Industrial rents in Australia still have further to rise, according to Knight Frank’s Australian Horizon 2024 report

Contact

Industrial rents in Australia still have further to rise, according to Knight Frank’s Australian Horizon 2024 report

Despite sustained and substantial growth in industrial rents over the past three years in Australia, they still have further to rise, with Sydney, Brisbane and Melbourne to have the strongest growth in 2024, according to Knight Frank’s Australian Horizon 2024 report.

Despite sustained and substantial growth in industrial rents over the past three years in Australia, they still have further to rise, with Sydney, Brisbane and Melbourne to have the strongest growth in 2024, according to Knight Frank’s Australian Horizon 2024 report.

The forecast for ongoing industrial rental growth is one of the top seven property predictions for 2024 from the report, which notes that a key question being asked in the industrial market as we head into next year is ‘Does the current phase of rental growth in the industrial market have further to run?’.

Knight Frank Partner, Research and Consulting Jennelle Wilson said the answer to the question was yes, pointing to the level of rent as a proportion of total operational costs for industrial users, as well as global comparisons.

“The first reason industrial rental growth is set to continue is that an assessment of rental costs as a proportion of total operational costs for a wide range of industrial space users suggest rents are not yet presenting an unmanageable burden,” she said.

“Analysis of third party data shows that for most business types studied, less than five per cent of total costs came from rents. Anecdotally rents, on new leases or market reviews are representing five per cent to up to 10 per cent of the total operational costs for the majority industrial users, although for some Sydney tenants it may be up to 15 per cent,” she said.

“While rents and other operating costs are increasing, the data indicates that in most cases companies have been able to pass through the increases to end consumers, in keeping with the wider dynamic of a high inflation.

“Large companies appear to have the resources and business need to continue to absorb higher rental levels, although very tight supply levels in Sydney may drive longer term changes to the way companies allocate their holdings across the country.”

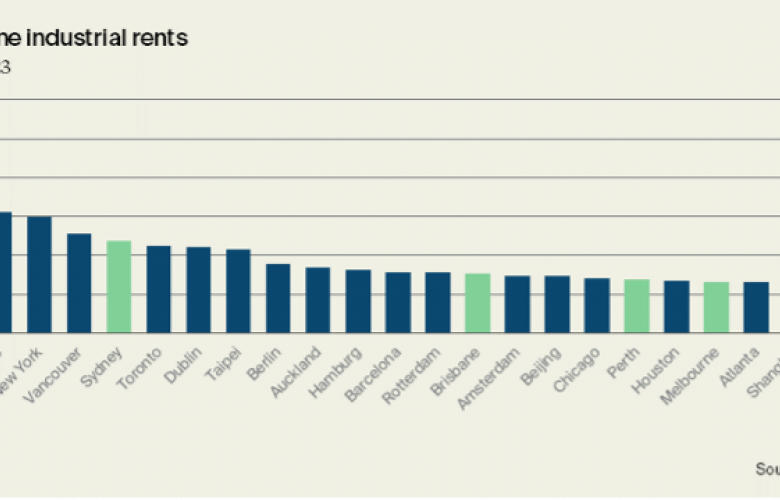

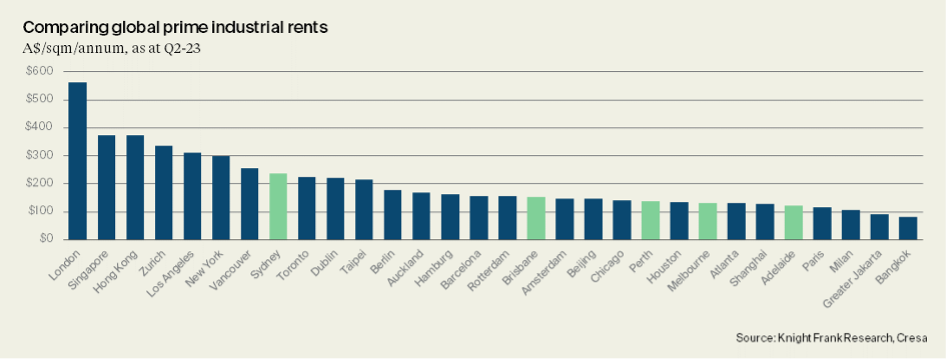

The second reason industrial rents have the capacity to rise further is that in Australia, they are by no means out of line with the level of rents in comparable cities globally, most of which have also seen a sharp rise in rents in recent years, according to Knight Frank’s Australian Horizon Report 2024.

“Comparing Australia’s current prime industrial rents to other major economies indicates that the rent levels in our markets fall in the middle of the pack when compared on a like-for-like basis,” said Ms Wilson. “The growth experienced has also been in keeping with, rather than run substantially ahead of, the rise experienced in other major markets over the past five years.

“Amidst rapid population growth and ongoing supply shortages, rents can be expected to continue to grow, although the pace of growth will be more modest than in 2022 to 23. The market is transitioning from scarcity-led and unsustainable level of rental growth to a more moderate but viable uplift due to the ongoing demand in the market for prime industrial space and the benchmark rents needed to trigger new supply.

“We do also expect this will engender greater differentiation between the performance of prime and secondary assets in the median term.”

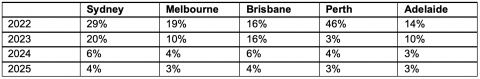

Knight Frank’s Australian Horizon Report 2024 found Sydney and Brisbane were predicted to have the highest industrial prime rental growth in 2024 at 6%, followed by Melbourne and Perth at 4% and Adelaide at 3%.

Sydney and Brisbane have also had the strongest prime rental growth over 2023, with Sydney seeing a 20% rise in rents, followed by Brisbane (16%), Melbourne (10%), Adelaide (10%) and Perth (3%).

Forecast average prime rent growth in major cities:

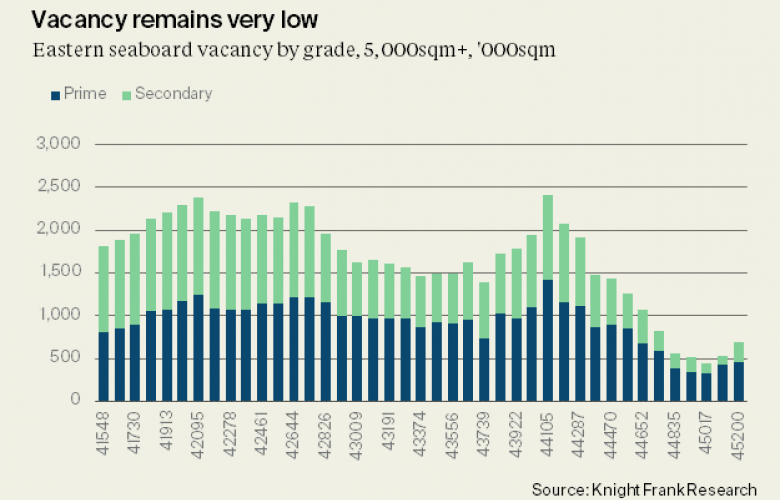

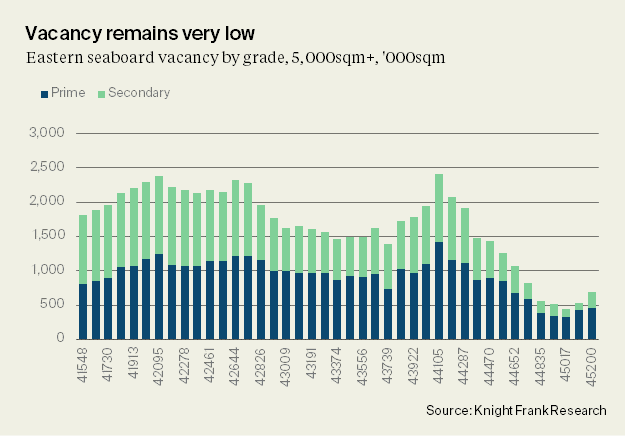

Knight Frank’s latest Australian Industrial Review Q3 2023 found there was a 30% increase in vacancy across the Eastern Seaboard cities over Q3 but vacancy was still 52% below the level of two years ago.

Knight Frank National Head of Industrial Logistics James Templeton said despite the increase in vacancy, rental growth was continuing at a moderating pace, with Sydney and Melbourne recording the strongest prime rental growth of 3.2% and 3.1% respectively over Q3.

“With available supply set to remain tight for the foreseeable future, rental growth is expected to continue, albeit at a slower pace, with growth expected to revert to an annual pace in the range of around four to six per cent over the next 12 months,” he said.

“Underlying investor appetite for industrial assets has remained steady over Q3 with sustained tenant demand and rental growth adding to the sector’s appeal, and we expect these factors will continue to drive investor appetite in the sector.”

Related Reading:

Growth in Adelaide’s industrial market underpinned by an ongoing demand-supply gap - Knight Frank