Adelaide industrial sales hit record high in 2019 - Knight Frank

Contact

Adelaide industrial sales hit record high in 2019 - Knight Frank

New data from Knight Frank has shown Adelaide industrial sales reached their highest level yet last year.

Industrial sales in Adelaide hit a record high over 2019, according to the latest research from Knight Frank.

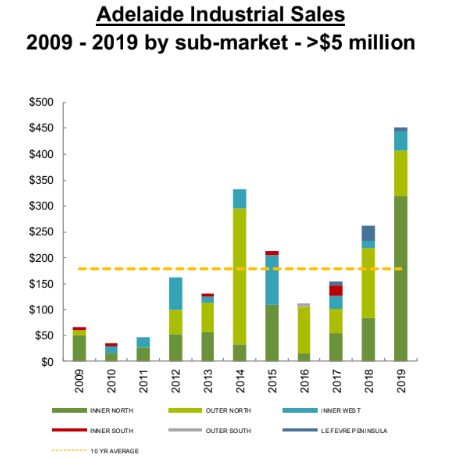

The Adelaide Industrial Market Overview February 2020 found there was a total of $452.56 million in industrial sales transactions for properties over $5 million over the calendar year.

This was significantly (more than 36 per cent) higher than the previous record high of $333.03 million in 2014 and 73 per cent higher than 2018, when sales volumes totalled $261.93 million.

Adelaide Industrial Market Overview February 2020 - At a glance:

- The research found there was a total of $452.56 million in industrial sales transactions for Adelaide properties over $5 million over the calendar year.

- Total sales for 2019 were 35 per cent higher than the previous record high of $333.03 million in 2014.

- Around 37 per cent of transactions have been for properties of $20 million-plus, while the remaining 63 per cent has been for properties sold for between $5 million and $19.9 million.

The 2019 figure is also well above the 10-year average of $178.84 million.

Around 37 per cent of transactions have been for properties of $20 million-plus, while the remaining 63 per cent has been for properties sold for between $5 million and $19.9 million.

Source: Knight Frank

One of the biggest transactions in Adelaide’s industrial market over 2019 was the $80 million sale of the Port Adelaide Distribution Centre at 25-91 Bedford Street in Gillman, which was purchased by Melbourne-based Quintessential following off-market negotiations.

The price reflected a core market yield of circa 9.5 per cent and a WALE of around 1.7 years.

An industrial property at 12-14 Bradford Way in Cavan, which was part of a national cold chain logistics portfolio, also sold for $67 million, reflecting a core market yield of around 6 per cent and a lease term certain of 23.1 years.

Knight Frank Partner and Chief Economist Ben Burston said the record low cash rate, coupled with the abolition of stamp duty on commercial property, had continued to have a positive impact on the industrial property market.

“The value proposition and demand from interstate investors to chase industrial yields have helped further strengthen demand for industrial properties located in South Australia,” he said.

“Currently average prime yields across the Eastern Seaboard are generally in excess of 100 basis points firmer than in South Australia, hence the state remains attractive for investors seeking higher income returns.

“Fully leased industrial property with strong lease covenants, in particular, will continue to attract strong interest in 2020, with the outlook for the year ahead looking positive.

“Industrial yields have shown a continued firming bias over the past six months and are likely to continue firming given the attractive yields on offer in Adelaide compared to interstate.”

Click here to view the full report.

Similar to this:

Industrial capital forecast to grow with $30 billion 'ready to be deployed'