Colliers Q2 2022 Industrial Market Snapshots

Contact

Jul 12, 2022

Colliers Q2 2022 Industrial Market Snapshots

Gavin Bishop, Managing Director of Industrial, Colliers provides an insight into the performance of the Industrial markets over the second quarter of 2022.

Q2 2022 Key Observations

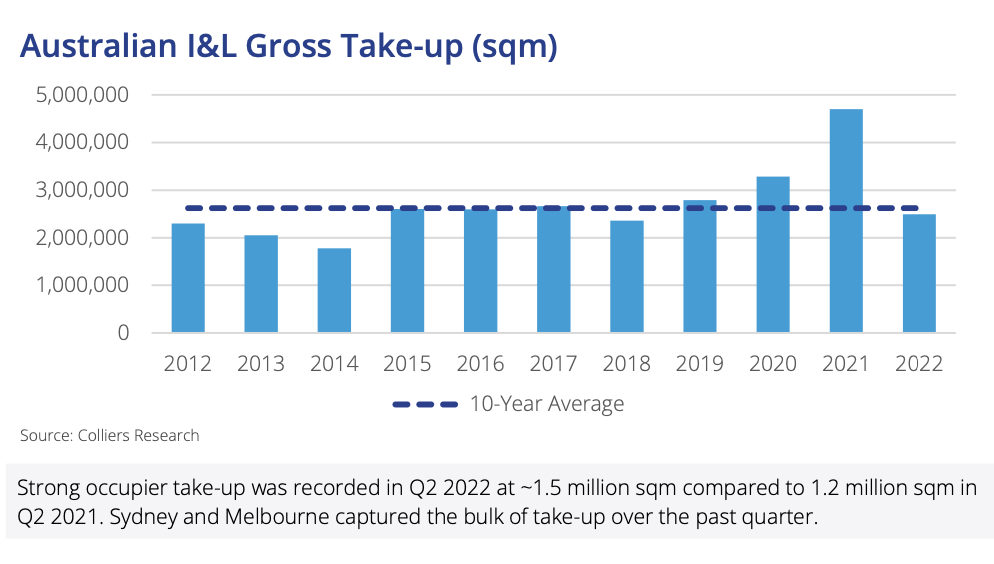

- Despite record low vacancies, industrial leasing demand reached record highs in Q2 2022 with almost 1.5 million sqm leased in the period (for deals >5,000 sqm). Pre-commitment/speculative deals underpinned this, representing almost 70% of deals by NLA in the quarter.

- Vacancy rates have fallen to new lows and currently average 1.0% nationally in Q2 2022, down from 2.3% in Q1 2022.

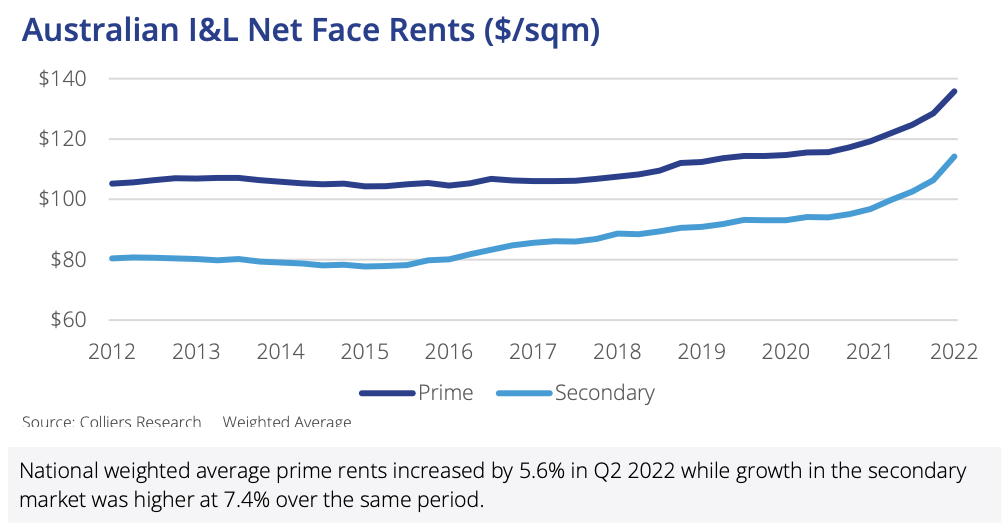

- The lack of leasing options has driven a further acceleration of rents across all markets. In Q2 2022, the national weighted average prime rent increased by 5.6%, representing a new record high while YoY growth of 13.8% has been recorded. Infill markets continue to outperform with selected precincts recording growth in excess of 16.0% with rental auctions occurring in some cases.

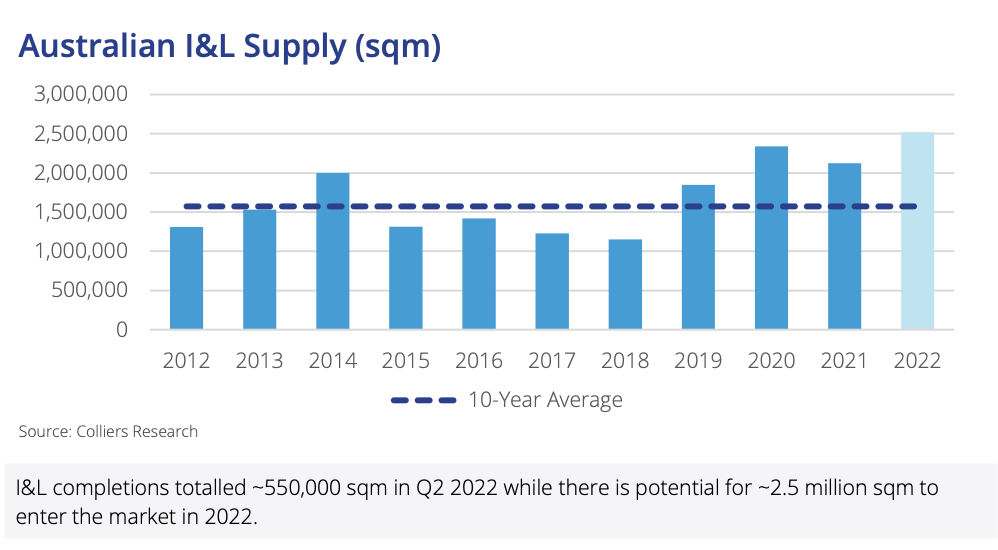

- The supply pipeline for 2022 remains strong at ~2.5 million sqm, however, this is below our Q1 2022 estimate as weather and material delays have pushed the completion of a select number of projects into 2023 with Brisbane being the most impacted.

- Given higher funding costs, prime yields have recorded modest levels of softening in Q2 2022 while asset values continued to grow given the significant growth in rents. The national weighted prime yield softened 16 basis points to 4.14% while selected markets recorded yield expansion closer to 25 basis points.

What is driving these trends?

- Continued port and shipping delays around the world have continued to force occupiers to hold more stock locally which has bolstered demand.

- A combination of a lack of leasing options and continued robust occupier demand has driven the uplift in rents.

- Over half of take-up in Q2 2022 stemmed from transport and logistics or retail trade sectors with e-commerce still having a large bearing on these occupiers. While e-commerce growth has fallen in many key markets around the world including the US and UK, it continues its upward trajectory in Australia and currently totals 15.1% of total retail spending.

What it means for the second half of 2022

- While macro headwinds have emerged including higher inflation, interest rates and funding costs, the fundamentals of warehouse demand remain strong and will continue to drive growth in take-up and rents.

- Vacancy rates are forecast to remain close to their current levels as new supply is largely pre-committed.

- The key downside risk is consumer sentiment which has fallen sharply in recent months. Cost of living pressures and higher mortgage repayments have the potential to tighten household purse strings which would mean less money will be spent on discretionary retail items. However, offsetting this is household saving rates which remain well above pre-COVID-19 levels and will provide a buffer to the reduced household purchasing power.

To view and download the full report click here.

Important Information:

Contact details:

Contact details:

Gavin Bishop

Managing Director, Industrial & Logistics & Head of Industrial Capital Markets | Australia.

+61 401 146 051

Email

10897

9411

Gavin Bishop