Australia’s highest performing industrial market down to only 2.7 years’ developable land supply - Colliers

Contact

Australia’s highest performing industrial market down to only 2.7 years’ developable land supply - Colliers

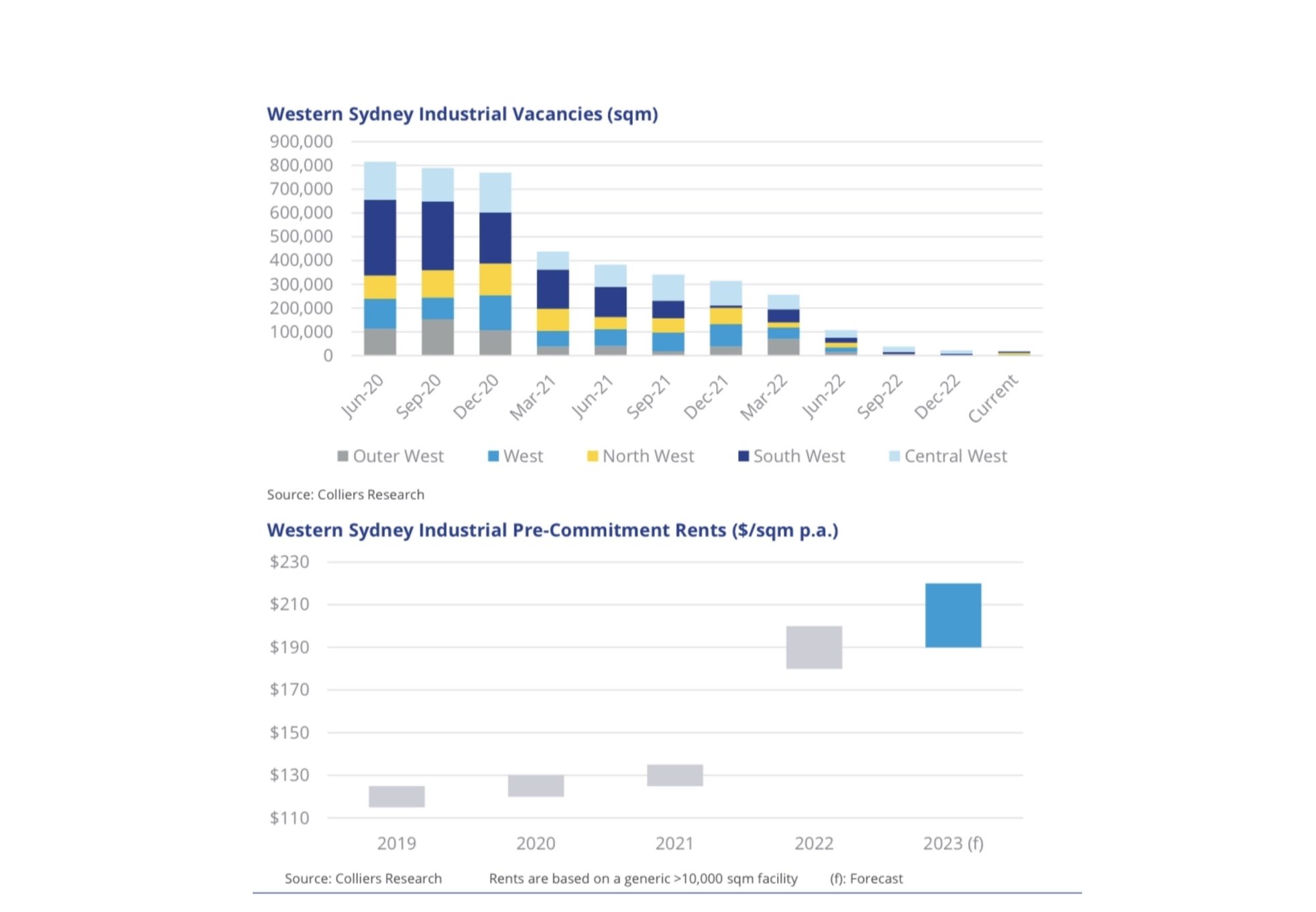

Western Sydney is experiencing an acute shortage of developable industrial land supply, at a time when record demand from occupiers has driven 0.2% vacancy, reveals Colliers’ research.

While Western Sydney has 1,615 hectares of zoned industrial land yet to be developed, only 70 hectares (4%) can support the completion of assets within the next 12 months, with around 2.7 years’ worth of total industrial land supply remaining for development, according to Colliers’ Western Sydney Industrial Development Update Q1 2023.

It is imperative that the potential of Western Sydney’s land is realised to address burgeoning demand, which saw land take-up by industrial occupiers reach 54% above the five-year average and establish a record at almost 290 hectares last year, according to Colliers’ Head of Industrial Capital Markets Gavin Bishop.

“Developers control 47% of the total 1,615 hectares of land available for industrial assets, with the balance dominated by private groups who have shown limited urgency to progress development in recent years.” Mr Bishop said.

“There are also only 70 hectares of land in Western Sydney that are serviced with foundation infrastructure such as roads, enabling the completion of industrial assets this year, but they primarily consist of lots below two hectares, which are not suitable for big box demand.”

The Mamre Road and Western Sydney Employment Area (WSEA) Precincts, which account for 60% of available land, have incurred planning, servicing, and road infrastructure delays for the past 18 months, and won’t be able to deliver an additional 414 hectares to the market until at least next year.

The Aerotropolis could provide an additional 2,920 hectares of gross area from 2025 onwards, which can be leveraged for industrial, in addition to several other uses, depending on the Precinct Plans and their implications for the Enterprise and Agribusiness Zones, according to Colliers’ Senior Executive of Industrial Jock Tyson.

“Since industrial users have shown a greater desire to accommodate newer, more modern premises, there has been a recent increase in activity from industrial occupiers acquiring Aerotropolis sites, including DHL who obtained 24 hectares for almost $600 per square metre in early 2022.” Mr Tyson said.

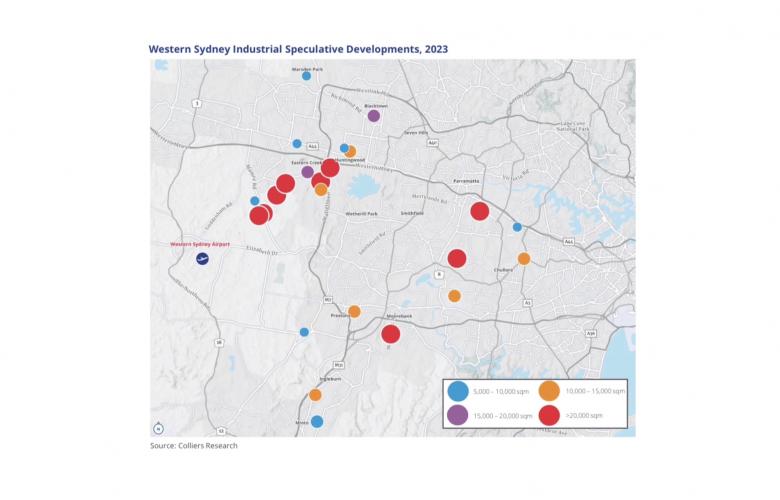

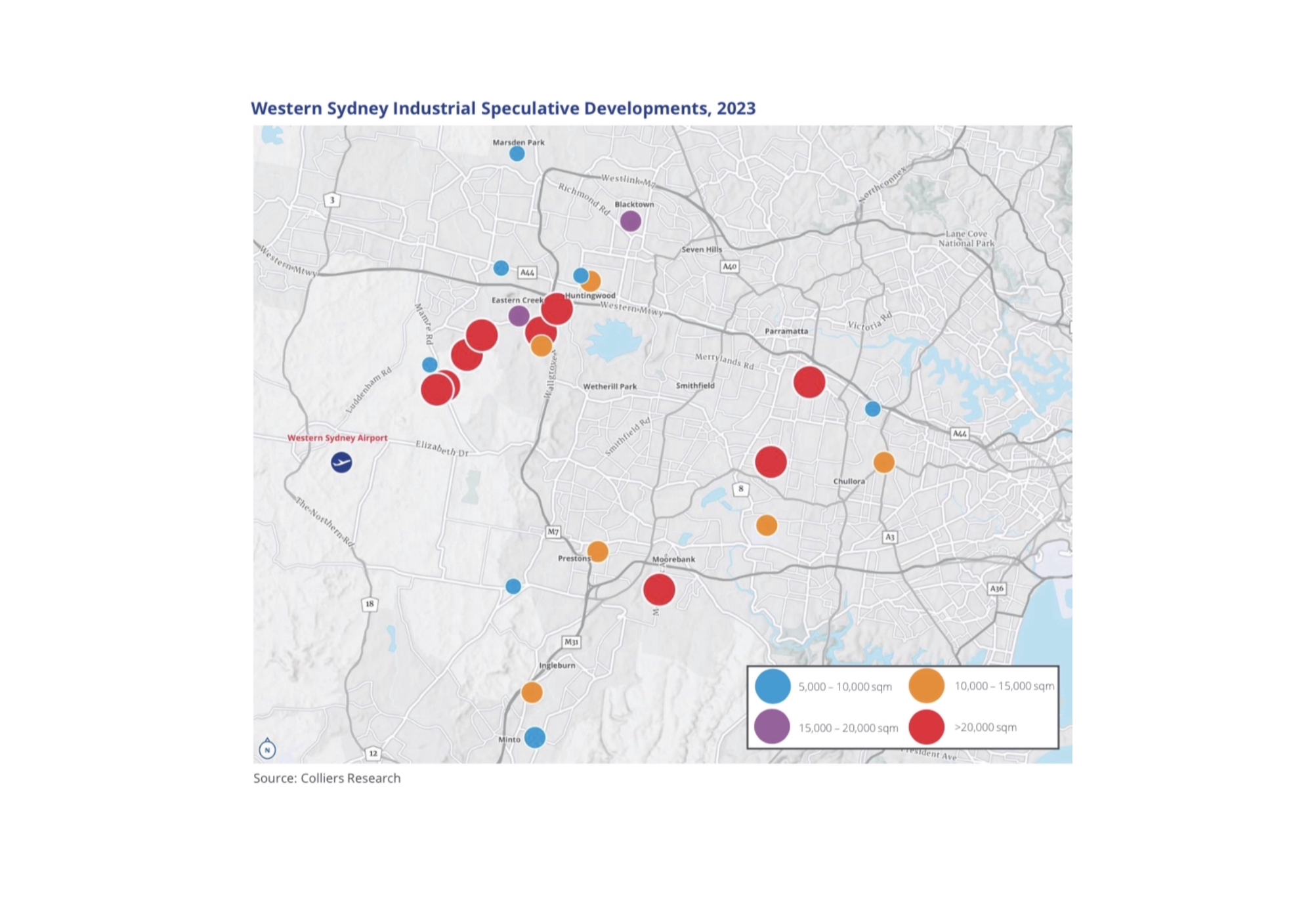

To answer demand for new assets, developers have fast tracked master plan staging to accommodate speculative development and capitalise on favourable leasing conditions, according to Colliers’ Director of Research Luke Crawford.

“While the speculative development pipeline for Western Sydney has increased from 270,000 square metres last year, to currently stand at just under 600,000 square metres for 2023, this is outweighed by current market demand for 1.6 million square metres in Western Sydney.” Mr Crawford said.

“The Outer-West and South-West submarkets will remain the most active for speculative supply this year, with the delivery of major facilities such as the Moorebank Intermodal Terminal (around 100,000 square metres), and the Light Horse Business Hub (around 43,300 square metres).

“We expect rental rates for new developments will grow by up to 10% in some instances, with pre-commitment rents ranging in the order of $190 to $220 per square metre by end of the year.”

The level of rental growth across Western Sydney has been unprecedented, with prime rents jumping by around 40% across the market, while selected precincts recorded growth exceeding this.

Over the past 12 months, demand driving rent rises is largely attributed to the retail sector, which accounted for 40% of land take-up in Western Sydney last year, including deals with Winning Appliances, Bunnings and Woolworths.

Rising rents and limited supply underpinned 2022 investment volumes for land in Western Sydney, which reached just over $1.2 billion – a slight drop from $1.5 billion in 2021, due to investor cautiousness regarding market fluctuations and capital constraints.

Although, demand for land acquisitions was broadly spread across Western Sydney, the Outer-West remained the most active market, with around $530 million trading last year. While the South-West submarket saw a large jump in activity, with over $500 million trading, led by infill precincts such as Milperra, due to multi-level and rental reversion potential.

“Following a rise in land values in 2022 by around 27%, there has been a lack of sales evidence this year to demonstrate softening land values in Western Sydney in response to rising yields and elevated construction costs.” Mr Crawford said.

Click here to view and download the report.