Industrial vacancy increases across Australia’s East Coast as market normalises, Knight Frank research

Contact

Industrial vacancy increases across Australia’s East Coast as market normalises, Knight Frank research

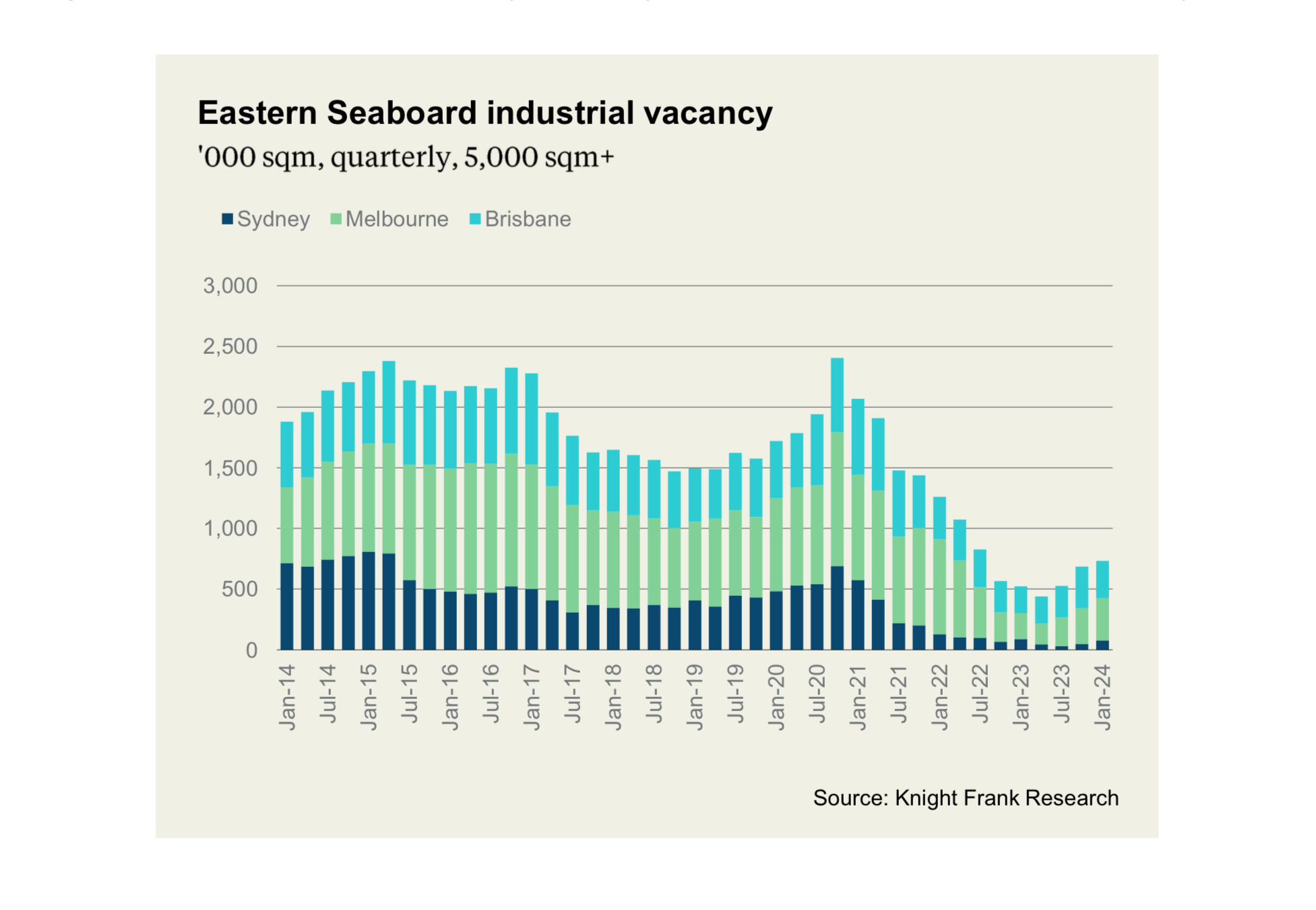

Knight Frank’s Australian Industrial Review Q4 2023 found available industrial space increased by 7% in Q4 across the eastern seaboard, however vacancy remains 42% below the level two years ago and 70% below the 2020 peak.

Industrial availability across all the East Coast capital cities has increased, coinciding with a slowdown in quarterly rental growth, according to the latest research from Knight Frank.

Knight Frank’s Australian Industrial Review Q4 2023 found available industrial space increased by 7% in Q4 across the eastern seaboard, however vacancy remains 42% below the level two years ago and 70% below the 2020 peak.

Sydney remains the tightest market with only 76,175sqm available, up from 48,716sqm in Q3 but still functionally at gridlock. Melbourne vacancy lifted by 18% in Q4 while Brisbane fell by 10%.

Eastern Seaboard industrial vacancy Sydney Melbourne Brisbane. Source: Knight Frank Research

This lift in overall vacancy is being driven by greater secondary vacancy which was up 30% in the quarter.

Prime vacancy decreased by 5% in Q4, as an increase in existing prime space was balanced by falls in speculative availability. Speculative space is 29% of total vacancy, still well above average (20%) but the lowest proportion for 2.5 years.

Knight Frank National Head of Industrial Logistics James Templeton said the severe undersupply of 2023 was easing, with industrial construction across the East Coast rising by 26% last year to 2.6 million square metres.

“This level of construction is beginning to ease undersupply in the market, and we are now seeing a return towards more normal vacancy levels and rental growth amid ongoing robust tenant demand,” he said.

“Annual take-up across the East Coast was 2.8 million square metres, only 5% below 2022, as tenant activity has somewhat defied softening sentiment on rental affordability.

“Sydney was the only city to breach 1 million square metres leased, with Melbourne only slightly behind.

“With more than a million square metres of pre-committed space expected to be delivered in 2024, the supply for 2024 may well be on par with last year.

“The drive for efficiency and to meet ESG standards will continue to support above-trend demand for new space.”

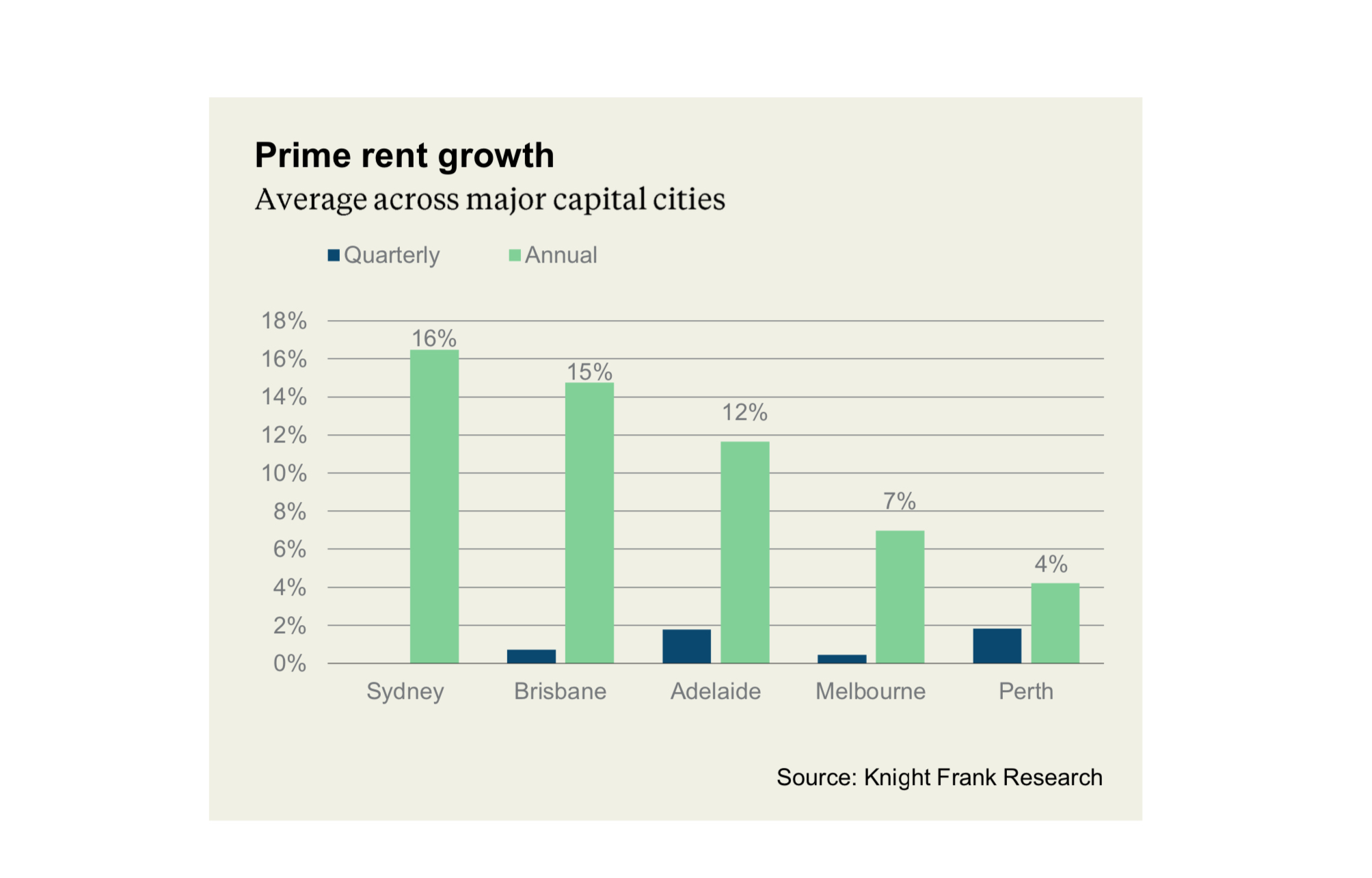

Knight Frank Partner, Research and Consulting, Jennelle Wilson said rental growth would be slower in the first half of 2024.

“After exceptionally high rental growth of 25 to 50% over the past two years the market has entered a stabilisation phase for rents.

“Quarterly prime growth was sub-2% across all capital city markets in Q4 as the expected pause in rental growth eventuated.

“Annual growth remains led by Sydney at 16% year-on-year, ahead of Brisbane with 15% year-on-year and Melbourne at 8.8%. The remaining cities range from 4% - 12% annual growth.”

The highest quarterly growth for Q4 2023 was recorded in the Perth (1.8%) and Adelaide (1.7%) markets.

Incentives have remained mostly stable, with increases across selected Sydney and Melbourne precincts.

“Rental growth is expected to remain subdued through H1 2024, before prime rents are again drawn upwards by economic rents required to trigger additional development in the second half of the year.”

Investors poised to return to acquisition mode in 2024 Industrial investment volumes nationally fell by 26% in 2023, as property markets paused to digest the impact of higher funding costs and an uncertain economic outlook, according to Knight Frank’s Australian Industrial Review Q4 2023.

However, the decline in the industrial market was significantly less that the decline experienced in other sectors, including offices (-65%) and retail (-48%), reflecting that valuations have not been impacted to the same degree, plus greater confidence in the outlook.

Sydney was the most actively traded market among the major cities, with turnover in 2023 being $4.6 billion, followed by Melbourne at $2.4 billion and Brisbane at $973 million.

“Green shoots are emerging in the investment market due to greater financial market stability,” said Mr Templeton.

“Many investors are viewing current conditions as providing an opportunity to bid for Sydney assets with less competition than normal; given that many institutional investors have not been acquisitive.

“Reflecting this, private investors – typically HNWIs and syndicates – were the most active buyer type in 2023, accounting for 46% of total volume, compared to a historic average of 30%, with cross-border and listed investors taking a commensurately smaller share.”

Ms Wilson added: With yields having substantially reset and the macro picture more encouraging, deal flow is likely to pick up as more investors return to acquisition mode.”