New industrial development to be driven by demand for efficiency - Knight Frank

Contact

New industrial development to be driven by demand for efficiency - Knight Frank

Demand for new industrial development will continue to be strong in Australia driven by the ongoing drive for efficiency, according to Knight Frank’s recently released outlook report Australian Horizon 2024.

Demand for new industrial development will continue to be strong in Australia driven by the ongoing drive for efficiency, according to Knight Frank’s recently released outlook report Australian Horizon 2024.

Energy efficiency is firmly in the spotlight

The pursuit of energy efficiency is being heightened by the new mandatory sustainability reporting requirements being rolled out in Australia in phased tiers from July 2024.

It means there will be compulsory reporting with a requirement for hard data on the level of a business’s greenhouse gas emissions. This will force businesses to look at where they can cut emissions as they also work towards their own corporate net zero targets.

The evolving reporting requirements surrounding ESG is exposing the shortcomings of older-style facilities, which are less able to demonstrate environmental credentials.

Reducing embodied carbon through green steel and green concrete slabs are part of the answer, but the ever-increasing focus on operational emissions require other measures such as solar power, cross ventilation, LED lighting, flood mitigation and retention and bio-diversity. Greater staff amenity in outdoor spaces, socialisation zones and other facilities such as gyms are also increasingly sought by tenants.

Economic environment puts the spotlight on cost control and operational efficiency

Property is one of the major levers to impact both environmental and organisational efficiency, either through retrofitting or relocation into newly-built facilities.

The Australian Horizon 2024 report highlighted that for many industrial tenants, advances in technology surrounding warehousing, distribution and stock tracking also offer new opportunities to drive operational efficiencies.

These technological advances also make many existing premises functionally obsolete. For instance, robotic systems may favour deeper warehouse spaces with higher eaves, greater racking density and different fire suppression demands. Super-awnings, also fully sprinklered, are increasingly favoured to allow all-weather loading without internal docks reducing warehouse floorspace.

As industrial occupiers increasingly seek sustainable, energy-efficient and operationally efficient buildings, industrial developers and investors are capitalising on this trend. This will continue to support the demand and pipeline of new industrial construction, even as the overall tenant demand moderates from the recent highs.

The UK experience

ESG is now recognised as fundamental to property strategy by landlords and occupiers all around Australia, across all asset types, with industrial real estate central to this.

In the UK the ESG journey is more advanced than Australia. Even so, the logistics sector there remains in the early stages of making meaningful changes to address environmental practices, according to Knight Frank’s recently released report from the UK entitled Is the Logistics sector delivering on ESG?

Similar to Australia, UK occupiers are increasingly seeking high-quality, modern facilities to help them achieve their ESG goals, reduce running costs, and enhance operational efficiencies through automation and technology.

This rise in demand is driving the need for new, sustainable, and well-specified warehouses, creating a significant opportunity for development within the sector.

The Knight Frank UK report highlights the balance in capital expenditure where existing warehouses are being retrofitted to enhance energy efficiency, while new developments prioritise sustainability and automation.

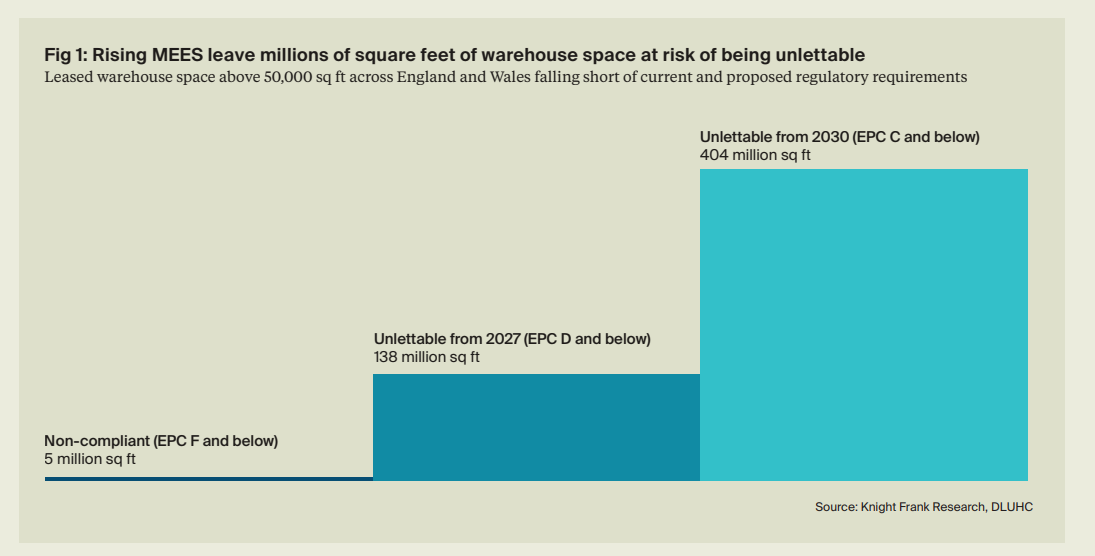

In the UK warehouses now face strict energy efficiency standards. To help achieve the UK government’s goal of net zero carbon by 2050, Minimum Energy Efficiency Standards (MEES) have been introduced for commercial buildings in England and Wales. These standards set a minimum level of energy efficiency that must be met before a property can be let. The minimum required rating of E in 2023 will be increased to Grade B by 2030.

Warehouse landlords must upgrade their properties to meet these new standards or risk being unable to lease their properties, unless eligible for an exemption, further accelerating functional obsolescence in industrial stock.

As global tenants’ expectations and regulatory requirements become increasingly stringent, many properties will no longer meet the standards expected by either occupiers or institutional investors. Capital allocation into the sector will continue to facilitate this improvement to industrial built form, supporting retrofitting where applicable, but also ensuring a healthy development pipeline.

Click here to read the Australian Horizon Report 2024

Related Reading: