Australia’s Industrial Sector Records Strongest Ever Quarter - RCA

Contact

Australia’s Industrial Sector Records Strongest Ever Quarter - RCA

Australia’s commercial property sales moved up a gear in the second quarter, with the industrial sector posting the strongest ever quarterly deal flow, the latest Australia Capital Trends report from Real Capital Analytics (RCA) shows.

Australia’s commercial property sales moved up a gear in the second quarter, with the industrial sector posting the strongest ever quarterly deal flow, the latest Australia Capital Trends report from Real Capital Analytics (RCA) shows. Investors are slowly returning to the market, led by domestic and APAC institutions, encouraged by a more positive outlook for the economy.

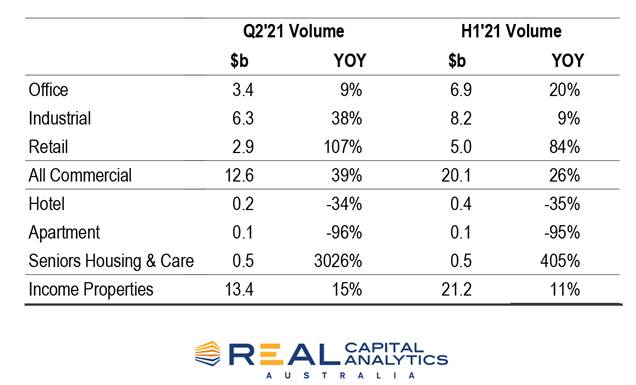

Commercial property sales worth $13.4 billion were closed over the second quarter, up 15% on the same period last year. For the first six months of 2021, volumes reached $21.2 billion, up 11% compared to the same period in 2020.

Domestic investors spent $9.9 billion in the second quarter, a 60% increase compared to the same quarter last year. In the first half of the year, domestic players invested more than $14 billion evenly across the three main commercial sectors — office, retail and industrial. This underlines a broad-based return in confidence for Australia’s commercial property market.

By comparison, offshore investors stuck predominantly to industrial and offices and virtually avoided retail, acquiring just $400 million of retail assets in H1 2021 and closing $3.5 billion worth of deals in Q2 2021, a 35% fall from Q2 2020 when offshore investors’ quarterly sales reached a six-year high. APAC investors represented around 90% of all cross-border investment in the quarter, while U.S. and EMEA investors had a quieter quarter.

Join RCA for an in-depth view of commercial real estate investment activity across Australia for the second quarter of 2021 on Wednesday, 4 August at 11am Sydney time. Journalists can register to join the webinar here.

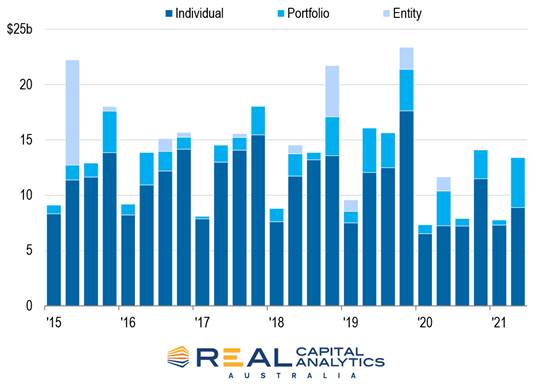

Chart 1: Quarterly Transaction Volume by Deal Type

Chart 2: Acquisitions in Australia by Property Type

Industrial Sector Outperforms Office and Retail Sector Combined

Australia’s industrial sector posted its strongest ever quarter, with $6.3 billion of closed deals, narrowly outstripping the office and retail sectors combined. Over 550 industrial assets were traded in the quarter, and Blackstone’s “mega” sale of the Milestone Industrial Portfolio to GIC and ESR for $3.8 billion - which is the largest ever portfolio transaction in Australia - pushed the quarter to a record high and accounted for 60% of the second quarter’s volume.

Benjamin Martin-Henry, RCA’s Head of Analytics, Pacific, said: “Quarterly sales of industrial stock outpaced offices and retail properties combined for only the second time since the start of 2020, having never achieved this feat in the previous two decades. This record was despite a relatively quiet first quarter for the industrial market. With a hefty deal pipeline of around $2 billion of industrial deals awaiting settlement, 2021 is highly likely to be a record-breaking year for the sector.”

Retail Sector Comes To Life In The First Half Of 2021

There are tentative signs of a recovery emerging in the retail sector, spearheaded by domestic investors. Retail transaction volumes were $2.9 billion in the second quarter, up more than double the comparable sales year-over-year. Sales included assets in the sub-regional sectors that have been firmly out of favour for several years. Notable deals include Fortius purchasing Rundle Mall, which includes the A-grade office 80 Grenfell, in Adelaide, for $410 million. Savills IM and Elanor Investors also acquired a shopping centre in Toowoomba, Queensland, from Blackstone for $145 million.

Volumes for the first half reached $5.0 billion, surpassing the equivalent pre-pandemic six months in 2019 and almost equal to annual transactions in 2020.

Benjamin Martin-Henry, RCA’s Head of Analytics, Pacific, said: “After several years of muted investments, local investors seem to be coming back to the sector with Australian investors accounting for over 90% of the $5 billion deployed in the sector in the first half of the year. Conversely, over the last 18 months, offshore investors have sold more than they have purchased, resulting in a net negative position of $1.8 billion.

Increased transaction volume for higher quality retail assets has pulled up average pricing, which may also have encouraged current owners to sell. With the market appearing to stabilise somewhat, owners seem to be more willing to part with well-performing centres because they will not necessarily have to accept bargain-basement prices.”

Uncertainty over the future of the office contribute to lackluster performance for the sector

Sales in the office sector were muted in the second quarter. Volumes reached $3.4 billion, a 9% year-on-year increase, but a 40% decline compared to the pre-pandemic five-year average of $5.7 billion. The largest office deal in the quarter was a portfolio transaction in Sydney: EG Funds purchased 32 Walker Street in North Sydney and a 50% stake in both 50 & 60 Carrington Street for $450 million. Sydney offices deals reached $3.5 billion in the first half, 44% higher than the same period last year.

Other notable office transactions included 10 Eagle Street in Brisbane, sold by CPP Investment Board and Dexus to Marquette Properties for $285 million, and Dexus’s purchase of two buildings at Monash University in Melbourne for $140 million. However, office transactions in Melbourne were just $1.2 billion for the first half of the year, down 23% year-on-year as the city has been hampered by repeated lockdown restrictions since the pandemic began.

Elsewhere, Perth saw a bounce back in office sales. This included GIC picking up a 25% stake in the Chevron HQ, while BlackRock is awaiting settlement on 140 St Georges Terrace from AMP Capital for $260 million.

Benjamin Martin-Henry, RCA’s Head of Analytics, Pacific, said: “The relatively lacklustre performance of the office sector can be partially attributed to the uncertainty around the office’s role in workplaces of the future, and in a clear sign of the times, it was the CBD market dragging the office sector down this quarter, with volumes down 70% on the same period in 2019.

Conversely, suburban office volumes for the first half of this year are up over 90% compared to a year ago. Compounding this issue, Australia’s major office markets are going through a supply boom of late, with over 870,000 sqm of office stock under construction in the major CBDs.”