Colliers launches 2024 Global Investor Outlook - As industrial sectors continuing to lead the charge

Contact

Colliers launches 2024 Global Investor Outlook - As industrial sectors continuing to lead the charge

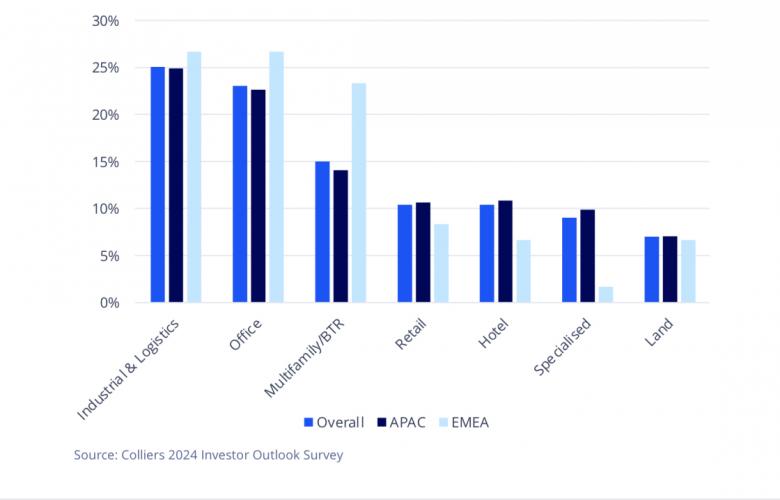

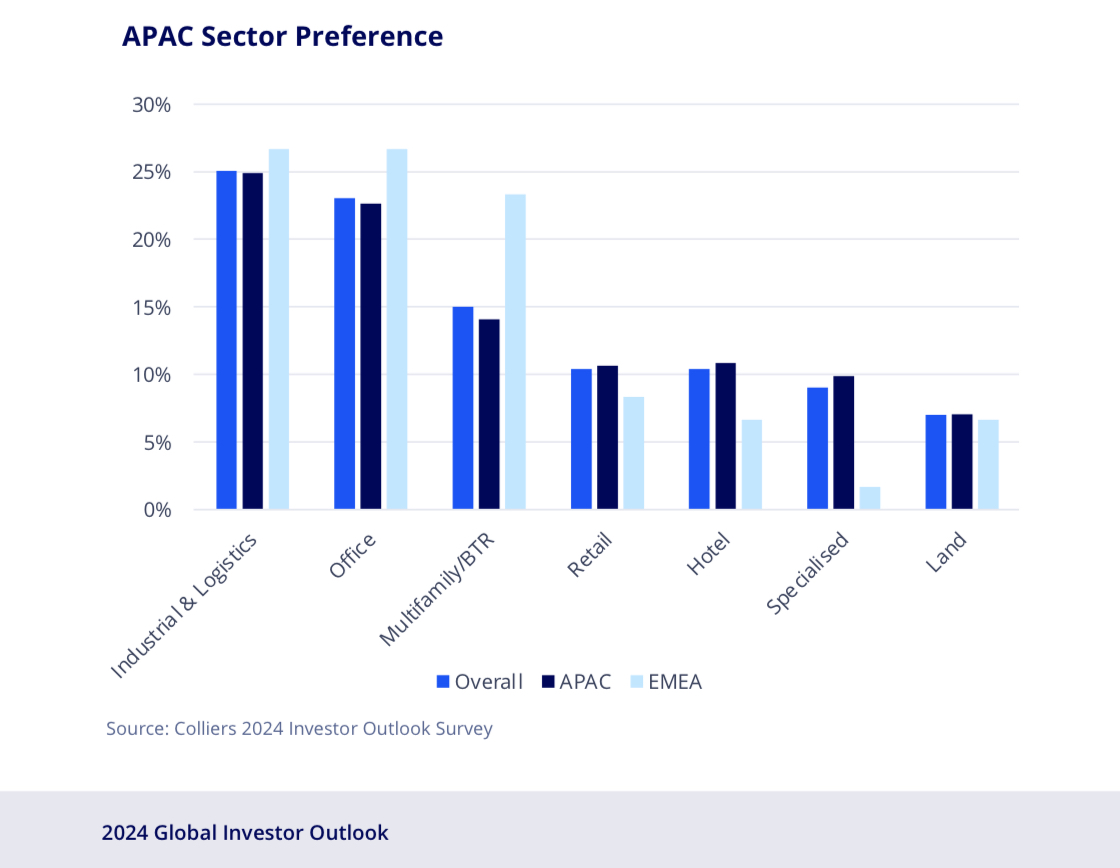

On a sector basis, industrial and logistics (I&L) has overtaken office as the asset class of choice for investors in the region, with 25% of investors naming I&L their preferred sector vs. 23% for office, followed by multifamily/BTR (14%), retail (11%) and hotels (11%) says Colliers 2024 Global Investor Outlook.

Rising investment activity expected across APAC in 2024 - Investment activity is forecast to increase steadily across the Asia Pacific region in 2024 , according to Colliers’ (NASDAQ and TSX: CIGI) 2024 definitely looks more positive than 2023, with a lot of pent-up equity which is looking to find a home,” commented Chris Pilgrim, Colliers Managing Director of Global Capital Markets, Asia Pacific.

“We expect APAC’s commercial property market will continue to uphold its strong position on the global stage over 2024 and contribute to a growing share of global investment activity.”

On a sector basis, industrial and logistics (I&L) has overtaken office as the asset class of choice for investors in the region, with 25% of investors naming I&L their preferred sector vs. 23% for office, followed by multifamily/BTR (14%), retail (11%) and hotels (11%).

Digging into I&L sub-sectors, big-box/warehouse assets are the main target, cited by 26% of investors, followed closely by last-mile distribution (25%) and industrial park/manufacturing facilities (16%), in line with what Colliers experts see as a trend of investors in the space pushing into new segments.

“Investors are expanding their diversification efforts within the I&L sector, moving beyond the broad big-box approach to explore opportunities in last-mile logistics or cold/dark storage. Investment in Data Centres as a specialised asset class lost some ground to living sectors but the region's strong economic growth, favourable government policies, and improving infrastructure are all expected to support continued investment in Data Centres.” Said, Michael Bowens Head of Industrial, Asia.

The continued growth of e-commerce and the surge of interest in AI-led platforms mean that demand for data centre space continues unabated across APAC. China has the most tradeable assets, accounting for 37% of historical data centre transaction activity, followed by Japan (16%) and Australia (16%)5. Due to the lack of modern data centres, we expect more global operators to enter the market through development and hold strategies.” Commented, Gavin Bishop Managing Director, Industrial, Australia.

Other key highlights from the survey include:

• Both established and emerging markets to be favoured by investors

• Rising awareness of ESG driving value: 28% of APAC respondents reported fully assessing the ESG performance of their assets, versus just over 20% last year, and 20% said ESG factors were now dictating CapEx decisions, up from the 15% who said they had an ESG-based disposal and acquisition-based strategy in place last year.

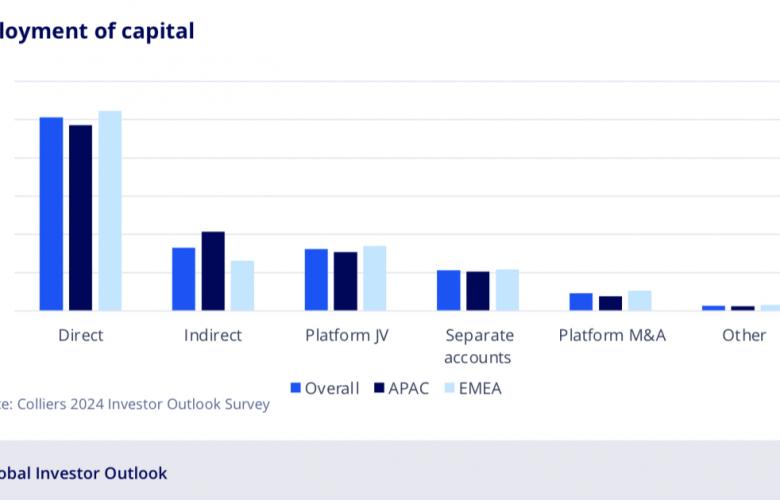

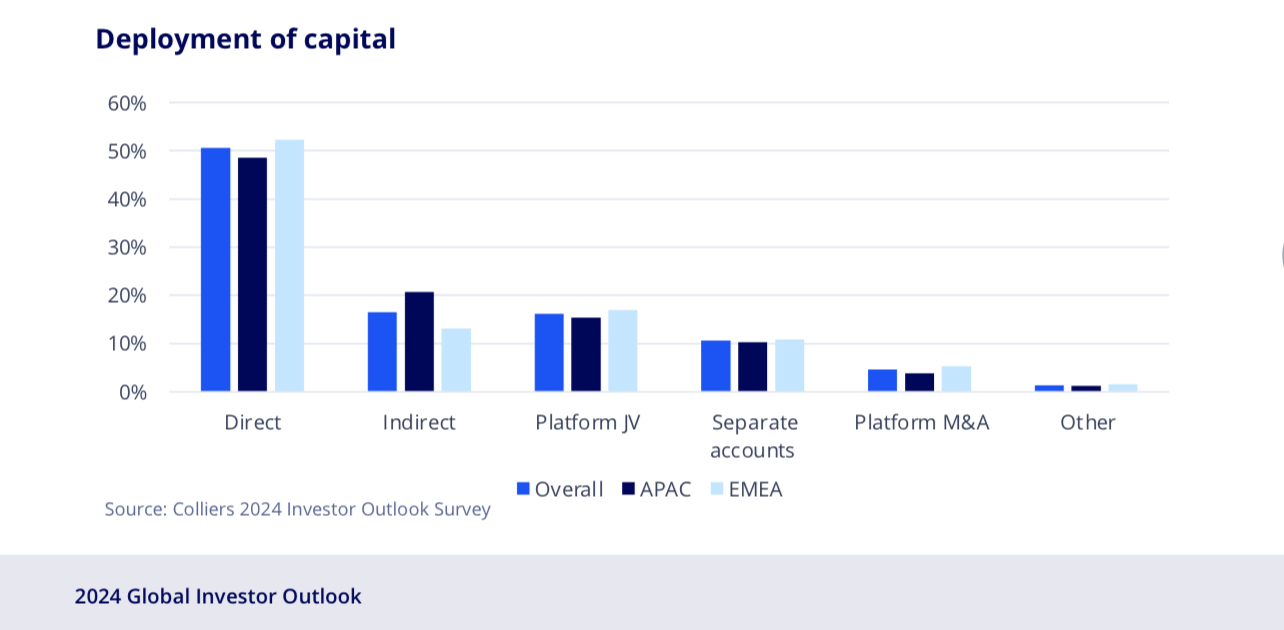

• New alliances and shifting strategies: Around half of APAC investors no longer necessarily deploy capital into real estate in the traditional way, with 21% favouring an indirect approach, 15% exploring platform joint ventures and 10% maintaining separate accounts.

With most big institutions or funds in the region having increased allocations to real estate, just the sheer quantum of capital they have to deploy means we're likely to see more indirect strategies. In sectors like build-to-rent, the thematic of partnership with best-in-class developers and managers is very much in place. Certainly, a partnership can provide the ability to access a market or product without necessarily the full responsibility of the operational side of it as well.” Said, John Howald Executive Director & Head of International Capital, Asia Pacific.

Read and download the 2024 Global Investor Outlook Report.

Related Reading:

Colliers launches 2024 Global Investor Outlook - Retalk Asia

Industrial & logistics driving real estate investment across Asia Pacific - Colliers

Read and download the 2024 Global Investor Outlook Report.