I&L National vacancy figure falls to record low of 0.6%, Sydney tightens further to 0.2% - CBRE Research’s H2 2022 report

Contact

I&L National vacancy figure falls to record low of 0.6%, Sydney tightens further to 0.2% - CBRE Research’s H2 2022 report

Year-on-year rent growth reaches 25.3% as the vacancy rate in Australia continues to fall and sits at a new record low, with the downward movement reflecting the chronic undersupply of stock, says, Sass J-Baleh CBRE Head of Industrial & Logistics Research Australia.

Industrial and logistics vacancy rates around Australia have reached a new record low at the end of 2022, with the dearth of supply propelling record rental growth.

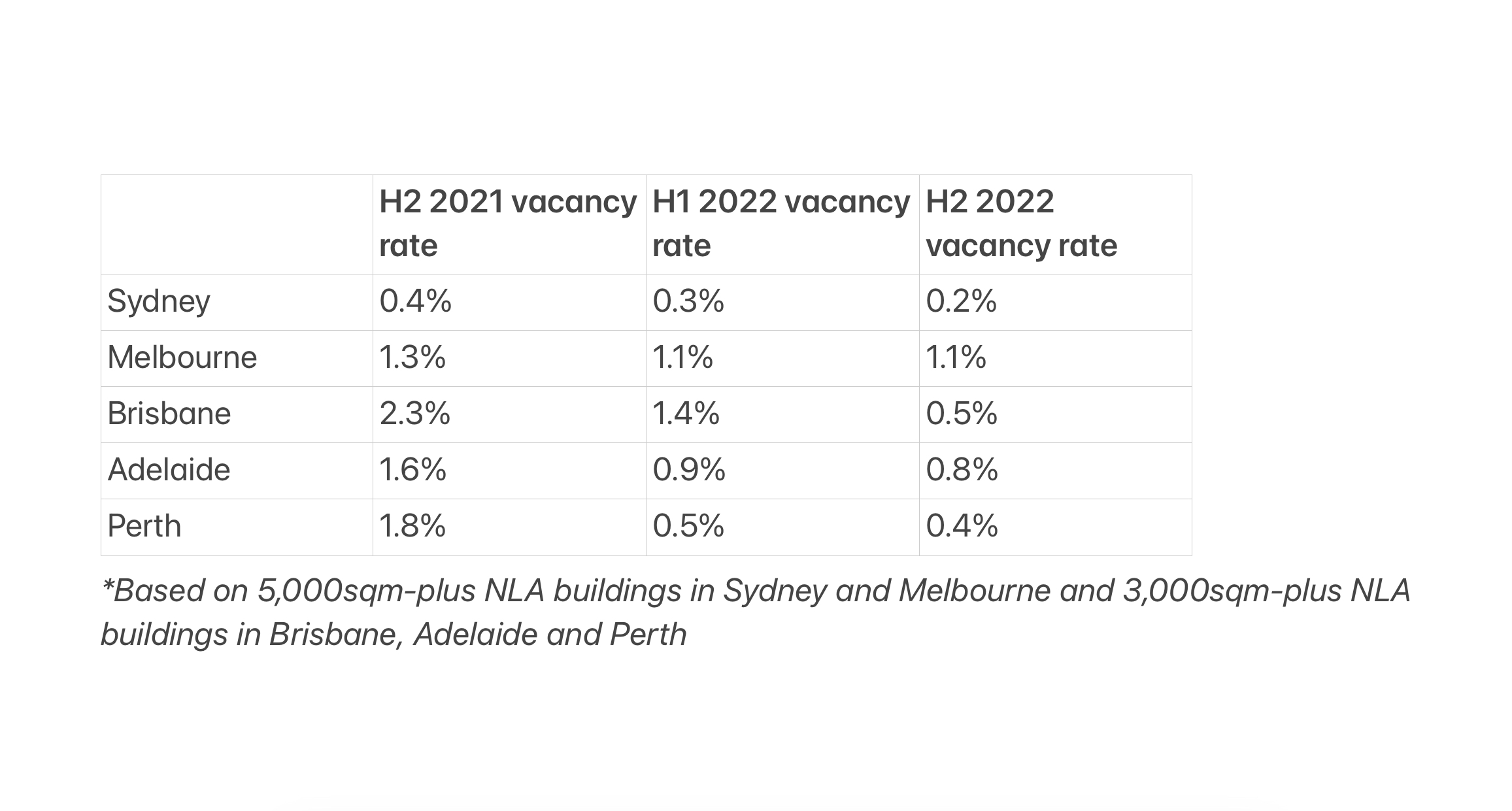

CBRE Research’s H2 2022 report documents that Australia’s vacancy rate across its five major markets tightened further from 0.8% to 0.6% through the second half of the year.

Having started 2022 at 1.3%, the H1 tightening of the market gave Australia the world’s lowest vacancy rate, a mantle it comfortably maintained ahead of the UK on 1.6% and Hong Kong on 2.3%.

The lack of opportunity for tenants, meanwhile, drove a 25.3% year-on-year rise in supply-weighted average super-prime grade face rents across Sydney, Melbourne, Brisbane, Adelaide and Perth.

“The vacancy rate in Australia continues to fall and sits at a new record low, with the downward movement reflecting the chronic undersupply of stock,” Sass J-Baleh, CBRE’s Head of Industrial & Logistics Research Australia, said.

“While vacancy rates in other countries remain low, we have begun to see a slight uptick in some offshore markets, mainly owing to a significant slowdown in the e-commerce penetration rate.

“We expect to see more of this globally over the next six-to-12 months amid the challenges of the global economic market, however the supply-demand dynamics in Australia are unique.

“The Australian market is shaped by pent-up demand, with an immature-but-growing e-commerce sector and a chronic undersupply of industrial space, which will keep vacancy rates at extremely low levels.”

Sydney maintained the lowest vacancy rate of any major city in the world at 0.2%, following a further tightening across H2, ahead of Perth on 0.4%.

Sydney maintained the lowest vacancy rate of any major city in the world at 0.2%, following a further tightening across H2, ahead of Perth on 0.4%.

Brisbane, meanwhile, started 2022 with the highest vacancy rate of Australia’s five key cities at 2.3% but was the big mover to finish H2 on 0.5%.

Net absorption across H2 2022 matched H1 at 1,400,000sqm nationally, led by 600,000sqm in Sydney and with pre-leases accounting for almost half of all transactions nationally by floorspace.

While the calendar-year figure of 2,800,000sqm is above the 10-year average of 2,600,000sqm, it is a significant reduction on the 4,200,000sqm documented in 2021.

Of the 2023 and 2024 supply pipeline of 4,600,000sqm, only 50% is speculative development, compared to 76% in the United States.

“We expect that even if demand weakens significantly in 2023, there is still not enough supply to satisfy space requirements from major occupiers that are setting up their activities and supply chains for the long-term servicing of the Australian population,” Ms J-Baleh added.

The super-prime grade rental growth is led by a 38.1% year-on-year increase in Sydney, hitting a supply-weighted average of $200/sqm, and 31.6% in Perth.

Only Brisbane fell short of a double-figure-percentage increase in 2022.

“Sydney and Perth were certainly challenging markets this year for occupiers with effectively 0% vacancy in most major sub-markets, and landlords reaping the benefits from huge rental growth as tenants fought it out to secure space,” said Cameron Grier, CBRE Regional Director, Industrial & Logistics, Pacific.

“Our view is that Melbourne and Brisbane are only six-to-12 months behind Sydney and Perth, and we all saw what happened in those markets in 2022.

“While we do expect economic headwinds in 2023, multiple identified tailwinds and our view that demand should continue to outstrip supply should set up our sector for another strong year of growth in 2023.”

Click here to view more articles on market trends, overviews and research reports.