2024 Commercial property frontrunner: Industrial’s performance anchored by structural shifts - Colliers

Contact

2024 Commercial property frontrunner: Industrial’s performance anchored by structural shifts - Colliers

Economic market conditions unable to unseat Industrial’s golden child status, with prime weighted average rents expected to increase by 8.5% nationally, over 2024, according to Colliers Industrial & Logistics Investment Review 2024.

Economic market conditions unable to unseat Industrial’s golden child status, with prime weighted average rents expected to increase by 8.5% nationally, over 2024, according to Colliers Industrial & Logistics Investment Review 2024.

Despite slight moderation over 2023, the strength of the Industrial occupier market has proven to be a robust arsenal against interest rate fluctuations, with 21.5% prime weighted net face rental growth at the end of 2023, which is around six times the 10 year annual average of 3.6%.

While severe lack of supply significantly underpinned return to more sustainable growth levels, falling from 4.85 million square metres in 2022 to 3.2 million in 2023, key performance metrics such as vacancy and rents will continue to outperform historical averages at a national level, according to Colliers Head of Industrial & Logistics Capital Markets, Gavin Bishop.

“With an average national vacancy rate of one percent, and 80% of last year’s record annual national supply (3.3 million sqm) already committed, the supply and demand imbalance driving Industrial income growth is a permanent structural shift for the foreseeable future.” Mr Bishop said.

“Rents will continue to preserve capital values and significantly offset yields, following national weighted average prime yield softening of 70 basis points over 2023, compared to 80 basis points over 2022.

“Despite a slight uptick in national average vacancy levels last year by 0.1%, prime weighted net face rents still grew over 2023 by 21.5%, and the expansionary yield cycle off the back of rising fund costs is coming to fruition with more stable economic conditions anticipated mid 2024.

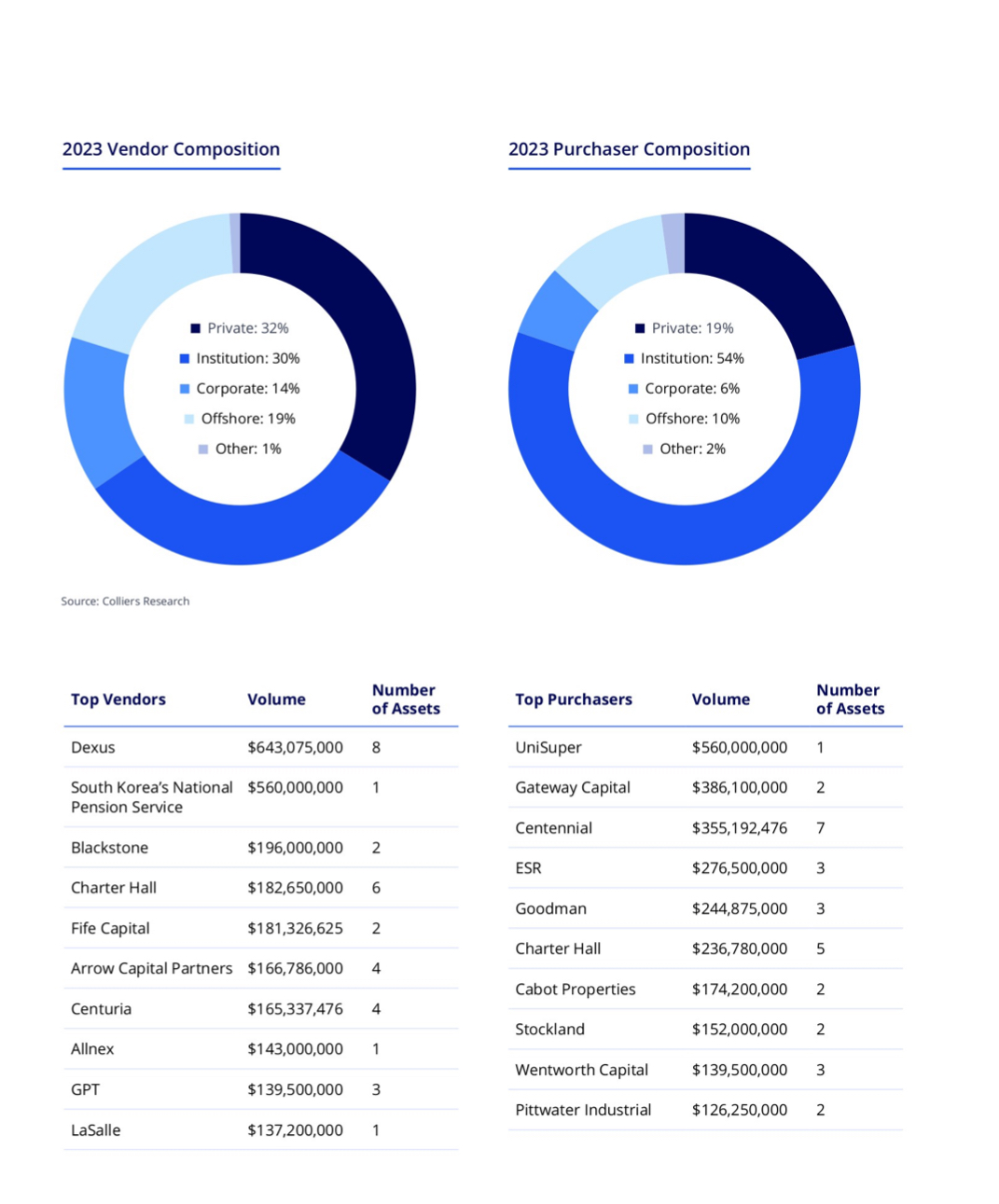

“Lucrative returns associated with industrial assets is attracting domestic superannuation funds, with Unisuper and Aware Super being active over 2023, and REST Super and Australian Super gearing up to deploy capital over the next 12 months.

“Private investors are also sharpening their focus on the sector, accounting for 19% of overall industrial investment activity, compared to 15% in 2022.”

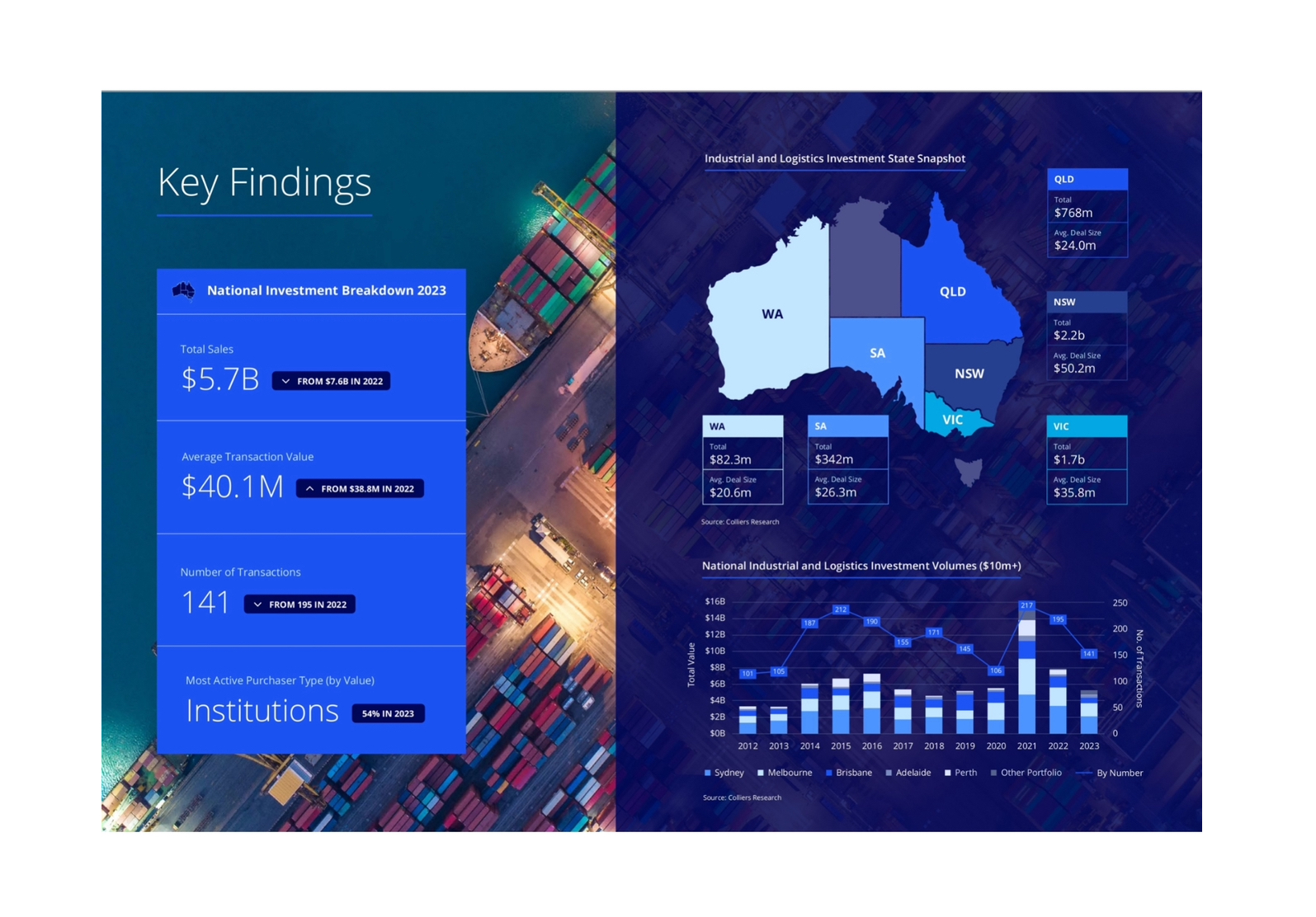

Overall industrial transaction volumes for 2023 were aligned with the 10 year historical average, notwithstanding a fall of 25% from the year prior to $5.7 billion, according to Colliers National Director of Research, Joanne Henderson.

“Following two record years of industrial investment activity, last year’s market was subdued but strong, holding the long-term transaction volume average in the face of economic fluctuations.”Ms Henderson said.

“Sydney remained the most sought-after market in the country, accounting for 39% of overall transaction volumes in 2023.

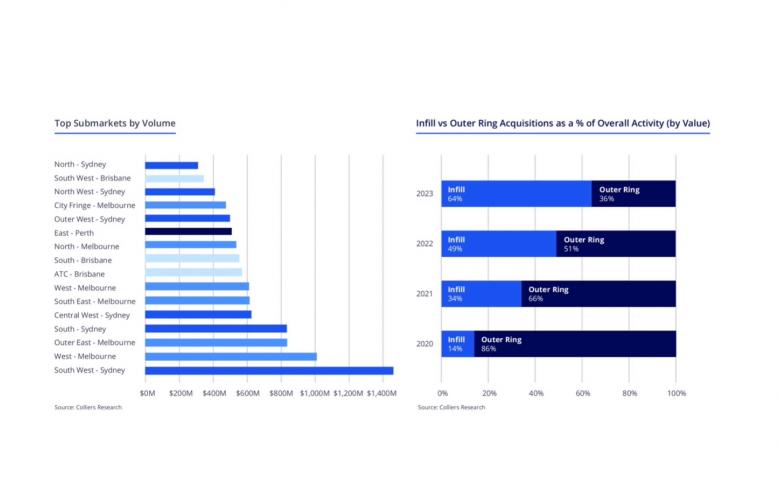

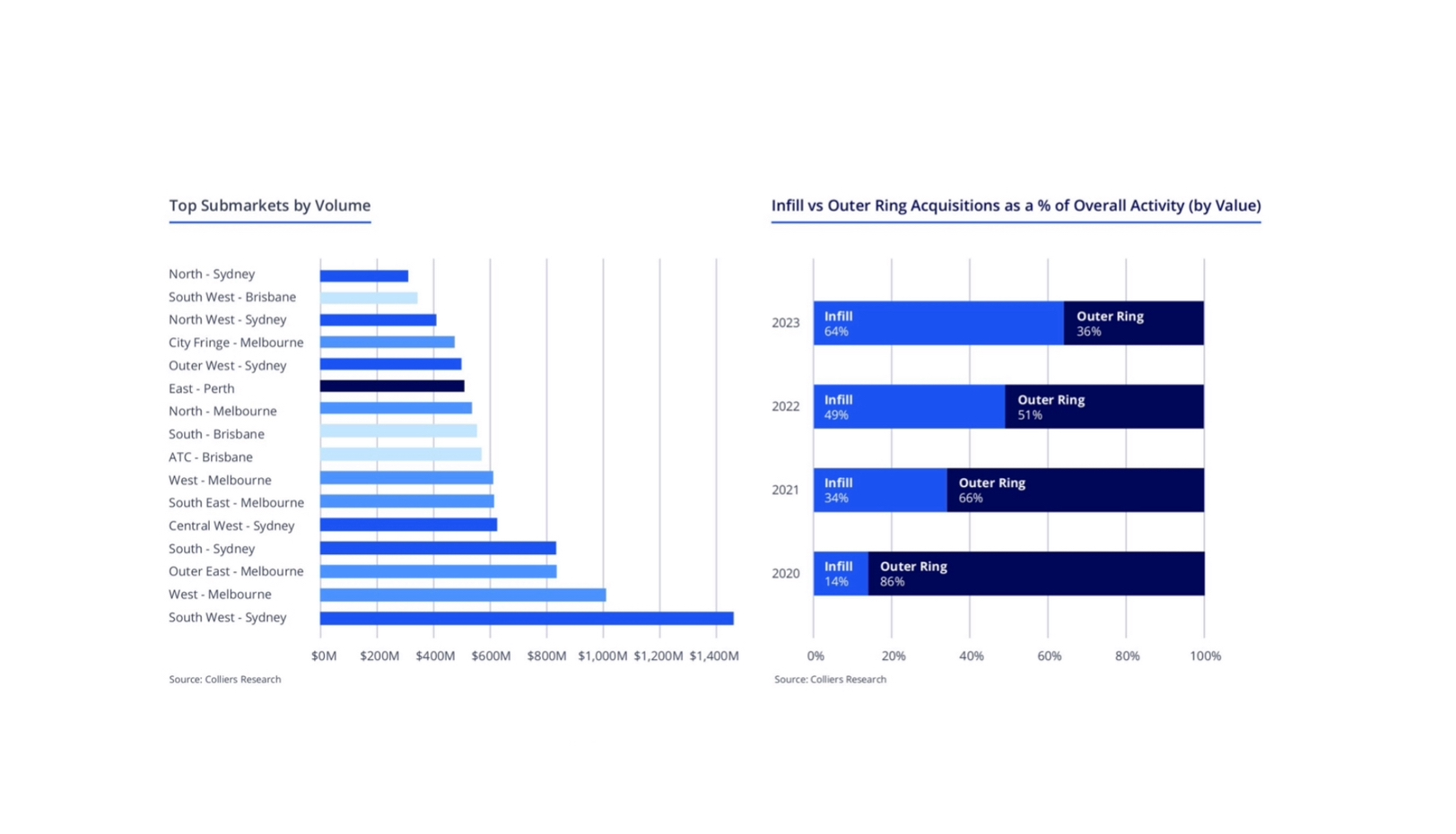

“Investment in infill locations such as South Sydney, Inner West and Inner South West jumped from 49% to 64% over the last year driven by institutional investors acquiring assets of scale which has historially been tightly held, addressing consumer preferences for shorter delivery times and mitigating transport costs for the last mile, which can comprise up to half of the overall supply chain cost.

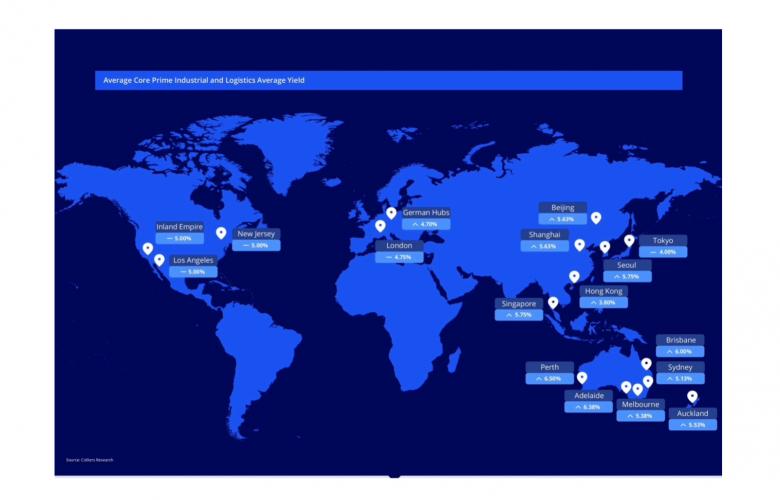

“Adelaide and Perth, with prime yields averaging 6.38% and 6.50%respectively, will continue to be targeted, particularly by syndicators and mid-tier funds. In contrast, prime industrial yields now average 5.57% nationally, with Sydney averaging 5.13% and Melbourne averaging 5.38%.

“Investors also continue to focus on short WALE assets to capture the uplift in rents and offset yields, ensuring the average WALE in 2023 remained low at 4.0 years.”

However, long-WALE assets will become more attractive through 2024 as core capital becomes active again.

“Increased weighting of capital towards the Industrial sector is ensuring its evolution, fuelling greater diversification and scale of assets.” Mr Bishop added.

Colliers’ sale of the institutional A Grade two-level warehouse, at 42 Raymond Avenue in Sydney’s Matraville, for $137.2 million and a core capitalisation rate of 4.60%, is testament to the booming multi-storey industrial segment. The sale will be settled upon completion in May 2024.

The data centre market has also begun to mature in Australia, with the portfolios of several domestic and offshore REIT’s now boasting this coveted asset class amid continued work from home patterns and heightened Artificial Intelligence demand. Brisbane currently possesses 22 data centres, while Sydney and Melbourne have 36 and 32, respectively.

“From an investment standpoint, it is imperative to be cognisant of ESG considerations in addition to growing industrial asset segments, since non-compliance will carry potential risk for owners, including diminishing asset values or a brown discount in future.” Mr Bishop said.

Related Reading:

Colliers launches 2024 Global Investor Outlook - Retalk Asia

Industrial & logistics driving real estate investment across Asia Pacific - Colliers

Read and download the 2024 Global Investor Outlook Report.