Cushman & Wakefield releases latest Self Storage Performance Indicators (SSPI) series Australia and Auckland NZ

Contact

Cushman & Wakefield releases latest Self Storage Performance Indicators (SSPI) series Australia and Auckland NZ

Cushman & Wakefield has released its latest findings from the Self Storage Performance Indicators (SSPI) series, tracking the performance of nearly 280 self storage facilities across major cities in Australia, and Auckland.

Cushman & Wakefield's Self Storage Performance Indicators (SSPI) Series reveals return to normalised revenue growth in Australian and Auckland markets

Cushman & Wakefield has released its latest findings from the Self Storage Performance Indicators (SSPI) series, tracking the performance of nearly 280 self storage facilities across major cities in Australia, and Auckland. The SSPI series provides valuable insights into the self storage market, monitoring its growth and stability at six-month intervals.

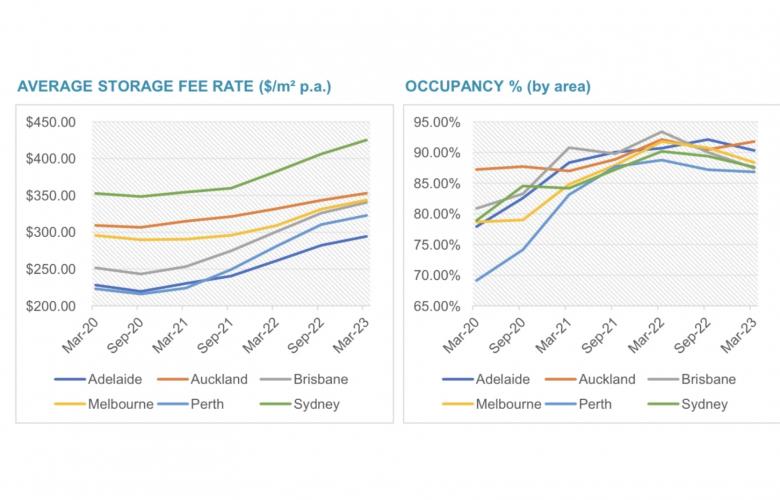

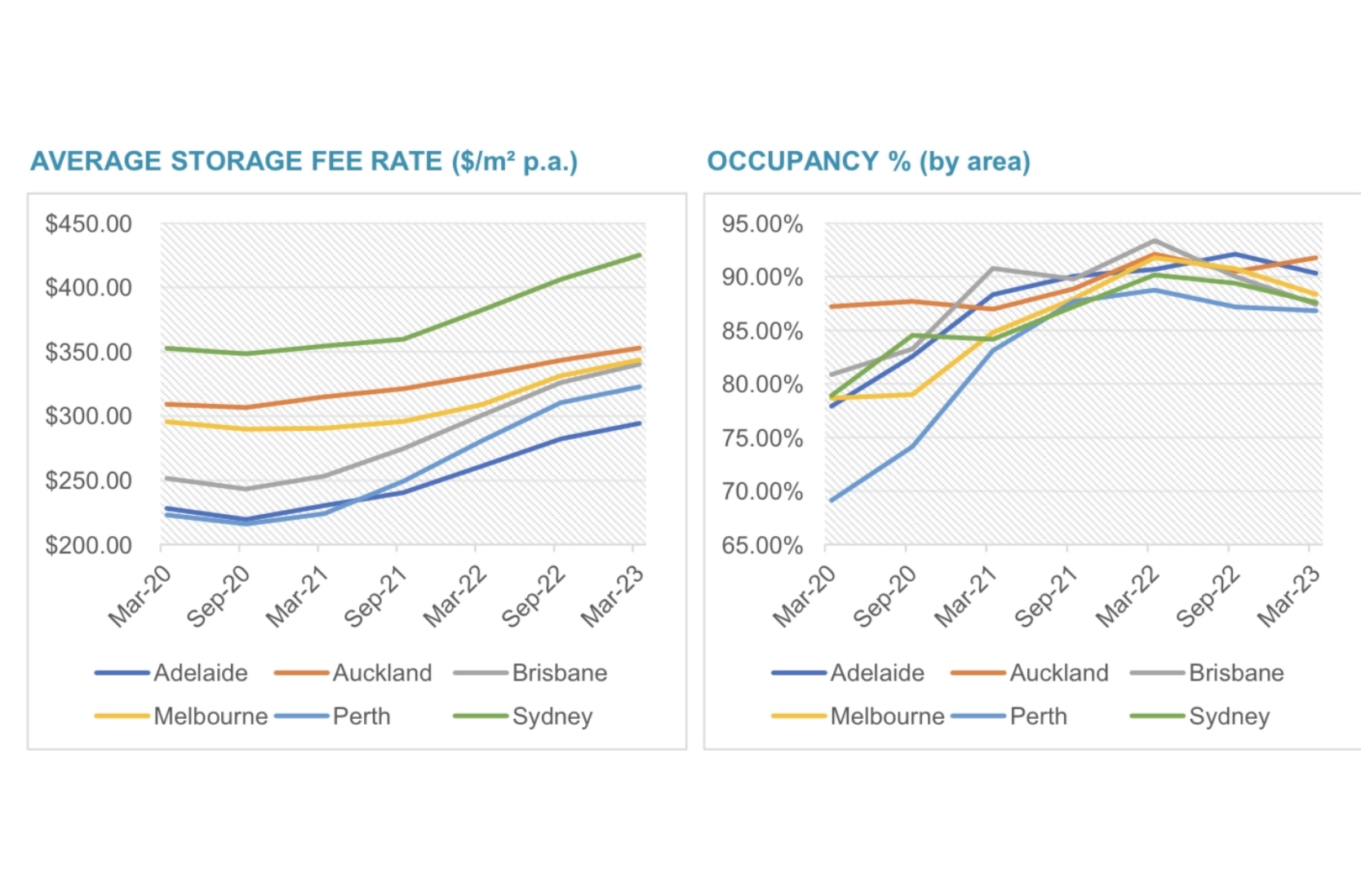

The most recent release of the SSPI series highlights a notable return to normalised revenue growth within the self storage market. After experiencing mammoth growth of approximately 15 to 20% per annum in some markets, the revenue growth in the industry is now stabilising, although it remains ahead of inflation.

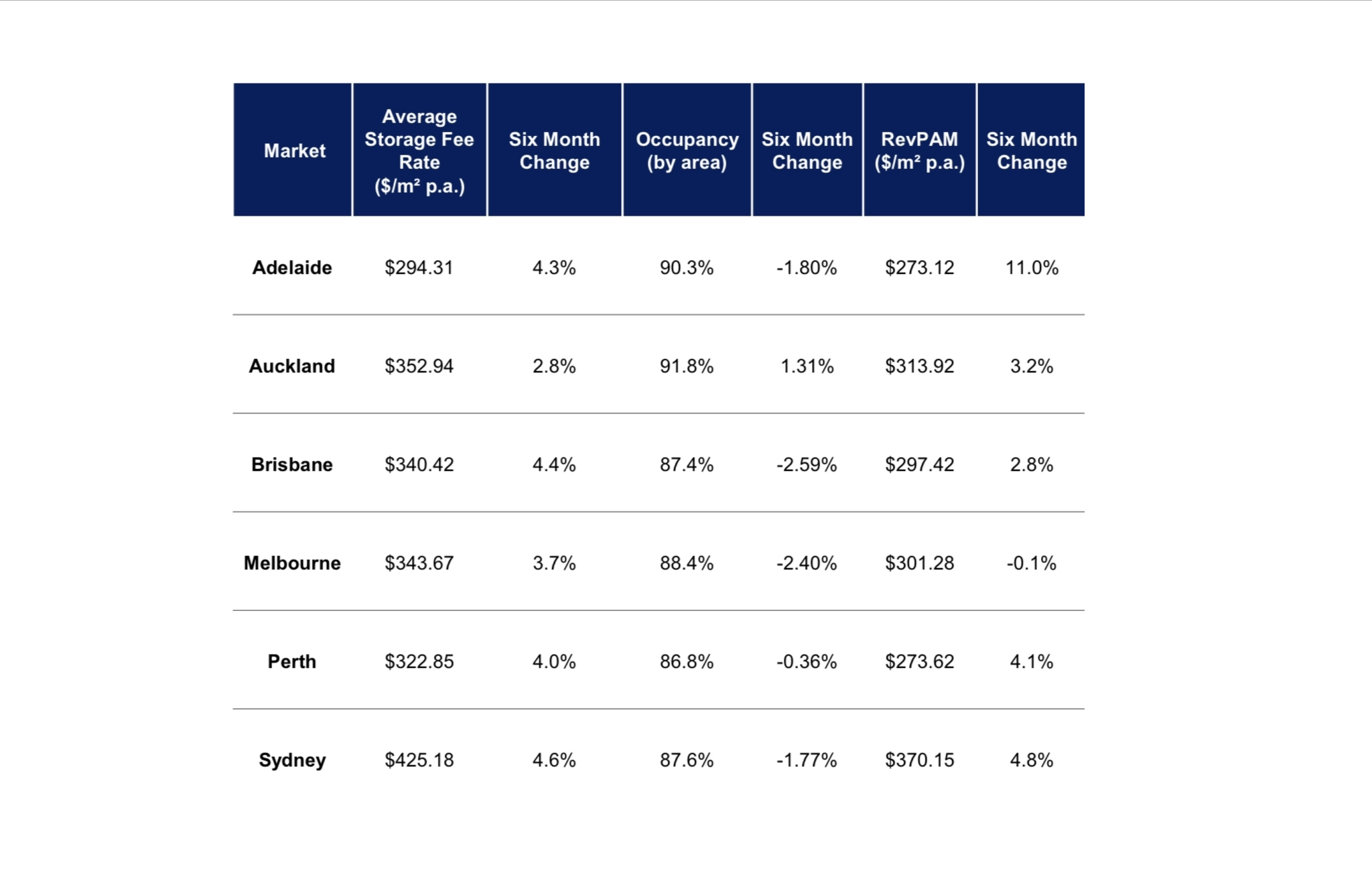

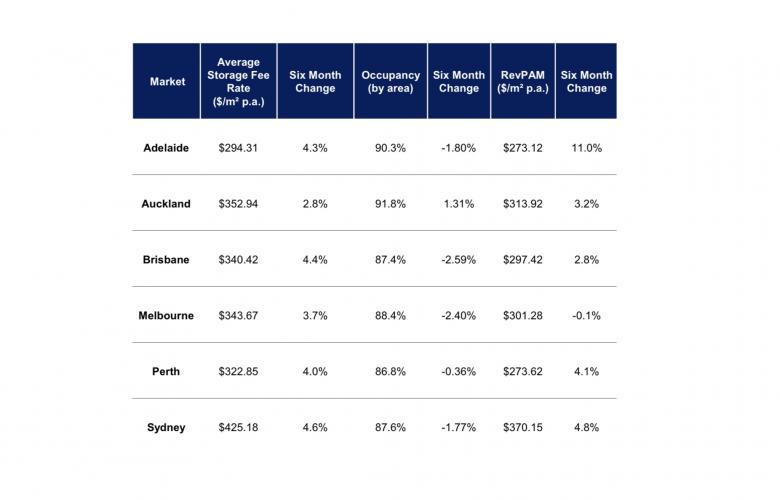

The data reveals that Adelaide and Sydney have emerged as frontrunners, demonstrating impressive double-digit revenue growth rates. Adelaide achieved an exceptional growth rate of 14% over the 12 months leading up to March 31, 2023, while Sydney recorded a commendable growth rate of 12% during the same period. These figures showcase the resilience and continued demand for self storage in these cities.

Other cities such as Perth and Brisbane also displayed significant annual growth rates, reaching 8%. Melbourne followed closely behind with a growth rate of 7%. Auckland, on the other hand, demonstrated steady growth with a respectable rate of 5%. These figures indicate that the self storage market remains strong across multiple cities, albeit with varying growth rates.

Linda Sharkey, Divisional Director of Self Storage at Cushman & Wakefield, commented on the recent developments in the industry, stating, "Storage loves change. Operators have capitalised on the heightened level of demand for self storage since the onset of the COVID-19 pandemic, with some markets experiencing revenue growth of over 50% in the 36 months leading up to March 2023."

Ms Sharkey further noted that in recent times, occupancy levels in certain locations have started to decline.

“This trend raises the possibility that fee rates may have been pushed too aggressively in some markets, potentially leading to a regression in fee rates as these markets strive to retain self storage customers”.

However, she emphasised that the growth journey is far from over and anticipates a slightly bumpier road ahead for the industry.

The SSPI series by Cushman & Wakefield continues to serve as a valuable resource for industry stakeholders, providing comprehensive data and insights into the self storage market in Australia and New Zealand. As the industry adapts to evolving market dynamics, the SSPI series remains a reliable tool for tracking performance and making informed decisions.