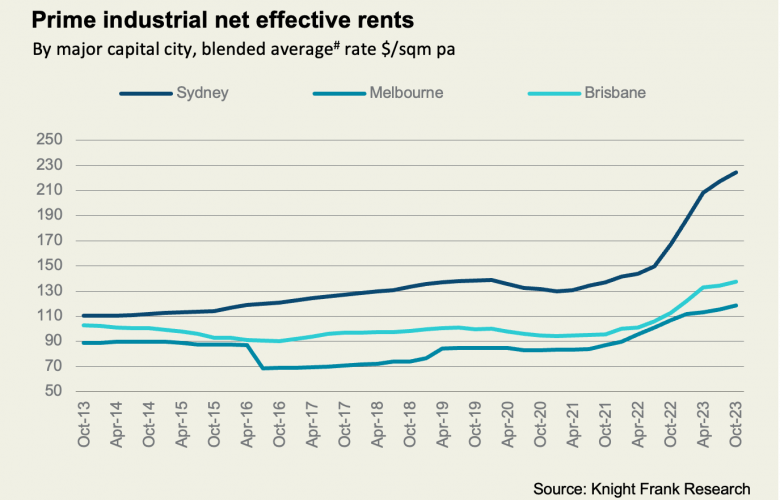

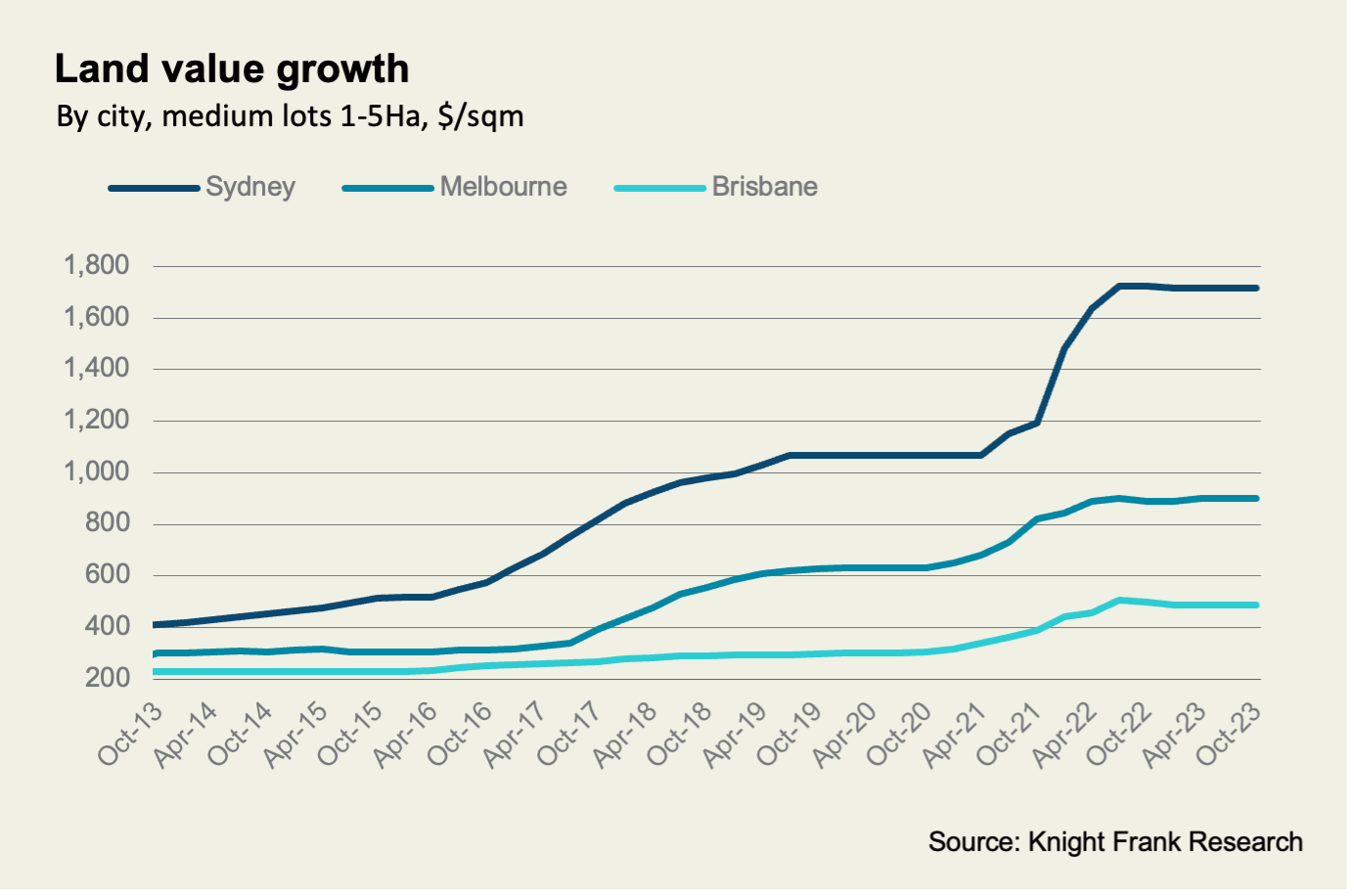

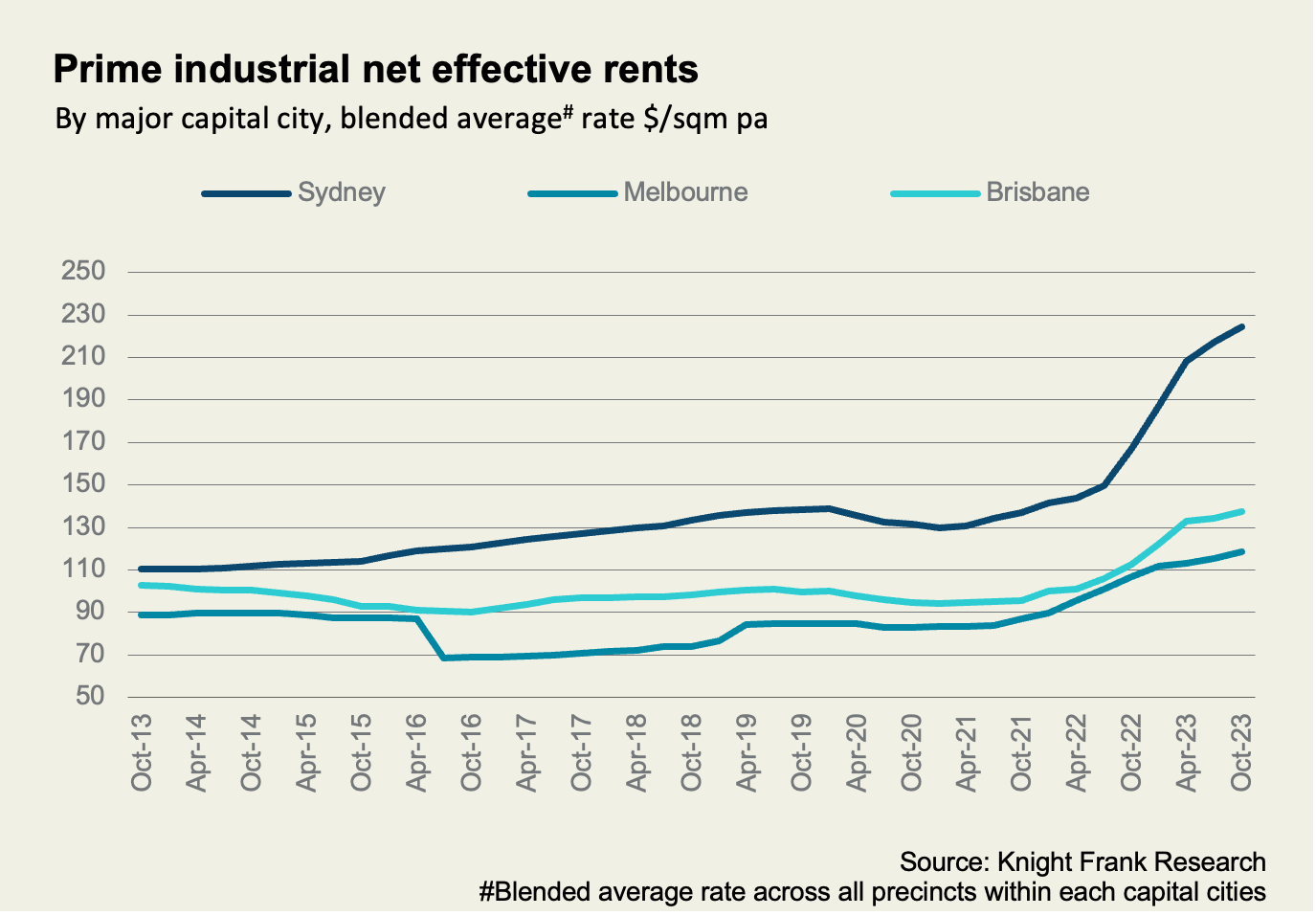

The short supply combined with high demand led to rapid and historically extreme rises in both rents and land values as landlords and developers responded to the rapid changes in the markets. Industrial land values have risen by around 50% in the last 3 years, with some large lot sizes in Sydney more than doubling in value as developers rushed to grab land, with a FOMO hitting the market. Similarly average rents rose by over 40% in Melbourne and Brisbane and over 70% in Sydney since the pandemic began.

What has happened to the supply pipeline?

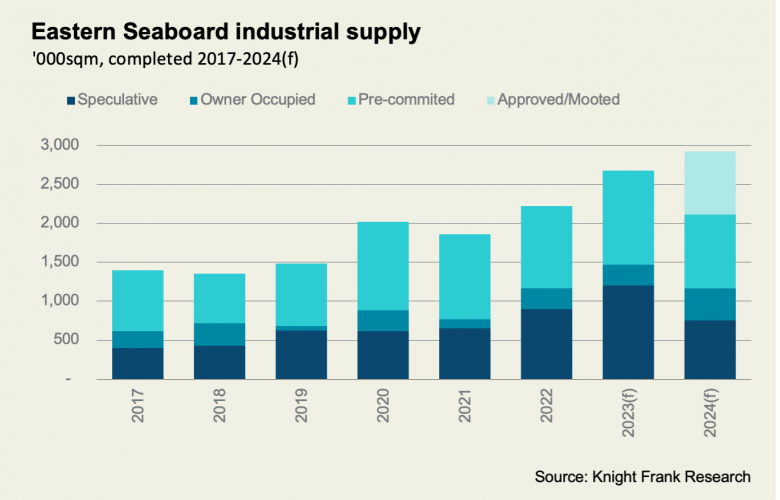

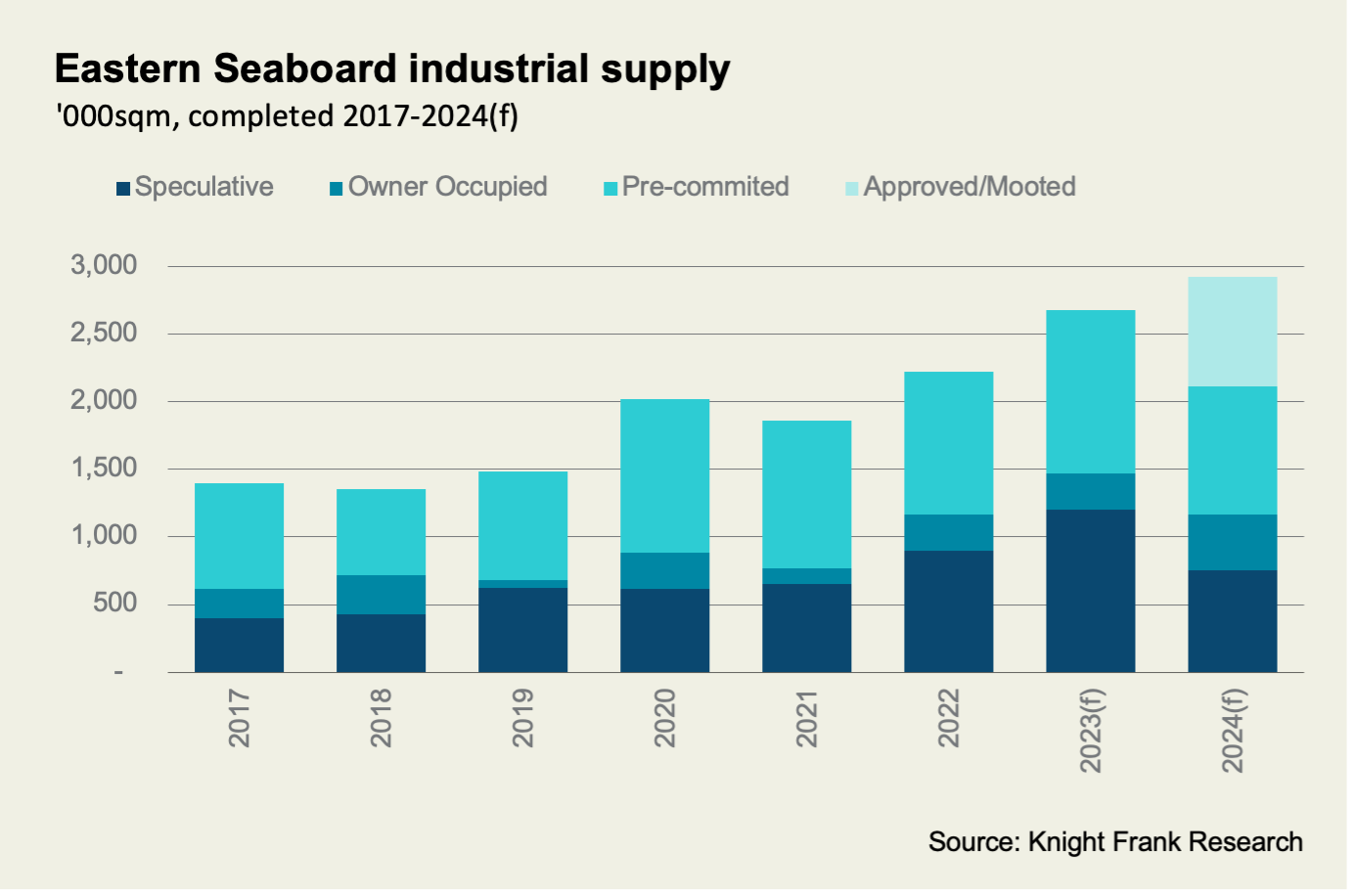

The boom in industrial property made developing industrial space a profitable option, which resulted in a rapid rise in the development pipeline as rising rents (and initially falling yields) more than covered the cost of rising land values, and more recently rising construction costs.

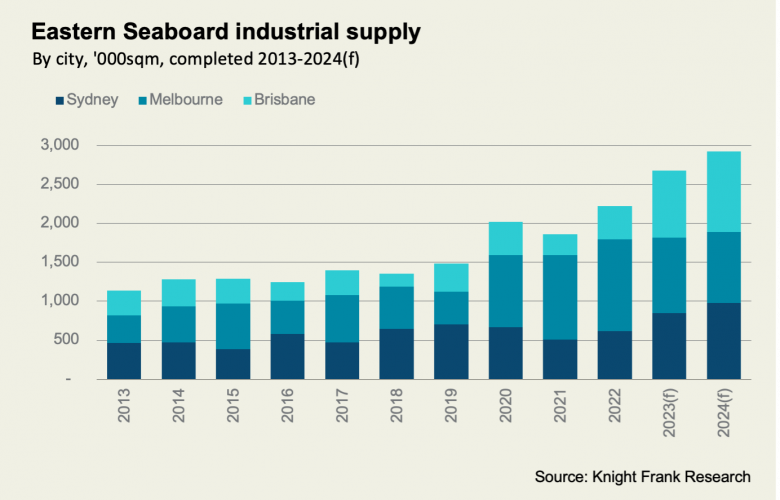

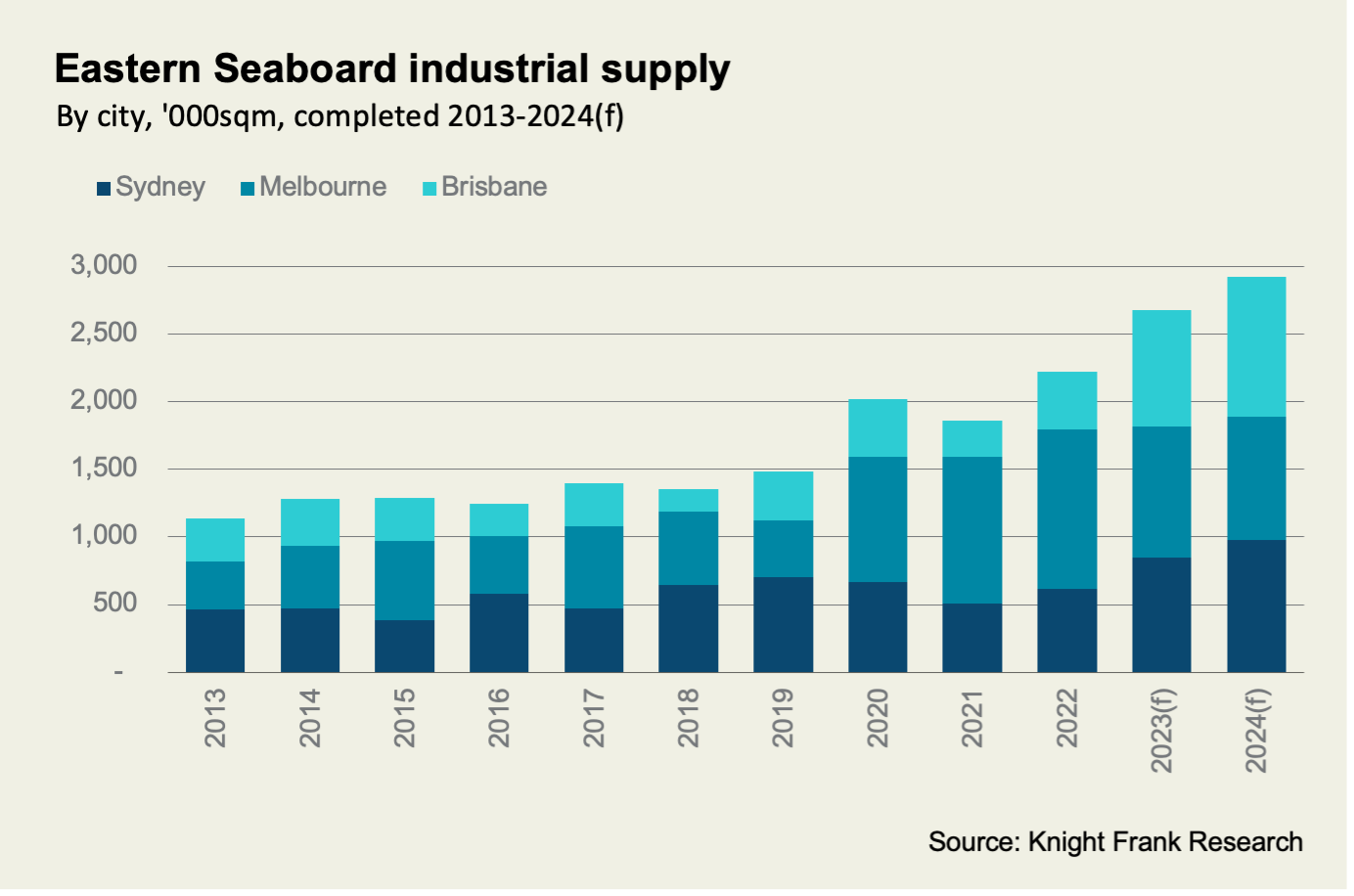

New completions had been slowly edging up from around 1 million square metres per year, broadly 40:40:20 split between Sydney Melbourne and Brisbane, with new supply ratcheting up markedly. From 2020-2023 Melbourne will have added over 4.1 million square metres of space alone. Average completions for the Eastern Seaboard are now well over 2 million square metres per annum, and with Brisbane responding with more space, heading towards 3 million square metres a year.

The initial increase in completions was quickly absorbed and vacant space continued to decline, but vacant industrial space is now starting to rise as demand has slowed. The Australian economy is slowing and e-tailing’s growth has flatlined, demonstrating that the expansion of online spending will be far more gradual than initially thought and demand for space will not grow as rapidly.

Could new supply be put on hold?

After several very strong years of growth, both in demand and supply, it is clear that demand is moderating to some extent in light of a slowing economy.

New supply is forecast to continue to expand to nearly 3 million square metres in 2024, but there is a possibility it may be put on pause due to this slowing in demand.

While there is still some unmet demand, much of this will be covered with pre-committed space. We expect that not all the historically high amount of new space coming on the market in 2023 and 2024 will be absorbed and vacancy levels will rise.

This is not necessarily a problem as Sydney, in particular, is suffering from a lack of choice in space in the market. We also expect that some of the mooted space for 2024 will not come on the market, given how rapidly industrial developers can respond and consequently any increase in vacant space will be moderate. Looking at present vacancy rates it will be returning us to historic averages in percentage terms, providing some liquidity and choice in the leasing market again after a period of scarcity.

The industrial sector has an ability to quickly turn on, and off, supply.

Of the forecast supply for 2024, 28% (811,000sq m) is mooted and can be delayed. Another 409,282sq m is a historically large amount of owner-occupied construction (a response to the lack of availability in recent years), while a further 945,857sq m is pre-committed - leaving only 755,139 sqm speculative.

Whilst this is substantial, we must remember where we are coming from – that is, with historically low vacancy rates. Historically there has been 1.5 million sq m of space on the market, and currently there is barely 500,000sq m.

We may see a return to ‘normal’ availability, as long as the tap gets turned off quickly and the development cycle pauses for breath. With land values now stable, and rental growth beginning to slow, this may be exactly what is happening.

By James Templeton